We all know F&B has and continues to undergo enormous change. It’s not just happening in food courts, in cafés and restaurants, but supermarkets are now also entering the field. In fact, we’re seeing instances of people buying supermarket prepared food and consuming it in the food court. Francis Loughran looks at the whole issue and gives us an overall view. It’s a compelling article.

Shopping centre developers the world over recognise food as a vital part of the mix, thereby maximising sales, rents and asset value. However, supermarkets are now strategically aligned to compete with food halls, cafés, food courts and fast food operators. Here’s how serious the threat is and how malls can maintain a clear point of difference and grow market share.

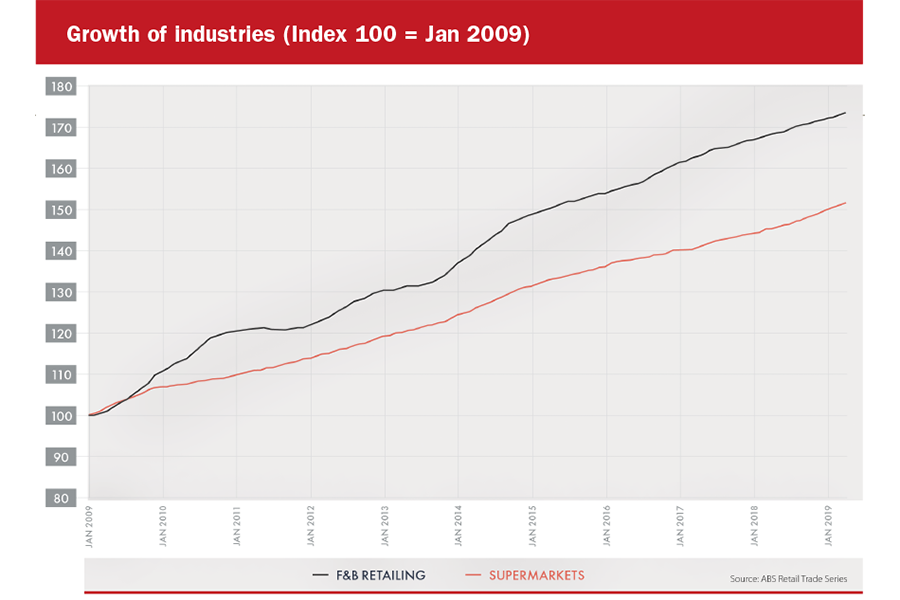

From 2007, spending at supermarkets has grown by 4.7% per annum, while growth in Food Catering outlets has grown by 5.2%. To borrow from the Industry Super Fund ads, this means that if in 2007 a supermarket and a restaurant were both turning over $5 million, then by 2019 the restaurant would have a larger MAT to the tune of more than $530,000. The power of compounding – that’s what the big supermarket chains are seeking.

The ‘Immediate-Consumption’ prepared food offer is a major opportunity for supermarkets to grow their sales within their existing retail footprint from an existing audience.

As the number of suitable locations for new supermarkets dries up, Coles and Woolworths need to find a new engine to power top line growth.

While traditional supermarkets in Australia are not in the food service industry per se, they are increasingly identifying the economic benefits of offering prepared food to their shoppers, who have an appetite to eat-now for breakfast and buy lunch or dinner at the same time at the best ‘value-price’.

Twenty years ago, 25 cents out of every food dollar went into prepared F&B. Now, it’s 28 cents. What’s more, all of that growth, and then some, has come from cafés and restaurants: In 1997, 12 cents out of every dollar went to cafés and restaurants and 13 cents went to takeaways. Currently, the figures are 16 cents and 12 cents, respectively. To emphasise the point, growth in F&B has come from shoppers and consumers flocking to cafés and restaurants because they are looking for a level of service and quality of food that is above and beyond the run of the mill.

These trends are also playing out globally where big changes have, and will continue to, take place in the way we appreciate and present food and hospitality in our shopping malls. This has been driven by a number of factors:

• Shoppers want good food. Food continues to increase as a % of GLA in shopping malls, mixed use developments, CBD locations and high-street locations.

A recent study by JLL and presented at this year’s ICSC RECon Conference found that shopping centres with quality F&B offers see the total number of transactions increase by up to 25%. Furthermore, shopping centre customers who also eat at the mall spend up to 15% more than those who don’t.

• The amount of space given over to F&B is increasing worldwide: Malls with strong F&B offers devote between 10% and 20% of floorspace to the category. In Australia, we are seeing Food and Hospitality outlets replacing vacancies created by non-food store closures.

• Food franchisors are rethinking how they can compete with local food operators and regain creditability as community-employers as they struggle to develop menus and elevate the experience as the demand for table service increases.

• Food court operators are discounting prices, promoting specials and meal deals in order to compete against a range of increased competition, including supermarkets.

• Food courts are being replaced with food halls (local chef driven eateries offering quality food, drink and entertainment in a neighbourhood setting).

• Fast food majors abandon food courts as they strive to become restaurants.

• Fast casual concepts are elevating their offer beyond counter service; but are yet to offer full table service.

• Single food concepts such as Subway have grown into hot grilled panini bars.

• Malls are starting to offer a world of dining options with a Kosher food court planned for a mega-mall just outside of New York City.

• Cinemas are offering delivery of choc-tops and popcorn in order to connect with consumers outside of their theatres.

• Diners are demanding value for money more and more and are also demanding employers share their profits with employees in a fair and respectful manner at all times.

It’s not just statistics that show there are growth opportunities in prepared F&B for supermarkets to exploit. Two other factors make the move into prepared food attractive for the operators.

The Market Kitchen by Woolworths

Firstly, there are cultural shifts that are taking place. We all know that the retail sector is undergoing a paradigm shift as consumers look for greater convenience, better food, cuisine choices, on-trend food and meaningful interactions with food retailers, café and restaurant operators. Meanwhile, new business models of engagement continue to transform access to goods and services, radically altering brand-consumer dynamics e.g. food delivery services bringing prepared food to homes and workplaces.

Secondly, complacency has infiltrated many F&B operators with many being slow to respond to these changes, missing valuable opportunities to thrive in this fast-changing landscape. Given the tremendous growth in the industry, many operators are expecting that growth will simply come to them, without having to do the hard yards. As a consequence, an increasing number of F&B operators are looking – in the first instance – to their landlords for assistance. This has come in the form of lower rents and/or allowances to expand their menus into non-traditional offerings: e.g. Asian QSRs selling coffee, fish and chips operators moving into Korean fried chicken.

We have seen a large number of requests of landlords for rent relief. Some of these are warranted where both landlord and retailer expected F&B to continue to increase exponentially for years to come. However, in many cases, rent relief has been the default mechanism to fight stagnant sales. As a rule of thumb, in a relatively buoyant economy like ours, stagnant sales generally means stagnant or stale food offers.

Recently, there was a terrific article by Penny Flanagan, ‘Dear cafés, you can do better,’ Melbourne Age (May 20 2019), describing her current local café search for a great café as a ‘journey of disappointment’ as she ‘bounced from one unsatisfying café to the next.’ She documents numerous ways in which cafés take their customers for granted and set up their operations to make it easier for the operator and not the customer. Flanagan calls out a variety of annoyances: “Please wait to be seated” and then never getting seated, jam in packets, DIY ordering, serve your own water and collect your own utensils – not at those prices!; food and presentation that looks great on Instagram but is otherwise ridiculous and impractical.

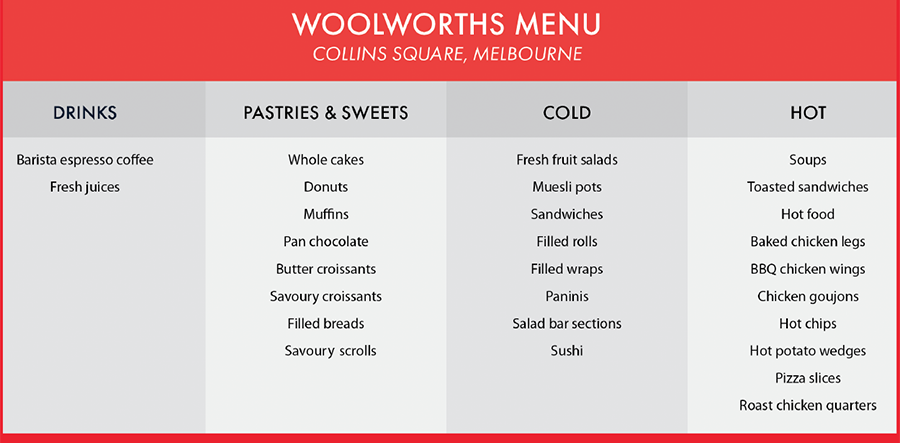

On a daily basis, supermarket customers are exposed to more prepared food offers that continue to grow in variety, to include barista coffee, full café offer, bakery, sushi, sandwiches, soups, hot pies, cut fruit and salad bars, deli, roast chicken and grilled offers, to name a few. The menu below is a mock-up of the range on offer at the Woolworths Metro store in Collins Square, Melbourne.

The range and the price points are extremely competitive for the casual F&B consumer. For someone who is looking for fuel, someone who just couldn’t be bothered making lunch before leaving for work, for someone who just needs a snack or a small pick-me-up, the offer is compelling.

For the non-discerning customer who has to buy lunch, snacks and coffee five days a week, he/she is, on average, paying up to 50% less for comparable food than what is on offer within food courts, café or food halls directly adjacent to the supermarket. The supermarket hook for consumers is ‘Reduced’ and ‘Special Offer’ draws for the FBH (food bargain hunter), who is able to shop at discount prices at lunch and again at the end of day for a take-home meal-kit or roast chicken for an easy-dinner option.

In addition to convenience and an evolving menu offer, supermarket food choices offering the ‘must-haves’ include coffee, breakfast bakery, juices, sandwiches and, most of all, value for the price charged. Supermarket menu choices are more cost-effective than food court and café operators since the ingredients used to produce their prepared food offers are sourced from within store.

- Collins Square Woolworths Metro

- Collins Square Woolworths Metro

Coles is ramping up its convenience strategy, with a plan to grow sales on the back of ‘food-for-now’ and ‘food-for-later’ products, according to the article ‘Coles fast tracks its convenience strategy’ printed in the Australian Financial Review, May 13, 2019.

As part of this strategy, Coles is fast-tracking its convenience strategy by adding 75 new products to its existing range – including smashed avocado and toast – and refurbishing 100 supermarkets in six months to stock more ready-to-eat food and semi-prepared meals – such as breakfast foods, curries, soups, roasted vegetables and stir-fry kits.

According to a report by Inside Retail, Coles Chief Executive Stephen Cain sees an opportunity through this strategy to grow another billion dollars in sales over the next five years.

The Metro store at Collins Square is an excellent case study of how supermarkets are learning. Collins Square is a mixed-use development that houses close to 20,000 workers and visitors every day. A traditional convenience store-style offer would simply not gain traction with such a captive audience. Instead, the Metro has evolved its offer to provide a value proposition that fulfils the needs of its customers.

- Collins Square Woolworths Metro

- The Woolworths Metro concept delivered exceptional food and grocery options to residents

Romeo’s IGA in the MLC Centre, Sydney is another supermarket that long ago learned that a standard fresh food offer does not give the daytime population in business areas the breadth of choices that they want or need. Romeo’s from the beginning has emphasised equally its immediate consumption offerings, equal that of its grocery lines.

It is important to note that this new wave of in-store F&B does not represent a new way of thinking. The best delis, health food and grocery stores have for years been offering their customers places to sit and enjoy their products in-store. The big difference today is that, with the major chains taking this offer mainstream, this section of the F&B market has gone from a tiny niche to serious challenger almost overnight.

Given the chains’ access to reams of consumer data, the supermarkets are turning into formidable competitors.

Supermarkets appear to be adapting to customer demands by increasing their self-service check-out points within these busy prepared food supermarket stores, as hungry people don’t want to wait in a queue behind basket shop-shoppers. Supermarkets want to be places known for convenience, tasty food at great prices and as such are evolving their service-models accordingly.

However, if supermarkets want to become serious about immediate-consumption food, and not just pay lip service; they need to focus on catering first-principles with regards to healthier food choices, Asian food options, non-fried dishes, display formats, product presentation, garnishing and above all a reduction in single use plastic packaging. While supermarkets recently have improved the quality and presentation of their Home-Meal-Replacement (HMR) take-home to eat dishes, it takes another set of skills to deliver a complete customer-centric and appetising food service proposition.

In today’s age of high-tech and high-touch, people think things change; they don’t. We all want quality and consistency across all food and hospitality price points. There are no exceptions; today’s customer is king; they are informed, and they can decide the fate of a food business.

We study trends and changes taking place in the exciting world of food and hospitality and we know that cafés, fast food, restaurants, bars and the like need to fulfil two basic and timeless crucial criteria to guarantee repeat patronage:

1. The customer must value their offer – e.g. quality coffee – every time

2. The customer must trust the food operator – e.g. positive experience – every time.

Retail food, food service and hospitality sectors have many attributes and service-centric benefits that customers yearn for and are prepared to pay for, with which supermarkets cannot compete with. However, this evolving landscape proves again that café and retail food should take note of the two timeless criteria – value and trust – that makes hospitality unique.

Where shopping centre food courts, food halls, cafés, restaurants and bars currently enjoy the advantage over supermarkets, is their understanding of the hospitality industry and their ability to offer full-service options, great spaces to eat, personalised service, authentic cuisine and alcohol provision. Furthermore, where shopping centres and F&B operators can work together to provide a unique point of difference is in the design of the centres dining precincts and the concurrent styling of the tenancies. Shopping centres across the world are creating vibrant, exciting spaces that engage and excite their customers. F&B is a big part of this evolution – a trend that goes well beyond just satisfying our need for a snack and nutrition.

Serious food and hospitality operators are in the business of making people feel welcome and to have a good time while they part with their money – the more they feel good, hopefully, the more they will spend. However, the food and beverage industry from time to time forgets that it is part of the ‘hospitality’ industry and needs to be reminded that the customer is king or queen. (Flanagan’s recent article in the Melbourne Age is a case in point.)

While competition for the food dollar is increasing every day, the informed customers will continue to vote with their feet. Food and hospitality operators must join forces with shopping centre management to focus on food and service excellence, so as to maximise appeal and to remain relevant to their communities.

Community partnership is crucial in securing repeat customers and growing market share. A living-centre is one that offers a place to spend time and to make memories, one that strategically plans food and beverage, entertainment and a festival of events that appeals to customers and not just shoppers.

In a recent article in Commercial Real Estate from May 29, 2019, entitled ‘Retailers focused on delivering a richer customer experience’, CBRE Head of Retail – Pacific, Graeme Wakefield, said the changing nature of the retail playing field had resulted in a focus on entertainment, and food and beverage offerings. “There is an opportunity in the market place to give customers more of what they want as retail is changing,” he said, citing examples including restaurant precincts in shopping centres and indoor playgrounds.

While supermarkets continue to capture market share of prepared food sales, it will be intriguing to see where their menus take us. It is up to retailers, dining precincts and shopping centres to adapt to counteract this shift, as it will be those who acclimatise faster and more effectively that will reap the benefits in the long term.

Shopping is no longer limited to malls and the high street. Therefore, customers are looking for their managed centres to offer positive experiences: Exciting and safe places that simply welcome us, feed us, entertain us and make us feel part of the community, every time.