Australia’s hospitality industry is in a state of disaster. From the morning coffee to the late-night cocktail; our favourite Sunday brunch to the working weekday lunch; every business in the industry is impacted. In this two-part article, Francis Loughran of Future Food, explores the big issues facing the hospitality industry as it struggles to come to terms with the impacts of COVID-19 and associated political impacts.

- The ABC reported in early July: “CEO of the Restaurant & Caterers Association Wes Lambert, hypothesised that 10-20% of restaurants could close permanently in the wake of COVID-19

- Australian restaurant revenue has declined by 25.1%, according to industry market researcher IBISWorld, from $19.7 billion in 2018-19 to $15.0 billion in 2019-20.

- Australian Bureau of Statistics data shows more than a third of Australia’s accommodation and food services employees lost work between March and April, as COVID-19 restrictions began.

- In May, Treasury estimates released by Prime Minister Scott Morrison forecast 441,000 jobs would be lost in the hospitality sector.

Voice of the industry – one that is hurting badly

Ronnie di Stasio, a long-time veteran of Melbourne’s hospitality landscape, has become the unofficial voice of the industry with an open letter to the Governing Bodies of Australia and full-page advertisements in national newspaper magazines over the weekend. His frank and heartfelt messaging highlights the emotional and financial strain – a result of the lack of direction, the response to COVID-19 is having, not only on café and restaurants, but the bakers, farmers, fishermen, growers, artisan suppliers, wineries and many more small and large suppliers. It highlights that the current issues faced by the industry are not only about money, but also point to emotional challenges caused by uncertainty and frustration.

Di Stasio’s letter sets out both the problems that the Australian Hospitality & Tourism Industries currently face as well as a ‘simple five-point plan’ for consideration:

- Extend JobKeeper at the original $1,500 rate to Victorians beyond the September deadline, and extend it to temporary visa holders. Aren’t we all in this together?

- Provide access to funds to allow us to trade out of this cash-flow hole. Put real pressure on the banks, or underwrite them properly, to ensure that cash flows back into the economy.

- Abolish the national fringe benefits tax. It raises no revenue and stifles spending. Do you want to stimulate the economy?

- Abolish the state-based payroll tax. It is a tax on employment and is surely redundant in a post-COVID-19 world.

- Reform industrial relations. Provide an alternative to the archaic and punitive federal award. Create a new system that allows flexibility, surety and confidence for all employees and their employers alike.

Food operators are struggling

It doesn’t matter whether they are the best restaurants, the busiest bars or small single-operator coffee shops – everyone is impacted. This week Thomas Keller announced the closure of his marquee Hudson Yards (New York) Steakhouse TAK due to the pressures of the COVID-19 environment.

TAK Hudson Yards. Image via TImeout

Unfortunately turning the tap back on for customer numbers (if that was even possible) will not end the problem either. With large numbers of redundancies across the industry (accommodation and food services -33.4%, ABS/May 20), loss of the casual workforce (approximately 80% of the industry’s workforce) and temporary visa holders; reinstating the culture in many businesses will take time and money – the cost of hiring and training new staff is not insubstantial (productivity loss, training costs, HR staff costs, interview costs, advertising costs etc).

With emerging trends as they currently stand, staff roles may not even be the same as pre-COVID. For those operators that do re-open, it will be like starting from scratch, only with the added threat of return to lockdown (as demonstrated in Auckland last week) hanging over their heads and adding to the burden of stress.

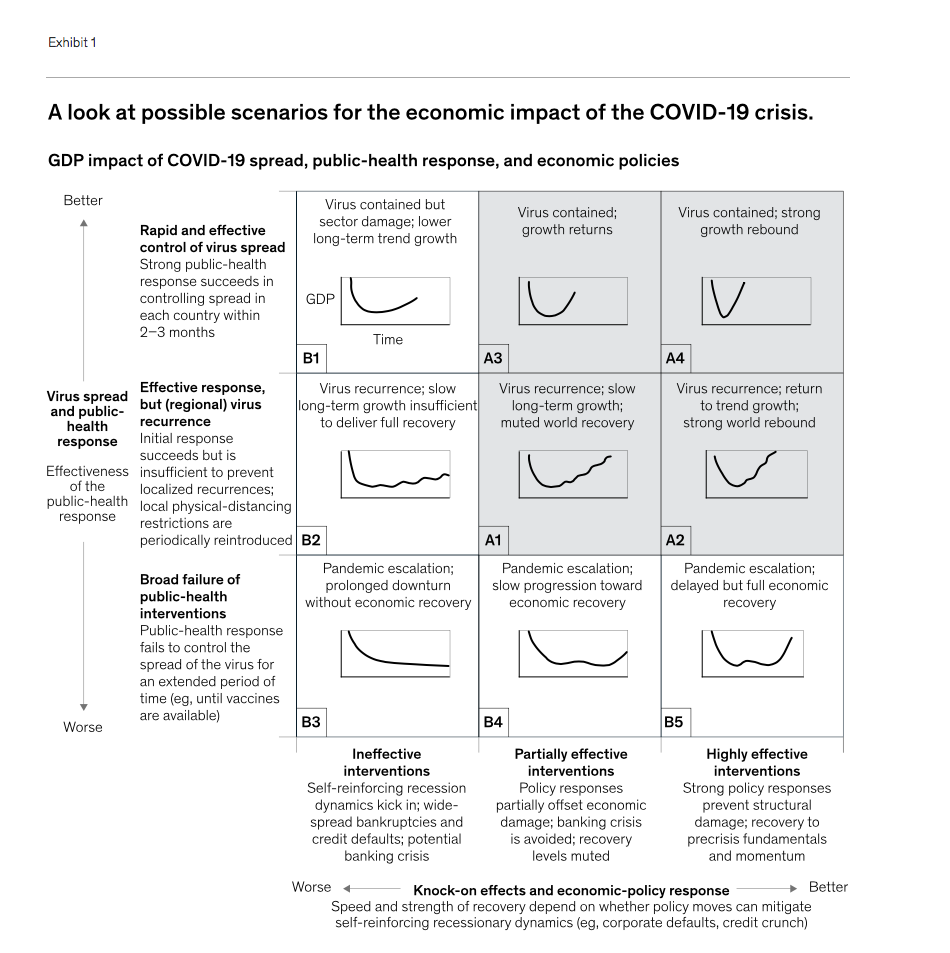

Source: McKinsey & Company

As far back as April of this year, the Restaurant & Caterers Association estimated that 25% of the 47,000-plus restaurants nationwide, could be lost in the wake of COVID-19. That represents almost 12,000 individual businesses, not to mention the staff that they employ, the food (as well as beverages) that they buy and the real estate that they rent. CEO Wes Lambert doubled down on that statement in an interview with ABC Radio National on 8 July, “We certainly could see a landscape where anywhere from 10% to 20% of restaurants closed permanently.”

This is not only due to mandated closures, but also economic recession, unemployment, lowered disposable incomes or discretionary spending, the loss of international tourism and negated business spending.

A changing model and the new cost of doing business

Every operator needs to approach the current issues with a completely clean slate. There are no silver bullets. Every operator must seek to understand their own unique circumstances and develop their own strategic response that speaks to the issues they face.

For some operators, it will be the inability to field large groups sizes (certainly in the short term) such as Christmas functions, events, EOFY dinners and so on; Businesses built on this model have an extraordinary amount of change that needs to be processed. Reduced seating capacity (i.e. 4m rule) due to state/national legislation or simply customer expectation will also reduce the potential for many operators to continue with their current operating model. Shorter seating times introduced by operators to combat this is also likely to result in reduced spend per head, also impacting on the financial sustainability of each venue. Diversification of the business model will almost certainly need to be considered, as a more substantial focus on smaller groups sizes is likely to be the norm for an extended period of time.

Many restauranteurs have pivoted to utilise a digital customer facing strategy, but not without cost

In other F&B businesses such as clubs and hotels, the likely loss of operating models such as buffets is expected to have a negative impact on customer value perception, customer uptake, financial return and profitability before the cost of redirecting a service and food strategy can be determined. Design solutions will certainly need to be a component of the industry response and determining new business cases for the refit cost and new service style development will take time, energy and money.

Regardless of industry sector, the costs of doing business continue to escalate as the revenue falls. As an example, many restauranteurs have pivoted to utilise a digital customer facing strategy, but not without cost. For many, this is achieved by utilising delivery aggregators, effectively cutting between 15-35% out of their revenue. Many people who read this will understand that there are few operators that can lose this ratio of revenue and remain profitable. Online representation across multiple social media platforms, review sites, delivery aggregators, industry publications, print media etc, does not come without investment of time and money also.

Remaining prominent and relevant online, amongst a sea of hospitality businesses is increasingly difficult and whilst points of difference can be easy to achieve inside a beautifully designed space with great food and service, the establishment of the same USPs are challenging to communicate in digital surrounds.

QR code menu. Image via Orderlina

Even if customers are able to make a return to dine-in, there is additional contactless technology that may need to be incorporated, such as QR code menus where customers scan a table code and are instantly presented with a contactless menu of food, products and services, in their web browser without the requirement for downloads. If contactless menus are not utilised, there is the cost of single use menus to integrate into the experience costing.

Additionally, many costs remain the same even though the revenue has disappeared. The costs of closing down, opening, closing and reopening; rates and leases and other fixed cost structures (with dramatically reduced benefit) continue to affect the bottom line.

Food costs continue to rise as the supply chain deals with a changing logistical backdrop. For those venues that have re-opened, the social distancing implications result in lowered seating capacity and limited seating times, ultimately reducing operating margins. For some venues this provides additional costs accrued through essential design modification.

To compound the issue further, most customers have a newfound awareness of visual hygiene and food safety protocols; the cost of which is inevitably borne by the operator through increased staffing, deep cleaning costs, contact tracing register management, PPE purchasing and distribution, re-engineered roster practices (i.e. splitting teams to reduce whole team infection potential) and increased compliance procedures.

In part two of this article, we’ll explore how the criteria of competency in F&B and hospitality operations have substantially changed in the past eight months and the light at the end of the tunnel…