Investing in the future of business, especially retail, should be at the heart of our government’s economic strategy.

The Australian retail sector has faced a dynamic of change during the past decade: increasing competition from international and online retailers, globalisation and a fluctuating economy all testing retailers’ mettle and promoting significant structural changes at the heart of the retail industry.

Since then, the Australian Retailers Association’s (ARA) policy team has called for recognition by all levels of government that long-term business planning requires investment certainty, low taxation, a flexible wages system and reliable, inexpensive sources of energy supply.

At the heart of retail investment strategies lies the need for a strong, globally competitive economy that provides businesses large and small with the commercial freedom to take calculated risks, invest and secure productive rewards that benefit business owners and managers, their families, employees and consumers.

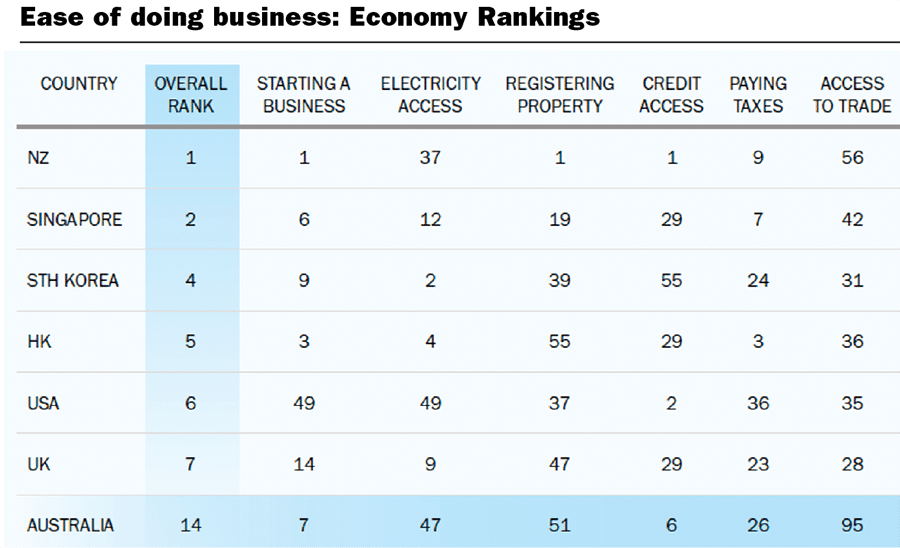

The ARA recently submitted to the House of Representatives’ Inquiry on Impediments to Business Investment. When researching business investment across the globe, we looked straight to the World Bank and its ‘Doing Business’ series. ‘Doing Business’ assesses 190 countries across the world for their ease of doing business.

The 2017 edition places Australia 14th, ranked behind our neighbours New Zealand, as well as Singapore, Denmark and South Korea.

Out of 190 countries, Australia ranks poorly on key indicators including cross-border trade (95th), registering property (51st) and electricity access (47th). Despite this, retail entrepreneurs can take comfort in Australia’s high rankings for starting a business (7th) and access to credit (6th). This proves that matters of the heart are not always so simple, and while the positives are definitely there, the negatives correlate with some of the more significant challenges facing local retailers in 2018.

The ARA believes that every new regulation, tax, law and public servant increases the compliance cost for business. We support the fundamental principle of small government, which removes the laws and regulations that create unnecessary time and cost burdens for business.

Retailers are clearly identifying the size and scale of bureaucracy within local government as a priority concern for their businesses. Many retailers often need to engage with multiple regulators, with differing timeframes and requirements, sometimes just to solve a single issue.

The World Economic Forum’s Global Competitiveness Index ranks Australia 80th out of 137 countries for ‘Burden of Government Regulation.’ Alarmingly, this places Australia behind a number of third-world nations, which is unacceptable for a G20 economy.

It is clear that while we have come a long way since the GFC, there is more that can be done to stimulate investment. Businesses need incentives and certainty to grow and employ more workers. Investing in the future of business, especially retail, should be at the heart of the economic strategies of our governments at all levels.

At present, the high corporate tax rate in Australia is discouraging investment and hurting competition, especially with overseas businesses that enjoy better trading conditions. Recent moves by several of Australia’s G20 counterparts to reduce corporate tax rates by 2020 will place Australia further behind the world’s advanced economies.

The ARA advocates the view that each dollar raised in tax revenue is one dollar less that a business or household spends. The realities for business and retailers are well known: we can continue to suffer the death of a thousand cuts or drive policy agendas that cut, reduce and speed up regulation and drive investment. Government should follow its heart, to help get ours racing again.