Retail centres are making a stable recovery post-COVID, but just how happy are shoppers? And more specifically, how likely are they to be loyal advocates – or consider their centre as better than the competition? While centres of varying scales have their own strengths – CBD centres have emerged as the forerunner on these factors. This is according to Prescient Research’s national study of customer satisfaction.

Since 2019, we have captured more than 80,000 in-centre responses from customers across Australia and the United Kingdom. Here, we unpack the topline insights of one of Australia’s biggest r`etail studies with a particular focus on CBD centres.

The data in this article is a snapshot of the findings from Prescient Research’s 2024 Annual Shopper Sentiment Benchmarking Report. The study captures a sample of 132 retail centres with 18 different landlords across Australia in 2021 and 2024.

Customers are more satisfied, but retail centres struggle to exceed expectations

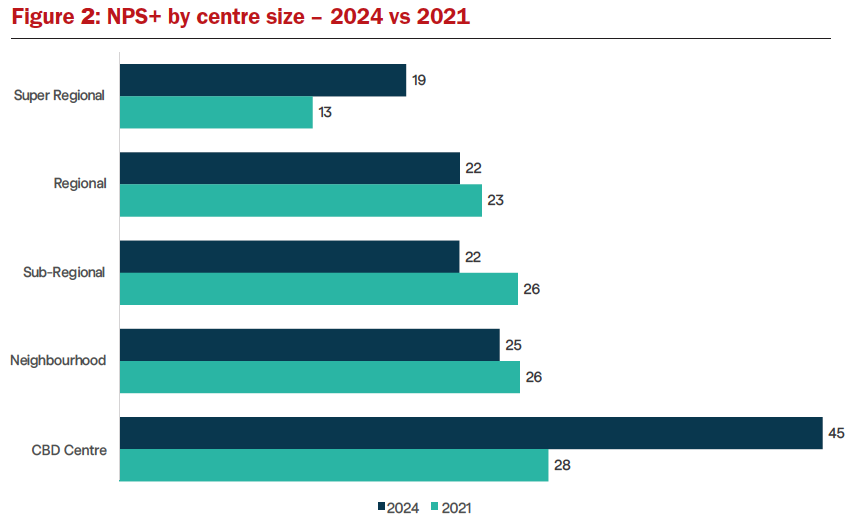

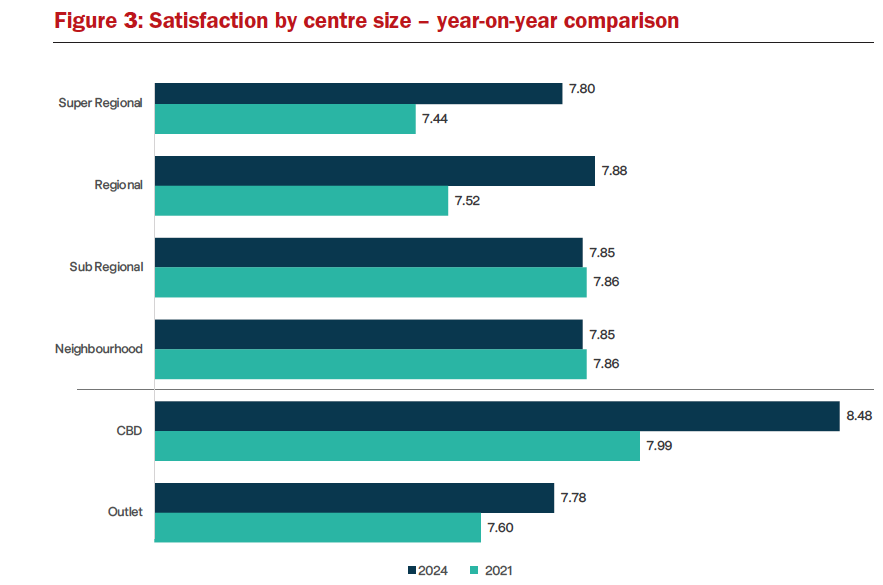

Overall, customer satisfaction is up. Our Net Promoter Score (NPS+) was fairly stable between 2021 and 2024, increasing by just three points to +23. This is when combining data from all centre typologies – from the super-regional down to the neighbourhood and including CBD centres.

However, when reviewed by individual metric, the data reveals that few customers felt their most recent visit ‘exceeded expectations’ in 2024 (+9 in 2021, down to -1 in 2024).

Across the board, it is clear that shoppers have higher expectations post-COVID. This is likely due to the convenience and choice of online shopping, and potential exposure to more compelling destinations, with travel also surging post-pandemic.

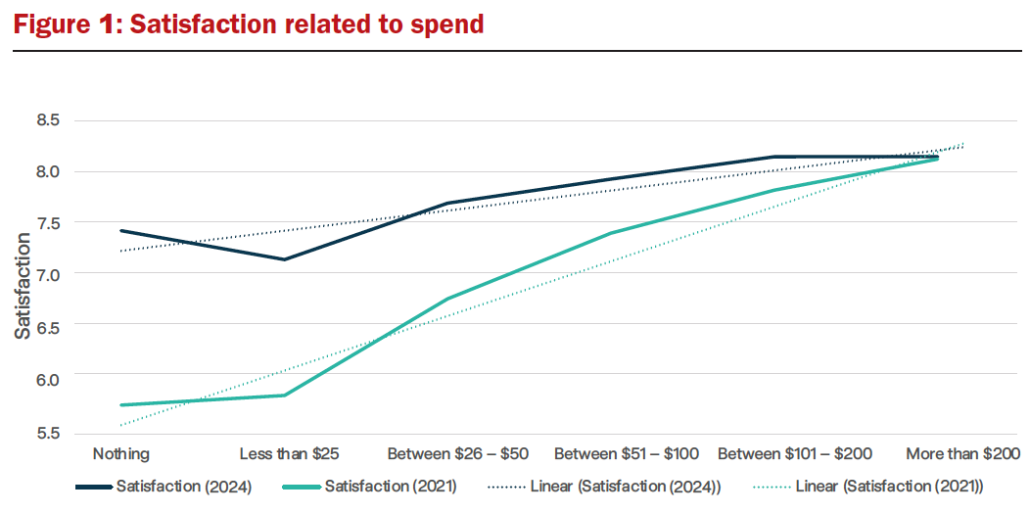

Happier customers spend more and visit more

The most satisfied customers are the biggest spenders – and spend increases $12.50 per visit for every 1% increase in satisfaction. The most satisfied customers are also the most regular visitors – visiting their centre nearly five times more for every 1% increase in satisfaction. Centres that ascertain exactly what satisfies their customers and invest accordingly, are able to unlock increased loyalty and spend.

Smaller centres = happier customers

When reviewing by centre type, it appears that smaller centres have the happiest customers, attracting more positive sentiment, and higher NPS+ scores. In particular, Neighbourhood centres captured an NPS+ of 25, and CBD centres were the highest at +45.

This suggests customers value a localised or curated retail offering tailored to their community or workplace.

Customers are increasingly loyal to their CBD centres

If we take a deeper dive into the metrics that make up NPS+, we’ll see that CBD centres continue to significantly outperform their suburban and regional counterparts on all counts. Firstly, CBD shoppers are abundantly loyal, with the top performing metric being the ‘likelihood to return’. CBD locations scored a high NPS+ of 55, with a 10-point gap between the next contender, being sub-regionals at +45.

While CBD centres have a somewhat captive audience of workers for weekday trade – cities are also marking increased visitation from tourists and visitors. According to recent data from Knight Frank, Melbourne CBD is recording Thursday footfall at 85% of pre-pandemic levels – and weekend and evening numbers surpass 2019 figures. Therefore, CBD centres with exceptional retail and dining propositions are likely leveraging the rising numbers of tourists, and local leisure-seekers.

CBD centres are highly competitive

The inter-COVID period called for landlords to work hard to lure workers back to the office and retain tenants longer term. The cleverest refined their retail curation as a point of competition – offering customers new levels of tailored, elevated or experiential operators. It is apparent that such efforts are being recognised by customers. When asked if their centre was ‘better than other similar-sized centres’, customer sentiment was high at +48, nearly double from 2021. By comparison, sub-regionals and neighbourhood centres lost ground in this area. Both typologies outperformed in 2021, but fell in line with other typologies by 2024 with scores ranging from +19 to +20.

CBD centres are also the forerunner in exceeding expectations

While other centres struggle to exceed expectations, CBD centres buck the trend with strong +35. The emergence of quality, COVID-period CBD developments supports this positive sentiment.

A standout being the 2022 opening of Melbourne’s 80 Collins. The precinct boasts a network of laneways, luxury and concept retail, renowned dining (eg. Farmers Daughters and Yakimono) – as well as event partnerships with Melbourne Food & Wine Festival. On-brand yet unique, the site has evolved how dining and retail are experienced at the Paris-end of Collins Street.

With sub-regional and super-regionals paling by comparison (with negative scores -6, and -16), they are right to learn from such examples. Particularly through exploring tailored yet unexpected ways to exceed the expectations of their customers.

Finally, due to the aforementioned factors, it’s no surprise that customers are strong advocates of their CBD centres. This is marked by a high likelihood to recommend the centre to family, friends and colleagues at +49. Other centres trail behind with scores in the mid-20s to 30.

Going strong, but with room for better presentation and engagement

While the story is glowing for CBD centres, there is still room for improvement. To capture direct customer feedback, Prescient Research asked customers: “If you were the shopping Centre Manager, what would be the first change you would make to improve the experience for customers?”

In-line with current market trends, the comments revealed a strong preference for more elevated and experiential propositions. Specifically, aesthetics are important to customers, desiring upgraded store and centre fit-outs. Comfort also plays a role, with customers wanting soft lounges, greenspaces and heightened cleanliness to improve the ambience. Attentive customer service is also valued and would support a more elevated experience.

While customers prefer more premium surrounds – they equally value a freebie. In particular, they want to be engaged through discounted events and promotions, as well as higher-quality moments for play and novelty (eg. photo-booths and brand activations). Positively – for centres and CBDs more broadly – customers are seeking longer trading hours, likely to support an evening browse before a meal out.

On the whole, these represent achievable adjustments for landlords to keep winning the hearts of their loyal and satisfied CBD customers.

This article by Stephanie Bhim, Associate Director, Prescient Research is featured in the latest edition of SCN magazine.