You’ve only got to look at the ownership list of Mini Gun centres to realise where the smart money has been going these past few years. Once a sector in which previously, the major shopping centre players had little or no interest, it has now become dominated by the heavies…

Neighbourhood shopping centres have emerged in recent times not only as preferred shopping destinations for time-poor consumers, but also as an attractive destination for investors in retail assets.

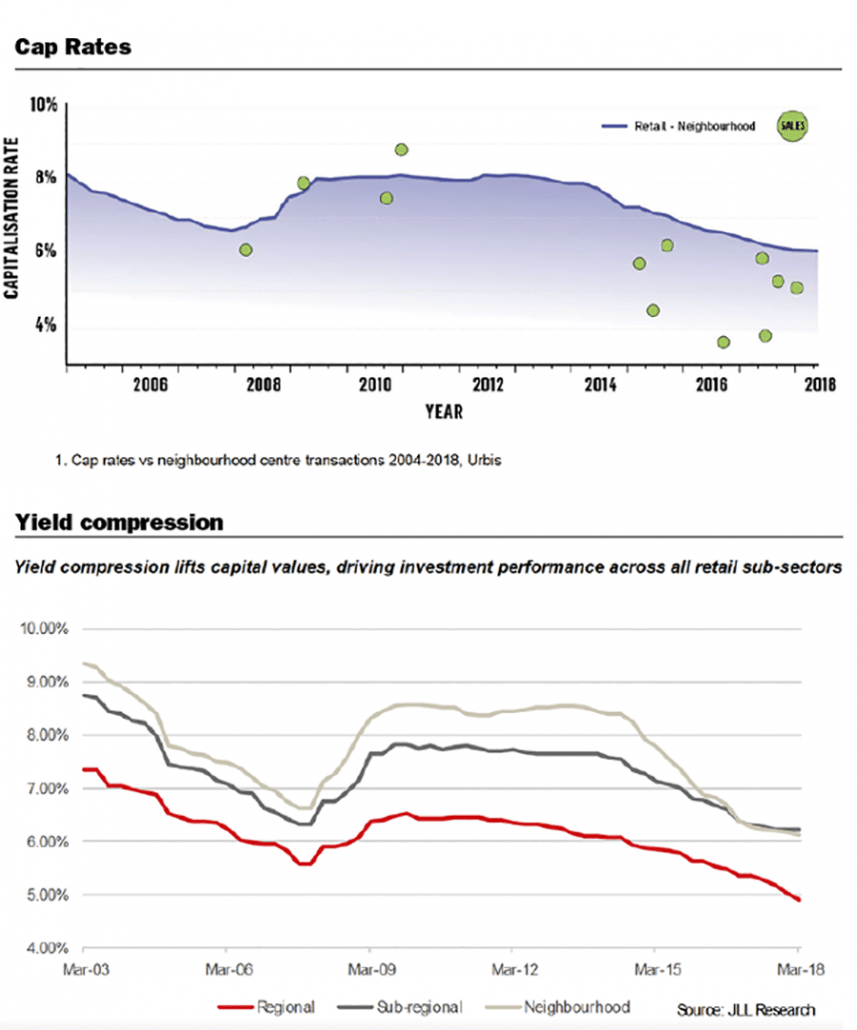

According to new research from JLL, the re-rating of neighbourhood shopping centres is reflected in the convergence of yields of neighbourhood and sub-regional centres.

This is the first yield cross-over on record and, while it is too early to know whether this is a permanent shift, it is evidence that investors are re-assessing neighbourhood centres that have historically traded at a discount to other retail formats – sub-regional and regional centres as well as CBD retail assets.

The change in the retail investment hierarchy can be attributed to a number of factors, not least the evolution of shopping towards a more convenient, non-discretionary focus.

Population growth and increased density in inner city catchments are giving rise to greater demand for new forms of convenience retail, as more health and lifestyle uses emerge and the demand for food and retail services increases.

This growth reveals a distinct opportunity for the emerging super-neighbourhood class of shopping centre, which mirrors the locally-curated tenancy mix of neighbourhood centres on a size scale similar to sub-regional centres. As planning regulations increasingly embrace more integrated and mixed-use forms of development, both in inner-city areas as well as for greenfield town centre sites, investment interest in the neighbourhood and super-neighbourhood categories can be expected to intensify.

While there has traditionally been a clear hierarchy in retail in terms of the risk profile for each shopping centre category, the changes in physical format to the traditional neighbourhood shopping centre, including the emergence of the super-neighbourhood centre concept, will support the recent convergence of yields between the two retail formats.

Andrew Quillfeldt, Director – Strategic Research, JLL, notes that while average yields have trended down and converged, the yield spread between the strongest and weakest centres in all formats is unusually wide, with considerable overlap between the neighbourhood and sub-regional sectors.

“Clearly, investors have become very discriminating in the pricing of retail assets. A range of factors – demographics, location, management quality and tenant mix – are all key drivers of value at the individual asset level. Increasingly, these factors dictate value rather than the simple categorisation of a centre.

“This reassessment of the retail sector creates opportunities for centre owners and active managers to add value by re-positioning their assets.”

Quillfeldt says owners of sub-regional centres have been actively driving rental growth by changing the tenant mix towards more F&B, retail services and convenience uses – categories that typically pay higher average rents than other uses, such as apparel, and bolster the performance of shopping centres over the longer term.

Investor demand and competition for neighbourhood shopping centres has been strong since 2014, driven primarily by private investors. The competition for neighbourhood centre assets has resulted in capital value growth and yield compression in all retail formats, but more so in the neighbourhood category.

The lower price point makes neighbourhood centres accessible to a wide range of private investors seeking yield. The non-discretionary nature of tenancies often operating in neighbourhood centres also offers stability of income.

“This trend has been complemented by capital market conditions conducive to private investors, given the low cost of debt finance and subdued returns available from many other investment classes.

We expect shopping centre formats and performance profiles will evolve as urban density continues to increase and shopping habits change, which will have implications for how they are valued and priced,” says Quillfeldt. The super-neighbourhood centre of the future, with its cinema, social spaces, flexible collaborative work environments and range of services from groceries to financial and health, will be an essential ingredient to an engaged local community. And according to Urbis, this configuration will see super-neighbourhood assets significantly outperform market benchmarks in terms of financial performance.”

Matthew Cleary, National Director, Urbis says super-neighbourhood centres with a targeted mix of uses, brought together with high quality design, will increasingly resonate with investors.

“Our analysis of the emerging super-neighbourhood category shows these centres have the capacity to deliver higher in-store sales through longer and more stable shopping patterns, in turn supporting higher rental growth which, in turn, drives value,” says Cleary.

Changes in social patterns, work flexibility and smaller inner-urban households are some of the drivers to people wanting better, more authentic engagement from their local community assets.

There’s growing recognition that shopping centres will be expected to perform a broader social role in the future. Whereas the design of some existing centres may limit their potential to fulfil this role, the focus on a locally-curated tenant mix in a sustainable, comfortable environment means super-neighbourhood centres are ideally positioned to satisfy community demands.