Vicinity Centres (Vicinity, ASX:VCX) today announced a progress update on its non-core asset divestment program, with the sale of a portfolio of ten sub-regional and neighbourhood shopping centres to SCA Property Group (SCP, ASX:SCP)* and one neighbourhood shopping centre to a private investor, for an aggregate sale price of $631 million*. JLL’s Head of Retail Investments – Australasia, Simon Rooney brokered the transaction. Antony Green from Macquarie Capital was Corporate adviser to Vicinity.

The aggregate sale price of $631 million announced today reflects a 5.1% discount to the combined 30 June 2018 book values of the 11 assets and a weighted average capitalisation rate of 6.9%. Including the interests in 24 assets sold since the merger, Vicinity has now divested 35 shopping centres for more than $2.5 billion at a 0.5% premium to book value.

These transactions form part of Vicinity’s non-core asset divestment program, of the sale of up to $1.0 billion of Sub Regional and Neighbourhood shopping centres, announced in June 2018. Discussions are progressing with prospective purchasers of three remaining assets included in Vicinity’s divestment program.

Grant Kelley, Vicinity’s CEO and Managing Director, said: “These transactions are a significant achievement and advance our strategy to unlock major potential in the business.”

“It is an important step in delivering strong and sustainable growth through focusing our directly-owned portfolio on approximately fifty market-leading destination assets, expanding our wholesale funds platform and realising mixed-use opportunities across the portfolio.”

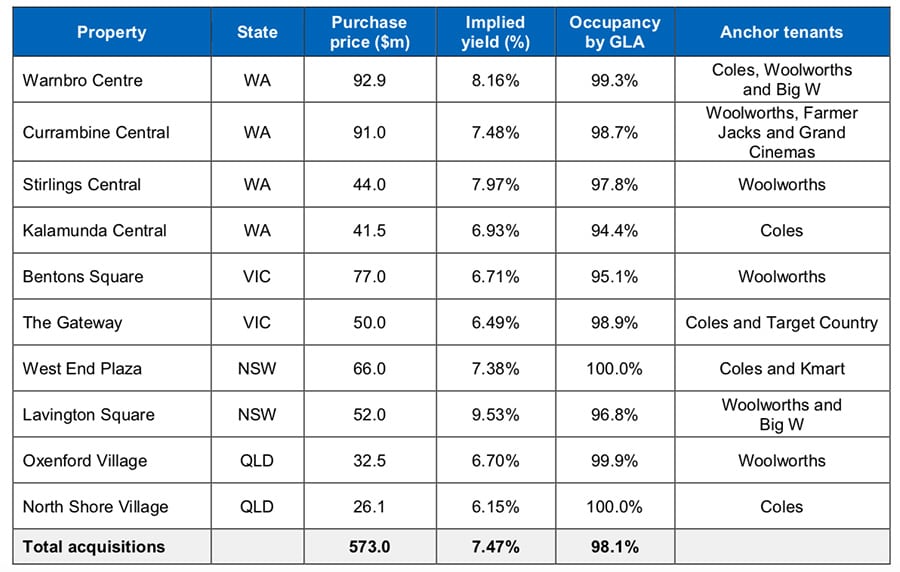

SCP will acquire ten assets (Bentons Square and The Gateway in Victoria, Lavington Square and West End Plaza in New South Wales, North Shore Village and Oxenford Village in Queensland, Currambine Central, Kalamunda Central, Stirlings Central and Warnbro Centre in Western Australia) for a total consideration of $573.0 million. Settlement of these transactions is expected later this month.***

Kelley said: “We undertook an extensive campaign to market these non-core assets, generating significant interest on both an individual asset and portfolio basis. In the interest of progressing our strategy of focusing on owning highly productive market-leading destination assets, the sale of the ten-asset portfolio to SCP makes strategic sense for both parties.”

Post the acquisition, SCP will own and manage more than $3.1 billion of convenience-based shopping centres making it the largest convenience-based retail specialist in Australia. SCP expects to add value to the Acquisition portfolio through its active asset management initiatives, including repositioning the tenancy profile further towards sustainable non-discretionary convenience-based retailers and achieving asset level operating efficiencies.

Anthony Mellowes, CEO of SCA Property Group, said “This acquisition represents a material and important strategic acquisition for SCP and is consistent with our disciplined approach to growth. The portfolio is being acquired on attractive terms and is expected to provide management with the ability to add value over the short, medium and long term.”

The sale of Belmont Village in Victoria to a private investor for $58.0 million was settled at the end of September 2018.

As at 30 June 2018, the eleven assets sold had specialty sales per square metre averaging $7,611. Adjusting for these asset sales, total portfolio comparable specialty sales per square metre for Vicinity would increase by 1.4% to $10,279, from $10,133 reported at June 2018.

The proceeds of the transactions announced today will be reinvested into opportunities consistent with Vicinity’s strong focus on value-accretive capital allocation, including investment in its retail development pipeline and potentially, a securities buy-back which will drive stronger growth in funds from operations (FFO) and net tangible assets, both on a per security basis.

Vicinity’s FFO guidance for FY19 remains unchanged at 18.0 to 18.2 cents per security. Assuming the sale proceeds of the eleven non-core assets are used to repay debt in the short-term, gearing would be reduced by approximately 280 basis points.

*Sale is conditional on completion of a capital raising by SCP. SCP has entered into an underwriting agreement on customary terms with Citi as underwriter including termination events.

**Transaction also includes a rental guarantee of up to $8.0 million available for two years to SCP. Excludes transaction costs.

***The settlement of Currambine Central is subject to head landlord consents being received in relation to the transfer of the ground lease. Sale completion for Currambine Central is expected by the end of December 2018.