A new tax database developed by the Shopping Centre Council of Australia (SCCA), in partnership with Urbis, puts a spotlight on the alarming tax increases being imposed on shopping centres and small businesses.

The SCCA / Urbis Statutory Charges Database contains detailed SCCA member statutory valuation, land tax and council rate data covering all jurisdictions.

The new Database has been developed to enhance the SCCA’s advocacy to governments on behalf of the industry and to enable SCCA members to better communicate to their retailers and tenants the nature and growth of taxes in relation to their operating and occupancy costs.

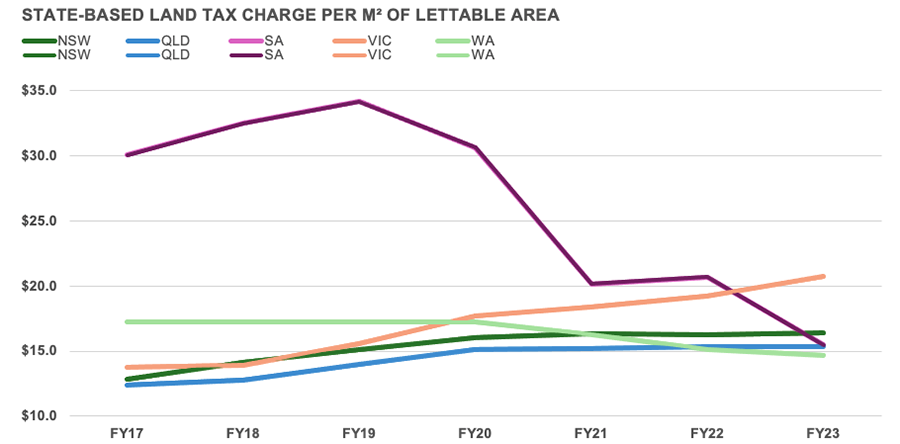

The Database highlights land tax charges are highest in Victoria, being approximately 50% greater than the average charge in other states and territories. While most of the other states and territories have adjusted tax policy to contain and even reduce land tax charges (South Australia for example), Victoria has taken the opposite course.

Figure 1 (above) shows land tax as a rate per square metre of lettable area by state illustrating Victoria as the highest taxing state

Findings also show council rates are the highest in Western Australia, being over 100% more than the average charge in other states and territories. The lack of legislative protection in both Queensland and New South Wales has seen discriminatory rating being applied by an increasing number of local governments, singling out shopping centres and their retailers and leading to exponential rate increases.

Angus Nardi, Chief Executive, Shopping Centre Council of Australia said, “Taxes on shopping centres and retailers are getting out of hand, being the biggest contributor to the growth of operating costs in recent years.

“Victorian land tax has become a real problem, and while Western Australia council rates are the highest in the country, councils in Queensland and New South Wales are getting away with creating lazy and discriminatory single rating categories targeting shopping centres resulting in an exponential growth in costs.

“Our new Database will enhance our advocacy capability, and we’ll be briefing key stakeholders such as Small Business Commissioners, and key groups such as the National Retail Association and Pharmacy Guild, so they better understand what’s happening and hopefully join us in making representations to governments.

“On the plus side, our analysis highlights the benefits of land tax reform in South Australia,” Nardi said.

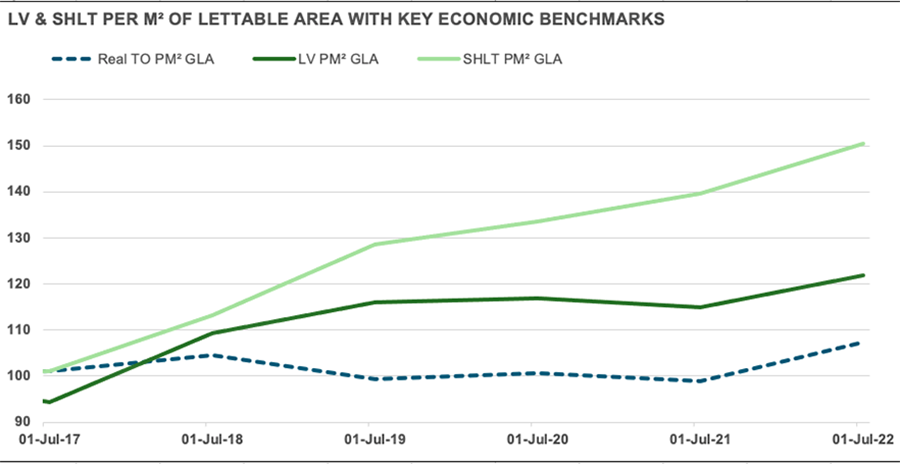

Figure 2 (above) shows the relative growth in both site value and land tax charges as an index

Marcus Conabere, Urbis Group Director Economics & Property said, “Urbis are pleased to partner with the SCCA on this new Database which provides a holistic picture as to what is driving the significant increases and disparity in land tax and council rates charges across states and individual local governments.

“The emergence of discriminatory rating is real problem. In Queensland, 90% of SCCA member centres are contained within either a council rating category that applies to groups of shopping centres (74%) or a rating category that applies to a single shopping centre (16%) with significant ‘tax rate’ premiums being applied.

“Both local government rating and land tax require reform to ensure a fairer and more equitable system,” Conabere said.

The SCCA is the national industry group for major shopping centre owners. Access to the SCCA / Urbis Statutory Charges Database is only available to SCCA members.