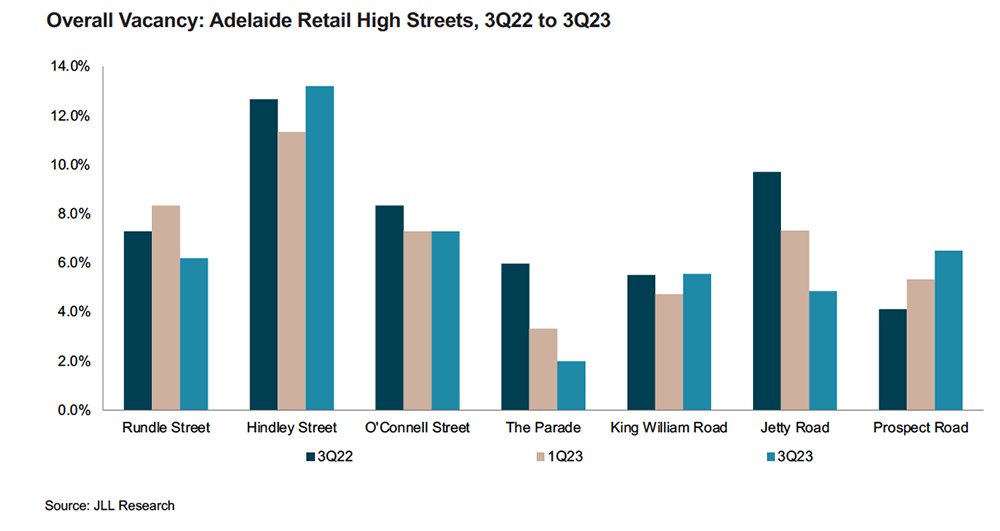

Vacancy along Adelaide’s retail high streets in Q3 2023 reached the lowest point ever recorded since JLL began tracking the data in 2015.

The Adelaide Retail High Street Overview by JLL tracks the vacancy across Rundle Street, Hindley Street, O’Connell Street, The Parade, Jetty Road, King William Road and Prospect Road.

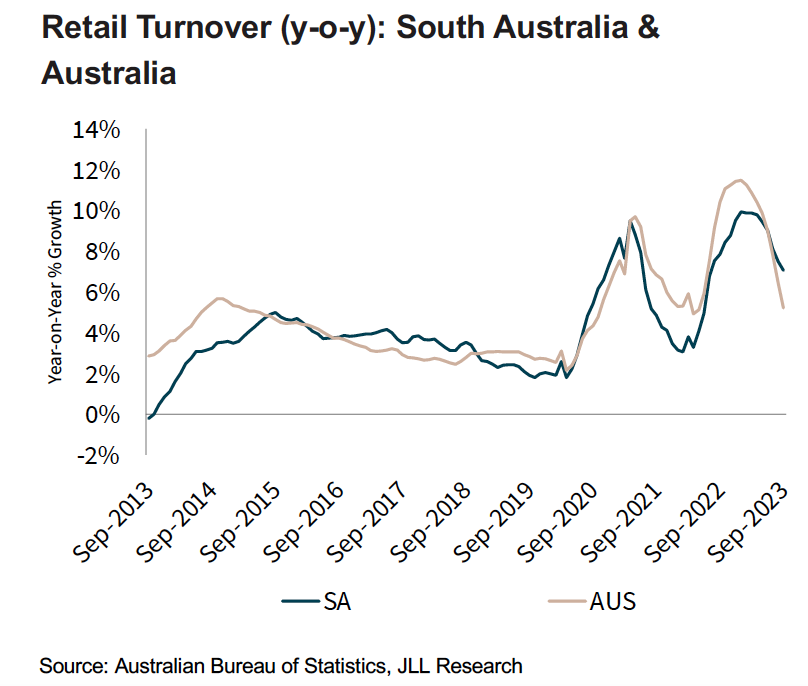

JLL Director, Strategic Research SA Rick Warner said that despite inflation remaining stubbornly high and interest rates continuing to climb, annual retail trade growth in South Australia is still one of the strongest in Australia, second only to the ACT. While spending is slowing from COVID-19 highs, the ongoing resilience of SA consumers is providing a level of confidence from retailers.

“Adelaide’s high streets continue to attract national and international fashion retailers – particularly along Rundle Street and The Parade. Over the past six months there has been new store openings for Oroton, Sass & Bide, Cue, Veronika Maine, Calibre and Simone Pérèle,” Warner said.

Demand for Rundle Street from hospitality groups also improved with three new cafes and restaurants opening in Q3 2023. National burger chain Milky Lane opened its first SA store at 272 Rundle Street.

JLL retail leasing executive Victoria Everett who closed the deal, said: “Established and emerging retailers are assessing their options carefully, seeking prime locations to maximise foot traffic and capitalise on the city’s vibrant retail scene. My recent deal with Milky Lane on Rundle Street is a testament to both the brand’s success and the attractiveness of Adelaide’s retail high streets. It demonstrates the strategic positioning of our city’s high streets as a preferred destination for businesses and consumers alike.”

However, occupier demand wasn’t uniform across the market. The vacancy rate decreasing along Rundle Street, Jetty Road and The Parade. Conversely, the vacancy rate increased moderately along King William Road, Prospect Road and Hindley Street.

“The popularity of The Parade from retailers continued in Q3 2023 with the vacancy rate along the strip falling to its lowest level we’ve ever recorded at 2.0%,” Warner said.

“However, the big surprise was the rapid recovery of Jetty Road. This precinct was one of the hardest hit over the last couple of years with vacancy peaking at almost 10% 12 months ago. Fast forward to Q3 2023, and the vacancy rate has halved to 4.8%.” Warner continued.

Warner noted that with inbound tourists into Australia increasing by 248% on a rolling annual basis to August 2023, Glenelg is likely to attract a disproportionate number of tourists visiting South Australia. This is expected to support consumer spending along the strip over the short-to-medium term.

Report summary:

- Rundle Street, CBD – Over the six months to September 2023, headline vacancy fell to 6.2% – less than half of the COVID-19 peak vacancy rate of 13.7% recorded in Q3 2021. Rundle Street remains the most important fashion destination of all tracked high streets. As of Q3 2023, 34% of all traders along the strip were fashion operators, more than double the blended proportion of fashion operators across Adelaide’s tracked high streets (15.4%).

- Hindley Street, CBD – Increased vacancy but day-time trade opportunity lies ahead. At 13.2%, the vacancy rate along Hindley Street edged up from 11.3% six months ago.

- O’Connell Street, North Adelaide – Vacancy rate along O’Connell Street was stable at 7.3% in Q3 2023. The proportion of dining out options remained the highest of all tracked high streets (43%) with two new restaurants opening – AMMOS Greek Bistro and Lucky Dumpling and Noodle.

- Jetty Road, Glenelg – Vacancy on Jetty Road has halved over the last 12 months, reaching 4.8% in Q3 2023. With inbound tourists into Australia increasing by 248% on a rolling annual basis, Glenelg is likely to attract a disproportionate number of visitors visiting South Australia which will support consumer spending.

- The Parade, Norwood – Vacancy along The Parade decreased to 3.3% as at 1Q23 – the tightest level of vacancy recorded along the strip since JLL Research began tracking the data in 2015. With limited opportunity to secure retail space along the strip, there was a small number of new store openings recorded over the last six months, notably including global fashion retailer Simone Pérèle.

- King William Road, Goodwood / Hyde Park – Vacancy increased 0.8 percentage points to 5.6%. King William Road continues to attract liquor-oriented hospitality operators. In Q3 2023, Alt. Wine Bar and Four Sides Bar and Kitchen opened on King William Road. These hospitality operators are generally leasing space being made available from closing beauty retailers. As a result, the proportion of beauty operators has fallen from 18% to 14% over the last two years and is no longer the strongest cohort of beauty retailers along Adelaide’s tracked high streets.

- Prospect Road, Prospect – Vacancy increased for two consecutive six-monthly periods, reaching 6.5% in Q3 2023, reaching an all-time high since the onset of the COVID-19 pandemic in Q3 2020 (7.1%). However, it must be noted that it is also the smallest by tenancy count. A new eight tenancy retail development at 85 Prospect Road is currently under construction.