It was a ‘split year’! The first half – July/Dec 2019 was ‘normal’; however the second half – Jan/Jun 2020 was anything but because COVID-19 arrived! Sales of shopping centres over $5 million this year were some 26% down on the previous (2019) financial year. Down they may be; but the sector still accounted for some $6.4 billion in sales. This article is co-authored by CBRE’s Simon Rooney and Kate Bailey.

FY20 – A year of two halves

Transaction volumes across FY20 were vastly different in H2 2019 and H1 2020. A number of record transactions were recorded in the back half of 2019, which included the respective 50% interest landmark transactions of Westfield Marion, SA and Garden City Booragoon, WA for a combined consideration of $1.25 billion while market uncertainty and economic volatility driven by COVID-19 saw transaction volumes decline sharply in H1 2020.

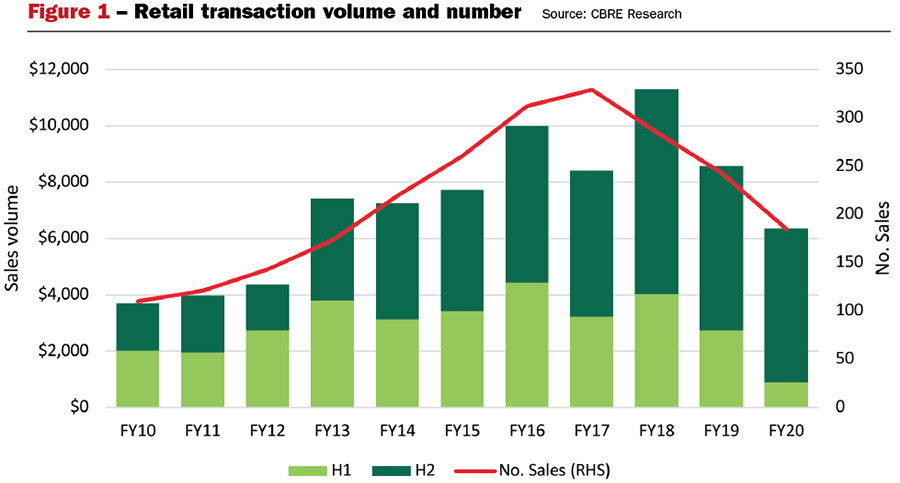

Total transaction volumes above $5 million in FY20 totalled $6.4 billion across 185 transactions (Figure 1). This was 25.9% down on FY19, primarily driven by a slowdown in transactions in H1 2020.

The advent of COVID-19 saw many investors delay decision-making due to travel restrictions, market uncertainty and global volatility. Total sales volumes in H2 2019 totalled $5.5 billion while just $883.4 million was transacted in H1 2020. Although the dollar value of transaction volumes was supported by a number of sales of larger assets, total sales numbers fell 23.9% from 243 transactions in FY19 to just 185 in FY20.

Record transactions drive sales volumes

Regional centres accounted for 19.6% of total transaction volume across FY20 despite comprising just two sales. Sales volumes were driven by record transactions in Western Australia and South Australia, both jointly marketed by CBRE and Colliers International.

The largest retail transaction in FY20 was the 50% share of Westfield Marion, Adelaide which transacted for $670 million reflecting a transaction yield of 5.25%.

Westfield Marion was attractive to buyers due to its location and dominance within its trade area

The asset was sold by Lendlease’s retail fund, APPF Retail and purchased by a Moelis Australia managed investment vehicle, fully capitalised by SPH REIT. Westfield Marion is the largest and only super regional asset in South Australia. The other significant transaction was Garden City, Booragoon in Perth. AMP Capital, on behalf of the AMP Capital Diversified Property Fund (ADPF) sold a 50% share of the asset, inclusive of management and development rights to Scentre Group to work in a JV partnership. The asset transacted for $575 million representing a transaction yield of 4.75%. Both deals were the largest to transact in their respective states and reflect continued investor appetite for high quality, well tenanted assets that dominate their respective catchments.

Following Vicinity Centres’ divestment in late 2019 of their 25% interest and management rights of Mt Ommaney Centre in Brisbane to YFG Shopping Centres (YFG) for $94.5 million, May 2020 saw YFG acquire the remaining 75% interest from Nuveen Real Estate for $285 million, reflecting a transaction yield of 6.25%.

Mt Ommaney Centre in Brisbane

New South Wales and Victoria dominate transaction volumes

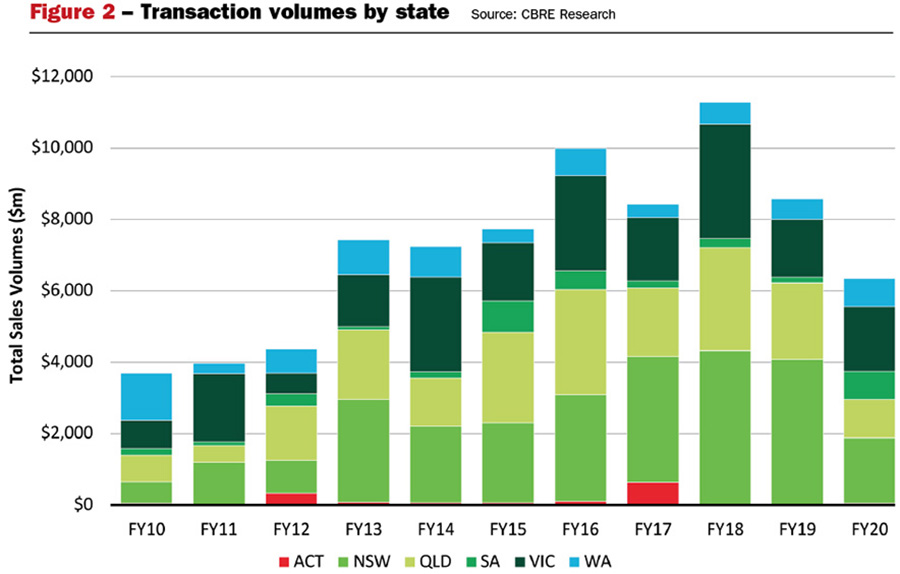

New South Wales and Victoria dominated sales activity, despite record transactions in South Australia and Western Australia. Excluding Westfield Marion and Garden City, Booragoon from South Australia and Western Australia’s total sales volumes, each state would have recorded $104.2 million and $212.0 million in transactions respectively. New South Wales and Victoria accounted for 57.5% of total retail transactions in FY20 (Figure 2).

Victoria saw an increase in sales volumes in FY20 with total sales totalling $1.8 billion, up 13.5% on FY19. The largest transaction recorded in Victoria was Brimbank Shopping Centre, sold by CBRE for $153 million by Blackstone to Mulpha International. The asset’s location within one of Melbourne’s major growth corridors should see continued MAT growth.

New South Wales recorded $1.8 billion worth of transactions across FY20; however, this was significantly down on FY19. Sales volumes in FY19 totalled $4.1 billion, in part driven by the transactions of Westfield Eastgardens ($720 million) and Westfield Burwood ($575 million). There were no transactions greater than $175 million recorded in New South Wales in FY20 and subsequently sales were 55.1% down on FY19.

Appetite for smaller investment grade stock steady among privates

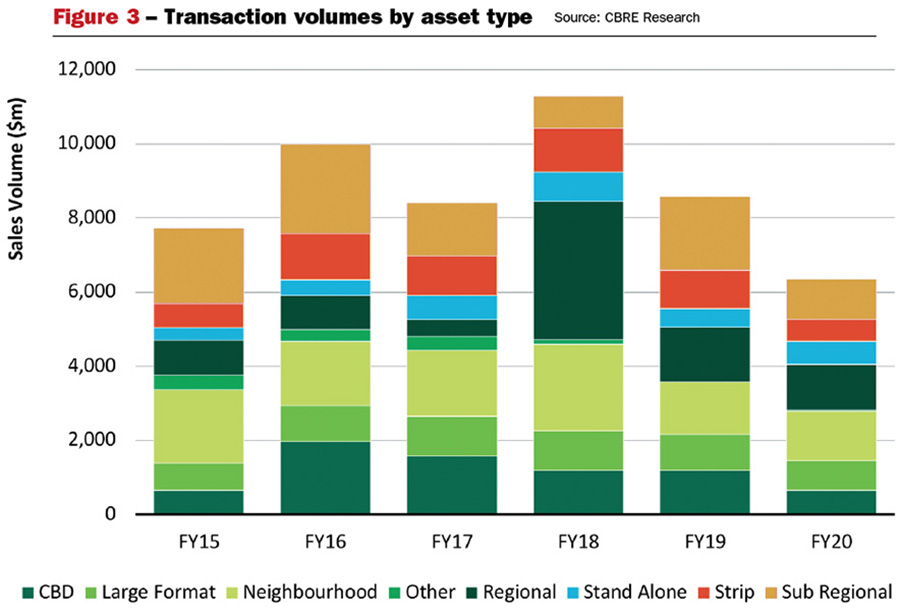

Neighbourhood and sub-regional centre transaction volumes totalled $1.3 billion and $1.1 billion respectively across FY20. Neighbourhood centres comprised 21.1% of total retail transactions in FY20 which was higher than FY19 (16.4% of total retail sales) (Figure 3). Many investors are gravitating towards smaller assets (non-discretionary focused shopping centres) that provide an increased level of liquidity, lower occupancy risk and required capital expenditure.

Furthermore, neighbourhood centres provide relatively attractive risk-adjusted returns when compared to other retail asset classes, commercial property assets and other types of investments such as equities and bonds.

Grocery retail, which comprises the bulk of the GLA in neighbourhood centres, saw strong sales growth during the COVID-19 pandemic. This helped drive foot traffic and resulted in occupancy levels in neighbourhood centres remaining broadly unimpacted. As a result, Woolworths, Coles and ALDI are fast-tracking plans to roll out new stores in their network to meet growing demand. The strength in grocery trade is expected to continue over the medium term and, subsequently, investor interest in assets with a strong performing Coles or Woolworths is expected to continue.

Major neighbourhood centre transactions recorded in FY20 include Norton Plaza Shopping Centre NSW, which transacted for $153.2 million, which represents a yield of 5.5%. Stockland Tooronga sold for $62.8 million on a yield of 6.7%.

Both assets traded in Q3 2019 to domestic investors and were sold by listed REITs (GPT and Stockland respectively). It is likely that listed entities will continue to sell down these types of assets to maintain liquidity.

Norton Plaza Shopping Centre NSW

Redemption pressure for some retail funds

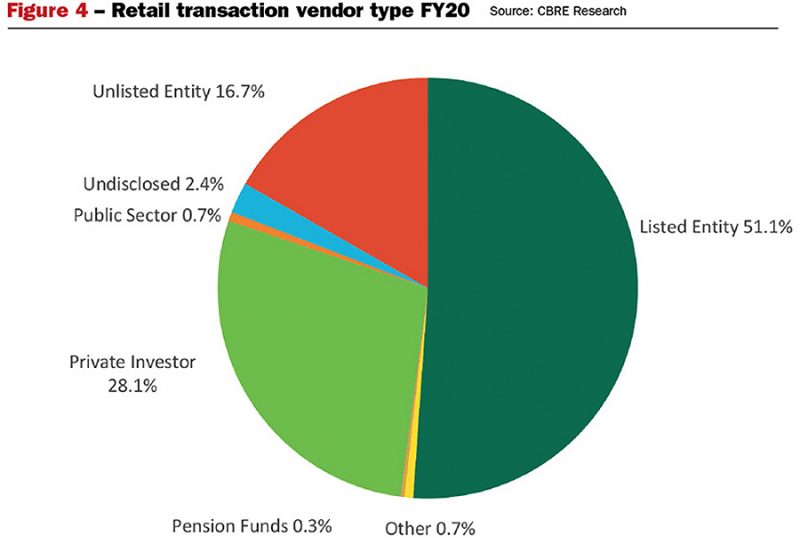

Continued negative sentiment in the retail sector has seen a number of investors seek to reweight portfolios away from retail, which is putting redemption pressure on some retail funds. Across FY20, 51.1% of all transactions were from listed entities, up from 45.0% in FY19 and 28.2% in FY18. It is anticipated that unlisted retail funds will continue to look to divest non-core assets to ensure they have a degree of liquidity to meet any redemption requests. If retail REITs continue to trade at large discounts to NTA, they may choose capital management strategies that result in asset sales and subsequent share buybacks.

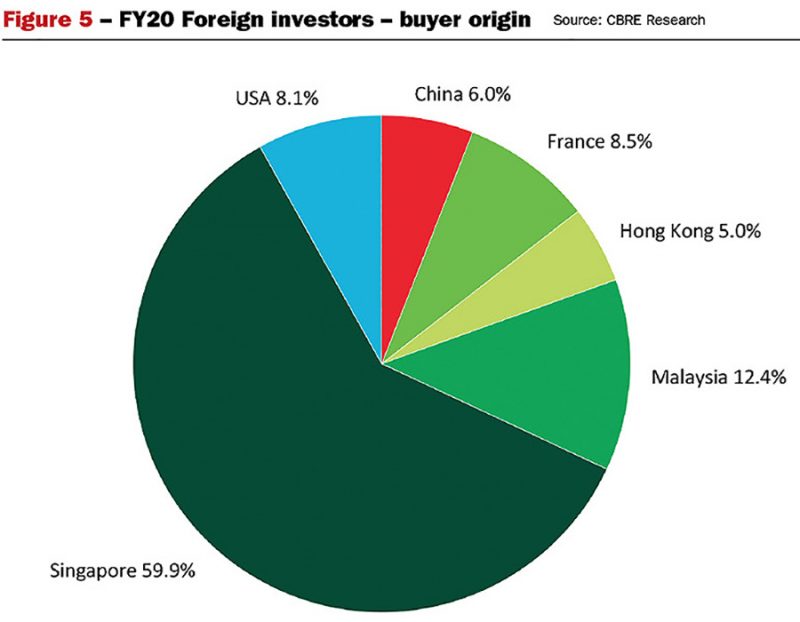

Australia remains an attractive destination for offshore investors

The proportion of total Australian retail assets sold to offshore investors increased significantly in FY20. Across FY20, 20.5% of transactions were to foreign buyers with the largest group made up of Singaporean investors whom invested $737 million in Australian retail assets. The proportion of foreign investment in Australian retail assets has been falling in recent years, comprising just 8.1% in FY18, 12.9% FY19 of sales over $5 million. The rebound in foreign investment in FY20 was primarily due to the transaction of Westfield Marion, excluding this transaction, the proportion of offshore investment would be 8.9% or approximately $566 million, which is below the ten-year average of 15.3%.

The outlook for continued elevated levels of foreign investment in the Australian retail sector is mixed. Instability in Hong Kong could spark further investment from the region as investors look to move capital out of Hong Kong. Conversely, growing diplomatic tensions between China and Australia could have an impact on the flow of Chinese capital entering Australia. This trend has already been apparent since the Chinese government tightened capital outflows from China since 2018. A total of $73.3 million of capital from China was deployed into the retail sector over FY20, down from $621 million in FY19. The bulk of these transactions were smaller, neighbourhood or sub-regional assets purchased by private investors.

Recent changes to FIRB regulations and approval process will see transactions from foreign investors potentially take longer to complete, however this should have little impact on the ability of investors to enter the Australian market. Australia’s relatively low COVID-19 infection rates and swift response to the slowdown in the economy will help promote Australia’s reputation as a stable, liquid market, with a population in relative health compared to other western economies. Stable population growth and limited supply of new retail assets should see the market maintain its appeal to offshore investors. Furthermore, the low cost of debt and low Australian dollar will promote Australia as an attractive destination for global capital, particularly for small to medium sized investors that don’t hedge against currency movements and regard currency arbitrage as an opportunity to boost returns on investment.

How are investors responding to COVID-19?

Australia’s relatively low case number of COVID-19 and swift reopening of the economy has seen consumer and investor sentiment improve. Retail spend and foot traffic in retail centres are showing signs of recovery, however are expected to slow once Job Seeker and JobKeeper are rolled back at the end of September. Investors are refocusing and restarting decision-making processes with significant capital waiting to enter the market. There is a strong buyer preference for high quality assets, core investments and stringent due diligence as investors look to generate stable and reliable cash flows.

Travel restrictions have made it difficult for foreign investors to inspect Australian assets. This is not expected to change until mid-2021, however a number of active offshore investors have established local offices or rely on trusted local capital partners and technology to invest into the Australian market.

Investors will seek out retail assets that can be future-proofed

The Australian retail sector is going through a period of transformation with changing consumer habits impacting the performance of bricks-and-mortar retailers. This trend is consistent around the globe. Retailers who fail to adapt to these changes by improving their online platforms and investing in customer experience will likely be impacted most. The retail sector is set to face a few challenging years ahead as this transition period impacts retailers and landlords alike. The changing retail landscape presents an opportunity for investors, landlords and retailers to transform retail centres into mixed-use hubs and future-proof against continued change. The impact to retail spending has been strongest in the apparel and footwear and department store categories and, as a result, store networks may be consolidated, resulting in vacancy risks for landlords.

Garden City, Booragoon

Retail centres are increasingly becoming mixed-use hubs with residential, education and office space all prevalent and investors are actively seeking out such assets. These uses increase footfall to retail centres and bring in customers in times when retail centres wouldn’t traditionally have customers (ie. early morning, late night). Investors will increasingly seek out centres with opportunities to develop these ancillary uses.

The continued structural change in the retail sector will see investors seek out assets with the potential to diversify into mixed-use assets. Vacancies also present an opportunity for landlords to remix centres to ensure they are future-proofed to meet changing consumer needs. Centres with accessible loading docks and surplus carpark space could be repurposed to provide space for last mile fulfilment and click-and-collect however the economics of relatively higher retail rents may be a deterrent for some occupiers. This could increase income collected at the centre while click-and-collect facilities could increase footfall. Most retail centres have good connections to the local population base and transport connections, which are key criterion for last mile fulfilment.