Competition amongst supermarkets, not just Coles and Woolworths but Aldi as well, has major implications for Mini Gun centres. The consumer may well benefit from lower prices but centre owners may well be adversely affected by lower turnover rents.

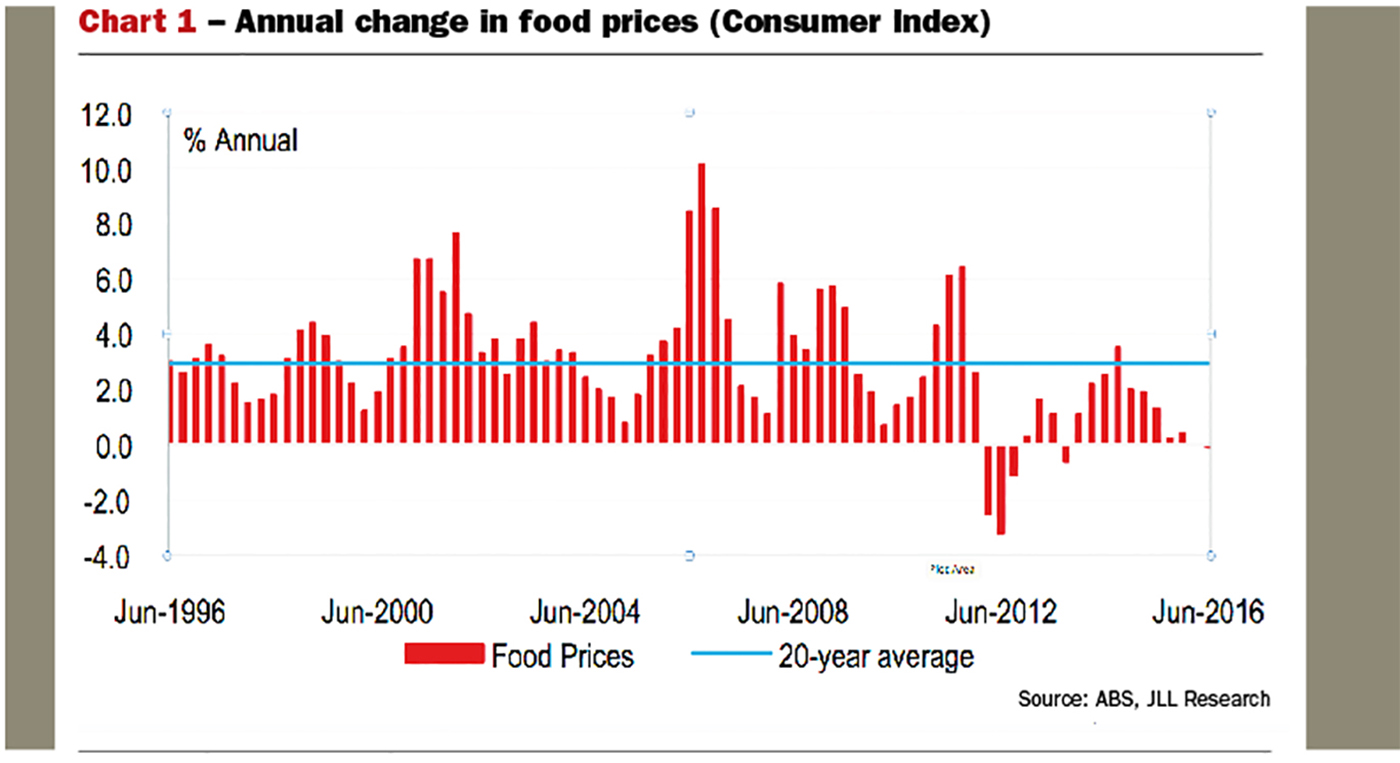

Over the last 20 years, food prices have grown by an average of nearly 3% but in Q1 and Q2 of 2016, they actually declined. More and more, Mini Gun centres are becoming the target of major players in the shopping centre industry.

This article by JLL Research written specially for our Mini Guns edition, details the implications of the strategies being adopted by the supermarket chains.

Neighbourhood shopping centres have been the primary target for acquisitions in the last few years by many private investors, syndicators and property funds management groups. Investors are attracted to the non-discretionary nature of the assets and the long lease terms to major supermarket chains. Demand for neighbourhood shopping centres has been reflected in very high levels of transaction activity and notable yield compression.

Approximately $4.5 billion of neighbourhood shopping centres have traded over the three years to June 2016 across 175 transactions. In addition, 56 new neighbourhood centres have been developed over the same period.

Given the high level of investment into this sector over the three-year period, it is worth reviewing two of the key trends impacting the performance of neighbourhood shopping centres.

Firstly, heightened competition between major supermarket chains has depressed food prices resulting in slower growth in food sales, with some flow-on effects for owners.

Secondly, Woolworths Limited has recently announced that the supermarket chains future network expansion will be tapered and that some underperforming stores will be closed, suggesting lower levels of new supply in the short to medium term. The two issues are related and it is worth examining the implications for neighbourhood shopping centres.

Food is a major driver of neighbourhood shopping centre performance. Approximately 60% of a neighbourhood shopping centre’s floorspace is dedicated to selling food through supermarkets (49%), mini-majors (2%) and food specialty retailers (10%).

Competition for market share in the supermarket sector has intensified, not just between the two major supermarket chains but also due to the expansion of Aldi. Aldi entered into new markets in 2016, namely, South Australia and Western Australia, and have opened 19 stores and 16 stores in the respective states. Furthermore, David Jones, under the direction of the new ownership and management, has committed $75 million to $100 million over the next three years to develop a premium food offering, with the initial focus on cafe and takeaway food before extending to fresh produce and prepared meals. This new plan is likely to add another competitive element to the grocery/food sector over the next few years.

The impact of greater competition has driven food price inflation lower as each of the supermarket chains compete to offer customers lower prices. In fact, through Q1 and Q2 of 2016, food prices declined. On an annual basis, food prices declined by 0.1% in the year to June, according to the ABS consumer price index, but historically food prices have grown at 2.8% per annum over the last 20 years.

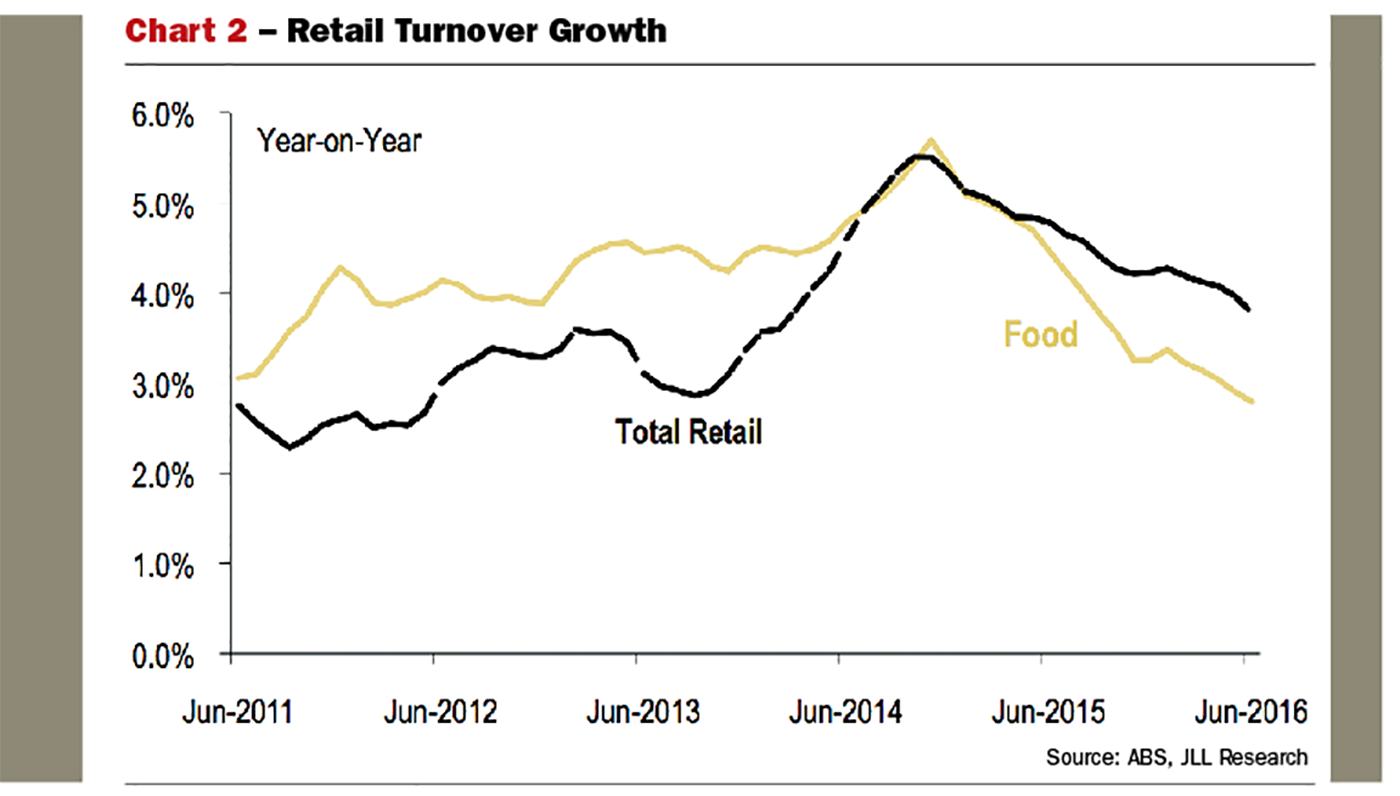

Given prices have been essentially stable over the last 12 months, growth in food sales has been limited to volume growth. Retail spending in the food category has gradually slowed from 5.7% year-on-year in November 2014 to just 2.8% in June 2016, below the 10-year average of 4.7%.

Approximately $121 billion per year is spent on food. It is the largest category of retail spending, accounting for 40% of the total, more than double the second-largest category, which is household goods at 18%. Given the size of this category, when food sales growth slows, it weighs heavily on total retail spending. As a result, total retail spending growth slowed to 4.0% year-on-year in June 2016, down from 5.5% in late-2014.

So what are the implications of lower food price inflation and slower growth in food spending for neighbourhood shopping centres?

One of the risks is that landlords may capture less turnover rent (sometimes referred to as percentage rent) than previously anticipated, as supermarkets take longer to reach turnover rent thresholds while growing at a slower rate. Some owners are now factoring in more conservative assumptions for supermarket sales in terms of budgeting for expected turnover rent.

Many supermarkets trade below their turnover rent thresholds. The largest owner of neighbourhood centres, SCA Property Group, has 10 supermarkets paying turnover rent out of their portfolio of 83 assets (as of FY16 results). Charter Hall Retail REIT, another major owner of neighbourhood shopping centres, reported that 31% of their anchor tenants are above the turnover rent threshold.

In an environment where retail rental growth remains relatively subdued, turnover rent can be an important source of growth. In the case of a strong performing supermarket that is trading 10% above its turnover rent threshold for example, it would typically add approximately 4% to 5% to a typical neighbourhood shopping centre’s total rental income.

The impact of price discounting is not limited to supermarkets, it also flows through to the food specialty stores as they reduce prices to remain competitive. From an owner/investor’s perspective, specialty stores typically provide the majority of the growth in rents in a neighbourhood centre. In their quest to compete for market share, supermarkets have also expanded their product range, in many cases adding additional pressure to food specialty stores.

Prices are just part of this theme. Supply is also a contributing factor. The rapid expansion of the major supermarket chains has resulted in sales cannibalisation in certain areas.

Development of new neighbourhood shopping centres has been driven largely by Woolworths and Coles on an owner-occupier basis, but also increasingly by private developers and institutional owners/developers over the last two to three years. Neighbourhood shopping centres currently account for the largest share (41%) of the retail supply pipeline over the next three years. However, some of this supply may not eventuate.

In July 2016, Woolworths announced a plan to shift to a productivity-based performance measure and to grow store numbers in a more balanced way. Under the plan, Woolworths stated that it will close 17 existing Australian supermarkets which have low sales productivity and halve the rate of the store network expansion over the next three years to approximately 45, down from 90 under the previous strategy. For context, in the last few years, Woolworths opened 34 stores in FY14, 30 in FY15 and 31 in FY16 (net basis). The new plan guides to 10 to 20 per year over the medium term.

Closing 17 Woolworths supermarkets is not going to impact the performance supermarkets at the market-wide level. It represents less than 2% of Woolworths’ store network of 960. However, over the medium term, the implication of moderating their future growth plans and the lower level of new neighbourhood shopping centre supply will be positive for the broader market. Existing centres will become more productive as the population continues to grow, particularly in Melbourne, which has the highest level of population growth nationally. Furthermore, under the new strategy, capital earmarked for expansion will now be re-invested into upgrading existing supermarkets.

Coles has also been expanding in recent years, just at a more measured rate. Across the construction projects that completed over the three years to 2016, Woolworths have anchored 34 new neighbourhood centres and Coles have anchored just 15.

As of June 2016, there was 143,300m2 of neighbourhood shopping centre supply schedule to complete in 2016, significantly above the 10-year average of 103,400m2, with a further 118,900m2 due in 2017 and 143,600m2 in 2018. Clearly development activity in the neighbourhood shopping centre sector will be impacted by Woolworths’ announcement. It was outlined that 20 of their own development sites would be deferred or cancelled and we would expect that some further projects by private/institutional developers to be similarly deferred. As a result, annual supply is likely to decline from 135,300m2 (2016-2018) to approximately 95,000m2 per annum (JLL estimate).

Even if supply of new neighbourhood centres (and supermarkets) reduces in the short term, competition between existing operators and new operators is likely to remain intense, resulting in an extended period of low food price inflation and food sales growth. Achieving turnover rent, or growing turnover rent, is therefore likely to remain challenging in the short to medium term. However, store reinvestment plans by Woolworths are likely to yield positive results and lift the performance of neighbourhood shopping centres. In addition, the moderation in new supply will be a positive factor for reducing supermarket sales cannibalisation.