Melbourne CBD’s retail vacancy has been on a consistent decline while office vacancy continues to trend upwards – why the disparity? Jacqueline Darwis, Research Analyst at JLL explains…

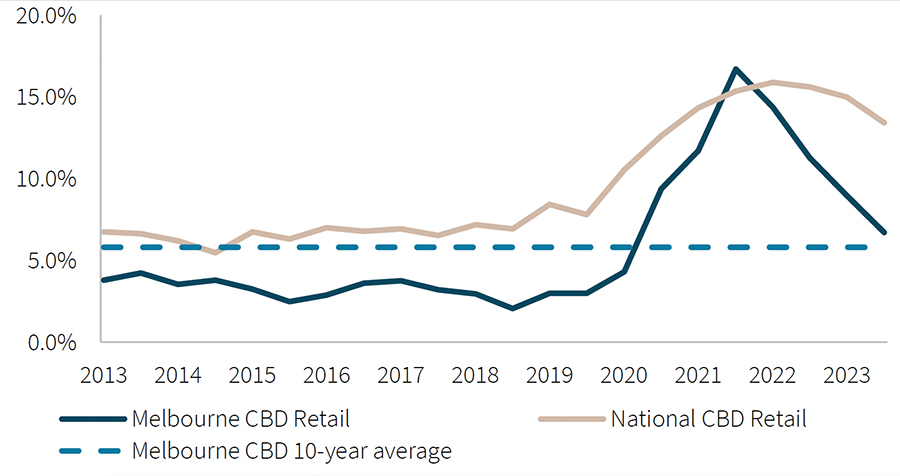

CBD retail has been on a recovery trajectory for a number of years. The national CBD retail vacancy rate peaked in June 2022 at 15.9%, gradually reducing to 13.4% by December 2024. Most markets have recorded only a marginal decline in the level of vacancy, but the shift has been much more significant in the Melbourne CBD.

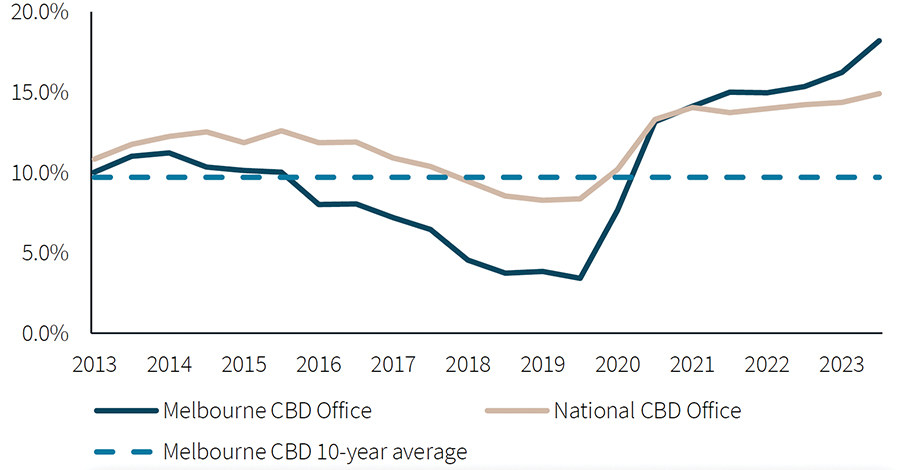

Melbourne had the second lowest CBD retail and CBD office vacancy rate across the nation prior to the onset of COVID-19. In 2020, the vacancy rates for both sectors began to increase as mandated lockdowns halted in-office work, enforced lockdown travel limits and restricted retail spending.

The Melbourne CBD retail vacancy rate peaked in December 2021 and has been declining consistently, while the CBD office vacancy rate has continued to trend higher, begging the question – why the disparity?

- Figure 1 – Melbourne CBD retail vacancy rate

- Figure 2 – Melbourne CBD office vacancy rate

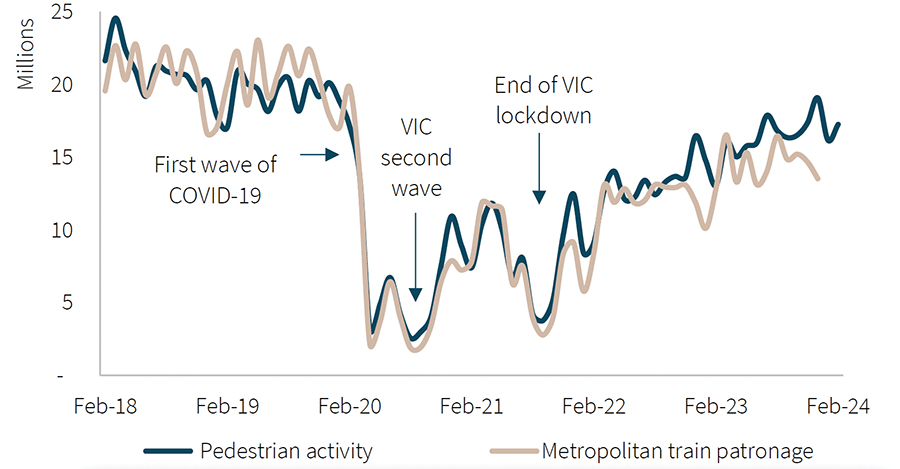

Analysing pedestrian activity provides context on the condition of the CBD. Coinciding with the increase in retail and office vacancy rates, pedestrian activity in the six months to June 2020 was down by 45% and metropolitan train patronage by 50% compared to the previous bi-annual period. During this same period, office landlords contended with tenants downsizing or opting for flexible co-working spaces in lieu of traditional office space.

The disparity between office and retail recovery in Melbourne CBD widened in December 2021. While CBD retail vacancy rates began to trend downwards, office vacancy rates continued to drift upwards. By the end of December 2023, Melbourne’s CBD retail vacancy rate had reduced to 6.7% (only 0.9 ppts above the ten-year average), whereas the Melbourne CBD office vacancy rate reached 18.2% – the highest level since 1996.

Melbourne’s CBD retail vacancy is now the second lowest in the country after Canberra. On the other hand, Melbourne’s CBD office vacancy rate was the highest in the nation, being 3.7 ppts above the national average of 14.5%.

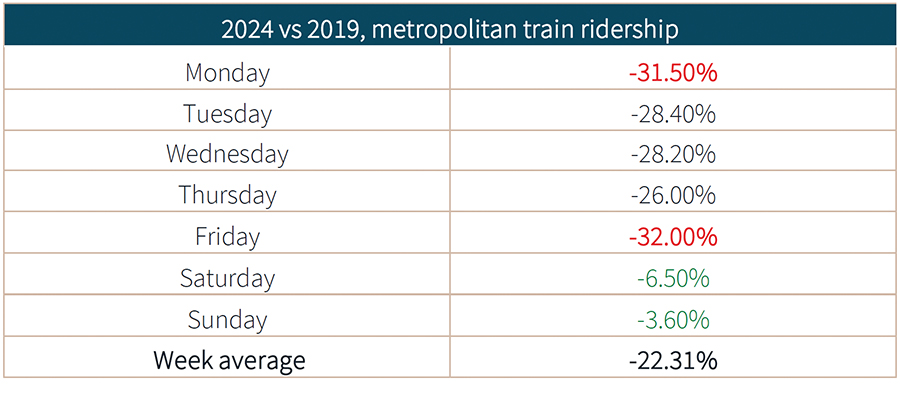

Since the trough of travel within the CBD in 2021, international arrivals into Victoria (1.86 million as of September 2023) have rebounded to 60% of 2019 levels (3.13 million). In the 12 months to December 2023, CBD pedestrian activity has rebounded to 84% of 2019 levels. The influx of international travellers and students, as well as the implementation of return-to-office mandates, likely drove a further recovery in foot traffic.

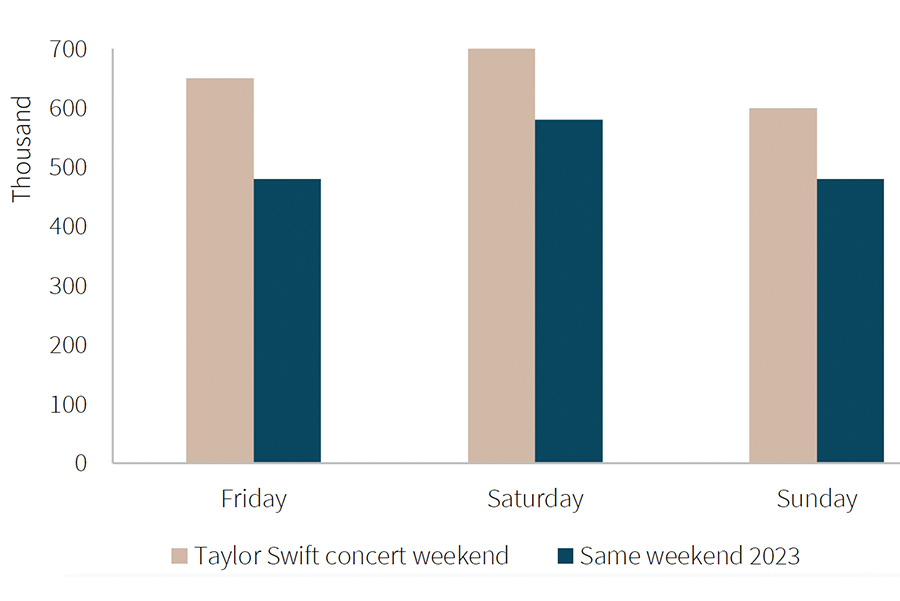

Post-pandemic, consumers are being drawn into the CBD for social reasons, entertainment concerts, recreational activities and cultural exhibitions. City of Melbourne data recorded a 26% uplift in pedestrian traffic during the Taylor Swift concerts across the local government area compared to the same weekend last year.

- Figure 3: Pedestrian activity and metropolitan train patronage

- Figure 4: 2024 vs 2019, metropolitan train ridership

- Figure 5: Pedestrian levels across City of Melbourne during Taylor Swift concerts (16 – 18 February 2024)

AFL games are also becoming ever more popular, contributing to a 30% boost in spending in Docklands during game days, according to the City of Melbourne. More broadly, food and beverage establishments benefit from pent-up demand with spending despite the elevated cost of living.

With a decline in retail vacancies across prime and secondary shopping streets as well as shopping centres, the overall retail vacancy rate in Melbourne CBD decreased to 6.7% in December 2023, albeit it remains well above the pre-COVID ten-year average of 2.8%. As occupancy rates have increased, we have seen an uplift in centre turnover. For example, GPT’s Melbourne Central recorded MAT for December 2023 at $612.3 million (+17.7%), which was 4% higher than in December 2019.

On the other hand, the CBD office market is still working through structural changes. Vacancy is negatively impacted by the Docklands precinct (with a vacancy rate of 20.7%), which is characterised as the back-of-house offices of large multinational corporations. Given the solidification of hybrid working policies by many large occupiers and a notable office supply pipeline, it will likely take some time before the Melbourne CBD office vacancy rate trends materially lower.

The Melbourne CBD rebound in overall foot traffic and activity is clearly being led by social factors, with consumers drawn to the F&B, recreation, sport and entertainment events that the city offers. These social factors are being supplemented by strong population growth and a rebound in tourism to Melbourne, which will continue to support the recovery in the retail sector.

This article by Jacqueline Darwis is featured in the latest edition of SCN magazine.