Times are a changing! Millennials are now the largest generational group in Australia; yes, they’ve overtaken the Baby Boomers! Generation Z (the 10 to 24 age) are in hot pursuit. This of course, changes retail expenditure – this cohort buys differently. And where is this change mostly seen? The luxury end of the market. A lot to learn here about your centre’s tenant mix…

As we continue to review incoming economic data in the wake of rising inflation and interest rates, perhaps one of the most surprising outcomes has been the continued strong performance of retail spending in Australia. Retail spending in September grew +0.6% on a monthly basis, representing nine consecutive months of growth and an annual MAT rate of +10.4%.

Reasoned assumptions would predict that in the face of the current macroeconomic climate, a sharper decline in consumer spending would be expected. However, this has yet to come to fruition, likely prompting the Reserve Bank of Australia to consider further elevations to the cash rate, in a bid to soften demand and tame inflation.

It is without a doubt that several factors are at play in the sustained demand, namely record low unemployment coupled with high levels of household savings accumulated during the pandemic. However, considerate views would suggest the changing demographics and personal situations of young Australians may be at play, supporting the upward trend in retail spending.

So, what potential reason could be driving the current appetite for retail spending? When looking at the Census and population data of Australia, an interesting insight begins to appear that may have been previously overlooked.

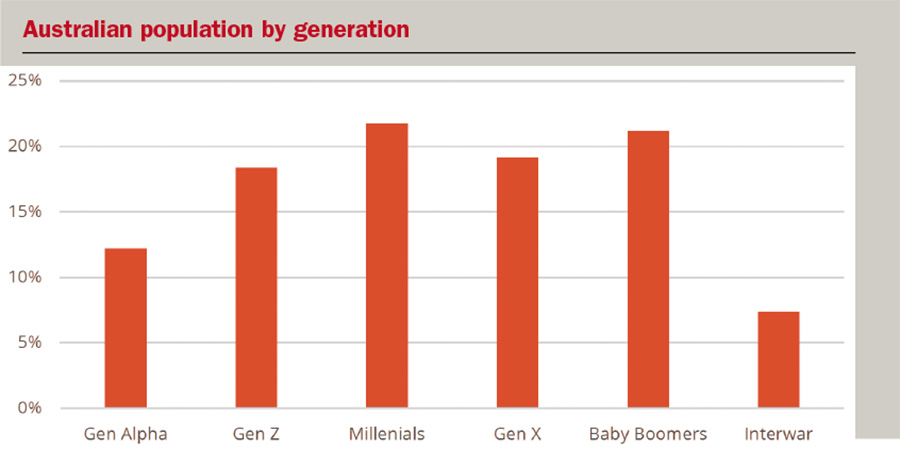

Data released by the Australian Bureau of Statistics in March 2022 indicates that ‘Millennials’ (ages 25 to 39) have now overtaken Baby Boomers as the largest generational group in Australia, accounting for 22% of the population (5.6 million people).

Closely following Millennials are ‘Gen Z’ (ages 10 to 24), who represent 18% of the Australian population, with 2.2 million of this population group being between the ages of 18 to 24.

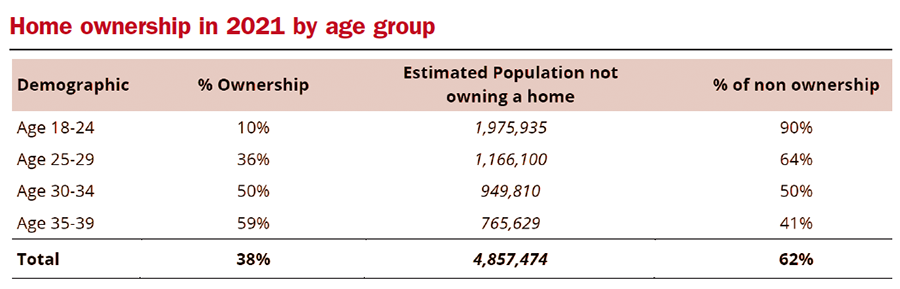

Further analysis of this demographic shows that 62% of Australians under the age of 39 currently do not own a home. This represents 4.85 million people, or 19% of the total Australian population, which is a population group equivalent to all of ‘Gen X’ (age 40 to 54) in the country.

This low level of home ownership from this group of the population, would indicate that members of this portion of the Australian economy are largely immune to the impacts of rising interest rates (at least in the short term).

Adding further leverage to this assumption is research from the Australian Institute of Family Studies in 2016 indicated that 44% of Australians aged 20 to 24 and 17% aged 25 to 29 are still living at home, a trend expected to be marginally higher following the pandemic.

When we couple this demographic data with higher savings rates and record low unemployment, it starts to present a segment of the Australian economy with a potentially high level of disposable income who are immune to the current income pressures of rising mortgage rates.

Younger generations boosting the rise of luxury retail

With the recent rebound in physical shopping experiences; Colliers have seen a trend from these young consumers towards luxury retail.

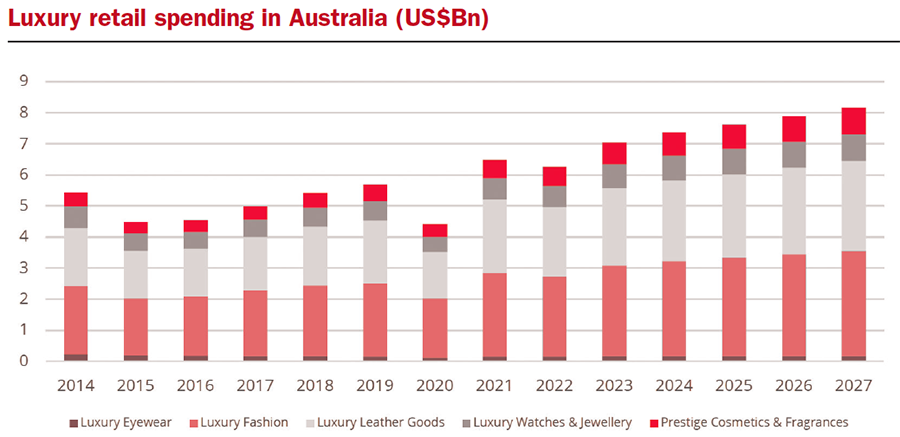

The luxury retail market in Australia is worth approximately US$6.7bn annually, with this market expected to growth annually by +5.42% (CAGR 2022-2027), according to Statista. The largest sector for luxury retail in Australia is the luxury fashion market, representing $2.6bn annually and is forecast to grow to as much as $3.39bn by 2027.

Colliers’ Director of Retail Leasing Michael Tuck, comments that luxury retail trade has proven its resilience throughout the pandemic, bolstered by domestic consumer spending.

“We can expect that with a positive trending return of international tourism, these sales will continue to rise, and increasingly particular among the younger demographic. Supported through demographic spend data, luxury brands have capitalised on the nuance of engaging younger demographic consumer groups through social influences with the likes of social media, interactive pop ups and strategic in-trend designer-led campaigns,” said Tuck.

Luxury retail continues to source high demand in recent years from younger consumers as tastes transform away from ‘fast fashion’ and more towards higher quality, brand name purchases. This is most evident by Millennials and Gen Z now accounting for more than 30% of all luxury spending in Australia.

In 2021, research in the United States undertaken by the Bank of America using credit card data; indicates that luxury spending has surged +47% higher than pre-COVID 2019 levels. For 2022, the data indicates that luxury spending is up +14% through to April 2022. The trend for growth in luxury spending is being felt in the Australian market, with many retailers experiencing similar levels of growth.

Across Australia, there is an expected additional supply of luxury retail underway in response to the growing demand; namely in Sydney at 111 Castlereagh (ex David Jones building), the Chatswood Chase phase 2 development and the recently completed Raine Square in Perth.

Burnside Village in South Australia, was recently ranked the number one ‘Mini Gun’ in the country for MAT, having grown +5.4% on 2021 to a total MAT of $238 million. With a forecast future development project in the pipeline, Burnside Village will look to further enhance its tenant mix by the introduction of exciting new international brands to the centre, illustrating how market trends continue to dictate and shape future retail design.

This article by Nik Potter, Associate Director, Colliers Retail Research is featured in the latest edition of Shopping Centre News – view the full digital edition here.