Australian-owned and Melbourne-based technology provider, Quest Payment Systems (Quest), has launched a software only tap-on-phone payments solution, Airpay TAP, which allows merchants to accept contactless card payments on almost any modern Android smart phone simply by downloading an app.

The tap-on-phone technology developed by Quest will be the first solution of its kind made available in Australia, able to process higher-value transactions securely using a PIN as verification. The launch comes as Quest has entered into agreements with major payment networks including Visa, MasterCard, eftpos and American Express. This follows an earlier trial of the technology by NAB and Visa, proving the technology in a real-world environment.

Quest CEO, Jan Mason, said the company is proud to have developed the home-grown technology, which can significantly improve the day-to-day operations of businesses of all sizes.

“Whether it be a tradie accepting payment in a customer’s home, a café enabling simultaneous transactions during the breakfast rush or a large retailer reducing queues during busy periods, the flexibility and mobility of this solution is a game-changer for businesses.

“Everybody already owns a phone; now we are giving them the ability to have a payment device in their pocket with no additional hardware required. We are already receiving strong interest from local merchants and banks, as well as internationally. It is our plan to take the technology global in the coming months,” said Mason said.

Demand for the solution is expected to surge in the wake of the COVID-19 pandemic, given general hygiene concerns around the use of cash and consumers’ growing preference for contactless payments.

“The COVID-19 pandemic has changed the way people pay and how many merchants are doing business. Facilitating a rapid and flexible payments process, that avoids bunching around a counter, has never been so important,” Mason added.

Leanne Walker, Vice President Payment Consulting Group, American Express, said: “The use of mobile devices continues to transform the point-of-sale experience, both for consumers and merchants. American Express is pleased to see a local Australian company innovating in this space and delivering greater convenience and choice for users.”

Visa’s Dan Parsons, Head of Merchant Sales and Acquiring for Australia, New Zealand and South Pacific, said: “As more consumers choose to tap to pay with their card or smart device, Visa believes ‘tap to phone’ can enable more merchants, especially small and micro businesses, to securely and efficiently accept these digital payments. We look forward to continuing our work with partners like Quest to ensure the technology enhances the consumer experience and meets Visa’s high security standards.”

Tom Graham, Head of Innovation at Quest, who together with his team developed the solution, said: “Quest has gone to great lengths to provide a level of security on par with that of a traditional payment terminal, enabling protection at all points through the transaction process, while also ensuring the mobile device maintains a constant level of integrity.”

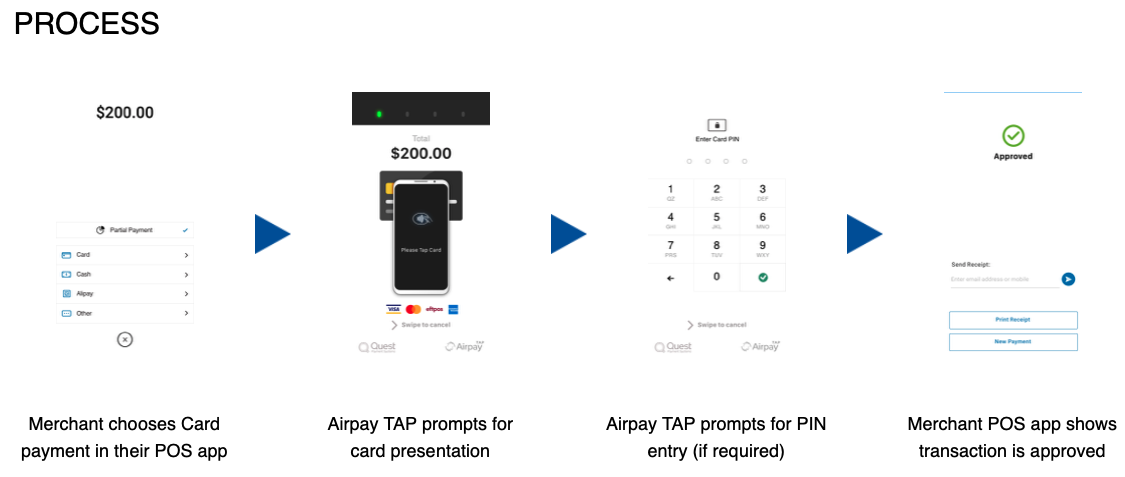

Transactions over the contactless limit will still require customers to use their PIN to authorise payments, entered on the screen of the Android device. Biometric authentication (Consumer Device Cardholder Verification Method) is also supported for mobile wallet users.

At launch, Airpay TAP will be available on Android devices only. The solution supports most Android phone devices manufactured since 2016 running Android 7.0 and above, including all major Android phone manufacturers including Samsung, Google, LG, HTC, Sony, Huawei, XiaoMi and OnePlus.

For Apple devices, Quest offers a Bluetooth contactless reader that can be used to add contactless payment capabilities to an iPhone, iPad or iPod touch.

Emma Russell, Vice President, Acquiring and Account Management at MasterCard Australia, said: “The retail landscape is changing at an accelerated pace as consumers continue to demand more seamless ways to pay. With one in four contactless transactions now made on a device, tap-on-phone solutions such as Airpay TAP enable businesses of all sizes to accept electronic payments, meeting customer needs head on, while ensuring transactions remain simple, safe and secure.”

The new technology is the next evolution for Quest, which has built a strong reputation developing innovative physical payment terminals and software for some of Australia’s largest retailers and banks.