It’s CBD Guns issue and a research piece on the Melbourne CBD follows. It’s exhaustive, comprehensive, specialised and professional. A textbook case of an expert research overview.

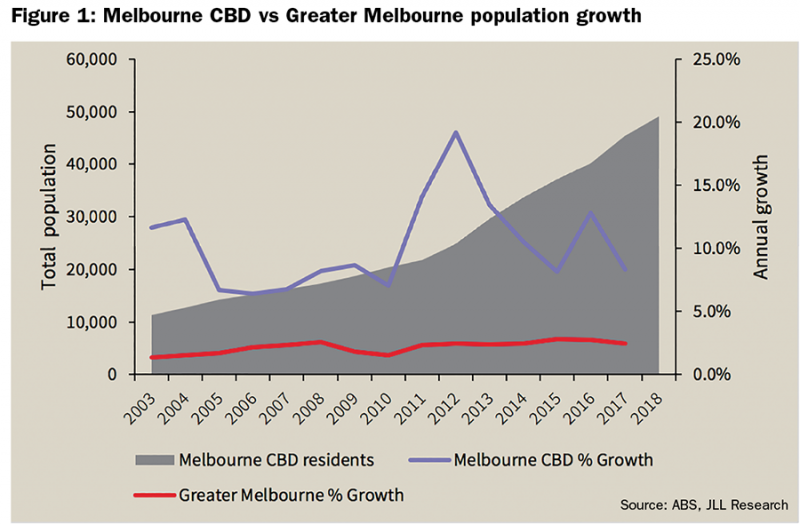

Melbourne’s CBD arguably presents a strong opportunity for both retailers and landlords. Over the past decade, Melbourne’s CBD resident population has more than doubled and the city has transformed into a 24/7 commercial and lifestyle hub. Both planning policy and an appetite for development from domestic and offshore groups have stimulated this transformation.

A strong phase of development remains ahead with a large pipeline of office, hotel and residential projects set to be completed in the coming years. In turn, this phase of development is likely to result in an increase of residents, workers and tourists seeking goods, services and experiences. Considering the current challenges within the Australian retail landscape, new and existing retail space will need to keep up with the changing requirements of CBD space users. Providing convenience and experiences will be key themes for retail spaces going forward.

Current retail market dynamics

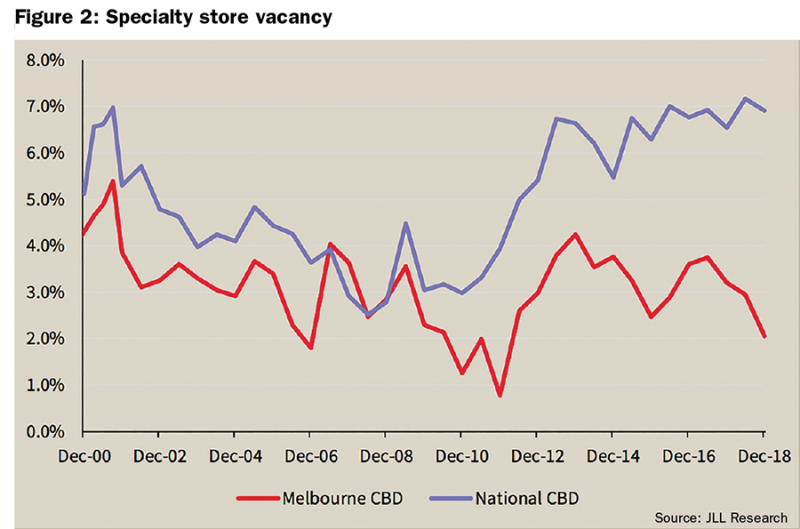

To date, Melbourne’s CBD has already proven itself as a strong retail market with specialty store vacancy significantly declining over 2018. The Melbourne CBD vacancy rate currently sits at 2.1% (Dec-18) compared to 6.9% for CBD markets nationally. Vacancy is now at its lowest level since December 2011. This contrasts to most other cities and retail sub-sectors that have maintained stability or seen moderate rises in their vacancy rates.

On an annual basis, gross rental growth in the Melbourne CBD has been the most resilient to date out of any Australian retail sub-category.

However, like all other retail sub-categories, the CBD market faces a number of challenges such as competition from e-commerce and domestic retailers consolidating their physical footprint. These pressures were reflected in the withdrawal of Just Jeans and Dotti from popular the Bourke Street mall in 2017.

Despite the current pressures, the leasing environment has remained relatively competitive with a number of international retailers entering or expanding in the market in the past 12 months, particularly in the luxury sector. New international store openings in 2018 included Fendi, Mulberry and L’Occitane’s new Australian flagship store.

In early 2019, luxury shoemaker Christian Louboutin also renewed its Melbourne presence by signing a lease for new premises on Collins Street. Additionally, consistent with other retail sub-sectors, there is continued demand from food retailers and retail services. Although sector-wide headwinds remain, rising development is likely to result in increased foot traffic and significant leasing demand from retailers.

The development pipeline

Supply is elevated across multiple real estate sectors in Melbourne, reflecting strong population growth and job creation. Greater Melbourne’s population grew 2.5% in FY2018, outpacing the already strong national rate of 1.6%. In this same period, the Melbourne CBD population grew at an even stronger rate of 8.3%. This current period of growth and revitalisation is driving more ‘upscale’ developments, which is catering for an increasingly globalised, educated and wealthy workforce.

Office

A number of high-quality prime buildings are set to be completed over the next few years. These new developments all have substantial pre-commitments by major corporate tenants such as, McKinsey and Co (80 Collins), Minter Ellison (Collins Arch), Macquarie Bank (80 Collins) and Deloitte (The Olderfleet). It is a positive sign that these companies are upgrading or expanding their office space, as it demonstrates how Melbourne is becoming increasingly recognised as a global city. Growth in white collar employment in the CBD drives significant demand for convenience retail and F&B amenity. Additionally, growth in professional services jobs leads to a greater proportion of workers with high spending capacity.

Hotels

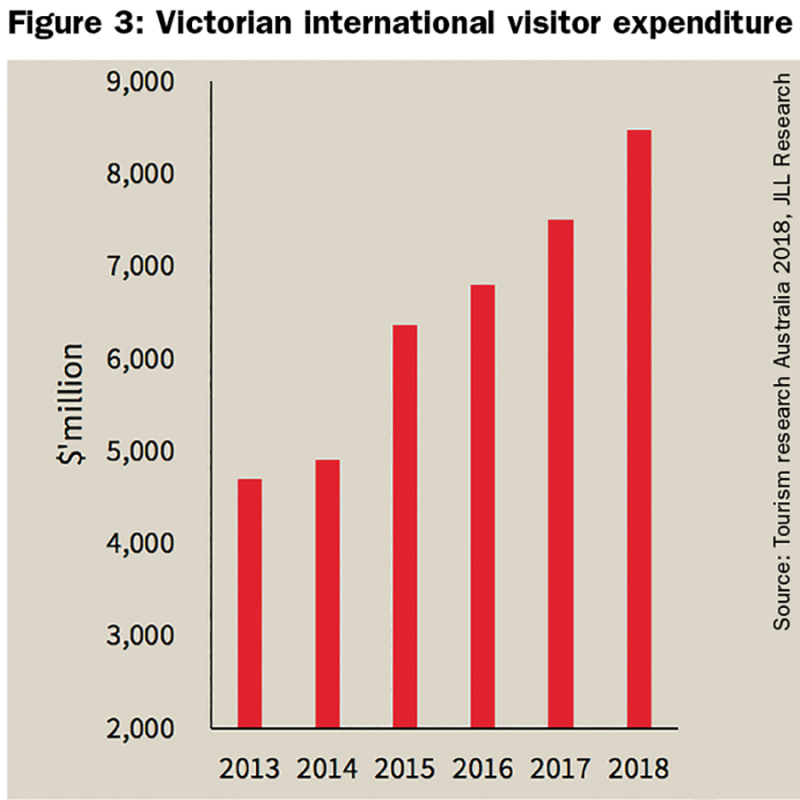

Melbourne is becoming an increasingly popular tourist destination and there is a strong pipeline of hotel projects to support this. Big luxury names are coming to Melbourne for the first time, including the Ritz Carlton, Shangri-La, W-Hotel, St Regis and Mandarin Oriental. In turn, these hotels are likely to attract a number of high spending tourists. Total international visitor expenditure in Victoria grew 13% in 2018 with the majority of this spending occurring in metropolitan Melbourne. The average spend per visit and night has also steadily increased. Notably, Hong Kong, Singaporean and Chinese visitors are the highest spenders per night. Melbourne needs to adequately service high-spending overseas visitors, who are most likely accustomed to experiencing superior retail amenity in other major cities. Apart from new luxury entrants, a number of upscale business hotels have committed to space in the Melbourne CBD to service work travel and mid-tier accommodation demand. This includes Next Hotel (80 Collins Street) and Hilton Bourke Street. According to JLL Hotels and Hospitality Group, there are 4,400 hotel rooms under construction across 18 projects in the Melbourne CBD (including Docklands and Southbank).

Residential

The Melbourne CBD already has a large number of residents compared to other CBDs and continued residential development means population growth is likely to continue. The 2016 Australian census showed that renters comprise 67% of the Melbourne CBD population (compared to just 28% throughout Victoria). This is an advantage as renters are unlikely to feel the current drag on household wealth that many owner-occupiers are feeling on the back of recent house price declines. In total, there are currently 7,200 apartments under construction in the CBD. A further 6,600 are either being marketed for sale or have plans approved. The recent phase of residential construction was dominated by high-rise towers targeting investor purchasers. However, the next period of residential development will feature more apartment developments targeting owner-occupiers that focus on upscale amenity to attract buyers. Another trend is combining luxury hotels with apartments, which lifts the prestige of the residential component. Additionally, the Melbourne CBD also has a strong student resident population, which is likely to grow on the back of a substantial student accommodation pipeline. This rising millennial population is supportive of continued strong CBD food retailing performance, as millennials tend to spend a greater proportion of their income on eating out compared to other generations.

Infrastructure

The Metro Tunnel is currently being constructed to support the commercial and residential development occurring. It will add five new underground metro stations to Inner Melbourne including two directly in the CBD grid. The project also involves network-wide rail upgrades to improve the frequency and capacity of trains arriving and departing from the CBD. This project will improve accessibility to the CBD, which should help to drive foot traffic and retail demand. Infrastructure upgrades and government-led initiatives have had a strong impact on managing the CBD growth to-date and enhancing the appeal of visiting the CBD. Key initiatives include free Wi-Fi in the Melbourne CBD and the ‘Free Tram Zone’, which has allowed for easier movement within the CBD.

Retail opportunities

While there is likely to be continued demand from existing prominent retail categories (such as international fashion retailers), it is important that new and existing retail space adapts to the needs of new CBD space users. Convenience will be particularly important for workers and residents, while creating retail experiences will be particularly important for tourism.

These key retail opportunities can be broadly split into the following categories:

New store formats

Smaller stores with tailored selections are becoming increasingly prevalent across the industry. The biggest Australian example to-date is within the supermarket industry where Woolworths established its ‘Metro’ brand. Coles also launched ‘Coles Local’ in Melbourne’s eastern suburbs in 2018, which includes a more gourmet, locally produced selection of products. In the department store sector, David Jones has emphasised its plan to focus on small format stores, partly to cater to time-poor city-workers. This makes tailored product selection highly important in providing convenient retail.

Convenience technology

Blending bricks-and-mortar stores with streamlined technology creates the opportunity to maximise flexibility and convenience for customers. F&B apps are changing the way people purchase food. Examples include the growing prevalence of ‘order-ahead’ services (Hey You), ‘meal plan’ apps (Mealpal) and delivery services (UberEats). There is a large scope for physical retailers to utilise convenience technology particularly in the ‘pick up’ space for transactions such as repairs, dry-cleaning and pharmacy items collection.

The experience economy

While technology plays a strong role in our society today, consumers value experience more than ever. Providing unique experiences is also crucial in maintaining tourism growth.

The most prominent example is blending F&B with leisure or ‘Dinetertainment’, which is becoming increasingly prevalent both internationally and in Australia. Current examples of this in Melbourne are ‘Cork and Canvas’ (painting with wine served) and ‘Holey Moley’ (mini-golf at a bar). Internationally, Barcades, which combines old school arcade games with alcohol, are gaining traction.

Holey Moley mini-golf and cocktail bar

More ‘up-market’ experiences are also rising in popularity. An example of this is ‘Milk the Cow’, which offers Wine and Cheese pairings and dairy tasting events. Milk the Cow currently operates two stores in Inner Melbourne. Aside from F&B experiences, more creative ‘competitive socialising’ activities such as Axe Throwing, Escape Rooms and Virtual Reality are beginning to emerge within Melbourne.

Market Style

Food halls and urban markets are growing in popularity. Food halls provide the opportunity for retailers to showcase their product and provide ‘something for everyone’. The Night Noodle Markets have been Melbourne’s leading example of a successful outdoor pop-up food market that brings together a variety of retailers. Going forward, providing space for such events will be important. However, there is also an opportunity for smaller, indoor and even ‘up-market’ versions. An existing example of this is HWKR, which is currently operating in Melbourne’s CBD and is inspired by hawker food centres in Singapore and Malaysia. The innovatively designed store includes regularly interchanging vendors and uses app-powered ordering. Looking internationally, the Eataly chain is a highly popular ‘market style’ retailer. Eataly stores comprise numerous restaurants and delicatessens normally over multiple levels. Eataly has expanded to more than 35 locations around the world. Urban food halls in all different forms are growing in popularity around the world. The UK’s largest food hall known as ‘Market Hall West End’ will cover 37,000m2 and is set to open this year. The hall will be located just off Oxford Street – the world-renowned retail high street.

Eataly

Is this a national trend?

Looking across Australia, the performance of CBD markets currently varies, but all cities are exposed to the same structural changes such as growing urbanisation, rising apartment living and increased mixed-use development. Most markets are going through some form of revitalisation. However, the end of the mining boom has held back the performance in markets like Perth where the CBD vacancy rate currently sits at 13%. Sydney certainly has a number of strong fundamentals such as its relatively high population density and the current pedestrianisation of George Street. Ongoing upgrades to retailer composition along with the activation of George Street continues to drive retailer demand.

Outlook and conclusion

Although the retail industry faces rapid change and constant challenges, there are a number of opportunities that could be pursued to service the changing physical retail needs of the Melbourne CBD. Whether that is simply providing small format stores with tailored selections or more innovative ‘market hall’ culinary experiences, there are many ways retailers and landlords can provide convenience and experiences to CBD residents, workers and tourists. At the end of the day, although we live in this highly advanced digital age, people do not always want to be confined to their office, home or hotel room and increasingly value social experiences and human interaction – which makes the role of physical retail space in city centres more important than ever.