FY19 Market Overview

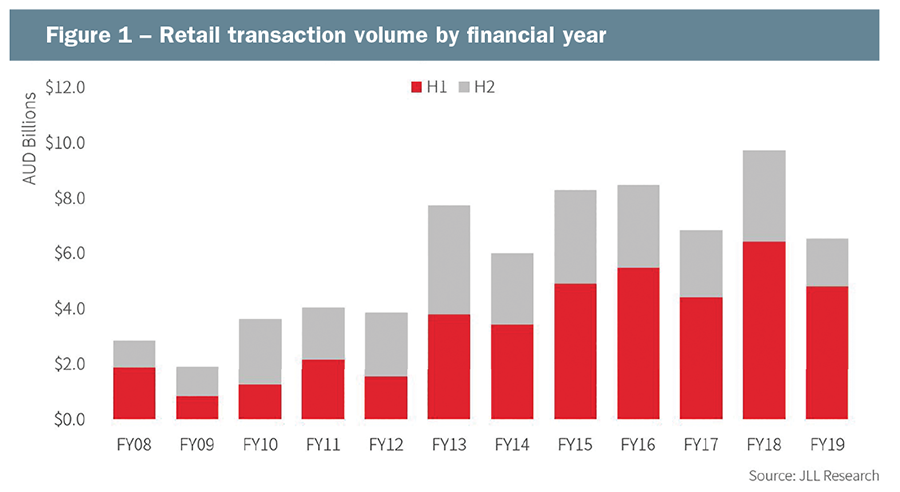

Transaction activity slowed substantially in the second half of FY19. Of the $6.5 billion of transaction volumes recorded in the 2019 financial year, only $1.7 billion (26%) was recorded in the latter half – the lowest half-year period in seven years. The sale of Westfield Burwood (50%) for $575 million accounted for 34% of the half-year volume in a single sale.

The FY19 total was notably below the record level reached in FY18 ($9.7 billion). The slowdown in activity, especially the second half (H2) of the year, is representative of buyers becoming increasingly cautious towards the outlook for retail pricing and leasing fundamentals.

Investor sentiment towards retail softened in the second half of FY19, which impacted the depth of demand and pricing for retail assets. Buyers remain cautious over the sustainability of income and about the general outlook for tenant demand. Leasing conditions remain challenging with transactions reportedly taking longer to complete. However, the outlook is improving with interest rate cuts and tax stimulus likely to flow through to retail spending in the first half of FY20, along with renewed optimism in the residential market likely to be supportive of household wealth.

There is a growing relative value story emerging in retail with a number of buyer groups attracted to the widening yield spread between retail and office/industrial whom are reviewing strategies to execute tactical acquisitions.

Despite the hype around the threat of Amazon to both online and in-store retailers, sales in its first full year of operations in Australia were lacklustre at just $106 million. Over calendar year 2018, Amazon’s share of the e-commerce market in Australia was only 0.4%. This equates to less than 0.1% of total Australian retail turnover, compared with the US, where Amazon accounts for approximately 40% of online retail, or about 6% of total retail sales. Nevertheless, the risk posed by ongoing ecommerce adoption should not be underestimated.

Owners of shopping centres have turned their focus to developing strategies to maintain and drive asset values through asset management (new and innovative leasing solutions to engage customers), by exploring development potential for alternative uses to maximise site potential and focus on refining and reducing the size of their portfolios.

Availability of investment product was high in FY19, particularly in the latter half, with a number of assets being offered as both ‘on-market’ and ‘off-market’ opportunities. AREITs and unlisted funds are reweighting to other sectors and down-weighting to non-core retail assets. As a result, there is a significant pipeline of retail product potentially available for sale by institutional owners. However, some assets that were previously for sale have been withdrawn as institutional owners consider repositioning options rather than divestment.

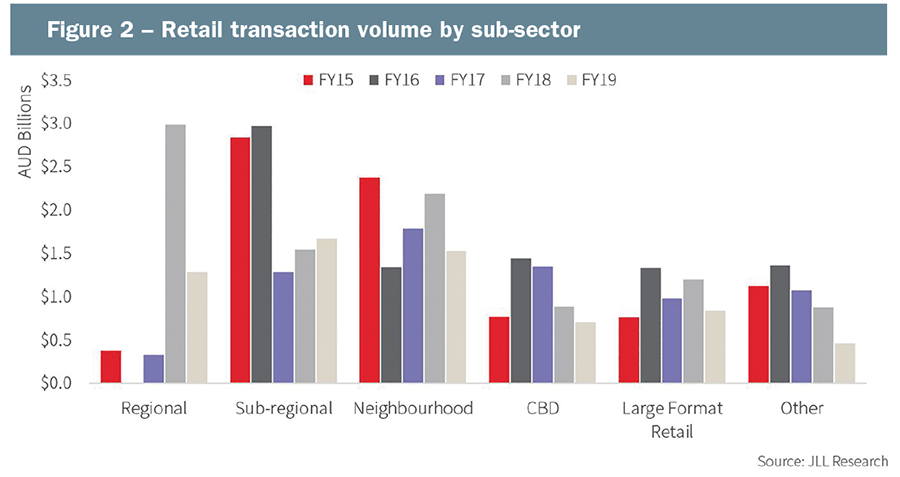

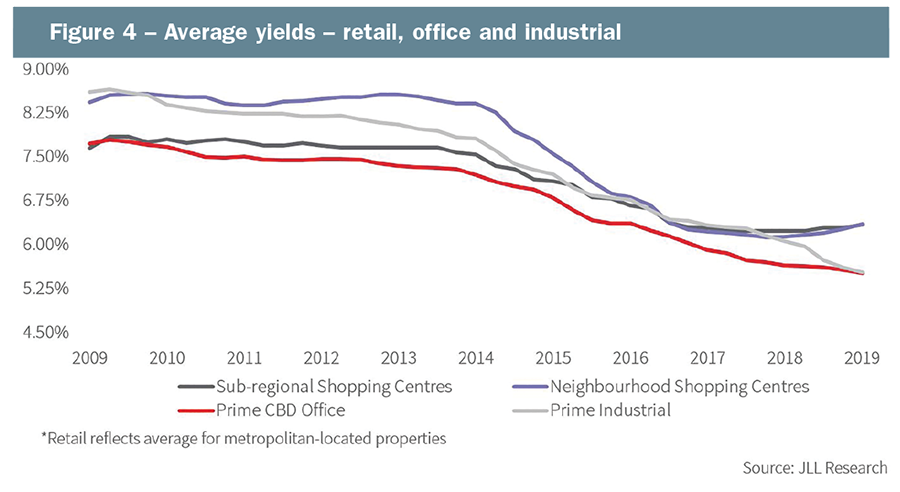

Activity was evenly split between the major shopping centre formats – sub-regional (26%), neighbourhood (24%) and regional (20%) in FY19. Regional shopping centre activity declined notably in FY19 ($1.3 billion) compared to FY18 volumes of $3.0 billion. Apart from the CBD sub-sector, regional centres have been the most resilient to yield decompression over the 12 months to June 2019 (+6 basis points) (bps). Sub-regional (+11bps) and neighbourhood (+21bps) centres have experienced more notable yield softening.

Fragmentation of retail ownership

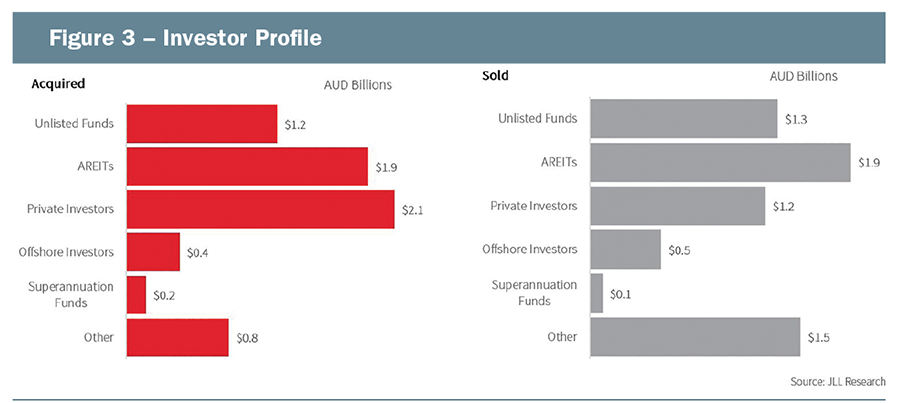

Retail ownership has started to become more fragmented. During the past 20 years, the asset class has been heavily institutionalised and ownership has been consolidated among a small number of major owners. However, this trend is starting to reverse as owners look to refine and focus their portfolios in order to extract value. For transactions in FY19, almost one-third of buyers were private investors, accounting for the largest share of acquisitions. Private investors were net sellers of assets for the six years to FY18. This notably changed in FY19, with net purchases of $849 million ($1.2 billion sold and $2.0 billion acquired).

As many AREITs and unlisted funds have announced plans to reweight their portfolios, fragmentation of ownership is expected to increase in the near term. A number of diversified institutional owners are divesting non-core retail assets and increasing exposure of other sectors. In FY19, AREITs and unlisted funds accounted for half (49%) of all assets sold, as they focus on smaller, more refined, portfolios. The influx of assets to market in the past six months has, and will continue to, provide opportunities for private investors.

Vicinity Centres, Scentre Group, Stockland, Abacus Property Group and Charter Hall Retail REIT all sold down retail assets in FY19.

Vicinity Centres, Stockland and Abacus were all exclusively sellers in FY19. Scentre Group was a net buyer of retail due to the acquisition of a 50% share ($720 million) in Westfield Eastgardens in July 2018 from Terrace Tower Group (which retains a 50% share in the centre), whilst divesting a 50% share in Westfield Burwood to Perron Group for $575 million in May 2019.

Emerging value in the retail sector

There is a growing relative value story emerging in retail with a number of buyer groups attracted to the widening yield spread between retail and office/industrial and are reviewing strategies to execute tactical acquisitions. Sub-regional and neighbourhood shopping centre yields converged at the same level in late-2016 and have remained closely tied as they slowly trended upwards to 6.35% as at June 2019. Prime office (5.51%) and industrial (5.53%) converged more recently (as of June 2019) and both sectors continue to trend lower. As a result, a positive spread of approximately 82 basis points has emerged between sub-regional/neighbourhood and office/industrial, which has widened from a low of just 6 basis points in March 2017. Syndicators and unlisted retail funds that heavily rely on yield as the driver of returns will be increasingly attracted to the retail sector.

The sharp fall in borrowing costs in the first half of this year is also supportive of acquisitions for investors attempting to generate high equity IRRs.

While the equity market is clearly pricing retail-focused REITs at a discount to NTA (net tangible assets), public debt markets have remained supportive, with some REITs such as Vicinity Centres recently issuing medium term notes on very low yields of approximately 2.6%.

As bond yields globally have taken a significant step down in the second half of FY19, the spread between retail yields and the risk-free rate widened considerably. The risk-free rate (long-term Australian Government inflation-indexed bond rate) fell to a record low of just 0.3% p.a. during June 2019 and was 0.39% on average over the month, down from 1.14% in November 2018. The risk premium for retail assets therefore has widened and provides greater compensation for risk.

There continues to be concerns towards the outlook for retail leasing conditions and income sustainability, which have impacted investor risk appetite. However, there have been some positive cyclical factors in the past few months to counteract some of the headwinds. The easing of monetary policy with two 25 basis points in the official cash rate (in June and July) along with recent tax cuts will provide relief to household budgets and will be supportive of retail spending from the second half of the year. The wealth effect should also be supportive, with house prices in Sydney and Melbourne bottoming post the federal election and equity markets reaching new highs.

A rebound in retail spending would stimulate investor demand given the relative pricing between sectors and recent step down in debt costs and the risk-free rate. It would also likely cause some major institutions to reconsider or scale back their intended disposal programs.

Listed market disconnect – M&A and transaction implications

Some of the diversified Australian REITs with residential exposure have seen a share price rebound in recent months given the renewed optimism towards the housing market. The improvement in share price may reduce some of the pressure to sell retail assets and may result in owners looking to retain or reposition assets instead.

However, the major Australian retail-only REITs (Vicinity Centres and Scentre Group) have been trading at a discount to underlying property values (net tangible assets) – a trend that could result in M&A if the discount were to widen further. Globally, the disconnect between share prices and property valuations has been more significant than in Australia, reflecting the more challenging retail environment in Europe and the US relative to Australia – among other distinct industry and economic differences. The share price discounts in the UK and US REIT markets are significant, in many cases between 40-70% for retail-focused companies. Some investors have sought to take advantage of the disconnect in listed market pricing around the world. Unibail-Rodamco acquired Westfield in June 2018 and Brookfield acquired General Growth Properties in August 2018.

What will bring global capital back?

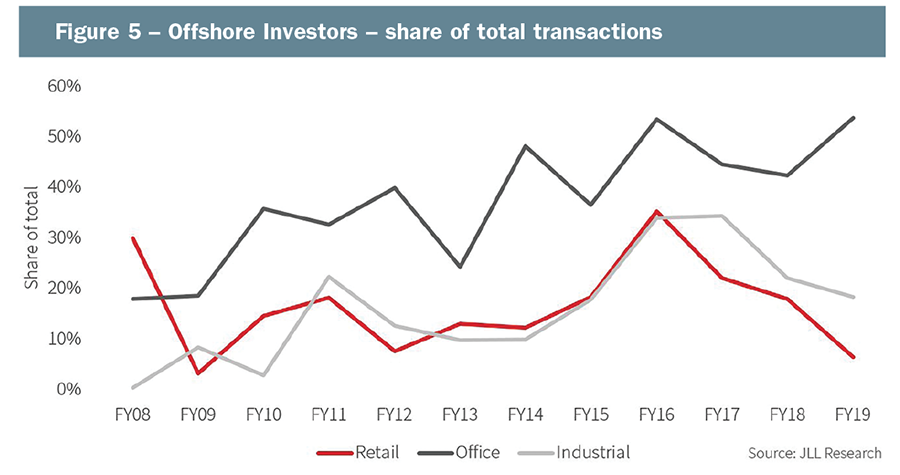

Offshore investors have been shrinking as a proportion of total retail transactions in recent years. Having peaked in FY16 at 35% (or $3 billion) acquisitions by offshore investors have fallen to just 6% in FY19 (or $418 million). The key transactions to offshore buyers in FY19 were two Blackstone centres, Waverley Gardens for $178 million to Heitman (as a joint venture with Elanor Investors) and Figtree Grove for $206 million to SPH REIT (as a joint venture with Moelis).

There are three main reasons for the decline in offshore participation in the Australian retail market.

Firstly, investor selection criteria narrowed as they became more selective in terms of asset quality and risk tolerance. Secondly, the yield spread between Australia and other countries has narrowed. The prime yield differential between Australia and the global average declined from about 150 basis points to 78 basis points in 1Q19. Finally, the buyer composition has evolved with fewer opportunistic buyers (such as Blackstone) and more core funds underwriting the Australian market with conservative investment strategies. Blackstone was a major driver of capital inflow ($2.4 billion) since its first acquisition in FY13, particularly in FY16 with two major portfolio deals.

Offshore investors will continue to be attracted to the fundamentals of the Australian market because of the low volatility of returns, market transparency, mature economy and highly institutionalised real estate sector with high quality management for joint ventures. The underlying demographic profile in terms of the age distribution of the population is also supportive of retail over the long term. Population growth in Australia is high by global standards and is forecast to be the fastest of any advanced economy during the next 10 years.

The office sector has attracted a disproportionate share of offshore capital historically, but the trend has been even more pronounced in the past few years. Sales to offshore buyers in the office sector accounted for 54% in FY19, compared with 18% in industrial and 6% in retail.

Offshore investors are now re-examining the Australian retail sector given the recent shift in pricing.Domestic institutional owners are either currently selling, or have flagged potential sales, as well as some major retail assets in order to meet fund redemptions, reallocate capital across different sectors to diversify their exposure, unlock capital for retail refurbishment or development projects and/or reduce gearing. As a result, there will be a number of opportunities for offshore investors to secure Australian retail assets which have historically been difficult to unlock.

Outlook

Retail transaction volumes are anticipated to increase from the low level recorded in the second half of the 2019 financial year. Investor sentiment is likely to improve as positive cyclical drivers of household budgets and household wealth become more supportive of retail spending in FY20.

Lower mortgage rates and tax cuts are positive for discretionary retail categories in the near term, while strong sharemarket performance and a potential recovery in residential prices will be positive for retail over the medium term.

Buyers of retail assets will remain discerning but with a notable decrease in the cost of debt and asset values having already corrected to some extent (depending on the sub-sector and asset quality), as opportunistic investors are revisiting plans for retail acquisitions. The relative value proposition between the sectors will attract new entrants to the market while existing institutions with extensive retail management experience will remain focused on driving value from their existing portfolios.

Authors: JACOB SWAN, SAM HATCHER and ANDREW QUILLFELDT

- Jacob Swan

- Sam Hatcher

- Andrew Quillfeldt

As joint Head of National Retail Investments at JLL, Jacob has been brokering major shopping centre asset sales for more than 14 years, specialising in the transaction of major Retail Investments on behalf of national and global investors. Now transacting major retail assets Australia-wide, Jacob is seen as a trusted advisor to a range of top tier investors. Previously the leading Retail Investment specialist in Queensland, he has transacted a significant $3.5 billion of retail assets since 2016 in Queensland alone.

Sam is joint Head of National Retail Investments at JLL, based in Sydney. Sam has more than 14 years’ experience and now specialises in the sale of major retail assets Australia-wide on behalf of national and global investors. Sam has a long-standing track record as the leading Retail Investment specialist in Queensland – having transacted a significant $3.5 billion of retail assets in Queensland over the past three years across sub-regional, neighbourhood, large format and freestanding supermarkets.

As a Senior Director of Research at JLL, Andrew leads the retail research function nationally and provides strategic advice to clients and JLL’s national Retail Investments, Valuations and Management teams. He has an active role across all aspects of research including the Real Estate Intelligence Service, JLL’s research subscription service. Andrew has more than 10 years’ experience with JLL and holds a degree in Property Economics from the University of Technology, Sydney.