This is the second of a two-part article in which Francis Loughran explores the trends in food and beverage precincts in major shopping destinations around the world. In part one he looked at the present – in part two he examines the future.

In part two of this article, I will share with you insights into what malls, shopping centres and retail precincts around the world are planning for the future so that they remain relevant and maximise market share. In part one, I spoke of how “today’s lifestyle destinations are capturing the customer’s attention by offering beautiful spaces to eat, drink, socialise, relax and spend”. But in addition to the beautifully designed and styled physical mall environments, there is the ‘Business of Food’ – how developers view the ‘experiential categories’ as central to the success of malls, lifestyle destinations and mixed-use development assets. Increased market share is available if you differentiate by offering excellent food and hospitality, outstanding customer service, state-of-the-art digital marketing combined with entertainment, leisure, tourism and wellbeing experiences.

Developers and asset managers recognise how food, hospitality and entertainment define a project’s positioning statement and enable it to capture market share.

Chadstone is a prime example of how food has revived the centre’s appeal beyond being the fashion capital towards being the food capital, with annual sales reported in June 2018 exceeding two-billion dollars. This positive impact is replicated around the globe, where sales are growing in all prepared food categories.

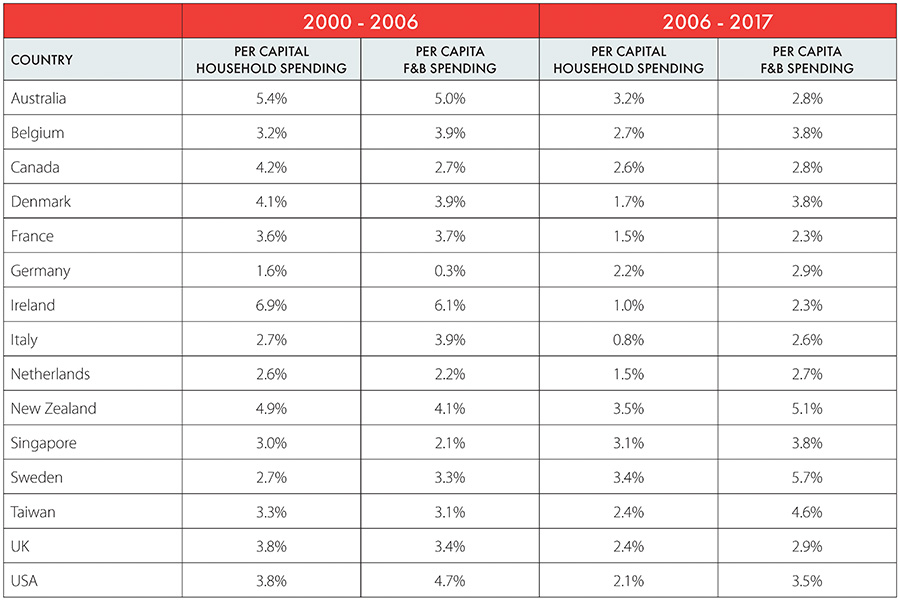

- The table above shows the move towards increased F&B in malls is justified by worldwide trends in consumer spending.

Prior to the GFC, most countries saw per capita growth in overall household spending grow at a faster pace than spending on Food Catering. In the time since, the strength of the Food and Beverage (F&B) sector has become apparent.

In the UK, growth in per capita total household spending fell from an average of 3.8% from 2000 to 2006 to 2.4% during the past 11 years. While per capita F&B spending also saw a decline in growth rates, the decline was less severe and growth in F&B now outpaces the rest of consumer spending. As a consequence, British Land has announced plans to increase the amount of floor space devoted to F&B to 16% of total GLA.

In Australia, growth in F&B spending has defied, somewhat, the global trends, remaining just below the growth trends of overall household spending. However, the largest Australian malls traditionally had only allotted about 3% of their total GLA to F&B tenants. This is well below international benchmarks. The growth in F&B at Australian malls reflects the continued strength of the sector as well as a large degree of catch-up with the rest of the world.

Modern malls are the complete expression of the new reality that hospitality and entertainment are the new retail. Malls are now so much more than product-focused, commoditised retail. The leading malls focus not just on food, but also on hospitality. Take Hudson Yards, New York, where design, choice of cuisine (from comfort food to aspirational dining) and the intelligent use of space and light combine to create spaces within the development that inspire people to congregate and enjoy. As a result, they stay longer and spend more.

The Grove in Los Angeles is another location that combines equal quantities of retail, food and entertainment as well as a fresh food market to add to the experiences available to users.

Moving south down the globe, Bogota’s Parque la Colina is home to SOCIAL, the mall’s smart casual dining collective which provides a safe, affordable, temperature controlled dining and socialising experience in a country that has not previously been renowned for mall dining.

Parque la Colina opened in early 2018 and is owned by the Parco Arque Arauco Group, which focuses on maximising food and hospitality in all its Parque Arauco Malls throughout Santiago, Chile.

As part of this emphasis on eating out and hospitality, malls are at the forefront of ‘Gourmet Democratisation’: where luxury food concepts, brands and cuisines become more attainable to the mass market.

This is the case when it comes to Eataly at Century City, Los Angeles. The opening of Eataly in May 2018 has hallmarked a new era of gold standard modern food and hospitality in malls. A key concept within Eataly is Terra – an Italian wood grill rooftop restaurant with direct access to the space via the centre’s carpark, which highlights the value of the food precinct to the centre.

- The original Farmers Market – The Grove, Los Angeles

- The original farmers marketing – The Grove, Los Angeles

Malls are benefiting from growing cities and changing lifestyles

Modern food and hospitality precincts should have a strong narrative, a story to excite, inspire and engage with people who will be the end user. The growth of digital and shifting urban trends have transformed the retail landscape these past two decades. Dense cities foster economic growth and technological development.

Retail has gradually evolved from street markets to sophisticated glazed mall and rooftop dining destinations (eg. Westfield Century City and the soon to be completed Hudson Yards, New York City). Today, when cities are eclipsing nations, current expectations state that before 2025, the 600 biggest cities of the planet will generate 60% of the global gross product. With the new ‘knowledge economy’ based on human capital, cities are now the driving force of growth and they are prepared to pay for the best talent, whom in turn will spend on retail and food. If we accept that retail, hospitality and cities are two sides of the same coin and that the future of humanity is inevitably urban, we can easily assume that retail will continue to play a key role in the decades to come.

- Artist’s impressions, Westfield Milan

This has been and will continue to be the case in the United Arab Emirates (UAE), which considers hospitality and entertainment as the key drivers in securing market share and asset growth.

The malls in UAE continue to focus on lifestyle experiences in addition to retail products with hospitality, tourism, leisure, entertainment, recreation, health and wellbeing, education and the arts featuring as key traffic drivers.

It is clear that urbanism has naturally caught up with the current trends, giving space to cutting edge concepts such as transport focused hubs (already happening in Melbourne and Sydney), which place public transport, pedestrian areas and mixed-use developments at the heart of urban design while the transport sector is experiencing its own evolution with electric cars and driverless vehicles. Parking spaces will no longer be required in downtown areas, roads will shrink and the number of cars in central areas will decline in coming years, leaving more space for green areas (eg. Cato Street Park in Prahran, Melbourne replaces an on-grade car park and offers all residents a new green space to enjoy).

- Cato Street Car Park Project – Prahran, Melbourne

While malls recognise some threat from online giants such as Amazon, stores and restaurant chains need to undergo a fierce adaptation process to successfully merge online and offline channels (eg. Uber Eats). After a period of growth in new build shopping centres, retail in Europe is currently experiencing a period of intense refurbishment.

These significant customer experience enhancements encourage people to return to shopping centres to shop, eat, drink, be entertained and leave their digital screens behind. This fast spreading refurbishment trend is stimulating the creation of dazzling gastronomic experiences and striking outdoor areas, encouraging guests to spend their free time at the mall and using leisure as the main anchor of the commercial mix.

- UAE Skyline

It’s not all about the Big Guns

Centres of all sizes can benefit from master planning and growing their F&B proposition. Existing malls, retail precincts and mixed-use developments are also rethinking how best to reinvent food and entertainment. Metrics of success for all assets are focusing more on both MAT and the importance of MAT/m2 and the alignment of café, restaurant or shop size to the specifics of the business. Forecasting sustainable sales and GLA volumes has never been more important and the key success factors of location, size, sales projection and occupancy cost are crucial in securing high performing, sustainable food and hospitality operators.

- Eataly, Westfield Century City, Los Angeles

- Westfield Century City, Los Angeles

Shopping centres of all sizes are repositioning their food and entertainment

Shopping centres of any size can no longer rely on the traditional food court and a range of cookie-cutter cafés. All centres – big or small – must give their customers a genuine reason to visit the centre and dwell longer, and food is now a crucial part of the appeal of any centre from neighbourhood to super-regional. Diversity of food mix coupled with high performing food operators, longer trading hours, an evening economy, licensed food offers and entertainment (cinemas, bowling, climbing walls, theme parks) and a physical environment that is purpose built, safe, welcoming, offers outdoor dining and greenery, are the cornerstones for our centres to enjoy the unstoppable growth in food sales, nationally and globally.

Globalisation, demographic shifts, urbanisation, climate change and internet proliferation are the macroeconomic megatrends that will shape the 21st century.

They are global, seemingly irreversible forces that have already made an incredible mark on economies and societies, and will continue to do so for the next few decades. But how will these megatrends manifest themselves on a shopping centre industry level? How will they affect and shape the mix of our malls in the future?

New generations of consumers are becoming a lot more conscious of their individuality and conscientious in their choices, which will drive everything from personal choices in shopping, better service, social spaces in malls, healthier eating, curated lifestyles and more social connection.

Food, hospitality and entertainment in shopping centres of all sizes (mega, regional, sub-regional, neighbourhood) must be professionally master planned and be sustainable to ensure the centre’s relevance and growth as a lifestyle destination.

- Parque la Colina, Bogota

- Westfield Century City