Growth in super prime CBD retail rents has been recorded in Brisbane, Sydney and Adelaide for the first time since the onset of the pandemic, new CBRE research has shown.

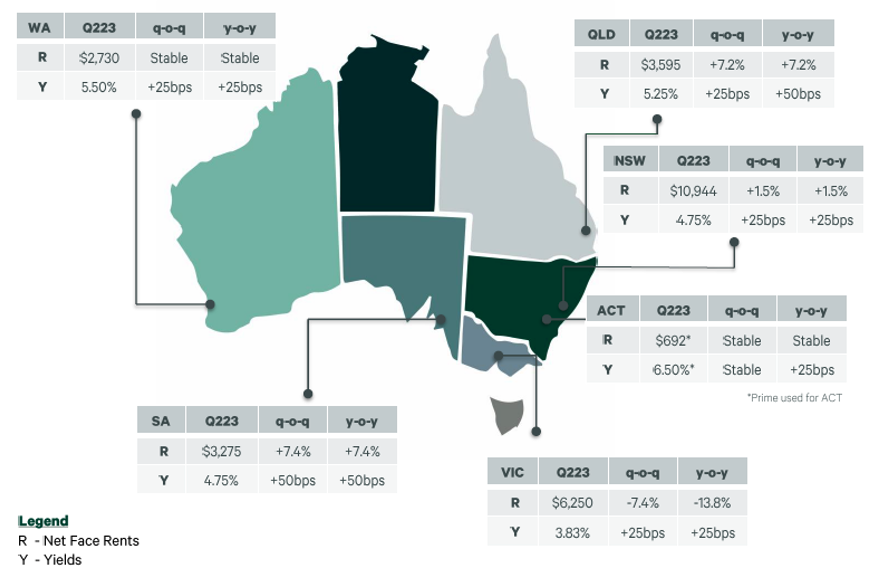

CBRE’s Australian Retail Figures Q2 2023 report shows the strongest rental growth occurred in Adelaide, where super prime rents rose 7.4% q-o-q to $3,275/m2. Brisbane was close behind with 7.2% q-o-q growth to $3,595/m2 followed by Sydney, where rents rose 1.5% to $10,944/m2.

Rents remained stable in Perth and Canberra, with Melbourne being the only capital city to buck the trend, after super prime rents contracted by 7.4% q-o-q and 13.8% y-o-y to $6,250/m2.

CBRE’s Australian Director of Retail Leasing, Leif Olson commented, “The Q2 result is evidence that retail rents may have bottomed across most CBD retail markets and are on the way up, particularly for super prime assets.”

“Melbourne’s super prime retail Bourke Street Mall is one area that has seen rental contraction; however, it is important to note that Bourke Street is undergoing generational change with a number of key world-class developments currently underway, bringing more stability to the city’s super prime retail sector.”

Bourke Street Mall is one area that has seen rental contraction

“With vacancy rates stabilising across the country, coupled with international tourists returning, we see a positive outlook for retail across all markets and are expecting more improvement in rents for the remainder of 2023 and into 2024.”

While super prime rents were stable or increased across most of the capital city markets, CBRE Research Analyst Bass Miller said super prime CBD yields softened for the first since the Reserve Bank of Australia’s interest rate hiking cycle that began in May 2022.

The national average yield increased by 30bps q-o-q to 4.82%.

The same trend has been evidenced across all retail asset classes over the past 12 months, with yields for regional, sub-regional and neighbourhood centres having expanded by 25bp, 32bp and 21bp respectively. Prime large format centres saw 24bp of expansion over the same 12-month period.

Shopping Centres:

CBRE’s report shows that regional shopping centres dominated transaction activity in Q2, accounting for 54% of all retail investment sales totaling $564.5 million.

Major transactions in Q2 included Craigieburn Central in Melbourne for $300 million and Broadmeadows Central also in Melbourne for $134.5 million (50% share).

Miller commented that, “Despite economic uncertainty and the high cost of debt, investment has been driven by the strong migration and tourism outlook. We forecast yields to soften in 2023 although, at a decreasing rate, in response to rising cost pressures and interest rates.”

Shopping centre supply completions were up on the previous quarter but relatively subdued due to rising debt costs and construction constraints and delays.

“Neighbourhood centres dominated new stock delivery in Q2, with projects including Woolworths Clarkson Shopping Centre in Perth (5,300m2). Neighbourhood centres also dominate the future pipeline, accounting for 51% of the shopping centre developments due to be completed in 2023. This comes as the COVID-19 pandemic highlighted the importance of the ‘20-minute neighbourhood’,” Miller said.

CBRE’s Simon Rooney negotiated the sale of Craigieburn Central on behalf of the vendors

Large Format Retail (LFR):

LFR face rents remained mainly unchanged quarter-to-quarter across most states. WA was the only state to record a rental movement, with rents rising 2.5% over the quarter. Miller said other states showed stable rents, most likely due to both occupier and owner uncertainty which also resulted in low leasing volumes.

“Positive consumer trends continued through the first quarter of 2023, however, LFR spend declined marginally over quarter two. This comes off the back of high interest rates and consequent decreases in the consumer savings rate,” Miller said.

“Household goods spend is typically first to go as household budgets contract impacting LFR sales and foot traffic. This trend is likely to continue until a peak in interest rates is observed.”

“Demand for LFR assets remains active and yield focused as limited market supply persists; short supply is being exacerbated as LFR sites are being repurposed to meet a shortfall in industrial land supply. Growth in new LFR supply is unable to keep up with population and migration increases and rents and yields are being protected through limited competing centres.”