In the latest issue of SCN magazine, we bring together insights from key industry partners who play pivotal roles within the shopping centre industry. Through an engaging Q&A, we delve into their strategies, challenges and innovations, offering a behind-the-scenes look at how they are navigating the complexities of this dynamic sector. Here we feature David Grant, Research Director at Prescient Research.

Tell us about Prescient Research and how it came to be?

Prescient Research was founded on over 30 years of property experience gained through Brickfields Consulting. For more than 13 years, we have specialised in evidence-based strategies that empower our clients to deliver successful places. With this experience, we identified a market need to more efficiently, and cost effectively, capture customer and tenant insights in a way that is designed specifically for places.

We knew how important understanding customer sentiment could be in unlocking unforeseen needs, and mitigating risk for property owners and managers – yet at the same time, how costly the investment could be to implement these programs.

When we connected with others from our industry with product and technology expertise, Prescient Research was born. Our goal is to use technological innovation to change the way places measure customer sentiment, enabling our clients to proactively anticipate the needs of their customers. The solution we developed, known as Prescient Voice, is ‘always on’, so our clients can track their performance over time, providing a way to take the heavy lifting out of market research for places.

So how do you measure customer sentiment for places?

Many people would be familiar with Net Promoter Score (or NPS) which is a metric that was designed for fast-moving consumer goods, which is a common sentiment measure capturing advocacy. It measures the percentage of customers rating their likelihood to recommend a company, a product or a service to a friend or colleague. However, this measure alone can be misleading when it is applied to places.

We’ve built on this traditional advocacy measure with loyalty, satisfaction and experience metrics that are linked to actionable business drivers. Essentially, Net Promoter Score Plus (NPS+), as we call it, is a more holistic measure designed by us specifically for physical places. It measures how satisfied customers are, whether their trip fulfilled their needs, how likely they are to return and whether the centre is better than others they have visited, as well as how likely they are to recommend it.

We also measure 12 customer touchpoints for retail centres that reflect the customer journey, across six themes including service, cleanliness, safety, maintenance, design and experience. This helps our clients diagnose where they need to focus their investment to improve customer satisfaction.

You mentioned understanding customer sentiment is important, why is it so critical?

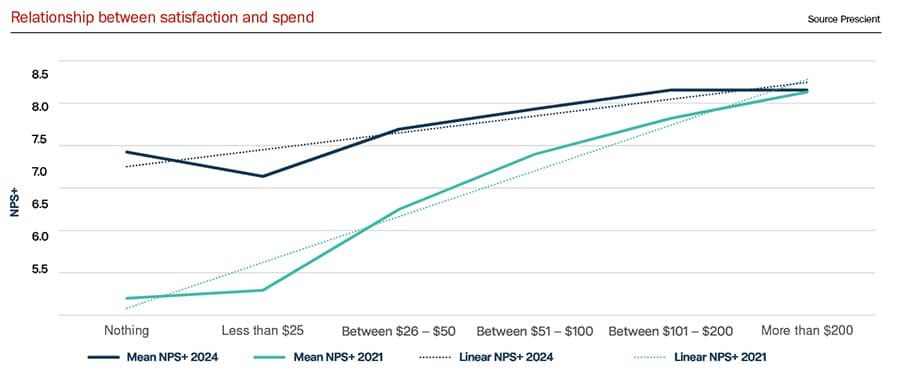

Through our data, we have been able to demonstrate there is a clear relationship between positive satisfaction and increased spend.

Highly satisfied customers spend on average $12.50 more each time they visit. There is also a relationship between positive sentiment and frequency of visitation. So highly satisfied customers are spending more and visiting more often.

Is this relationship between satisfaction and spend true for all centres?

Whilst this is true at a macro level when aggregating results across more than 123 centres across Australia, it is important to note that every centre is different. The geographic context and audience profile of a centre can influence sentiment, as different things will be important to different types of customers. For example, we know from our data that age can be a factor. As we get older, we are less likely to have positive sentiment towards retail centres.

It’s by understanding the nuances behind what is driving satisfaction at their specific centre, and what parts of the customer journey are underperforming, that centre teams can action improvements to improve customer sentiment and reap these financial benefits.

So how do centre teams know if they are under or outperforming, and where to invest to improve?

One of the most powerful tools we have in our Prescient Voice platform, is the ability to benchmark centre performance, both at the centre-level, but also at a touchpoint-level. This enables clients to compare their centre’s performance to other similar-sized centres, or those centres in their geographic region, to provide context for their performance. Identifying the strengths and weaknesses of a centre against these benchmarks, helps centre teams recognise their points of difference as well where they need to invest to maintain equivalent standards.

For example, Landsec (a UK client of ours) commenced collection using NPS+ in 2021 across 13 centres. During this time, the company received almost 20,000 responses from real customers in-centre. NPS+ is now the top reported metric in the organisation, and the improvements it has made have led to a +11% improvement in customer sentiment across the portfolio over those three years since Prescient Voice was implemented.

What new technologies are you leveraging to help deliver these insights?

In every centre, we ask the question, “If you were the centre manager, what would you change to improve the customer experience?” We are using AI to interpret these open-ended responses from customers, to provide a summary of key feedback themes and recommendations for improvements that can be made by centre teams. This provides automated insights that are timely (no waiting for that findings report to be completed) and immediately actionable – not just data for data’s sake.

For those who are already measuring in-house, what are the benefits of Prescient Voice?

While any effort to understand customer sentiment in your centres is worthwhile, whether it is internal or external, we would stress the benefits associated with using a market-leading technology platform that provides benchmarking against the industry and is always being improved to best practice industry standards.

Further, Prescient Voice has the potential to save in-house teams significant time that they currently spend preparing asset-level or portfolio-level insights and delivers them in a timelier manner. It essentially frees up customer teams, enabling them to focus on higher value work, rather than being focused on crunching the numbers each month or quarter.

So, what’s next for Prescient Research?

Right now, we are focused on expanding within the retail sector, both in Australia and overseas. However, we have also developed Prescient Voice for airports and are also exploring how we can tailor the tool for workplaces, for both tenants and end users. We are also investing a lot into AI integrations so that customers can leverage their data in a meaningful way, without needing to be a data scientist.

This exclusive Q&A feature is published in the latest issue of SCN magazine – premium members can view the digital magazine here.