As the risk of retailer exits becomes increasingly heightened, JLL’s Senior Research Analyst Louise Burke discusses the possibility and hurdles for REITs purchasing retailers.

Recently, a consortium including major North American landlords Simon Property Group and Brookfield Property Partners acquired bankrupt fast-fashion retailer Forever 21. The acquisition has got many retail stakeholders considering whether this will be a growing trend. Forever 21 accounts for 1.4% and 2.0% of Simon and Brookfield’s rental income, respectively. Private retail brand manager Authentic Brands Group (ABG) is also part of the consortium and will own a 37.5% stake. This is the second similar transaction to occur in the U.S. following Simon and ABG’s acquisition of another bankrupt fast-fashion retailer, Aeropostale, in 2016. In this scenario, landlords are acting as ‘angel investors’ by keeping these retailers liquid while also preventing vacancy in their centres to maintain asset values.

These acquisitions are another example of retail landlords taking on more business risk in the currently challenging retail environment.

An instance of this trend already occurring in Australia is the rising number of capped occupancy cost agreements (a clause in the lease to limit the base rent to a fixed percentage of sales).

The bigger implication of these acquisitions, if they become prevalent, is that retail could head towards an owner-operator model. While the industry is far from this scenario, this model may present advantages for retail as it encourages the alignment of interests between property and retail businesses. It also gives the owner more control over the asset, which may be useful for extensive and frequent re-development and re-positioning, particularly where other uses are added to the asset.

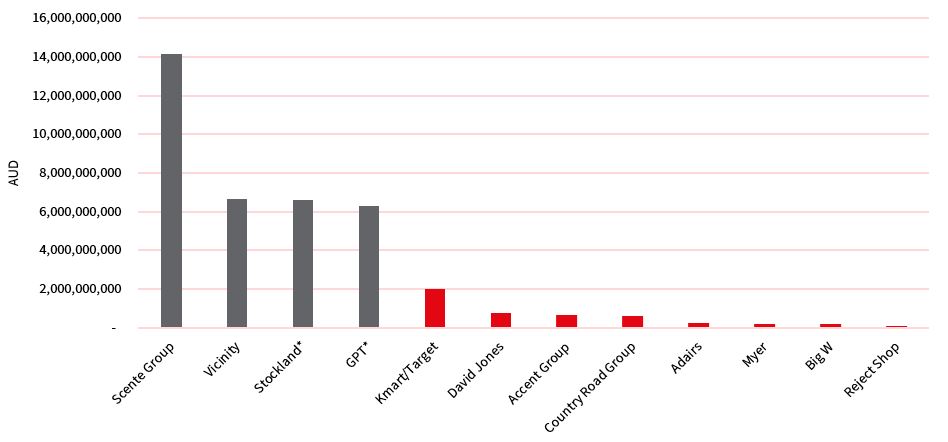

When considering the likelihood of these deals occurring in Australia, the relative scale of these landlords compared with retailers should be considered. Simon and Brookfield’s individual stakes in the Forever 21 deal equate to just 0.08% and 0.03% of their market capitalisation, respectively.

For perspective, Australian department store, Myer, and discount department store, Big W, each equate to a much more substantial 1.0% of Scentre Group’s market capitalisation – Australia’s largest retail landlord.

Figure 1: Value of retail REITs vs retailers (AUD)

*value of retail portfolio Source: Company reports, ASX

When assessing these deals, landlords may consider what the retailer’s occupied space is worth to them. For example, department store David Jones’s tenancies are worth an estimated AUD 2.3 billion to landlords collectively (total estimated rent capitalised at the median regional yield). However, David Jones’s current book value is approximately AUD 754 million.

Hypothetically, if David Jones were to go into voluntary administration, purchasing the company may be more feasible as the landlord could gradually convert the space and wind-down the company instead of being faced with a large amount of retail space to re-lease.

But how much would these acquisitions change the investment risk profile of retail landlords? Four of Australia’s five largest retail landlords are real estate investment trusts (REITs), comprising investors who have allocated funds towards them based on their own risk profiles and sector exposure mandates. While Simon Property Group has been making investments into retailers for several years, it would be the first time in Australia and the share market may be unforgiving.

Australian landlords will also need to assess whether the struggling retailer has strong brand equity or re-positioning opportunity. To deal with management issues, a retail industry partner will most likely be required. In both the Aeropostale and F21 acquisitions, Simon cited the strength of ABG’s marketing and branding capabilities. However, this contrasts with current reports of the challenging retail M&A climate, even in selling solvent Australian retailers.

Going forward, the decision to acquire tenants will likely be based on these key questions:

- Is the impact of losing the tenant’s income material?

- Is the acquisition price feasible relative to the landlord’s size?

- Does the retail business have longevity?