Indemnities are often the least understood clause in the retail lease. So says John Morrison. In this article, he looks at the topic and cautions both lessors and lessees to pay more attention.

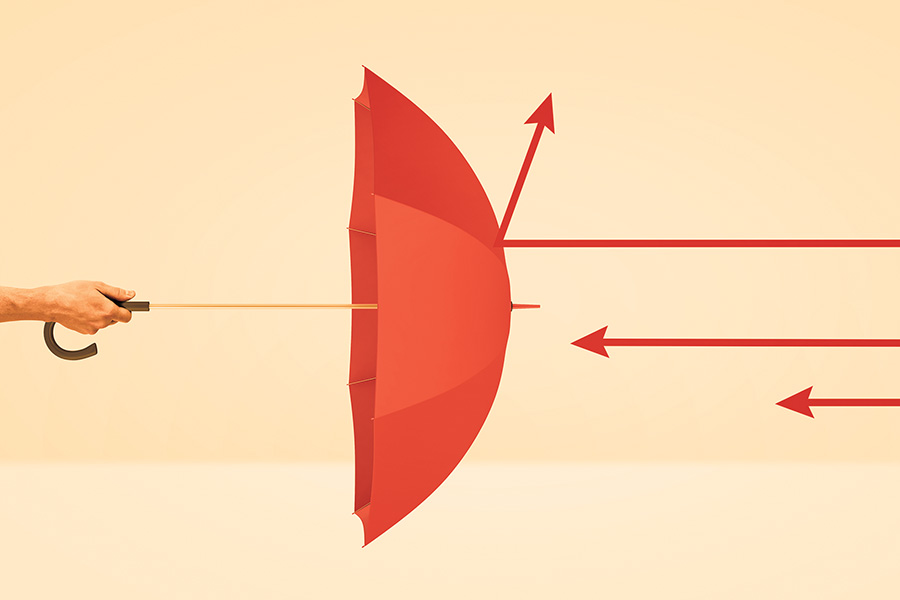

The lease is the means by which a landlord and tenant allocate risk between them. The starting point to both drafting and negotiation is to identify the inherent risk in the proposed lease transaction and which party will accept liability for that risk. The inherent risk in a lease is that a party may suffer loss and damage from breach of the lease terms, damage to property and injury to person. The purpose of the inclusion of an indemnity in the lease is to manage that risk.

Regrettably, indemnities are often the least understood clause in the lease. The principal reason for the inclusion of an indemnity in the lease is to shift the responsibility for an adverse event from one party under the lease to the other. Where possible, the object of the indemnity is to manage the rights the parties may otherwise have had at common law, in equity and under statute.

While the inclusion of an indemnity is commonplace in all retail and commercial leases, the drafting of the actual clause is often heavily negotiated and a common cause of disputes. Indemnities are not just words on a page; they transfer liability for a known or anticipated risk from one party to another, which may give rise to unexpected consequences for the party giving the indemnity.

The three common forms of indemnity found in a lease may be categorised as general, third party and party/party.

The majority of retail leases will be drafted to require the tenant to indemnify the landlord against a claim by a third party for personal injury and property damage and a general indemnity whereby the tenant indemnifies the landlord against an event or circumstances. The protection enjoyed by the landlord is no more or less than the loss the landlord has suffered.

The advantage of an indemnity

In the absence of an indemnity the common law implies the right to damages. Once the breach of a duty is established, the law implies a secondary obligation on the person in breach to pay damages. In contrast, a lease containing an indemnity may deal with and impose consequences for breach of its terms. For example, the amount of compensation payable under an indemnity may be greater than the damages that would flow from the same breach of the lease.

Unlike the operation of the common law, a contractual indemnity may, subject to the drafting and any limitation imposed by law or statute, reallocate responsibility between the parties for damages that may flow from the breach. Subject to drafting, the contractual indemnity may be the means by which the parties ensure a fair and proper allocation of risk with an appropriate remedy.

Under the common law the person suffering the loss must prove the alleged breach of contract, causation, demonstrate the nature of the damages being claimed is not remote and take steps to mitigate their loss. In contrast, a contractual indemnity may be drafted without the need for the claimant to prove breach and in its broadest form may be enlivened and give rise to the requirement to pay compensation without the need for a default.

Depending on the drafting of the indemnity, unlike a claim for damages at common law there may be no requirement for the person having the benefit of the indemnity to take steps to mitigate their loss. The amount payable under the terms of an indemnity is generally the amount of the loss for which the person having the benefit of the indemnity is entitled to be indemnified.

Reallocation of risk

A lease may contain a number of provisions that alter the allocation of risk and the position that but for the provision in the lease would have applied at common law. Examples of lease provisions dealing with the allocation of risk and liability between parties include contractual indemnities, provisions imposing liquidated damages, limitation of liability clauses, and exclusionary clauses.

Risk is also managed by the contractual obligations imposed on each party to the lease, warranties, releases, guarantees, security, insurance, rights of termination and where appropriate, step-in rights.

Bad risk allocation

Risk is best allocated to the party who has the ability to manage and control the risk. Risk allocation will be more likely to cause detriment when it is allocated to the party least able to manage the risk.

The drafting of indemnities is sometimes driven by the philosophy of shift all risk from the landlord as owner to the tenant as occupier. This broad brush approach to risk is unreasonable and, when adopted, must be rectified as part of the review and negotiation of the lease terms. But this is not always an easy or achievable task. When faced with this dilemma it may be difficult for the tenant to deal with a perceived unfair allocation of risk and negotiate a satisfactory outcome in circumstances where there is unequal negotiating power.

If a party is required to take on the risk of an event or occurrence then that party should consider offsetting the risk by obtaining proper and adequate insurance. Whilst insurance premiums are often expensive, this is an efficient way of protecting against the risk having an even greater detrimental financial impact on the tenant’s business.

Apportionment of risk

The problem with shifting all of the risk to the tenant is that if the risk eventuates and the tenant is unable to sustain the amount being claimed then it will still have an impact on the landlord. The parties will experience inconvenience and may incur significant costs associated with possible insolvency, termination, legal and administrative costs.

Where possible the indemnifier must ensure the indemnity is limited to acts or omissions within their control. Open ended liability should be avoided by ensuring the indemnity is drafted in a way that limits the events that may trigger loss.

In order to manage the risk, the indemnifier should give consideration to introducing contractual rules into the drafting of the indemnity. The indemnity may deal with the remoteness, exclude certain types of loss, limit liability by including a cap on the amount that may be claimed and require the other party to take reasonable steps to mitigate their loss.

The key take-away points are:

• The risk taken on by the indemnifier should be limited to actions that are under the control of the person giving the indemnity.

• It is important to consider whether the risk is something that can be insured against?

• The indemnity should not operate to indemnify the other party for loss and damage arising from their own negligence or default.

Conclusion

The perception of fairness will be determined by the drafting of the risk allocation provisions and the scope of the indemnities. The appropriate allocation of risk to one party over the other is part of good risk management practice. The indemnity must sit with the party best able to control the risk.

A broad indemnity may be of limited value. Unlike a security deposit or bank guarantee, an indemnity will only be of value if the party giving the indemnity has the financial resources and level of insurance required to answer the claim.

You must read and understand the scope and effect of the indemnity. The fact that you have misunderstood or ignored the indemnity will not excuse you from liability.

If you do not understand the indemnity then you must obtain legal advice. Otherwise, you may be exposed to unreasonable liability and forced to indemnify the other party for loss and damage that was not caused by you.

Disclaimer: This article is not intended to be a substitute for obtaining legal or other expert advice and no responsibility is accepted for any action taken as a result of any material in this article.