You need some security: a bank guarantee, a cash security deposit, personal guarantee? Which one? As Jodie Masson tells us, they’re all good. The differences lie in how you manage them!

The answer will likely rest on what you consider to be the most important aspect of a security, for example: how quickly you can access or call upon the security; potential barriers to calling upon the security; or, how ‘deep’ the security is at the end of the day, despite the enforcement costs.

Naturally, all options have pros and cons and it is important to ensure that you have all necessary protections in place regardless of which form of security you choose.

Bank guarantees

Bank guarantees are usually seen as the most preferred form of security for retail landlords, mainly because they are a separate contract from the lease and they involve less administration.

A bank guarantee is essentially a contract that exists between the landlord and a bank to release money upon the occurrence of particular events or circumstances, such as tenant default. Because the contract is between the landlord and bank, it is autonomous in its operation and the landlord can usually request payment from the bank without needing to consult or involve the tenant.

Importantly, the autonomous operation of a bank guarantee means that it is generally (but not always) beyond the reach of external administrators, receivers, liquidators, etc, in the event of tenant insolvency because it is not part of a tenant’s assets. However, it is possible for a liquidator to prevent a landlord’s call upon a bank guarantee in certain circumstances, for example: if the proceeds of the bank guarantee are considered an ‘unfair preference’.

Bank guarantees are also preferred by landlords because there is less ‘administration’ involved in keeping a bank guarantee, as long as you have somewhere safe to store the one or two-page document and a mechanism for remembering any expiry dates, unlike security deposits, which require a high level of maintenance and compliance, such as dealing with bank and trust account rules and liaising with government departments and their endless forms.

While the landlord’s ability to call on the bank guarantee remains separate from its lease contract with the tenant, the landlord’s right to call on it still depends on the terms of the lease and the terms of the bank guarantee itself. For example, some lease clauses require notice before a landlord may call upon the guarantee or impose conditions of reasonableness and in some cases prevent a draw down for a ‘bona fide dispute’. Usually, a tenant is able to challenge the landlord’s call on the bank guarantee if the landlord breaches requirements of the lease and injunctions have occasionally been granted to restrict the landlord’s actions. Accordingly, it is vital to ensure the lease clauses regarding a drawdown are certain and unambiguous.

It is also important that leases are correctly drawn to reflect what the landlord actually requires. Many leases that we see contain bank guarantee provisions that are completely unrealistic (for example, they require bank guarantees that have no expiry date or that are assignable – these days, most major banks will never issue a bank guarantee that complies with these requirements).

If you are a landlord, make sure your lease agreement is up to date and states your actual, real requirements.

Also, be aware that bank guarantees issued by different banks usually contain different terms. For example, some will be cancelled immediately upon drawing even only a small part of the guaranteed amount, whilst others will continue on until the full amount is eventually drawn. It is important to understand the exact terms of your bank guarantee and how difficult it might be to draw it down in the event of a tenant default.

A bank guarantee should preferably not expire until a reasonable period after the lease expiry date. A good rule of thumb is to allow 6 to 12 months after the expiry date so that the bank guarantee can be used for a failure to make good or if the tenant holds over the lease at the end of the term. Always diarise bank guarantee expiry dates and ensure that your lease permits a drawdown (and conversion to a security deposit) if a replacement bank guarantee is not provided on or before the expiry date. Don’t be left with no security!

Also, a bank guarantee should always be in the name of the then current landlord. We often see landlords with bank guarantees in a previous owner’s name well after the sale has completed. Although it’s common, it is legally problematic to get an old owner (who no longer has any rights under the lease) to drawdown a bank guarantee for a new owner.

A further tip is to not accidentally restrict what the bank guarantee can be used for by accepting a bank guarantee with restrictive wording. For example, a bank guarantee which is expressed to be a ‘rental guarantee’ can probably not be used to compensate a landlord for a tenant’s failure to make good.

Cash security deposit

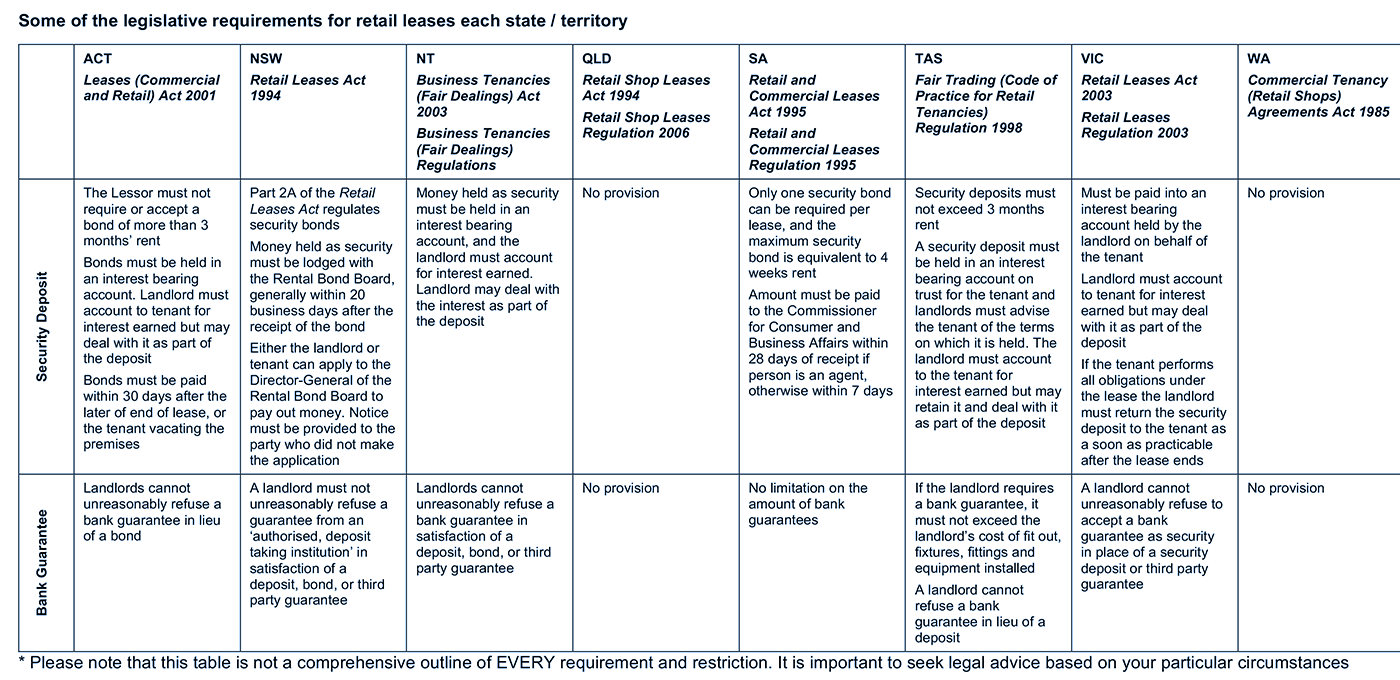

Traditionally, a cash security deposit was generally held by the landlord (or the managing agent) which made it more attractive than a bank guarantee in terms of landlords being able to access the security more directly and quickly. However, in the retail environment, there are usually more administrative requirements on cash security bonds than bank guarantees, and different legislative requirements apply in each State and Territory. In many parts of Australia, security bonds for retail leases are required to be deposited with the relevant government department who then strictly controls the process for drawing down the deposit. The table below outlines briefly the differing requirements in each State and Territory in Australia, showing the complex issues that national landlords are likely to encounter.

It is critically important with security deposits for the lease terms to cover who owns the money during the term of the lease and exactly who has the right to any interest earned on the deposit.

The interest component becomes particularly important on the sale of the shopping centre – does the selling owner get to keep the interest component or does it get transferred to the purchaser with the security deposit? Ownership also becomes a critical issue in the event of a tenant insolvency. We are often approached by real estate agents who have been ‘caught in the middle’ of a dispute between a landlord and a liquidator (or other external administrator) of an insolvent tenant and the answer to the question of who has the right to the bond often lies within the terms of the lease.

Of course, the retail legislation will always override the rules for the security deposit (including ownership) detailed in the lease, frankly usually to the detriment of the landlord.

Cash security bonds are also subject to the Personal Properties Securities Act 2009 (Cth) (PPSA). The receipt of a cash deposit as security for a lease creates a security interest for the landlord. However, this security interest must be registered or ‘perfected’ by the landlord. Otherwise, the landlord’s interest may not have priority over others (including the bank who holds the security deposit). With this in mind, it is prudent for landlords who accept cash security bonds to immediately register a PPSA interest as part of finalising the lease documents (and the lease should have an appropriate PPSA clause included).

There are other traps with a security deposit. For instance, a tenant may challenge the use of a cash security bond in the same way as a bank guarantee if it can be shown that the landlord has not complied with the process in the lease for a drawdown. There is also a possibility that the cash deposit could be declared unclaimed money under the Banking Act 1959 if it is in an account that is not accessed or used for a period of three years. Usually, the landlord would be responsible for ensuring that this does not happen and in a long term lease this could be problematic.

For these reasons, in the retail environment, our advice to most landlords is that a bank guarantee is usually a superior form of security over a cash security deposit, but, of course, this will depend on the particular circumstances of each tenancy.

Personal guarantees

Landlords often require a personal guarantee from a director of a tenant company whereby the director guarantees that he or she will be liable for the debt or commitment entered into by the company. Most guarantees are not time limited so the director’s obligations are continuing. This means that directors may be liable for past or present obligations owed by the company.

The main advantage of a director’s guarantee is that it allows landlords to access a (potentially) much larger amount of security than a bank guarantee or cash deposit (which is always limited to a particular amount). Director’s guarantees also often have the practical effect of pushing landlords to the ‘front of the queue’ when tenants are in financial difficulties (directors obviously don’t want any threat to their personal assets and will try to ensure that the tenant company performs under the lease to protect those assets!).

However, personal guarantees have the following downsides:

• Landlords need to enforce the guarantees. This usually means litigation, which is expensive and the outcome is never guaranteed. Landlords may ‘throw away’ more cash chasing a loss caused by the tenant.

• Most landlords don’t do any due diligence on whom they are obtaining director’s guarantees from. You are usually wasting your time if all the assets are held in the director’s wife’s name! Landlords should only bother getting a director’s guarantee if they believe that there are assets sitting behind a director.

• Personal director’s guarantees must be expressed carefully so that they ‘run with the land’ (i.e so that they are passed from owner to owner on the sale of a shopping centre).

This type of guarantee is usually unsecured, meaning that the landlord’s rights over the personal property and assets of the director may rank behind other creditors and may be accessible to a liquidator in the event of insolvency.

Directors are usually free to deal with their own property at any time even if they have given personal guarantees to a landlord. In other words, even if the director had assets at the beginning of the lease term, they may not necessarily have assets when you need to enforce the security.

As with other forms of security, it’s important to ensure that the drafting in the lease puts the landlord in the best position possible to enforce the personal guarantee.

Timing and leverage

At the risk of stating the obvious, it is paramount to obtain lease security before you allow a tenant to access the premises. Landlords lose their leverage once they give away access and it is costly to try to obtain lease security later. No-one wants to ruin a long-term relationship by threatening to evict a tenant for a breach at the beginning of a tenancy agreement.

Similarly, landlords often do ‘special deals’ for particular high net worth or sophisticated tenants accepting no lease security. Keep in mind that these tenants may assign, and it is important that your lease covers an automatic ‘fall back’ position on lease security if the tenant is not the original ‘special deal’ tenant. If your lease simply states “not applicable” beside the lease security requirements, then trying to extract a six month bank guarantee in the middle of an assignment process where the landlord’s rights are curtailed by the relevant retail legislation might be very difficult.

A final word of caution: in all cases with a tenant default and drawing down on security (particularly where an external administrator is involved, where ‘special’ rules apply that are not necessarily intuitive), it is important to consult with your legal advisors to ensure that you don’t take any action which may jeopardise your interests. A quick phone call may save you a lot of grief.

Conclusion

All forms of security are useful so long as landlords take necessary steps to ensure that they are protected and their use of the security cannot be easily challenged. Be aware of your rights and the restrictions applicable to lease security.