Talk about disruption and the need for innovation. The Little Gun category has never been under so much pressure. Caught between the convenience of the supermarket and services anchored neighbourhood centre and the glamour of the elder sibling Big Gun Centres with their international fast fashion, cinemas, ice rinks and rooftop dining precincts, the troublesome middle child is somewhat, … well how should we say it??…VANILLA!

291 flavours

According to the Key Facts on the Shopping Centre Council (SCCA) website, in Australia some 291 centres are classified as sub-regional (Little Guns) – that’s 291 flavours of vanilla making up the mix. It’s sure easy to get tired of vanilla, maybe that’s one of the reasons why sub-regional assets are experiencing the highest numbers of transactions of any shopping centre asset class in the past couple of years.

So for any readers with a recently acquired Little Gun centre looking to add some value to the asset or wanting to divest a Little Gun with a point of difference, here are three strategies we have devised in recent years to re-invent the food proposition within Little Gun centres and add or maintain the asset value in a difficult trading climate.

Strategy 1: Drop a bomb on the food court

Not literally, but don’t be afraid to NOT have a food court. The term food court in a Little Gun is actually not entirely accurate. Brain & Poulter defines a food court as a collection of seven food catering tenancies supported by a common seating area. Many Little Gun food courts average five to six outlets with the anchor tenancy rarely a fast food major, limited branded offers and no strategy as to the tenancy mix hierarchy. A Little Gun asset is lucky if its ‘pseudo’ food court is located at least on the busiest mall but we can think of several malls where the Little Gun food court was developed as a ‘destination’.

FYI ‘food court’ + ‘destination’ in a Little Gun = disaster!

That’s why some pretty smart clients at Yu Feng/Retail First asked the question: “Do we really need a food court?” Working with the owners and Buchan, we devised a strategy to de-commission the six-outlet food court at Brookside Shopping Centre in Brisbane’s north-west, and back fill it with some mini-majors to create a new ‘heart’ around the Centre Court comprising three quick serve casual dining outlets with their own attached seating and three kiosks in the common seating area. This move has re-invigorated the centre and elevated food as a leisure-based activity that extends the stay in centre.

Strategy 2: Double dip

What McDonald’s starting telling shopping centre leasing executives some 10 years ago when it came time to renew in a Little Gun food court was that there wasn’t the length of trade in a Little Gun food court like there was on a pad site or high street to justify the store investment. This was highlighted further as Big Guns ramped up the inclusion of dining precincts through the past five years and F&B operators got to experience the night time economy.

So, what does a Little Gun centre do when it can’t sustain both a food court and a dining precinct?

- Stanhope Village: trades to the mall and to the street

- Stanhope Village

Well you do both BUT you do it with the same tenancies. This was the strategy we worked with the Mirvac team to add some real value at Stanhope Village in Sydney’s north west. Conducting some deep customer and competitor research we curated a tenancy mix of four strong lunchtime cuisines and four cuisines that could trade at lunch and dinner, and then worked up a design that allowed the day/night tenancies to trade both into the mall and out to the street. The smoke and mirrors of the double-sided trading means there are about seven lunchtime offers co-located in the mall by day and once the majority of specialty retail shuts down for the night and the mall loses its buzz, the double-sided tenancies change their focus to trading directly on to a nicely landscaped street-facing precinct.

Strategy 3: A food court by any other name

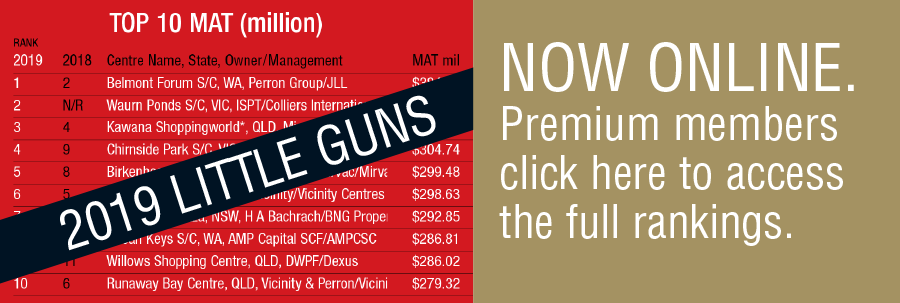

For our last strategy we head west to the Little Gun that roared – Belmont Forum in Perth, owned by the Perron Group and managed by JLL. The strategy needed for this Little Gun was somewhat different and related to how to support a major supermarket expansion to create a fresh food precinct between two major supermarket anchors. Now, fresh food precincts are a whole other ‘kettle of fish’ (foodie pun intended) when it comes to their future, but back to food catering as the focus of this article! It wasn’t sustainable to fill all the speciality retail stores between both supermarkets with fresh food specialty but our analysis showed food catering was still undercooked (another intended foodie pun there) so instead of another food court, the fresh food precinct became a hybrid mix of fresh food and food catering, with plenty of communal seating.

Belmont Forum: mixing up food catering and food retail

The beauty of blurring the lines between food retail and food court resulted in an active precinct with plenty of activity and natural levels of place-making from the fresh food merchandising.

Turn vanilla into tutti frutti

The aim of this article was to demonstrate that all is not lost for Little Guns. Hopefully, these strategies inspire you to re-think your Little Gun asset and look at creative ways to add value to this important shopping centre category.