SCN invited five women leaders in the field of property research to give us their thoughts on the current state of the industry and the future. It’s an interesting feature. As one would expect, COVID-19 has prime mention – but as an ‘accelerator’ of pre-COVID trends, rather than a determiner of new ones. E-commerce is a dominant topic, with some useful insights into future trends…

Nisha has been working across the property sector nationally for almost 15 years across both Valuations and Economics. She specialises in analysing changing situations and devising strategies that respond to shifting market needs and customer preferences. She maintains an emphasis on creating flexible, diverse and effective spaces while focusing on maximising the return for clients.

Nisha has worked on major Australian projects across a range of sectors, with a particular focus on helping shape new retail spaces, and increasingly, the integration of mixed-use practices into and around retail assets.

In her role as Director at Urbis, Nisha has worked on city-shaping projects with some of Australia’s leading developers, investors, owners and occupiers from the retail, commercial and mixed-use sectors, providing strategic marketing, repositioning and development advice.

Nisha Rawal, Director, Urbis

2020 has changed the way we work, socialise, exercise and, importantly, shifted the dial on how we shop. While the Australian economy has not been immune to the impacts of COVID-19, the economy’s robustness has been sustained through solid policy frameworks, government stimulus, institutions underpin by strong fundamentals, and an attractive investment environment.

From the peak of the virus to now, the retail and accommodation and food services sectors have experienced a volatility like never before. More than ever, the recovery for retail is reliant on improved economic conditions, including household consumption behaviours. Household consumption overall decreased 1.1% in the March quarter, largely a reflection of a 2.4% decline in services consumption, brought about by COVID-19 enforced restrictions, including closures and social distancing measures.

On the flip side, preparation for being at home meant an increase in household goods consumption of 1.0% (March quarter), as food spending, pharmaceuticals, household furnishings, recreation items and working from home equipment, all rose.

The news is not all bad, in fact, what we are experiencing is the acceleration of a sector already undergoing a phase of evolution.

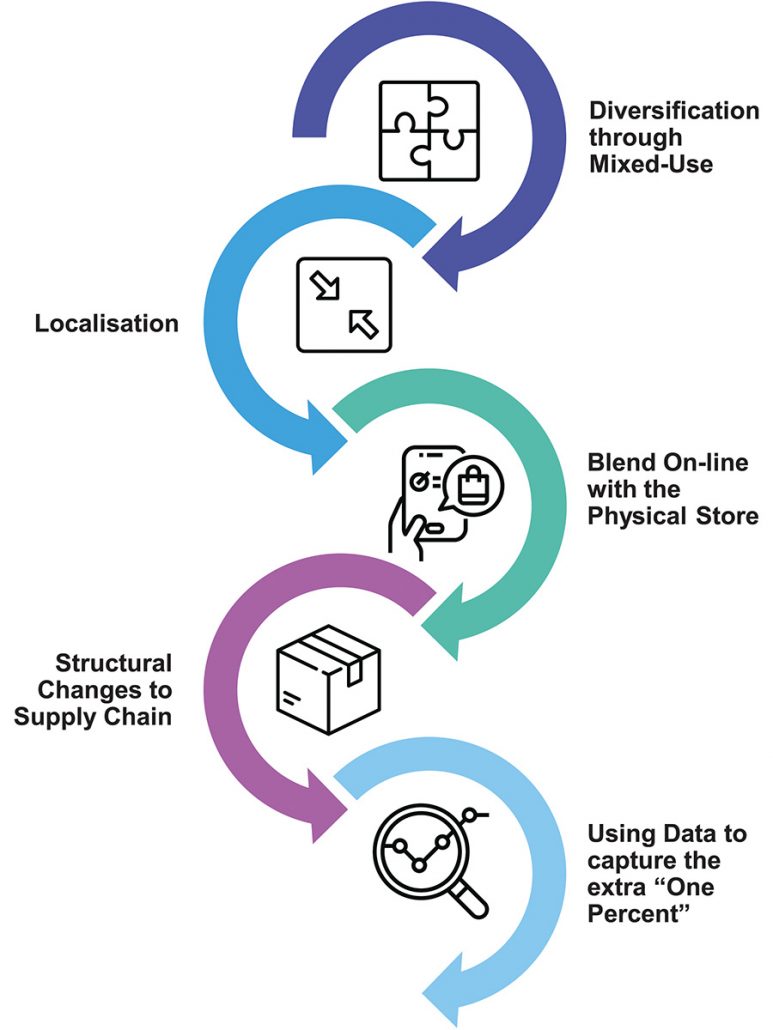

There are several trends impacting retail assets to watch going forward. As industry experts, but also thinking about our behaviours as consumers, we draw your attention in particular to five ‘mega trends’ going forward:

1. Diversification through mixed-use

Depending on the scale and range of uses, well-executed mixed-use integration can see a nexus value or flow on effect to turnover of up to 10% on to the core retail asset. Retail spending, particularly discretionary, is unlikely to reach pre-COVID levels until 2025, therefore, creating cross usage opportunities as well as exposure to a broader ecosystem of users is crucial.

While greater synergy is seen from the co-location of office and residential uses, thinking of the other future ‘anchors’ including major health facilities, entertainment and leisure, civic spaces, other health and well-being options, education will diversify sector exposure, re-weight the asset to reduce its risk profile and enhance value.

2. Localisation

Every development needs to respond to community values and requirements.

Initiated through enforced restrictions, the “Love Local” movement now has increased focus and importance, even as restrictions have eased across some states. Part of this comes down to knowing your customer base and responding with an authentic, appropriately mixed, convenient and diverse offer which in turn creates loyalty and repeat custom.

The renewed focus on localisation initially was about ensuring sustainability of our ‘high streets’ and is equally important for neighbourhood centre assets that thrive off these same characteristics.

3. The future is blending physical and digital

As we went into lockdown, we saw the transition of our economy from a greater in-store reliance to an online purchasing power. The online sector is now capturing a more diverse demographic than ever before.

According to the NAB Online Retail Sales Index, online retail sales as at June 2020 accounted for 10.7% of total retail, up from 9% the same time last year. Interestingly, omni-channel retailers (ie. those with a physical and online presence) currently account for more than 95% of total online spend, with pureplay accounting for the balance.

Going forward, omni-channel retailers are forecast to experience 4% growth per annum during the next ten years. While the spotlight has been placed on the online retail sector, what our forecasts show is that, to be successful, retailers going forward need to embrace the combined online and offline in order to maximise exposure and performance. Physical space is still expected to play a vital role in the future, however, the design and size of space may differ.

As retailers will increasingly not differentiate between where sales are coming from, this also means that retail owners need to ensure the process is seamless from both a recording of sales as well as an operational and design perspective.

4. Structural change for supply chain

The past six months has shown the importance that needs to be placed on investing in improved logistics and supply chain infrastructure in Australia. The pandemic has caused a situation of demand risk where sudden demand was placed on the supply chain in a short period of time. The increase in online delivery has stretched the current infrastructure capability, particularly the costly last mile freight component, which is often the hold up.

Going forward, expect growth in this sector and considerable investment in new facilities, increased technology and the use of more data analytics to better prepare for future demand risk that may arise.

5. Using data to capture the extra “one percent”

In a low growth environment, data holds the key to the potential capture of further market share. Immense data is at our fingertips and how we use it is critical. Through Human Movement Data, which leverages mobile phone data through apps, we can understand usage patterns across different periods, determine the relationship between precincts through cross-usage, provide insight where visitors are coming from and when they visit, and identify gaps.

Looking ahead, Human Movement Data can understand how centres and precincts are used to then give a competitive advantage and derive initiatives to penetrate markets more than before. Given the data is current, we can continue to monitor ‘the new normal’ and how this impacts activity patterns. Every additional ‘one percent’ that can be captured can create significant benefit and value.

While the retail sector is still navigating its way through the current environment, it is clear that the future of retail is encouraging. At Urbis, we think this is a great time to review and reset the approach to retail assets and precincts. Now is the time to be creative, bold and open to leveraging new and different opportunities and unlocking more value.