Sales is the key driver to success in any business. Therefore, if the cash register is ringing, sales are growing, rent is maximised, percentage rent is achievable, MAT is growing and asset value is heading in the right direction, the business case is a successful one.

However, in the competitive world we live in today, food and beverage sales just don’t happen, they have to be planned, executed and monitored to ensure market share is achieved and grown where possible.

Ever increasing competition in the CBD traditional restaurants, food court, cafés, food stalls, kiosks, sandwich bars etc comes from a range of digitally connected and competitively priced food providers such as online food deliveries, supermarkets, pop-ups, food halls, pubs, clubs, food vans and food markets, which means that a new business-case approach needs to be adopted if food operators wish to maintain sustainable businesses.

Competition across sectors of the food and beverage industry will continue as lifestyles are determined by urban-living and social-demographic changes. This includes the digital realm, as online ordering continues its ascendancy.

“Mobile food delivery services continue to boom, the idea of ordering food without the need for human customer service is also becoming second nature for Australian consumers.”*

*The Age, 30th April 2019.

To understand how food and beverage operators in CBD retail centres can maximise spend, they first have to stop and think about how they interact with customers – how are they interacting in their customers’ lives beyond providing a product or service? This goes beyond adopting a ‘customer centric’ approach (which we always advocate for!) and it dives deep into understanding and fulfilling the needs and wants of the residents, workers and visitors (the 60%) providing them with an indispensable and evolving experience (the 40%). These critical insights, by their very nature (i.e. flexible, convenient, always fresh appearance, new to market concepts, innovative) will create a culture of being continuously in tune with customers and create a competitive barrier to the wider CBD marketplace. Critically, when creating this connection with the customer segments – authenticity of the core message must be delivered – the promise must never be greater than the ‘product’.

Sales maximisation in the CBD is simple – give the customer 60% of what they want and 40% of something new and different.

Modern, connected customers (nine in ten) research pre-visit and 35% view the F&B options before they visit and if the hype does not meet or exceed their expectation, sales will not be maximised, dwell time decreases, customers question the spend and look to the competition for greater satisfaction.

What success looks like in a masterplanned environment

What does success look like in the business of food? A healthy, planned and well-balanced food mix is composed of happy F&B retailers, beautiful shops, promotions, design-driven environments, on-trend and popular cuisines, a diversity of price points, pro-active customer service and maximisation of F&B for all day parts, which creates a sustainable and self-perpetuating renewal process.

However, if it is not planned correctly – that is to say strategically – with the right amounts of volume, diversity of spend, GLA, the result is a fragmented F&B offer that doesn’t, or can’t, tap into the strong growth in the F&B Market Potential.

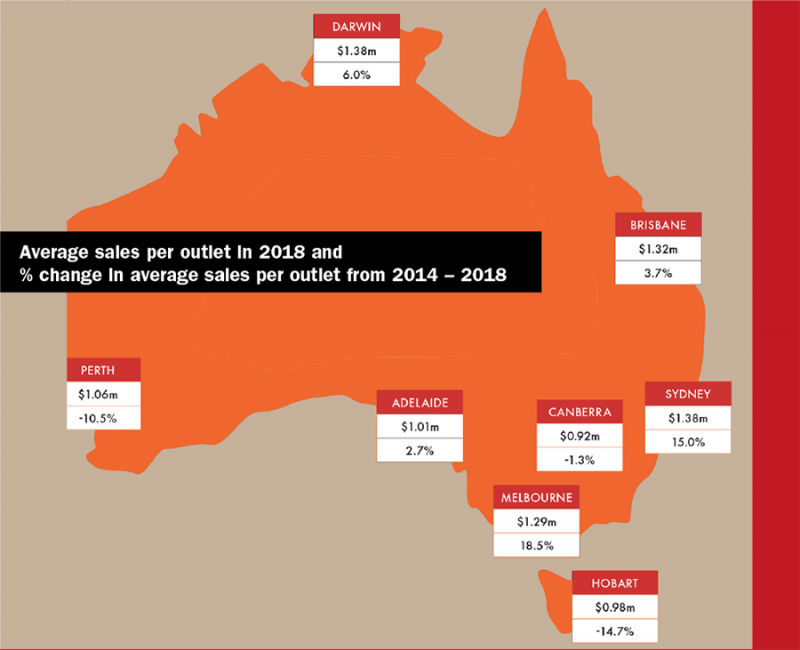

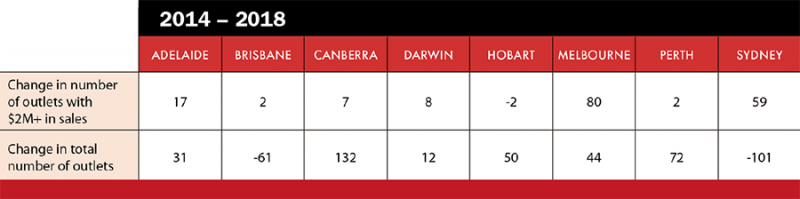

Most Capital City CBDs have achieved growth in their F&B market that is significantly in excess of the overall state and national benchmarks. Adelaide has seen its F&B market rise by 3 – 4% per annum during the past ten years.

From 2011, the Sydney CBD’s F&B Market Potential has risen by more than 5% per annum, while Melbourne has witnessed annual growth in its F&B market of approximately 4% per year.

These increases have been driven by CBD workers’ incomes growing faster than the state average, strong residential population growth and the rise of the CBD as a unique destination within the metro regions. We believe that the primacy of the CBD within the broader context of each state has never been greater. While decentralisation efforts have been underway for many years in most, if not all, of the capital cities, each of the CBDs retain historical, sporting, transport, cultural, commercial, governmental and entertainment aspects that combine to create a unique environment that could not, and has never been, replicated in suburban locations.

Given this greater role that CBDs play within the context of contemporary Australian economic geography, modern shopping centres and CBD Guns have now realised that there are (at least) three distinct day parts – morning, lunch and dinner into late evening. Each of these service periods can offer a level of visitation and engagement that provides the centre with a modern lifestyle approach, leading to an opportunity to be ‘top of mind’ for each customer segment. Customisation of the F&B offer to maximise the day parts with each customer segment, through realisation of the deep insights, is essential for creating a point of difference (POD) (while still maintaining a balanced offer) and requires a curated approach to ensure greater value is added. This can be especially relevant in CBD areas, where many residents live in apartments and seek not only a food product, but an alternative ‘lounge room’ and a social experience.

Lunch is the established revenue period of many CBD centres F&B, the staple food-court has set this pattern in place and provides a convenience offer that traditionally revolves around resident, worker and visitor need states and value-oriented food spend. For many CBD centres this pattern has been a hard one to break free from with a peak revenue period that is short-lived and focusing on an 11am to 2pm offer. However, if the modern centre is to become an integral part of the modern lifestyle, it must cater to a wider range of occasions than just the value or quick lunch.

Restaurants in the true sense of the word, have been the heart of wining and dining at dinner where residents, workers and visitors celebrate milestones, entertain and where great hospitality moments are immortalised. The evening economy provides the opportunity for a more leisurely offer (typically) with a range of cuisine styles, full service, casual table service and bar service style offers. Alcohol is frequently a component, (notably so in Australia and New Zealand, where we love a glass of wine or beer with our meal!)

At the other end of the spectrum, breakfast is equally important in the modern food landscape and both day parts provide a level of opportunity as traffic generators in their own right as well as providing a supporting convenience to the customer segments over weekdays and weekends.

Breakfast has many needs to fill – the quick coffee, breakfast on the run, brunch at weekends and even the informal business meeting can provide an additional revenue stream from early to midmorning. Coffee is the morning drink and is the highest consumed beverage in developed countries, the breakfast offer can frequently be well catered to by a series of well-located café style offers.

All day parts but especially lunch and dinner generally require the appearance of a diverse choice, ambience and atmosphere that comes about through the creation of critical mass. Each of these day parts has a dollar value, a revenue potential. This revenue potential can only be maximised when the mix, the menu and supporting characteristics such as entertainment, promotions and the calendar of events are built into the hospitality (not F&B retail) overlay of the centre.

This is a fine balance to strike and must be carefully considered against what is sustainable for each location with the context of the customer segments. Who is the customer, what is their spend-potential and what does that mean in terms of F&B GLA? The right amount of spend, at the right time and at the right price-points.

Failure to get this balance right will result in lowered F&B revenues, regardless of the design qualities of the centre, ultimately this impacts the asset value as well as limiting the centre’s ability to secure premium operators in premium locations. This imbalance then becomes a downward spiral of negative leasing patterns with fewer and poorer operators driving a negative food image within the centre in a self-perpetuating cycle.

On a recent trip to Queensland, we looked at a CBD centre that had significant investment in recent years, especially within the purpose-built dining precinct. The development team had taken a formulaic approach and adopted a predictable ‘Shopping Centre’ operator mix.

Compounding the outdated approach, there had been an inability to combine the centre into the lives of the identified customer segments with no key insights into what their customers wanted and little consideration into the mix breadth that was required. Instead of the development of a great dining precinct of individual, thoughtful, insightfully assembled restaurants, eateries and bars – a true hospitality precinct – they had managed to provide a two-dimensional retail statement with poor retail food standards, ambience and hospitality overlay.

The centre had a low percentage of licensed operators and limited externalisation of their F&B (particularly during the hours outside of core trading hours). Overall, the food mix was a range of common ‘shopping centre brands’ that offered no or low point of difference. Thirty per cent of the operator mix was already in the direct competitor set of the surrounding trade area.

The end result was significant vacancies across the entire centre, surrendered leases and a reluctance of the leasing team to put food back into the centre with the prevailing theory that the centre had too much food already, however this was not the case. (The centre’s GLA only accounted for less than 4% of the total centre GLA). The real and core issue was that the centre did not have a dining product that their customers were interested in. There were other options in the high street that would happily compete for repeat business by providing a genuine and authentic service option with familiar faces ‘behind the bar’ of the local pubs and restaurants.

The centre had not deeply considered the customer segments’ F&B needs and had missed the opportunity to create a F&B environment that was unique, engaging and ‘connected’ to all day parts in order to be successful. The result was an even more unloved centre and the least likely destination for AM and PM day parts.

Success in hospitality is not about providing the best lease returns, it is about ensuring the social needs of residents, workers and visitors are met, which drives uptake of the F&B offer, operators build great businesses and in turn drives the success of the centre.

- Palisades Village by Caruso

- Palisades Village

Rick Caruso’s Palisades Village in Los Angeles opened in September 2018 is a great example of the direction that modern CBD centres need to take. While not technically a CBD centre, this ground-breaking project is worthy of replication in any location in Australia.

The development was significantly influenced by the community of Pacific Palisades with more than 100 community meetings resulting in smaller, intimate, boutique outlets that were customised to suit the local customer segments with 33 retail outlets, 11 F&B outlets, cinema and events. Eight of the concepts were first time ‘bricks-and-mortar’ from successful online businesses and almost 50% of the outlets are owned by women.

- Palisades Village

The balanced centre adopts a flexible strategy, creates an experiential offer with a customised F&B offer that incorporates deep insights into the mix with an adaptable approach to leasing, allowing operators to present an evolving food offer, pop ups and markets that are in tune with customers. Shopping centre customers want to be amazed and intrigued by what a shopping centre has to offer. A curated F&B offer can help differentiate a centre from competitors, increase dwell time and footfall while attracting new customer segments ultimately changing the perception of the centre.

In summary, positive performance of hospitality in CBD Shopping Centres is through the balance of price points attuned to the residents, workers and visitors, offering a mix of on trend, popular, convenient and aspirational dining. Great food concepts plus great design equals Sales Maximisation. It’s about a strategic alignment of F&B options beyond the predictable mix with new to market and good concepts done well. SCN