We need to think beyond the ‘now’. Presently, our focus is on ‘getting back to normal’; but that won’t happen because ‘normal’ has disappeared forever. When the COVID-19 episode is all but over, a ‘new normal’ will be the order of the day. Those who plan for it will succeed; those who wait to see what happens will find it harder!

In the post-coronavirus era, every food business will have to plan, execute and continually adapt to the new reality of food and hospitality. Hospitality may never return to the close-quarter customer-interface, casualness, generosity and personalised service that we knew pre-COVID-19. Sales recovery may not eventuate fully, perhaps not until early 2021 or beyond.

By the time this article is published, the intellectual post-mortem of COVID-19 will have begun and hygiene will remain top-of-mind for much of the community because the psychology of many customers has substantially changed in a very short period of time. Businesses big and small have been decimated, highlighting in no uncertain terms the precarious short-term cashflow cycles that many operators run on.

Around the world, our individual daily routines have dramatically changed and entire industries reliant on human habit and behavioural patterns have been substantially impacted or even lost by government mandated lockdowns and societal fears of pandemic infection.

There are many questions concerning the viability of our industry in its current format. Resolving them will not happen through the actions of the property industry on its own, but rather by a concerted and united approach requiring all stakeholders to think differently.

Social distancing in hospitality

Based on an ABS survey, in the three weeks to April 4, Australia has lost about $5 billion in wages/salaries. This is due, in part, to about 700,000 people losing their jobs or having work hours cut. As the ‘next-normal’ emerges, restaurants can’t just rely on hampers of goods – they need to be able to offer something value-added (something they do themselves) as a point of difference.

Landlords must lead the way in strategic planning and operational support

Landlords, food operators and customers all play a crucial part in the future success of how food businesses will recover, thrive and return to the next-normal. As such, we must foster better relationships with our retailers, and in return demand their investment into our centres by following our lead in positive entrepreneurship, proactive marketing, health and safety, long-term planning and increased service-level provision that extends the customer experience regardless of short-term trends.

The astute operators in the property industry will benefit from the COVID-19 Pandemic. Proactive stakeholders will benefit from hindsight and, in turn, will be stronger, leaner and more resilient as a result of the COVID-19 impacts on our daily lives. Disruption is nothing new to the food and beverage (F&B), service or retail sectors over the past five years and it’s our perspective that this trend will continue. Natural disasters, the rise of digital disruption, rapidly changing workplace practices and employment conditions have all contributed to a highly dynamic industry that can rise to the challenge of COVID-19 and come out stronger on the other side.

Hygiene is a marketable commodity

We all have a very intimate relationship with our food – it requires us to use our hands and put things in our mouths. In the current climate of health and public safety awareness, we are now responsible for maintaining and promoting obvious health and safety protocols across our centres. If we are to maintain and grow our sales and footfall, ultimately protecting our rental incomes, we must ensure that we maximise our transparency of health and safety processes in an era of hyper-hygiene.

Operationally, our teams will need to provide better transparency of process with clear lines of accountability (ie. hygiene supervisor), with clearly documented processes. Prominent use of new tech, that has been commonplace in medical practices for many years, may become mainstream for shopping centres too.

Hygiene practices at an operational level will form an indirect marketing tool in addition to being a positive message for all centres to communicate to their communities.

Effective immediately, hygiene, health and safety processes and procedures must be visible, obvious and well communicated.

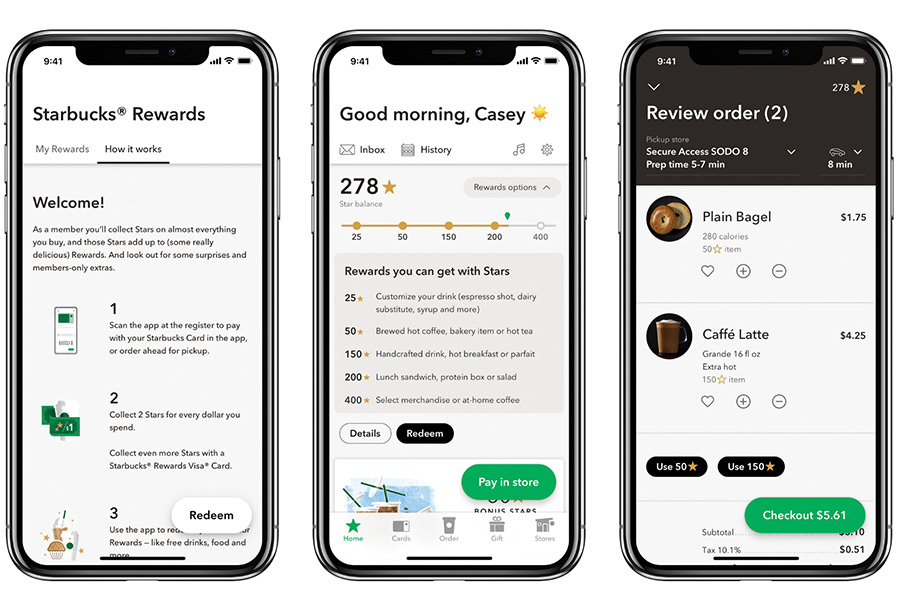

Starbucks in Toronto have recently opened their first pick up only store, with all orders placed via the Starbucks app

Hygiene, social distancing and its compound effect on design

Typically, F&B design in the past ten years has been influenced significantly by styling and productivity. But our next normal may well include visible hygiene and social distancing as key parameters to be incorporated into new centre and redevelopment designs and new tenancy designs. It certainly needs to be incorporated into our design strategies and masterplanning processes.

Common areas need to be perceived as not only healthy places to be but must also actively reinforce the messaging that our centres are safe places for our community to return to and remain in.

Customer confidence is the key to future success and a core component of this confidence will hinge on public spaces to provide a level of personal health reassurance at every ‘non-touchpoint’. Most certainly this will come to include:

• Productivity (ie. table spacing and seating efficiency) of dining areas both in common areas and individual tenancies will be moderated by the impact of COVID-19. Seating areas in dining room spaces can range from 1.8m2 per person to as little as 0.8m2 per person, but design solutions may need to consider less productive dining spaces as we increase the measure of safe seating in cafés, restaurants and bars. Existing operators that have dining rooms at lower ends of the above range, may have to reconsider seating plans with reduced seats, in order to maintain relevance to customers with a revised series of choice priorities.

• Reduced sales and reduced profits will have to be countered by increased productivity and lower staff costs. Ultimately, this will change the service experience for our customers as we re-evaluate our expectation of service-standards as a community. Never before have restaurants been required to remodel their seating plan to comply with code relating to safe-seating distancing. This reduction in seating will reduce sales and this will not be made up by deliveries and pick-up sales as these are generally lesser spends (ie. no add-on, alcohol sales etc).

• Queuing areas are likely to require social management for the foreseeable future. For fast casual and grab-and-go operators who see peak demand within concentrated time periods (ie. breakfast, lunch and dinner) ordering online in advance and skipping the queue is likely to be a key strategy to manage social distancing; existing order-online apps are already developing new improved formats.

• F&B operators will need to present clean and uncluttered working areas. Property managers should ensure that each tenant has adequate back of house storage areas for their business. Deliveries, dry goods, staff effects and clothing are examples of what the customer does not need to see. Kiosk retailers that have sightlines into all sides of their business have even greater exposure to this issue.

• Staff arriving to work in food premises are likely to need to change into uniforms, if this wasn’t the case in the past it will most likely be a necessary work practice going forward. Staff cannot be seen to be wearing ‘street clothes’ while working in food-service operations. In order to ensure that a level of insulation exists, individual retailers and centres will need to ensure that staff facilities, change rooms and lockers are available for personal effects, away from the customer experience.

• One of the short term trends that has been adopted by communities is an increased acceptance and use of delivery and takeaway dining. Future designs for many outlets are likely to include separation of delivery and take-home options from ‘eat in’ customer experiences, such as express windows, pickup lanes and third-party delivery (TPD) pick up zones.

• Congestion points such as point of sale areas, queue zones and egress points will need to be significantly reconsidered. Building occupancies may well be revised but ensuring that internal footfall routes and flows are contactless will likely result in revised design-briefs going forward. Individual operators will most certainly want to revise their own queuing strategies.

• Contactless experiences. From arriving in the centre’s carpark or visiting the bathrooms, centres will need to transition to a contactless environment. The process of ‘pushing open’ a bathroom door in our centres’ amenities has become unacceptable, overnight. End to end contactless and socially distant environments need to be factored into our planning. Even prior to COVID-19, some operators are exploring this potential business model; Starbucks in Toronto have recently opened their first pick up only store, with all orders placed via the Starbucks app.

Starbucks Toronto

• Elevated drive through experiences are already a burgeoning food trend in the US as majors such as Starbucks and McDonald’s seek to advance the drive through experience. As we accelerate the acceptance of contactless retail, it is inevitable to think that brands will want to retain the essential customer and experience-centric differentiation that is already a core component of their brand statements.

One of the biggest assets for any property is footfall. Maintaining footfall will become a by-product of the capability of our retail and food operators and their ability to adapt to the next-normal. High quality operators will become imminently preferred over a more dated approach as the ‘she’ll be right’ attitude quickly loses favour with society. For the operators who make it through this challenging period, some great lessons will be learnt.

Disruption management and reduced operating costs

Disruption management is no longer a response only. We must plan for it and ensure that our operators’ business cases stand up to scrutiny. We must do this to ensure that our leases are protected and in turn protect a principle revenue source, rent.

Our operators must be chosen for the calibre of their product and service as well as their business capability (including an ability to monitor and adapt) and retain a proactive approach to F&B retail. Sustainable business models must be identified to safeguard against any future outbreaks and disasters that impact on business.

Operators will need to ensure that their operations reflect the philosophies of the centre, as such contactless payment must become a standard capability. If cash only operators were an endangered species six-months ago, they must now be facing extinction.

Food delivery will form an ongoing component of future business for many outlets. Revenue diversification has literally been forced on to many of the food operators in our centres. If the COVID-19 crisis has done anything, it has been to strengthen the digital commerce landscape, including F&B. Many food businesses switched to delivery and takeaway as a sticking plaster response to the lockdown measures that impacted societies.

As a consequence of this, Tamper Protection Device (TPD) platforms have now become an extension of the food service operation (in effect a modern-day waiter). Operators and the property industry must become familiar with TPD providers and their operating practices. They will continue to attract market share and physical presence in our centres, as such they must also reflect the operational standards that we are demanding of our food partners. We must ensure that these TPD providers reflect the hygiene and professional standards that we expect our customers to receive in our centres.

Many small to medium size food operators will need guidance and leadership to navigate the required controls, processes and elevated code-compliance. (In Australia and New Zealand shopping centres, this represents the majority where 80% to 90% of F&B operators can be described as small to medium businesses.)

First, there is a greater cost. More labour will be required to apply stringent cleaning and hygiene standards. Many small operators do not have the processes and skills to ensure their food businesses will continue to appeal to customers because of their visual hygiene standards and practices. Staff need to be re-trained in hygiene, safe-interpersonal skills and safe food handling skills; this carries a cost. Other costs include ordering-technology, food packaging, delivery costs etc. The higher the rent, the more pressure is placed on the retailer to extend their service-platform diversification to drive sales.

For many operators, this will almost certainly result in the development of a more efficient staffing model to ensure reduced staffing costs and a lower number of staff in typically small working areas. Staff retraining and reskilling to reduce social interaction will most certainly become a factor of food service employment, as we look forward to potential code changes, it is highly likely that F&B servers and food handlers will be required to sit a food safety course in a similar manner to the current Responsible Service of Alcohol (RSA) requirements for licensed operators.

Physical changes may require the installation of sneeze-guard style screens at counters and in some seating areas, the inclusion of in-house toilets, handwash basins in the reception area, heat thermometers upon entry at reception, a reception waiter, cost may also be added to the labour cost so that protocols, queuing and general safety standards are managed. Internal spaces in restaurants, bars, cafés food stores, food courts etc will need to be re-balanced, resulting in less seating, therefore less sales.

There is also the overall cost of new measures, including the Code determined physical and operational remodelling of common seating zones and public spaces so that they can be prepared for safe-distancing, including food court and external dining zones.

To date many landlords have provided new systems to support retail sales (ie. Westfield Direct) but much more creativity will be required so that seated guests feel welcome safe, and sales potentials are maximised. Landlords need to be flexible and support proposed retailer changes to permitted use clauses to enable eat in, take away, delivery, grocery lines, seating areas etc. Bars come with an entirely different set of challenges and these too need to be worked through with landlords.

Westfield Direct enables customers to access multiple Westfield retailers in one online transaction, and pick-up in one, contactless stop at their local centre.

This may provide inherent determination of business models and business case remodelling. Outcomes of this may well include reduced service standards as we traditionally think of them. Personal service and connection with customers is likely to be less prominent as we shift our service values to incorporate speed of service, ‘no-wait’ collection of pre-orders and express grab and go facilities.

Landlords must adopt strategic leadership roles

So, who is going to pay for all of this change? Well the short answer is all of us, and the property industry must retain and protect its rent roll, maximise its yield and minimise vacant tenancies, in order to retain profitability and asset value in the face of these new challenges.

We must consider a long-term approach to ensure that we are making better decisions, and more strategic decisions that reflect not only a changing consumer sentiment but allow us to continue to be the first choice to spend time and money in by making our centres a destination of choice for our customers and communities.

Landlord and property management companies will be required to seriously consider the huge disruption to food and hospitality tenancies and how they need to think differently in order to plan for change. They will need to be proactive and lead the way in rethinking the new standard in a post-COVID-19 era. Solutions need to be found and landlords need to reskill themselves to provide a new level of retailer guidance. This guidance needs to include clauses for food and beverage leases, physical space remodelling, control of the key aspects of the food related projects including common areas, seating zones (such as food courts), public toilets, water fountains, cleaning contactors, cleaning processes and strength of detergents, playgrounds, back of house processes, local council food controls and relationships with F&B businesses, in order to ensure that customers are made to feel 100% safe. Sales must be secured.

Rent is the outcome of sales, it’s as simple as that. Landlords like never before must ensure sales are maximised so that rental income is maintained. Sales are the one and only saviour of food tenancies, business plans must focus on a variety of revenue streams such as in-restaurant grocery sections, service windows, seating areas, pick-up point for delivery-drivers; all possible avenues of sale opportunities need to be explored.

The time is now. It is crucial that landlords and food operators work out what each group needs to do to ensure that food and hospitality precincts remain safe and appeal to customers once bans are lifted and spending begins.

It’s now time for landlords and their food tenants to discuss the inevitable – where to from here? There needs to be increased communication and support to ensure food operators know where they stand and what their responsibilities are. Landlords and property managers will need to consider how practical and compliance controls are incorporated into lease terms with regards to post-COVID-19 code or local council food and safety standards.

Landlords will also need to be creative and work closely with food service professionals and consultancies to ensure the planning of future food zones and operating areas are designed with the flexibility to address current and future code and safety considerations. There is always the possibility of future viruses and pandemics.

Landlords need to create a ‘task force’ of skilled professionals from a range of disciplines that completely review and re-model the business case, design considerations, legal requirements and operational parameters and standards for all future food and hospitality precincts. Hotel companies in Hong Kong have started this, guests checking into hotels now experience a completely different process. It starts with a personal temperature reading at check-in and ends with each room’s carpets being cleaned upon check-out.

Landlords and property managers must commit to the development of physical and operational processes to ensure that every precinct, food hall, high street or mixed-use development is presented as visually hygienic and well-managed to promote safe eating and dining environments.

It is time for a new era in landlord – retailer relations. It must start now, and it must be strategically planned, implemented and evaluated so as to ensure there are no weak links in the recovery and sales maximisation process.

What we do in the short term will be manifested in the long-term gains.