The pandemic has clarified the vital role that grocery retailers play in society. Consumers expect these businesses to keep them fed and healthy, and groceries remain essential retailers in an uncertain situation that continues to evolve day by day. The short-term priorities for food retailers are clear. They should safeguard the health of employees and customers, maintain business continuity, and manage demand to align with supply-chain capacity. To better understand how COVID-19 is affecting people’s behaviors, spending, and expectations, McKinsey conducted research “Reimagining food retail in Asia after COVID-19” with more than 5,000 consumers in Asia, across seven countries: Australia, China, India, Indonesia, Japan, South Korea, and Thailand.

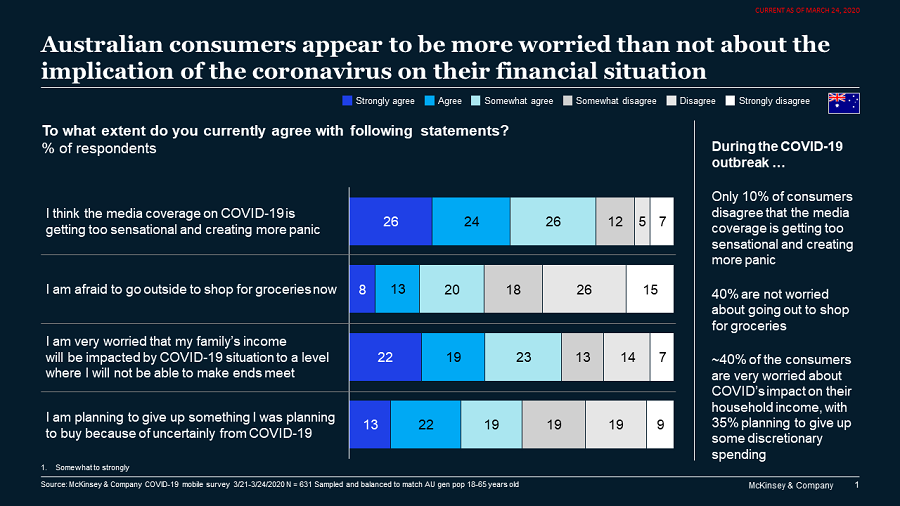

Australian respondents shared how their food-consumption habits have changed since COVID-19 began, and how their behaviours could change in the pandemic’s aftermath. The results are based on survey data collected in Australia from the 21–24 March, 2020. When the research was conducted, Australia was just starting to experience the COVID-19 situation and the economic uncertainty was in early stages. With the challenging economic environment, the focus on values such as pricing, promotions and discounts will likely be subject to further discussion.

Thomas Rüdiger Smith is an Associate Partner with McKinsey who specialises in retail and consumer goods, he said “It is almost a surety that we will see an increase with online sales as more retailers get onboard with e-commerce.”

The report provides insights from other countries who have been tracking ahead of the pandemic compared to Australia.

The countries surveyed were in different stages of the epidemic’s progression, and their governments have taken different actions to address it. Regardless, the surveys point to signs that some shifts in consumer behavior are similar and could be lasting. These shifts require food retailers to act— and in some cases, accelerate the changes they have already made in response to the crisis — in four areas:

Reimagine safety, health, and the scope of supply chains

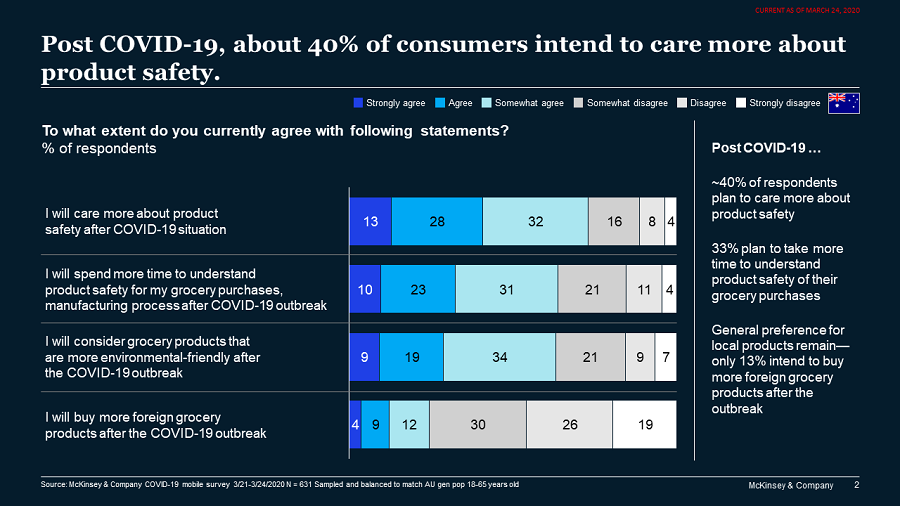

While there are local differences, consumers across countries appear to care more about in-store safety and to prefer offerings that are healthy and locally sourced than they did before COVID-19.

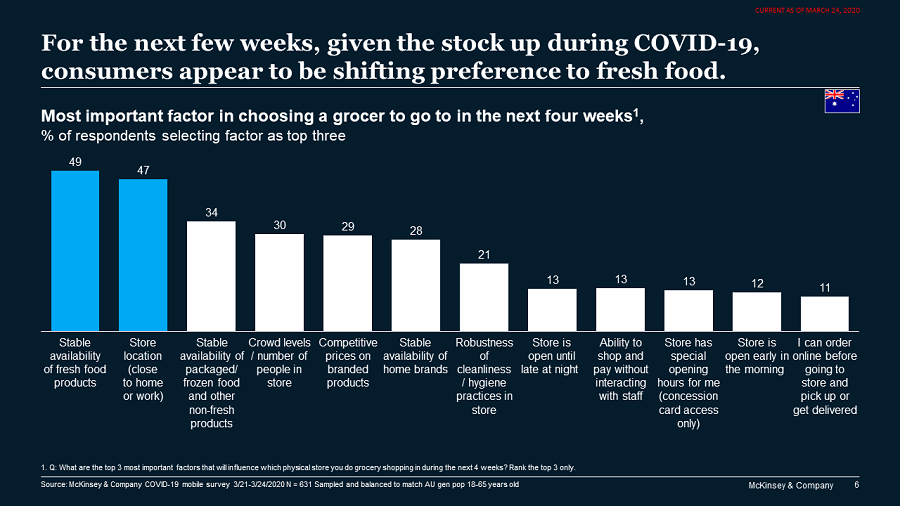

When shopping, consumers are worried about their personal safety: one in five Australians and more than half of all Thais are afraid to go outside to shop for groceries. What’s more, hygiene and cleanliness consistently feature among the top three reasons for positive shopping experiences.

In most countries, consumers also express strong preferences for local brands over international ones, across all categories. For instance, in Australia more than 80% say their preference for local brands has increased since before the outbreak began, while in China — a country where foreign brands have had a historically strong reputation — only 43% say they have a greater preference to buy from these brands.

To address these consumer shifts, retailers have a clear role to play. They should rethink their offerings and provide healthier, more locally sourced products (including ready-to-eat and ready-to cook items) with a smaller environmental footprint.

For shopping centres, the most important thing will be to continue to provide a safe environment for consumers to shop in.

In the recent research, 35% of consumers say that they will be more cautious when out and about once the virus subsides. Using China’s retail traffic as an example, their payment data shows that physical apparel retailing is currently at 40-50% below pre-COVID-19 levels. However the increase in e-commerce seen during this crisis has largely been sustained across most categories as they emerge out of COVID-19.

Reimagine how technology can enable delivery and the value chain

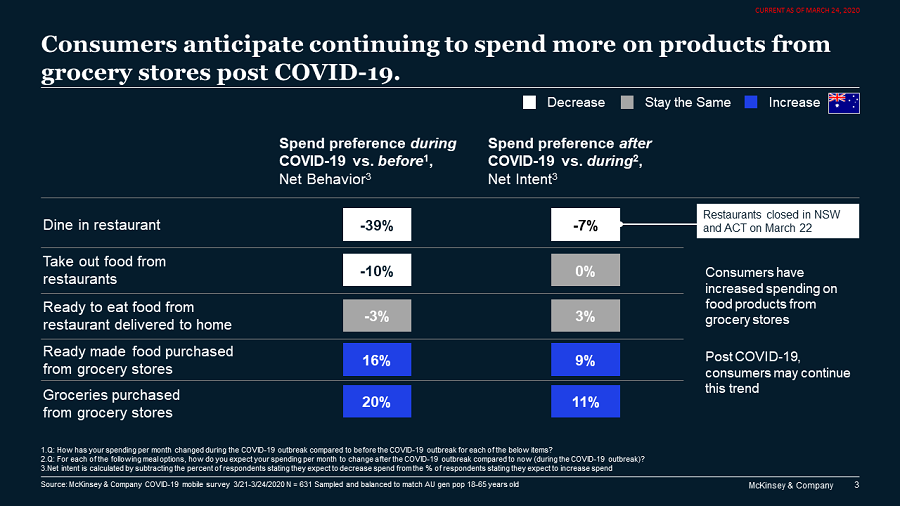

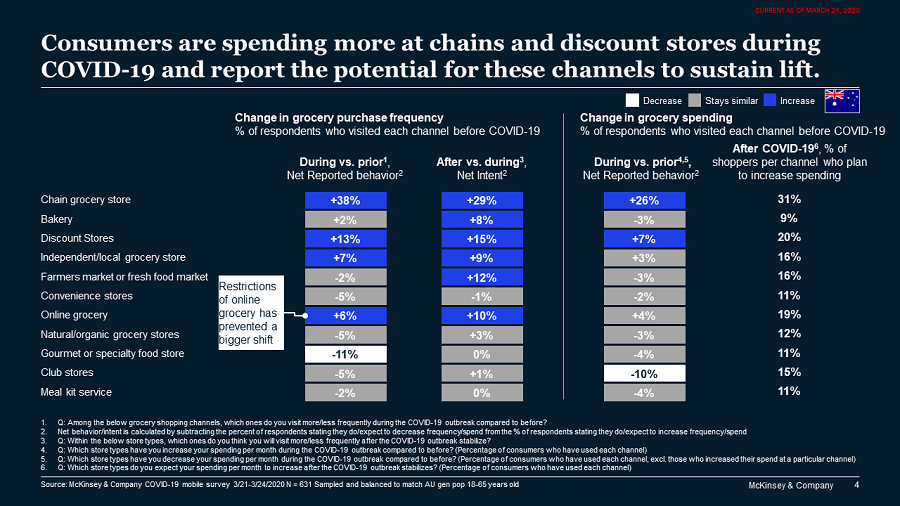

The results show that consumers are shifting their food spending online and have yet to return to their normal spending levels for food service. Responses also suggest an opportunity for grocers to digitise their stores.

Across channels of food purchasing, respondents in most countries report a 30 to 70% drop in their preference for dine-in spending and an increase in grocery shopping and purchases of ready-made food in grocery stores, which consumers tend to prefer more than meal delivery from restaurants.

To respond to the current crisis and meet future ones, food retailers need to use technology in new and different ways to scale up their e-commerce channels and their capacity for home delivery. They can do so by partnering with last-mile players and cold-storage warehouses. Other options are expanding shifts in existing warehouses, using hybrid picking models, and converting a few retail locations into dark stores.

Rüdiger Smith continued “With the current COVID-19 situation, we had anticipated that there would be a demand for online groceries and product availability. The big question we were not able to answer due to the supply constraint of online deliveries in Australia is how big it could have been. What is surprising is the speed and scale with which the health consciousness has become more important across the region including Australia.”

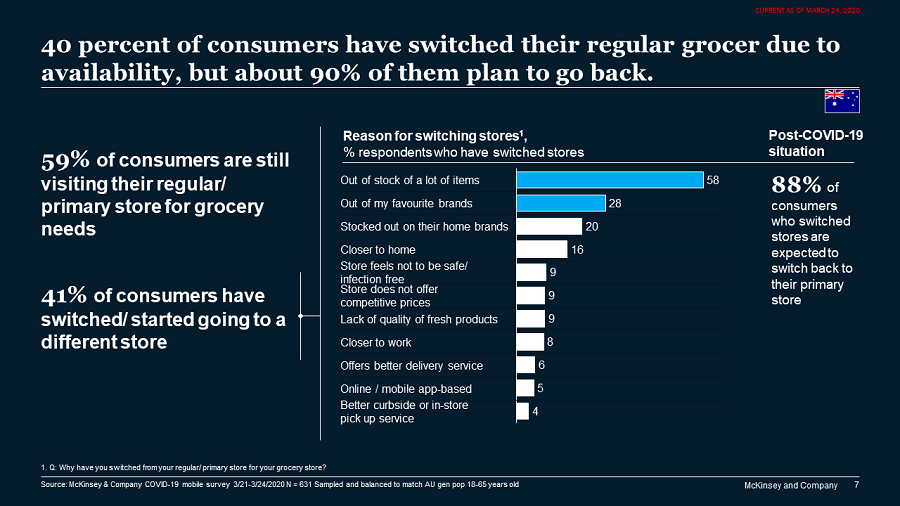

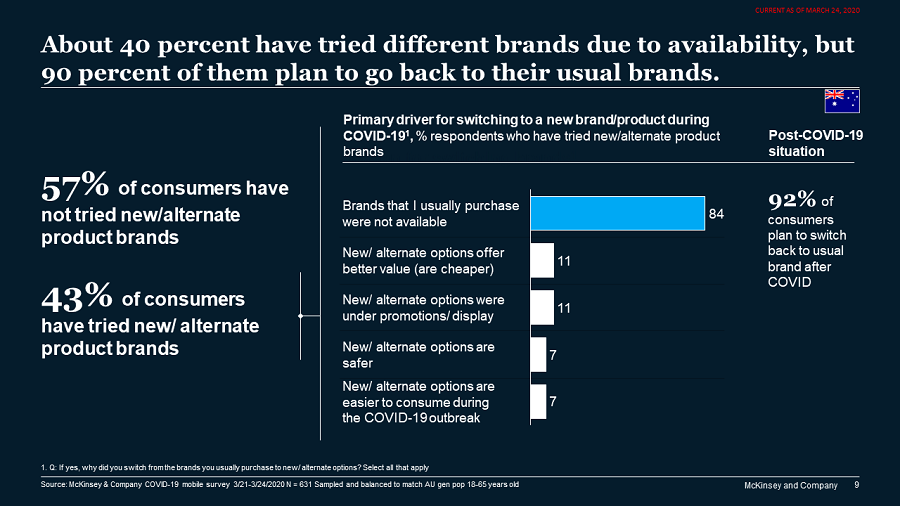

Secondly, strong loyalty to brands and consumers’ main grocery store that consumers know and trust is also surprising. In Australia, +40% of consumer have bought different brands and shopped in different stores than they would usually do, but more than 90% expect to return to preferred brands and stores post COVID-19.

Reimagine the meaning of value for money

In past crises, there have been surges in purchases of private-label and value brands. After the 2008 financial crisis, 60% of US consumers were more interested in reasonably priced products with core features than in higher-priced, cutting-edge products. Now, the consumers we surveyed expect times will only get tougher. As mentioned earlier, people are worried about the pandemic’s impact on their personal incomes.

What’s more, consumers are willing to forgo future spending. Up to 50% of Chinese consumers surveyed say they were planning to give up a future purchase because of uncertainty related to COVID-19.

Reimagine loyalty

During the COVID-19 crisis, consumers have been loyal to those retailers and brands who offered essential products in their assortments.

Location and availability of goods (often, fresh products) are the primary reasons why consumers have changed stores. In most countries, promotions or pricing has not emerged as a top three reason for switching to different stores.

To address this “loyalty shock,” retailers should determine which stores are being affected disproportionally by customers shifting to other primary stores. Targeted marketing may help bring these customers back, as would retailers finding a way to better communicate the efforts they are taking to support customers and their societies more broadly, so consumers will be likelier to give them a bit more leeway.

Rüdiger Smith said “Currently, China is showing recovery and is on the path to a new normal. I don’t think in the short term we can expect any country to return to pre-COVID times, but it is also too early to say which of the behavioural changes driven by COVID-19 will stick. We are seeing that existing trends such as an increase in omni-channel, e-commerce and a focus on healthier living are likely to continue, but unclear as to the extent.”

When it comes to ensuring customer safety, Australian retailers and shopping centres have adapted to this situation quite efficiently. As the industry continues to plan for the new normal, there are two main factors that they will have to consider. Firstly, how to ensure safety and secondly how to get customers back to the shopping areas.

How can the industry ensure customers feel safe in this new 1.5 metre social distancing environment?

Retailers have to continue to implement safety measures, including maintaining staff hygiene, limit number of customers in stores and conducting more visible store cleaning.

Beyond ensuring safety, landlords and retailers will have to take a proactive role in driving traffic. They will have to utilise more social and digital customer engagement, combined with direct contact through CRM systems and creating online events.

During this period, while having 75% store closures in China, Nike has only seen a 5% YOY decline in sales. They were able to achieve this by engaging with their audiences through digital activities, such as, live-streaming training sessions and conducting digital product launches. While it will take time for consumer to get back to the pre COVID-19 levels, during these times, brands have to activate their customer base and generate buzz.

Based on what we are seeing in China, retailers might also expect to review operating hours. Peak shopping hours will shift and more consumers shop often, over the course of the day and week.

McKinsey will continue to track consumer sentiment in Australia and globally at regular intervals. Understanding changes in consumer sentiment and behaviour should be a key priority for any B2C company, as we all try to understand what the new normal will be.