Forgive the pun, but construction costs are going through the roof! Structural steel is up 40% and plasterboard 35% on last year’s figures. That’s not all; labour costs are rising too. It will affect our industry as some 2.4 million square metres of retail are forecast between now and 2025…

Costs in construction have spiked in recent months, driven by inflation, economic stimulus and supply chain challenges, impacting material availability. The increase in construction costs is putting pressure on the development pipeline, margins and timelines.

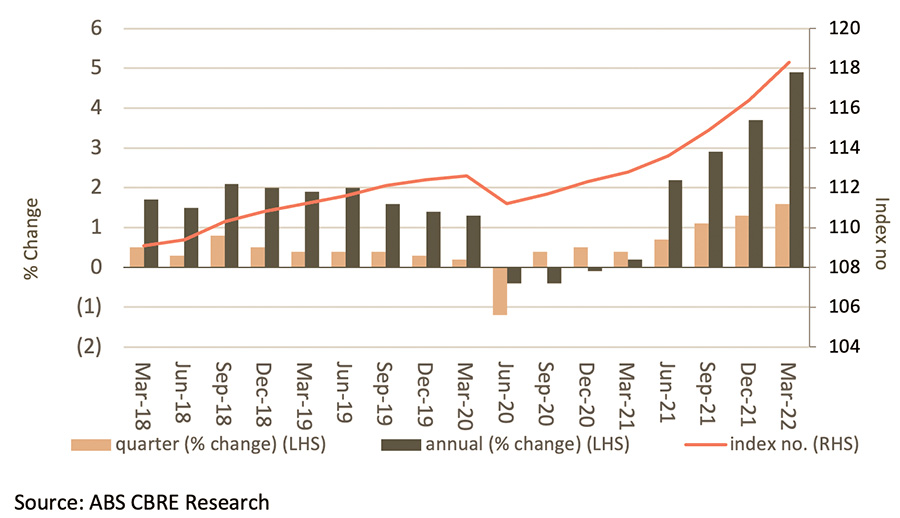

Australian construction prices have seen considerable growth between Q1 2021 and Q1 2022.

According to CBRE subsidiary Turner & Townsend, price increases were recorded across all key material and staffing indicators. The sharpest increase was structural steel which increased by 39.5% per tonne, followed by plasterboard, which increased 35.3% per square metre.

The cost of labour also spiked, with the average cost of a site foreman increasing 11.5% per hour and a group one tradesperson increasing 14.0%. Main contractors’ margin movement was 24.7%.

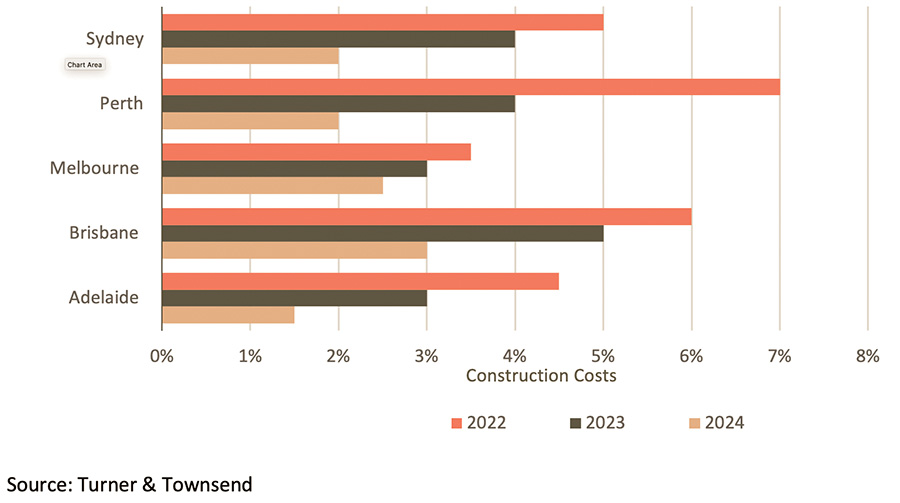

According to Turner & Townsend, building cost inflation is expected to moderate in 2023. Supply chain delays will persist into early 2023 but will begin to improve. It is anticipated that the bulk of cost escalations have now been built into project pricing, particularly for building materials and, subsequently, further price increases will be more modest.

Cost increases from 2023 onwards will be largely driven by increased wage costs. Although migration levels will pick up in 2023, recovery in labour supply may take some time and, as a result, wage growth will still be reasonably high, which will drive construction costs.

Figure 1 Final Demand

Perth and Brisbane to see the sharpest rises

The Perth market is expected to see the highest level of cost inflation in 2022, with prices increasing 7% y-o-y (Figure 2). This is in part due to a significant infrastructure pipeline contributing to the demand for materials. Furthermore, labour supply has been constrained by border closures and competition from the mining sector, driving wages up.

The Brisbane market also has a significant forecast increase in costs in 2022 (6.0% y-o-y) driven by a surge in population growth, fuelling a boom in residential construction, and a number of major infrastructure projects, including the Cross River Rail and Queen’s Wharf, which are placing pressure on demand for materials. Recent reconstruction works to repair flood damage has also driven up material costs. Continued population growth and infrastructure development for the 2032 Olympics is likely to see high costs persist.

Figure 2 Cost Escalation Forecast by City 2022, 2023, 2024

Labour market – a key driver in cost increases

Labour shortages have been a significant factor in cost increases. Job vacancies in the construction sector increased to 35,200 vacancies in February 2022. This has made sourcing labour for projects challenging, resulting in some delays and placing upwards pressure on wages.

According to the ABS, wages in the construction sector have increased by 2.5% y-o-y and 0.5% q-o-q to March 2022. Continued labour shortages are expected to see additional increases across 2022. Subsequently, this will put pressure on longer-dated (2023/24) construction costs.

A number of commercial building workers have enterprise bargaining contracts, which have kept wages relatively locked in at present. The most recent Attorney-General’s Department Trends in Federal Enterprise Bargaining report, Average Annualised Wage Increase (AAWI) showed wage growth in private sector enterprise agreements approved in Q4 2021 was 2.7%, and the industry with the highest AAWIs was construction (4.0%). As these contracts come up for renegotiation, it is anticipated that there will be a sharp increase in wage growth.

The recent FY23 Hays Salary Guide report states that 93% of Australian respondents believe skill shortages in the construction sector will impact operations or growth. Subsequently, 88% of employers have offered higher salaries than planned.

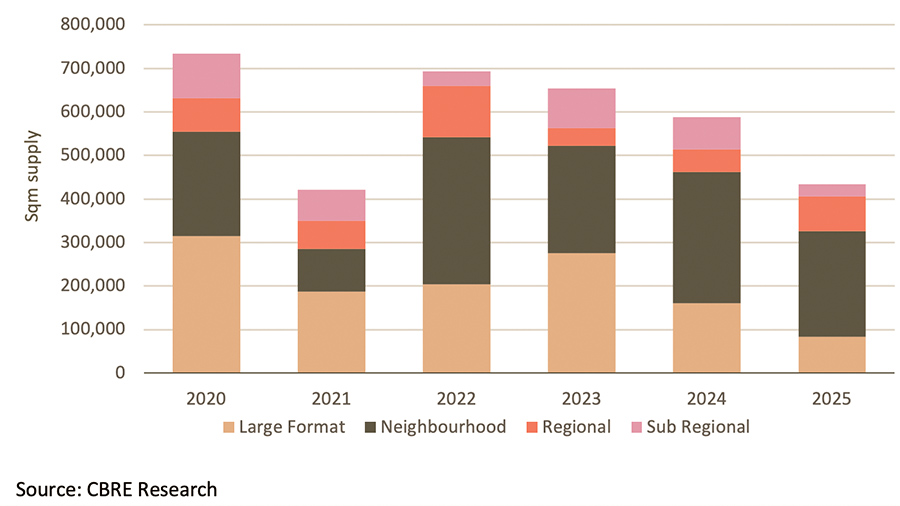

Figure 3 Shopping Centre Supply Pipeline

Construction outlook

The amount of new residential and infrastructure construction will remain elevated in the near term with a number of major projects already underway.

The majority of recent construction contracts have priced in cost rises, which will mitigate risks to developers. Although material costs are expected to moderate in 2023, renegotiated EBAs will drive the costs of unionised labour during the next 24 months. Subsequently, it is the cost of labour that will be the key driver of construction cost increases from 2023 onwards.

The pipeline for new shopping centre development in Australia remains stable, with 2.4 million square metres of new shopping centre space forecast to be added to the Australian market between 2022 and 2025 (Figure 3).

The bulk of this new space will be comprised of neighbourhood and large format retail centres off the back of population growth and resilient demand. Once the current development cycle is complete, interest rate hikes may help to slow consumption levels and new construction starts.

This article was published in the latest issue of SCN – Vol. 40 No. 3