We’ve been inundated with reports, opinions, commentaries on ‘the demise of CBD retail’. In the main, it’s all in response to the office worker now working from home far more than before COVID. But what’s the real picture? If we don’t panic and take a logical look, what do we find? That’s exactly what Tony Dimasi has done in his latest article for SCN…

At the recent SCN Big Guns Lunch, in March 2023, the excitement in the room was palpable. One reason was the participants’ appreciation that such industry gatherings could once again resume with enthusiasm, with the COVID-19 shadow having receded into the background. Another significant reason though was the fact that the shopping centre industry in Australia was once again able to celebrate trading success, most readily apparent in the fact that 10 of Australia’s regional centres are now recording in excess of $1 billion annually in retail sales.

However, the SCN Big Guns Lunch was all about suburban shopping centres. These centres have emerged from the two-and-a-bit years of COVID-related shutdowns battered and bruised – that is the bad news. The good news, though, is that they have also emerged, certainly in my view, with an enhanced reputation for relevance (to the consumer) and durability and are again back on growth trajectories.

But what about CBD centres? Against the renaissance of the suburban shopping centre, the most stubborn resistance to the return of pre-COVID activity levels in Australia’s cities has been in the office employment sector, the reasons for which are multi-layered. The reluctance of some office workers to return to the office post-COVID has in turn directly impacted the trading performance of retail businesses within Australia’s office precincts, i.e. the CBDs. Nowhere was this more evident than in the City of Melbourne, which at one point, in January 2022, recorded CBD office space occupancy of just 4%. Many commentators at the time proclaimed the imminent death of the CBD office as the focus of future employment and, consequently, the mortal wounding of CBD retailing.

The question for CBD retailers, and CBD Guns in particular, is what does the future now hold? To some extent, one’s answer to that question is influenced by what one believes the future of CBD office employment will be. So, just what is the relevance of CBD office employment to CBD retailing?

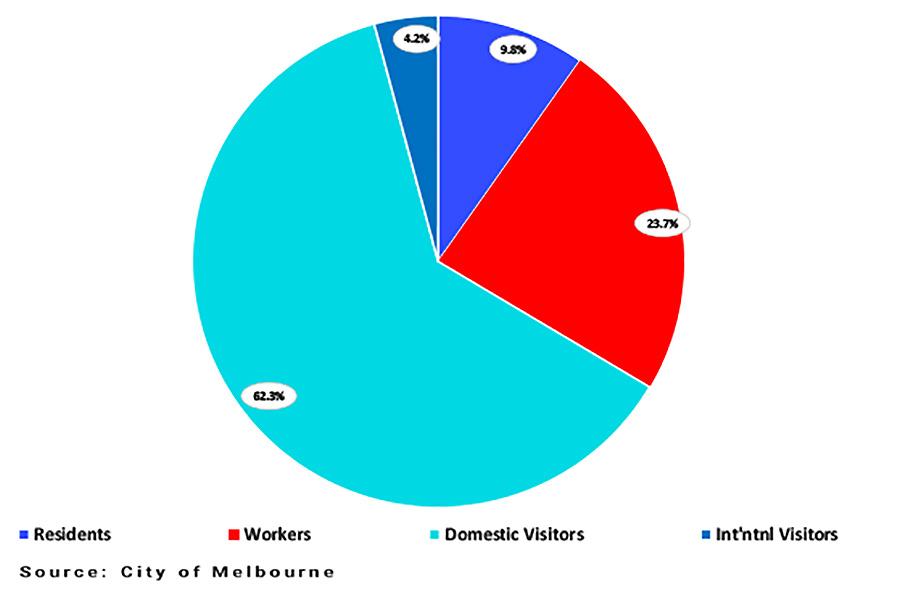

The reality is that while CBD office workers are significant contributors to CBD retail sales, the worker segment is by no means the most important driver of total CBD retail performance. As an example, Melbourne City Council undertakes extensive research on the various contributors to the daily population levels within both the City of Melbourne and the CBD. The chart below shows the generators of CBD daily population immediately pre-COVID.

At that date, in 2019, the average daily population was estimated to be in the order of 413,200, i.e. on average there were 413,200 people who visited the CBD each day for a range of reasons. As the chart shows, before the COVID-19 disruption, CBD workers accounted for approximately one-quarter of the total average daily population, with domestic visitors (i.e. residents of the Melbourne metropolitan area, other than the City of Melbourne, plus those from other parts of Victoria or interstate making a specific trip to the CBD) accounting for almost two-thirds. City of Melbourne residents, an increasingly important customer segment, accounted for 9.8% of total visitation with international visitors contributing 4.2%.

So, the first point to be made is that CBD retailing is not just about CBD workers – far from it, in fact. The absence of CBD workers is clearly a negative for CBD retailers, especially the food service and convenience retailers embedded within the office precincts, but really it was the absence of visitors during the periods of COVID-induced lockdowns that created by far the greatest problems for the CBD Guns and the retail core.

It is readily apparent now, wandering through Australia’s capital city CBDs as I have done during the past few weeks in Melbourne, Sydney and Brisbane, that general visitation levels have recovered. It is reinforced when trying to make a reservation, especially at weekends, for a good CBD restaurant.

Data provided by various analysts and by some councils confirm this observation. Even by mid-2022, reports in Sydney showed that 90% of the pre-COVID visitor population to the CBD had returned. In Melbourne, nighttime pedestrian traffic was measured by Melbourne City Council at 96.9% of the pre-COVID benchmark in January 2023, while during the weekends the numbers of people visiting the CBD are now higher than pre-COVID levels.

What is also readily apparent when walking around the CBDs is the return of tertiary students, in the case of Melbourne, particularly overseas students, whom contribute so much to the level of activity within the CBD.

The level of office worker activity within the CBDs though is not yet at or even close to pre-COVID levels, at least not in the CBDs of Melbourne and Sydney. This is most apparent when visiting the various office precincts of these CBDs, though not when visiting the retail cores.

Bourke Street Mall, Melbourne

But even CBD workers have been returning to the office, albeit not at the same enthusiastic rate as visitors. In March 2023, an independent survey commissioned by the City of Melbourne – which is particularly proactive in driving growth for the CBD – found that 88% of respondent workers had attended their workplace at least once in the previous week in December 2022 compared to just 55% in January 2022. Commuter levels for the Melbourne CBD are now estimated at 63% of the pre-pandemic benchmark. Pedestrian activity generally during office hours is now estimated to be running at 80% of pre-pandemic levels at lunchtime (obviously a crucial time for CBD food service providers) and 77% across afternoons.

The Property Council of Australia (PCA) undertakes surveys of the levels of office occupancy rates within Australia’s CBDs, and the most recently available information – for December 2022 – showed that Perth enjoyed the highest rate of office occupancy at 80% while Sydney and Melbourne had both seen their rates increase to the highest post-pandemic levels, at 59% and 57% respectively. These numbers should not be contrasted with 100% occupancy rates since even pre-COVID it was never the case that every office worker worked in the office every day. Realistically, the pre-COVID occupancy rates were probably in the range of 90% to 95%.

So, while the reluctance of some office workers to return to the office continues to be a constraint on CBD retail activity, now it is a relatively modest constraint, at least for the retail core and CBD Guns.

In rough terms, with office occupancy rates of Australia’s major CBDs of Sydney and Melbourne currently sitting at 25% to 30% below their pre-COVID levels, and office workers generally accounting for about one-quarter of the CBD daily population, we can estimate that the broad impact on CBD daily populations resulting from the reluctance of workers to return to the office is in the order of 7% to 8%.

But against that, there is offsetting growth in other sources of visitation while the rate of return of office workers is itself steadily increasing. As an example, Melbourne City Council’s recent projections of residents and jobs within the Melbourne CBD – issued after the COVID-19 pandemic – forecast a virtual doubling of the resident population between 2020 and 2040 and an almost 50% increase in the number of jobs in the CBD over the same period.

Such an outlook is supported by the broader population growth outlook for the state capitals, particularly Melbourne and Sydney. During the COVID-19 pandemic, I pointed out that the Australian government has the flexibility to adjust Australia’s migration intake annually and could choose, post-pandemic, to boost that intake, thereby making up ground on the migration gap that occurred in 2021-22.

Sure enough, today we are seeing headlines around a 400,000 annual migrant intake for the coming year (the typical annual intake is 230,000 to 240,000).

Melbourne CBD

Official population forecasts for each of the Australian capital cities issued by the Federal Government Centre for Population in January 2023 – which were based on an assumption of typical annual migration of about 240,000 not the 400,000 that now seems likely for the coming year – show that growth is already underway and that pre-COVID growth trajectories will resume in this coming year, i.e. FY2023/24.

It is now generally accepted that the pattern of office workers working from home for at least part of the week is here to stay. In my view, though, expectations of the degree to which work from home will continue are often exaggerated by the typical tendency, when forecasting, to place too much weight on the experiences of the current time and the immediate past, (i.e. the most recent lived experience).

Such changes in office worker behaviours will shave some daily visitation from the total for the CBD, though a relatively small share in my view. However, CBD resident population growth and jobs growth, and even more importantly, CBD visitation from the balance of the metropolitan area and other sources, will continue to grow at levels that will more than offset any visitation that might be lost from the absence of office workers.

So, I don’t believe the CBD Guns have any reason for undue concern about their future outlook, rather the next decade is likely to see Australian capital city CBDs take another big step in their continued growth and evolution.

This article by Tony Dimasi features in SCN’s 2023 CBD Guns edition. Premium members can view the full digital magazine here.