For our 2017 Little Gun edition, this article was both relevant and timely. It deals with adding a dining precinct in a Little Gun centre. It’s a no-brainer in a Big Gun, but what are the considerations for the smaller centre?

With food catering sales up by 6.8% YTD according to ABS Retail Trade data for August 2017, many owners of sub-regional-sized centres are keen to add additional GLA in the car parks, rooftops or on grade parking areas to accommodate a casual dining precinct and take advantage of the ‘main courses boom’.

But with total GLA of between 20,000-50,000m2, foot traffic at around half of a regional centre and often no cinema, converting or adding additional GLA for food catering needs to be planned extremely cautiously in order to secure quality long-term tenants.

So how do you assess an asset to determine whether food will bring a strong return on your investment?

- Perron’s Belmont Forum ‚Äì A Little Gun dining precinct success

Here’s B&P’s Top 5 essential criteria for Little Guns:

1. Anchors

“Man shall not live by bread alone,” according to Matthew 4:4. That’s correct. Man needs lots of other things to do than just eating in order to leave his home and this is particularly so when it comes to adding a casual dining precinct. A dining precinct needs an anchor above and beyond its own critical mass. B&P defines anchors into three levels of ‘pulling power’;

1. Super-power anchors are 8+ cinema screens, 300+ room hotel, 50,000m2 commercial or high-rise ressie in excess of 2,000 dwellings adjacent to the dining precinct;

2. Medium-strength anchors are smaller cinemas/hotels/offices, cinemas within walking distance of the centre, transport interchange, mini major entertainment, stadiums, student accommodation, medium-density housing;

3. Low-level anchors include library, council offices, retirement living, low-density housing estates.

The more ‘anchors’ you can include, the higher the likelihood of being able to establish the casual dining precinct as the dominant dining destination within the trade area.

2. Location, location, location

These are the three most important words in the development of casual dining precincts (after the word ‘anchor’!). There’s a whole slew of criteria we review in regards to where you can add the dining precinct. Some of the elements we have tested and measured include the influence of views and the effect the travel path from the car park to the dining precinct can have on uptake (sales per square metre can trade twice as high when customers travel on grade from their car to dine than when they have to use an escalator or lift to reach the dining precinct). Other influencing criteria include trophy parking, aspect, distance to other anchors and whether the dining precinct can be seen from the high street or whether it is internalised.

3. Placemaking

We hear a lot of talk about placemaking, go to a lot of conferences on placemaking, work with a lot of specialists in placemaking and, from all those experiences, we’ve come up with a really simple strategy towards placemaking: the B&P Power of Ten. It means we are looking for 10 other reasons to come to the dining precinct (and we don’t mean 10 different restaurants!). The addition of a child’s play area registers as the power of one so most developments need a lot more placemaking than just this often expensive placemaking strategy.

Think public seating, passive art, interactive games, augmented reality, pop-ups, pianos, book exchanges, a stage… and keep going.

4. Design

There’s a lot of psychology that goes into creating a precinct design that the public will engage in. In Europe, the scale of the dining precinct’s psychology has been created through centuries of using very large public piazzas that are ringed with restaurants but, in Australia, our psychology for dining space is more ‘strip scape’, which requires a different scale and relationship between the public space and the retail. Restaurant depths that are too deep make customers afraid to enter, while multiple entry points make it too confusing for customers to orientate their arrival. And we can’t stress enough the importance of actually understanding the wind and shade studies. Wind shear down the face of high rise above a Little Gun will kill a dining precinct, no matter how many wind breaks the architects install around the outdoor seating zones.

- Mirvac’s Stanhope Village ‚Äì merging food court and dining precinct for all-day trade

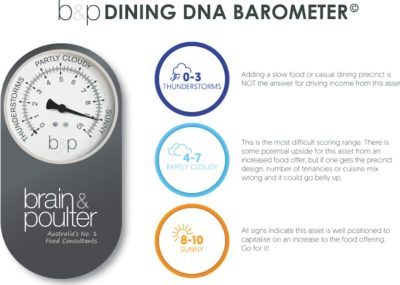

- Figure 1: B&P’s Dining DNA Barometer

5. Hungry customers

Even if you tick every box on every criterion mentioned above, any Little Gun needs to consider its relationship to the trade area. Often we see a leasing-led casual dining development – that’s to say, national brands looking for space in Little Guns to expand their empires and property owners keen to add them to the tenancy schedule. But many of these brands are failing to reach their trading expectations because the homework wasn’t done on the trade area. B&P has profiled the ultimate casual dining precinct customer but, even then, it takes approximately 500 fully employed Asian heritage DINKs/SINKs renting in high-density apartments to support just one restaurant to trade to a sustainable volume. Now consider the trade area of your Little Gun – the less of this ‘ultimate profile’ diner and the more white Anglo Saxon young families paying off their mortgage, then the numbers blow out to in excess of 1,000 residents to make one restaurant work. Plus, you need to consider the competition – what else is already available, and where is the dominant precinct currently?

The trade area for travelling to a dining precinct is also about half the trade area distance that people will travel for fashion shopping.

All these factors will contribute to getting a casual dining precinct to stack up at a Little Gun. Using a tool like our Dining DNA barometer can shine a light on just how strong the likelihood of success will be, should you want to use food to drive Little Gun success.