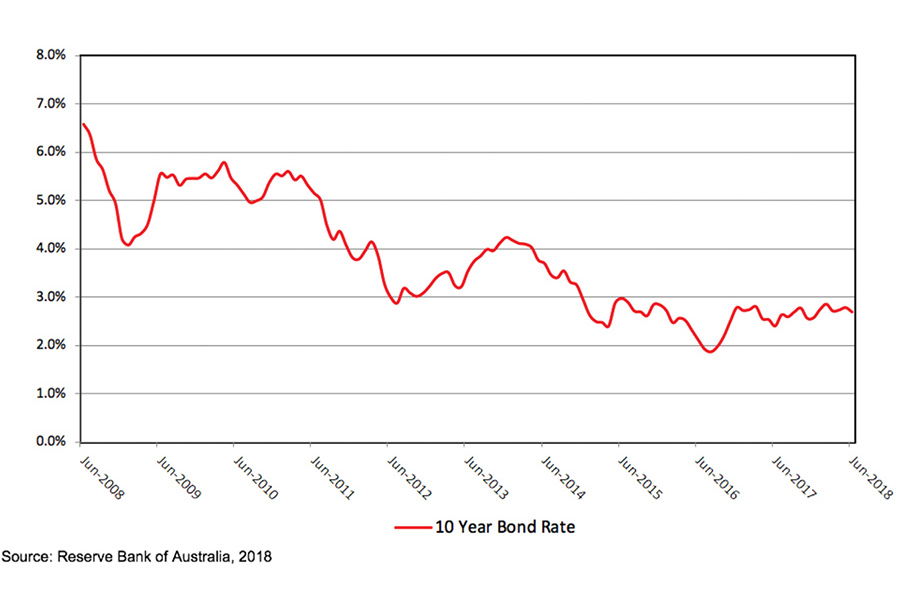

The Australian risk free rate has been rising since mid 2016 following a global trend. Bond yields, rate rises, cap rates – all heady stuff but the absolute core of our business. It can be complicated but Michael Schuh explains it all. Is there a link between capitalisation rates and Collingwood Aussie Rules Club? There is, as Schuh tells us!

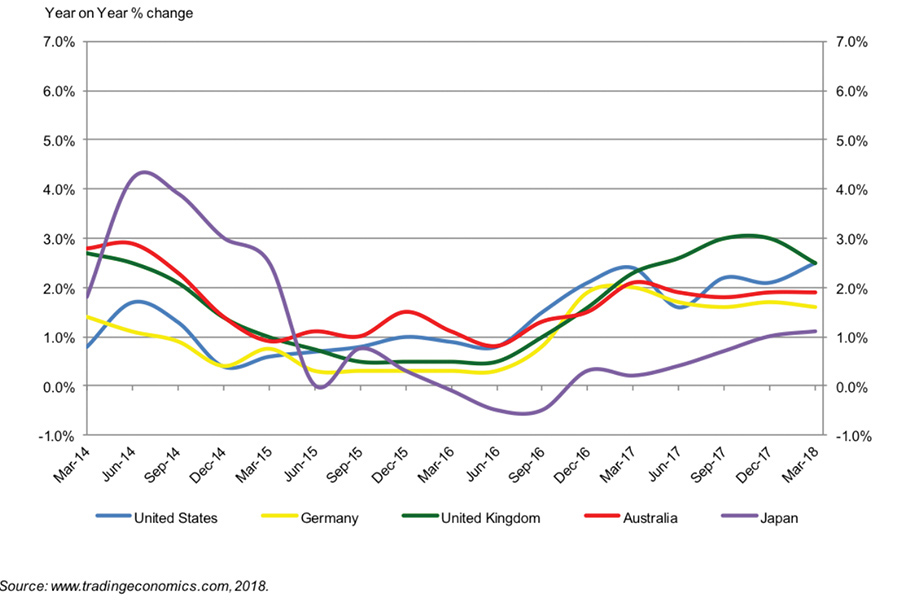

Beautifully coincidentally, world inflation rates (apart from ours) had begun rising at the same time, almost to the month. Adam Smith’s Invisible Hand – an economic fundamental established around 1780 a Scot I’m proud to say – immediately returns as financial markets are leaving artificial government manipulation.

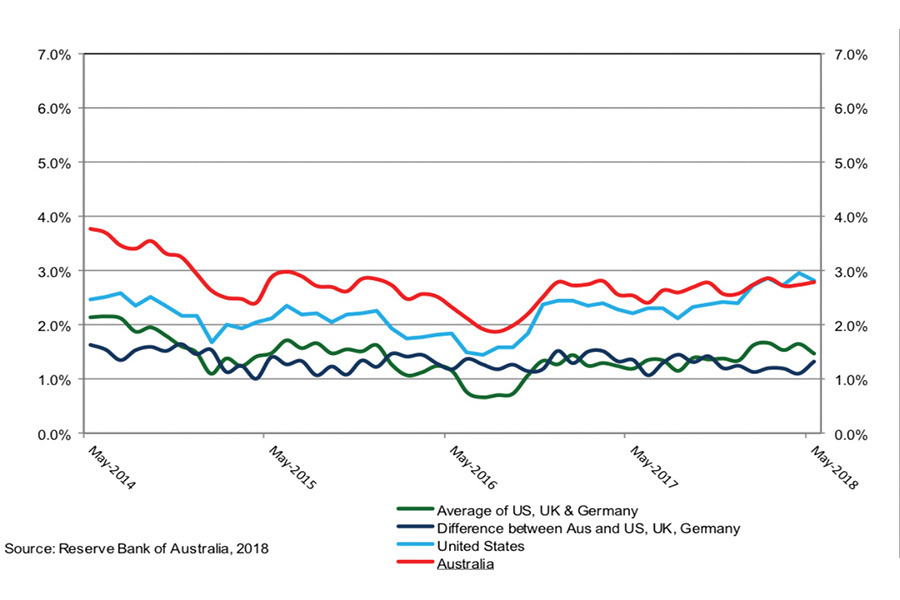

Very uniquely Australia’s 10 year bond rate is more or less equal to the US bond rate – versus a long history of a 1% to 2% gap.

Bond theory is bond rate = inflation plus sovereign risk – and Australia’s sovereign risk has to date always been above the US. There are varying theories at play about this, particularly in the context of the Euro zone when the same risk rate is between 1% and 1.5% – and the obvious market concerns on the Trump administration’s pioneering economic policy, which may well be the driver of the US yield spike.

- 10 Year Sovereign Bonds last 4 years comparison

Ultimately though rising global inflation – even if Australian inflation is not – means the cost of capital must rise here as elsewhere – and this mean total return expectations for property, played out in a less sophisticated part of the property market by rising commercial debt costs – will also increase.

That does not however mean that all cap rates (which are the sum of all things – particularly growth) will rise. If interest rates rise due to inflation generated by economic growth, cap rates could fall for those properties levered to that growth while total returns continue to rise in line with the cost of capital (because IRR less net growth equals cap rate). This scenario does mean the cap rates across markets and property types that have previously moved in unison will now diverge following traditional valuation fundamentals – and primarily the growth outlook.

Growth in shopping centres is unique in a way other property sectors are not – office and industrial for instance benefit from the rising tide lifting all boats. Shopping centres however do not – the rental growth of a centre is unique in almost every single instance.

Population growth, competitive supply, catchment, etc. This does set the stage now for shopping centre yields in particular to move in different directions (up and down) within the same sector according to the growth outlook peculiar to each centre.

Retail spending retains its headwinds as rising rates add to the cost of living against a back drop of weak wages growth. Population growth however is a key offset that is little discussed but again this is very much catchment by catchment. Then of course there is the contracting circle of expenditure in centres brought about by Amazon and other digital competition.

This Contracting Circle of Expenditure – meaning that shoppers spend the same but less often in a shopping centre – potentially could make regional centres more valuable to retailers because retailers need to be where the foot traffic is. Foot traffic could in fact increase in prime centres – at expense of their competition – if one believes that digital shopping is different to ‘going to the shops’. This then means that the centrality of ‘offer’ as the most crucial ingredient of a centre will be doubly important. Diversifying that offer into communal needs – and schools – which is no more than following the arrival of child care centres – is a wild idea that is not that crazy. The diversifying offer in shopping centres is a trend that has a long way to go.

- 4 Year Foreign Inflation Rates

Property yields generally in 2018 appear to have contracted again, which is counter intuitive against the recent rise in bond rates – notably though a rise that has not yet filtered into Australian commercial borrowing rates – however this is actually very usual. The SMSF market has opened up a huge new mobile source of capital and the collapse of the Telstra share price shocked a lot of people. When we look at the combined volatility of the share market an obvious correction that looms in the bond market for Big Capital, and a loss of confidence in the residential market, the fall in yields for commercial property as a safe house is extremely predictable.

The recent trend in yields for prime regional centres – which I don’t think is a contraction of yields but a realisation of where prime yields sat is not that surprising. These centres have the greatest agility to reposition their offer and will be the beneficiary of retailers trending more toward fewer stores but more key flagship stores, is a well founded vote of investor confidence in the belief of the centrality of ‘offer’.

The total return for these prime regional centres make perfect sense once one factors in growth and competitor risk, and supply volatility relative to other asset classes. In particular, the supply risk for regional shopping centres has improved markedly. The contraction in the DDS market makes transitioning of sub-regional centres to regional centres almost impossible. The only regional centre supply risk – outside of digital – is expansion of existing regional centres and there are many regional centres that enjoy no or very little meaningful regional centre competition. CCE also means that some regional centres will benefit from a contracting offer in competing sub-regional centres, which may transition some areas to medium density residential. Regional centres that have sub-regionals as their only competitors are therefore very well placed. Add in population growth and this outlook magnifies again – if the offer can capture the people.

For shopping centres yields generally from this point, old investment fundamentals are returning because rising capital costs (or debt) is an iron rod that property investments without growth cannot withstand. A focus on the growth outlook as a key driver of the investment decision is something that will return as a centrepiece. Equally, in the very near future assets not priced to growth will be found out in the same way Collingwood has following its free ride in the draw that took it to the top of the ladder for no good reason. There are some assets that Collingwood shares a lot in common with.

*At the time of writing on the 16 July, Collingwood has just been thrashed by Westcoast in a 2 v 3 clash. Quite a bit of face painting gone to waste in the Schuh house.