A rare opportunity to partner with Scentre Group in one of Australia’s most dominant retail assets and South Australia’s only Super-Regional shopping centre as a 50% stake in Westfield Marion is offered for sale on behalf of the Lendlease managed Australian Prime Property Fund Retail (APPF).

Strategically located 13 kilometres south-west of the Adelaide CBD, Westfield Marion is being offered for sale, subject to pre-emptive rights. APPF has appointed JLL’s Head of Retail Investments – Australasia, Simon Rooney and Colliers International Head of Retail Investment Services, Lachlan MacGillivray to conduct a domestic and international sale campaign.

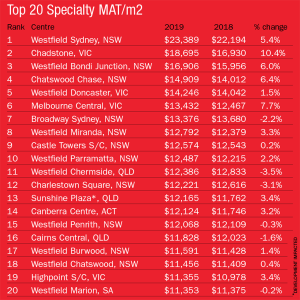

Rooney said, “There has been a shortage of large high quality retail assets offered to the market. Westfield Marion is expected to be the most highly sought after asset in the country this year, appealing to various core investors, both domestically and internationally, because it’s one of the top 20 centres in the country for specialty sales productivity (MAT/sqm). Long term return performance will be underpinned by the dominant nature of this centre – given it’s the 13th largest centre in Australia by MAT.

- 2019 Big Guns Top 20 Specialty MAT/m2

- 2019 Big Guns Top 20 MAT million

*Rankings based on SCN Big Guns 2019

“Fortress assets of the calibre of Westfield Marion are very highly sought after in the international marketplace,” said Rooney.

Co-owned and managed by Scentre Group, one of Australia’s leading operators and developers of shopping centres, Westfield Marion provides significant and ongoing development opportunities.

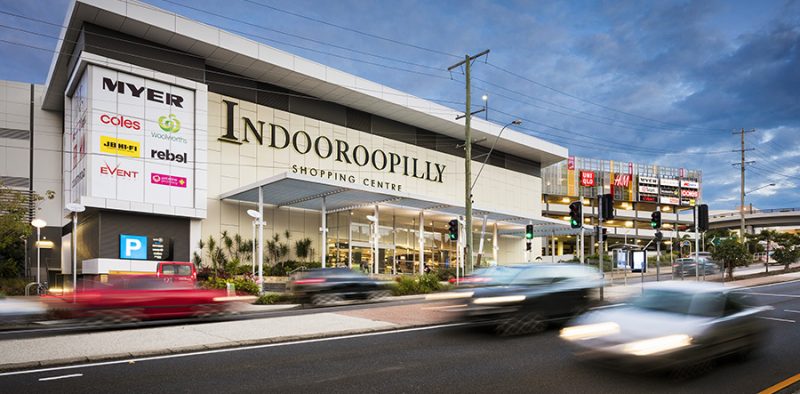

MacGillivray said “Super-Regional shopping centres represent the pinnacle of shopping centre investments, offering the highest risk-adjusted returns across commercial real estate sectors, stronger income growth profiles over the long-term and are highly resilient. The yields achieved on the latest regional shopping centre transactions have been at or below 4.25%, demonstrating the strong demand that still exists for core assets from both domestic and offshore groups. These transactions include Westfield Eastgardens, Pacific Werribee, Indooroopilly and Highpoint.

Sales: Indooroopilly Shopping Centre

“Prime retail will continue to perform well by attracting and retaining tenants, and investors want to be on the right side of the divergent retail theme. Australia remains an attractive investment destination for foreign capital seeking stability, transparency, quality assets and transaction scale with professional management,” said MacGillivray.

“The growth drivers for the South Australian economy are very positive. With $90 billion of investment into defence and a $3.8 billion Bio Med precinct, the defence and health industries will boost economic activity. Health is the largest and fastest growing employment industry in South Australia. In addition, strong growth in tourism and education will also fuel employment and retail spending and will underpin shopping centre performance over the medium and long term,” said Rooney.

According to JLL Research, employment in Health Care and Social assistance in South Australia has grown strongly at 38% over the last decade. The sector accounts for 15% of total employment (ABS).

Tourism has been growing at an above trend pace. International arrivals to South Australia grew by 14.3% year-on-year in FY18 (SATC).

Representing the largest and most dominant shopping centre in South Australia, Westfield Marion benefits from an exceptionally strong anchor tenant profile including two full-line department stores in David Jones and Myer, as well as Harris Scarfe, Big W, Kmart and Target discount department stores, Coles, Woolworths and ALDI supermarkets, Dan Murphy’s, Bunnings and an Event Cinema complex. Accommodating a quality and diverse range of approximately 310 specialty stores, Westfield Marion is Australia’s 11th largest centre by size with a total gross lettable area (GLA) of approximately 136,837m2, in addition to parking for approximately 5,549 vehicles.

Westfield Marion was attractive to buyers due to its location, dominance within its trade area

Occupying a substantial 22.9 hectare site, strategically located 13 kilometres south-west of the Adelaide CBD, Westfield Marion dominates the southern urban area of Adelaide. The significant site area, favourable planning conditions presents long-term masterplan opportunities for mixed-use development.