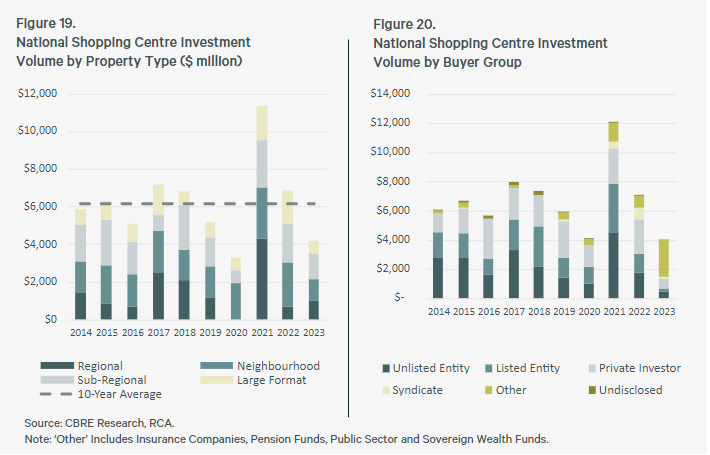

Tailwinds are emerging for Australia’s shopping centre sector after investment hit a cyclical low last year.

CBRE’s latest Australian Shopping Centres research report forecasts shopping centre investment will grow by circa 50% between 2023 and 2025 from $4.2 billion to an estimated $6.3 billion.

Simon Rooney, CBRE’s Pacific Head of Retail Capital Markets, said this would be buoyed by the recent reset of asset values and the sector’s positive underlying fundamentals.

“Private capital has opportunistically and strategically dominated investment activity, while institutional capital has essentially sat on the sidelines during this period of pricing recalibration in shopping centres over the past two years,” Rooney said.

“Global institutional investors have slowly re-entered the Australian market primarily via domestic managers, a trend we see increasing over 2024, along with domestic institutional capital at the back end of this year. The speed and volume in deployment will be heavily dependent on pricing, quality and number of opportunities that come into play.”

“The relatively high returns and recalibration in values for high-quality assets are simply too compelling, reinforced by market-adjusted income streams and robust tenancy performance, providing attractive inbuilt growth. The lack of recent and forecasted competing supply has also been a key contributing factor to asset performance and investor demand.”

The report also identifies mixed-use redevelopment opportunities – including building apartment towers – where centres are situated on larger sites, close to transport in areas with high residential rents.

Turning to the sector’s underlying fundamentals, CBRE Research is forecasting retail sales will grow to $500 billion by the end of the decade underpinned by a triple boost of population growth, jobs growth and income growth.

CBRE’s Pacific Head of Research Sameer Chopra said other positive drivers for the sector would be limited new supply and a continued improvement in shopping centre vacancy rates, which were currently sub 5%.

“Future supply of shopping centre developments is expected to be less than half of the historical average over 2024-2028 and we anticipate further vacancy rate compression as city centre performance improves,” Chopra said.

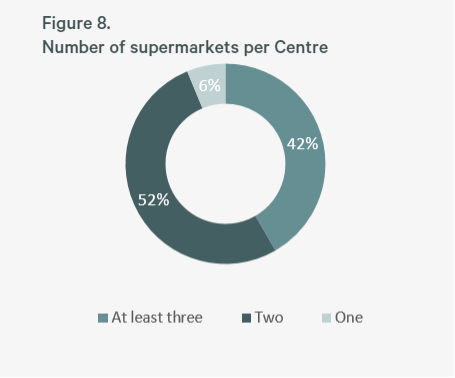

While CBRE is forecasting e-commerce to grow from 13% to 15% between 2024 and 2027, the report highlights that shopping centres have become more defensive, with 94% of centres having at least two daily needs supermarkets, representing around 11% of gross lettable area.

Omni-channel click and collect/return facilities are also expected to assist with ongoing shopping centre visitation as well, with scope for rents to grow as vacancy tightens and shopping centres continue to generate foot traffic.

The report also highlights shifting trends in terms of retail spending and occupancy costs.

“Retail categories that relate to looking good, feeling good and travelling well have taken an extra 20% share of wallet over the past two decade,” Chopra said.

“Our data also shows that occupancy cost ratios (OCRs) have declined over the past five years. For categories such as women’s fashion, café/restaurant and mini-majors, OCRs are 15% lower today than in 2019, due to re-based rents and higher retail sales.”