Food & Beverage (F&B) has been and will continue to be impacted enormously. Many restaurants, cafés, food court operators and specialised food outlets, will never open again and others will fail in the coming months. Whatever happens, one thing is clear; the F&B component of our centres will never be the same.

Packed in like sardines at the latest hip café, share platters of food lining the group table to celebrate your best friend’s birthday, handing over your keep cup to your favourite barista for your ritual morning coffee, paying cash for your takeaway dinner. These were all our ‘normal’ F&B behaviours that have evaporated overnight with the spread of COVID-19. Since early March 2020, we have been bombarded with queries as to what F&B precincts in our shopping centres, office complexes, universities, airports and tourism precincts will look like when we emerge into our ‘new normal’ once the pandemic is over.

In this article we will cover off B&P’s expectations around;

1. Timing – the stages and likely times of re-opening the food service market to arrive at the ‘new normal’.

2. Tenancies – who will survive and be able to re-open, which precincts will be most affected by shutdowns and which precincts may actually grow in F&B numbers?

3. Trends – What changes in customer purchasing behaviours and expectations adopted during the pandemic will remain post COVID-19?

Timing – The ‘new normal’ won’t start until Q2 2021

First and foremost, COVID-19 is a health threat that is resulting in an economic downturn. During the GFC, customers reduced spending on dining out significantly because they couldn’t afford it but they weren’t afraid to go out to dine. This time is different. Until there is a widely available COVID-19 vaccine, the ‘fear’ of catching the deadly virus from social interaction will keep all but the ‘bullet proof’ Gen Z/Millennials away from large places of social gathering such as cafés, restaurants, food courts, food halls and entertainment venues.

So between now and the new normal, B&P is planning to support our clients to prepare for the ‘semi-normal’ – where reduced social distancing measures see dining-in resume but with enforceable social distancing measures and heightened customer expectations around sanitation. Customers cautiously and in small group sizes will venture back into restaurants to celebrate events or to relieve cabin fever, business meetings over a coffee may resume in smaller numbers, a reduced or alternating week workforce returns and requires takeaway lunches and morning caffeine fixes. Non-essential shopping is permitted, creating some impulse F&B sales opportunities, school and school sport resumes creating increased takeaway and casual dining chances.

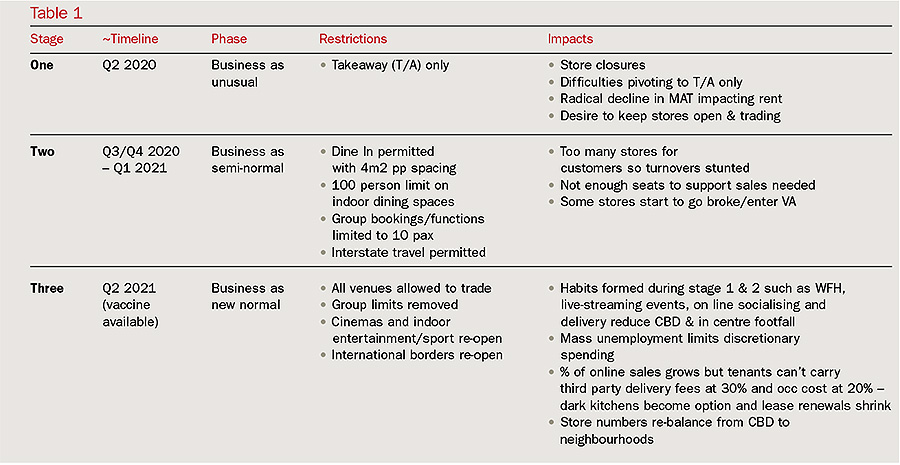

During the ‘semi-normal’ period, a time when it is likely we could see mass unemployment and reduced income for over half of the AU/NZ workforce and many enterprises going under, there will be too many food service outlets open for the demand. In order to pay the rent, wages and food costs, tenancies will need to turnover at least 70% of what they were taking pre COVID-19. Not all will be able to do this and there will be further closures, vacancies and reduced lease renewals. Our ‘semi-normal F&B preparation package’ is ready to be deployed by pro-active landlords to ensure re-opening tenants have developed hygiene protocols, physical and digital communications, social distancing measures, booking management systems as well as implementing takeaway and delivery platforms to maximise every sales opportunity. So far, less than a third of Australian food service operators are prepared for the semi-normal. Table 1 (below) is our estimate of the staging to get to the new normal.

“Tenancies – 25% of all F&B could close permanently”

Whoa – that’s a headline that’s hard to write but the evidence is mounting that it’s a likely outcome. Figures from Business NSW indicated food service sales were down 15% in March and 30% of food service businesses closed, current estimates from the Restaurant & Caterering Association NSW is that sales in April will be down 25-35% and by the time you’re reading this we could be starting to see the start of the bankruptcies and closures. So why wouldn’t we just see a V-shape recovery in food service spending to return us to pre COVID-19 spending levels?

Here’s a few significant reasons;

• Two million unemployed and six million workers on JobKeeper means about two-thirds of the workforce have reduced earnings. Eating out is always one of the first non-essential categories to tighten when times get tough.

• Health fears – until there is a vaccine widely available, the majority of consumers will remain cautious of close social contact and will opt for cooking at home and takeaway, both of which have a lower cost and offer a safer experience.

• Social spacing in a restaurant is costly – reducing the number of customers that can be served, even placing limits on total numbers of customers allowed within enclosed spaces means it will not be economical for operators – especially large format operators to open.

• The BIG spenders are missing – tourists and the big end of town corporates are no longer around. Border restrictions, work from home mandates and limitations on group sizes for dining mean those that spend the largest amounts on average transactions have disappeared. At risk in particular is the CBD and waterfront tourist precincts.

Now is a time for very strategic analysis of food service performance, trade area sensitivities to post COVID-19 affects and a real understanding of the mechanics of which food service cuisines and operators can be more productive and profitable than others in order to prepare an F&B strategy, lease plan and abatement program to trade your centre, precinct or store out of trouble.

Trends – retained habits in the ‘new normal’

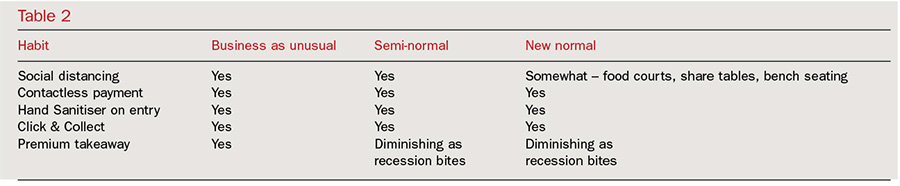

According to research from Euromonitor International, habits adopted during a crisis remain if the crisis extends for longer than one financial quarter. B&P has been studying and analysing consumer behaviour coming in from Asia, Europe and the US and over-laying an Australian food lens on the insights to pinpoint the habits that will remain and which will re-lapse through the stages of recovery. So far, we have reviewed 27 habits from full body spray sanitation machines at the entry to restaurants to loo paper being delivered with your takeaway pizza. What we’re clear on is that different habits will remain under the differing trading restrictions – some will stay and some will fade. If you’d like the full list contact our office but here are five habits to get you started. See Table 2 (below).

The Upside

The upside

B&P is more excited than ever at the chance for shopping centres to emerge from the COVID-19 crisis as the new omni-channel marketplace. Re-configuring food offers within centres to create harmonious spaces and offers where customers can interact in centre, online and remain connected as a community using live streaming, video and digital tools will be paramount in the new normal. With increased adoption of working from home, reduced working hours and online learning there is a potential ‘re-balancing’ of food hot spots from the CBD to the neighbourhoods and villages and changing the purpose and role shopping centres play in our daily lives. We look forward to supporting you with smart strategies and innovative physical and digital concepts through these unprecedented times.