SCN is, and always has been, a leading proponent of the importance of ‘spaces’ in regards to our shopping centres. For years, our design articles by leading shopping centre architects have espoused the commercial reality of providing ‘places’ for social interaction. It’s not just the designers who recognise this. In this article Kevin Taylor talks about the importance social experiences linked with the digital world, have on the retail operations in our centres.

Today the shopping experience is becoming less about performing a transaction and more about creating spaces where people can immerse themselves in an experience or a lifestyle activity. But before we dive into talking about the social experience of retail, we first need to set the scene and look at how things are continuing to change in our increasing digital environment.

The digital challenge

Online research by eMarketer analysing online versus offline purchasing has found that every region globally will see an increase in both internet users and digital shoppers over the next three years, with internet sales accounting for nearly 9% of total retail sales by 2018.

In terms of media consumption, it is estimated that, by 2019, time spent per day by smartphone users will rise to 2 hours and 42 minutes. Of this time, nearly 90% will be spent specifically surfing in apps versus mobile web content.*

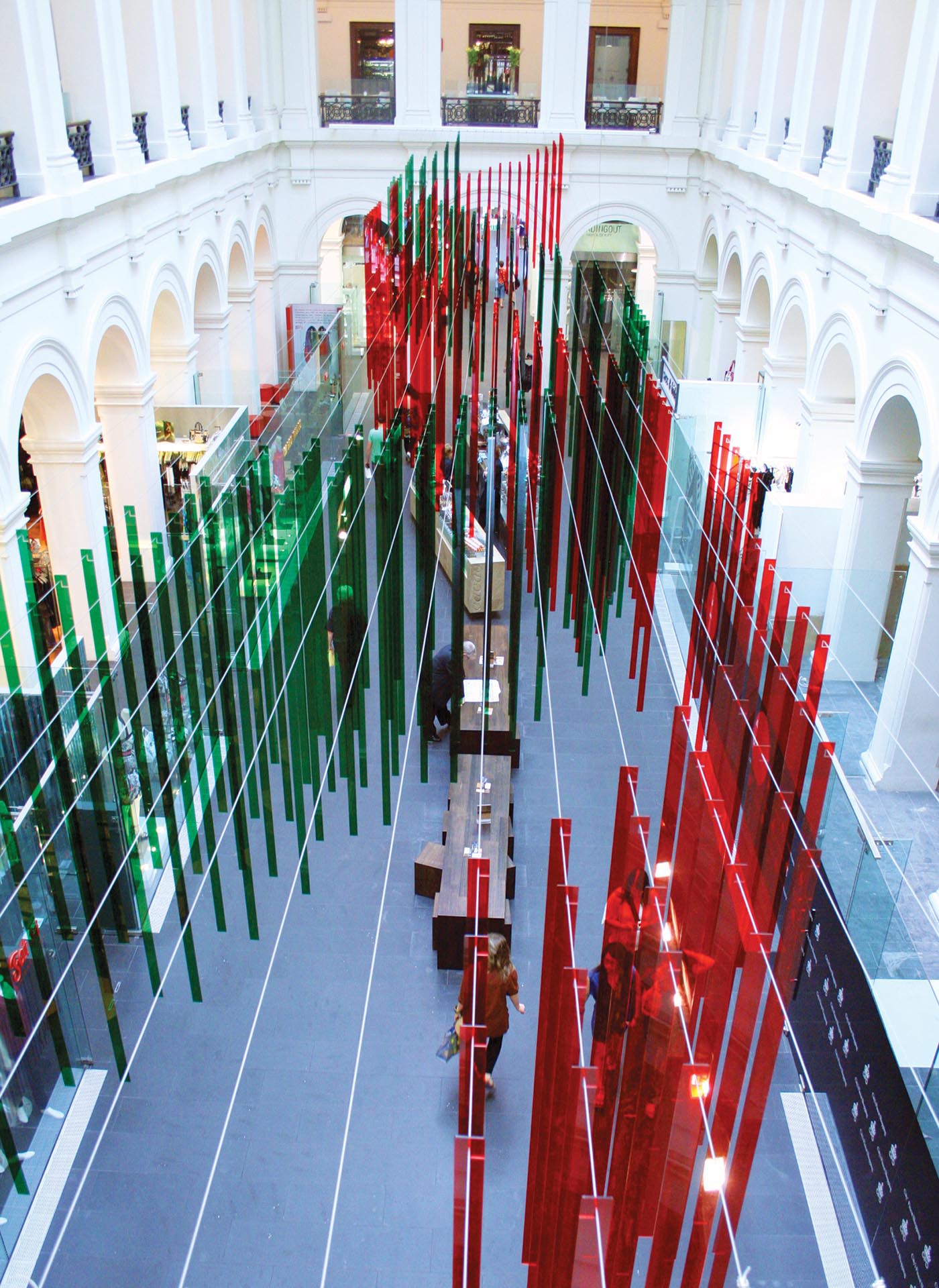

- Christmas decorations at GPO Melbourne

- Christmas decorations at GPO Melbourne

Thrive or perish

So what does this all mean for shopping centres? Consumers are changing their habits and purchasing practices at a faster rate than the retail sector can change their physical format to accommodate. The scope of what consumers want never stands still. The content that an individual is exposed to, and the methods of sharing that content via Facebook, Twitter, Google+, Instagram, Pinterest, Snapchat and the like, can’t be converted to measurable data quickly enough for the bricks-and-mortar retailer to respond in a timely manner.

Retailers and shopping centres have to adapt to the agility offered by digital channels. For retailers to thrive, they need to be investing in ways to gather and combine all the shopper metrics and deliver this analysis in real time to enable change.

Customer-centric outlook

It is clear that an omni-channel approach to targeting and reaching an audience is required. 71% of Australian consumers state that digital channels have a positive influence on the way they interact with brands and organisations.

Events held at the shopping centre, such as a fashion launch, can be promoted through a real-time window via Instagram or similar to help link the designer or maker with the products that are in-store.

The reopening of the high-fashion precinct at Indooroopilly, coupled with a fashion show entitled ‘Lead the Field’, shows how a physical event can maximise the customer experience while showcasing the venue.

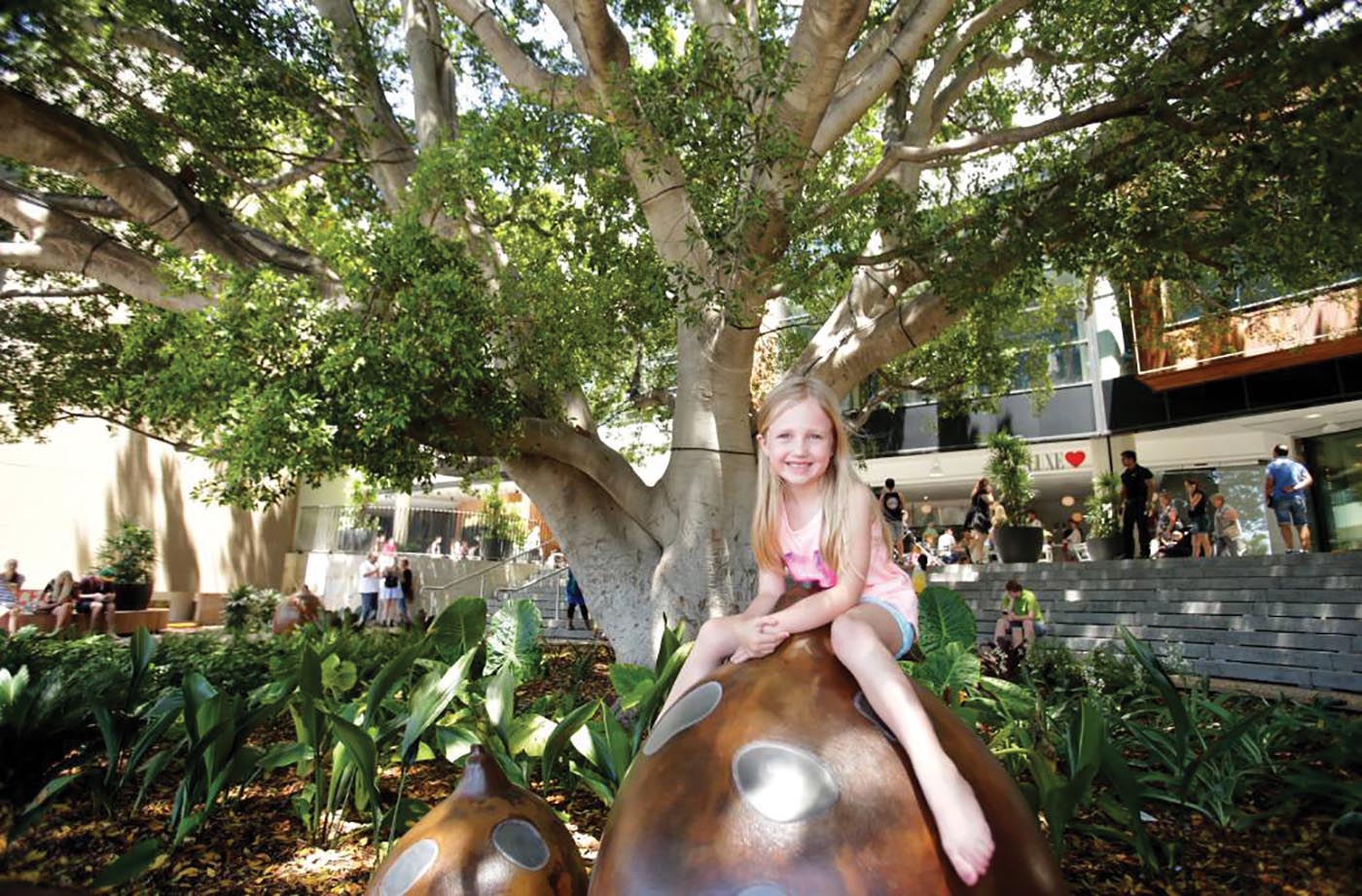

Shopping centres can build customer interest and exposure by having a social outlook. The online world is trying to replicate the social experiences that occur offline. Shopping centres can make the most of their physical assets by encouraging visitors to share their experiences online. It’s about personalisation, creating links and storytelling. Eating a Messina ice-cream late at night under the hero tree at Westfield Miranda while listening to the birds and gazing at the stars above is a wonderful experience.

- The hero tree at Westfield Miranda

The inflatable installations at Darling Harbour that featured widely in Snapchat, Pinterest and Instagram posts, or the Christmas decorations at GPO Melbourne, are other examples.

- The inflatable installations at Darling Harbour featured widely on social media

- The inflatable installations at Darling Harbour featured widely on social media

The takeaway here is to build and feature elements within a centre that may be easily photographed and shared on social media. Create interest and customer inspiration through user-driven content. This turns a physical asset into something more personal and human.

- Bike retailers – bringing the workshop and sales teams together

- Bike retailers – bringing the workshop and sales teams together

Immersive experiences

It is generally agreed shopping is much more than just a pure retail experience. Retailers that have embraced this concept are Giant Bikes and Shimano. Both retailers are reinventing the sector by bringing the traditionally unseen back-of-house activities of bicycle fitting, repairs and maintenance out into the front of house. Shoppers can now immerse themselves in the tech side of the product experience. It’s a bit like restaurants that have working kitchens on display. Bringing the workshop and the sales teams together has produced efficiencies and better ‘flow’ that creates theatre and atmosphere for the customer.

Shopping vs entertainment

Customer satisfaction is being determined by more than just the transaction of shopping. Customers are judging the overall experience. We have to ask: what is it that makes each retail encounter unique to the shopper’s requirements?

A ‘retail-only’ experience doesn’t cut it any more. Shopping centres are morphing into spaces that provide opportunities for retail, entertainment, hospitality, wellness and social interactions. The blurring of lines between retail and leisure is driving foot traffic to physical spaces.

- The silent cinema at World Square, Sydney

- The silent cinema at World Square, Sydney

The silent cinema at World Square is a great example of creating ‘shopper-tainment’** initiatives. Innovation and the creative use of space also provide attraction; examples include farmers’ markets, concert and arts precincts, libraries, churches, spas and fitness centres, off-licenses hosting wine and food tasting events, fashion shows and pop-up events.

All these experience-based offerings differentiate the consumer offering and help de-commoditise the shopping experience. These types of innovations provide a level of leisure and entertainment that cannot be satisfied by a solely online experience.

Alternative venue formats

Many redevelopments are reviewing the mix of tenant and public space. GPT’s Rouse Hill is a good example, with the planned redevelopment of transition spaces between the arterial roads, and the new rail link, and the mall spaces being developed as medium-density housing. This application suits the town-centre model at Rouse Hill. This sort of trend will see the tenant/public space mix move from the current 70/30 to 64/40, or even 50/50. The expanded public spaces that will be a feature of the future shopping centre will need to be curated much like an exhibition or arts space. The use of the space is more akin to managing content that real estate.

Adapting to change is critical to survival. The shopping centre and retailer are no different in this regard. A customer-centric approach that embraces the social experience and immerses the customer in the physical environment is something that cannot be replicated online.

………………………………………………….

* Source: eMarketer, April 2017. ** Source: NZ Retail Magazine issue 739, September 2015.