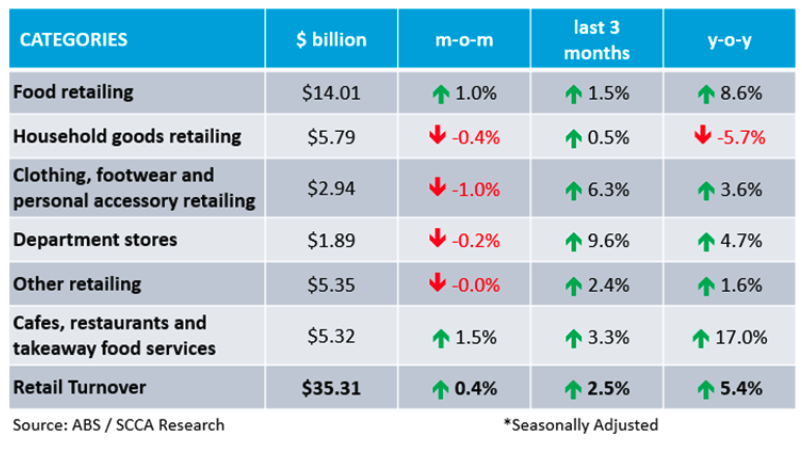

According to figures released by the Australian Bureau of Statistics (ABS), shoppers spent more than $35.3 billion across the country in March. The monthly ABS Retail Trade data for March 2023 indicates that the overall month-on-month (m-o-m) estimate increased by 0.4%, up from 0.2% in February 2023. Retail Turnover increased by 5.4% year-on-year (y-o-y), down from 6.4% in the prior corresponding period (pcp).

There were significant year-on-year sales increases for cafés, restaurants and takeaway (up 17.0%) and food (up 8.6%). Department stores (up 4.7%) and clothing, footwear and accessories (up 3.6%) showed more modest growth. While some categories continue to show reasonable sales growth year-on-year, overall retail sales are slowing as cost-of-living pressures bite. The following table summarises the key data in seasonally adjusted terms across the six ABS retail categories.

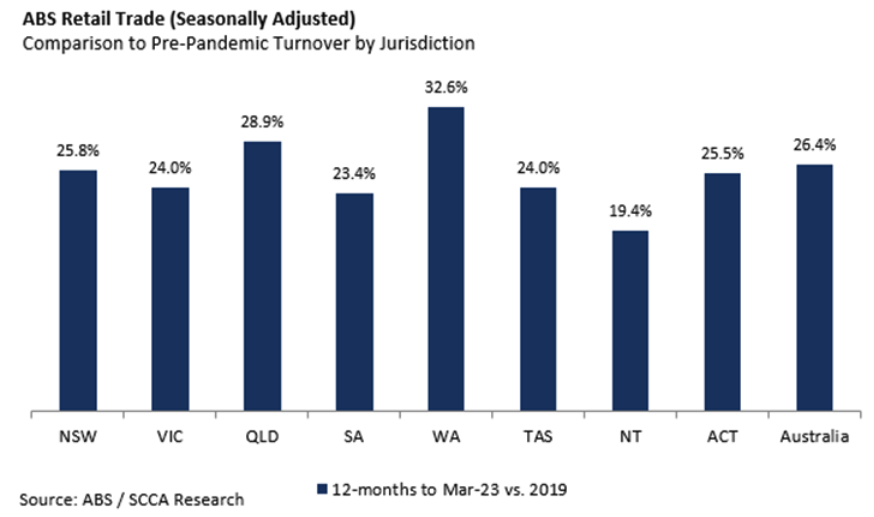

All states and territories recorded growth year-on-year, led by South Australia (up 8.2%) followed by the ACT (up 7.9%), Tasmania (up 7.1%) and Western Australia (up 6.9%). New South Wales (up 5.7%) and Victoria (up 5.6%) were closely matched in growth, followed by Northern Territory (4.7%) and Queensland (up 2.7%).

Commenting on pre-pandemic analysis, Simon Hemphill, Head of Research, Shopping Centre Council of Australia said: “Comparison of retail spending will be affected throughout 2022 and into 2023 given two main factors. Firstly, lockdowns and Government restrictions for ‘non-essential’ retail in certain jurisdictions (including during post-lockdown periods) will negatively impact short to medium-term comparisons, especially for month-on-month or quarter-on-quarter periods. Secondly, record spending during 2020, 2021 and 2022, due to the bounce back of consumer activity, has an impact on longer-term analysis (year-on-year). Given these factors, it is worth making a comparison of Retail Trade versus pre-COVID spending. Interestingly, all jurisdictions (including those exiting Government restrictions in the latter part of 2021) show positive growth versus the corresponding 12-month period in 2019.”

The National Retail Association (NRA) said the Retail trade figures for March underline the need for urgent cost-of-living relief for households in next week’s Federal Budget.

NRA CEO Greg Griffith said under normal circumstances, retailers would welcome growth in turnover of 0.4% in March and 5.4% for the year, seasonally adjusted.

However, the positive figures were largely driven by high food inflation, which is also being passed on to cafés and restaurants, while consumers were pulling back their discretionary spending.

“With inflation running at 7%, annual growth of 5.4% means retailers are actually going backwards, particularly when you take into account increasing rent, wages and input costs.

“There’s no doubt the cost of living continues to hurt Australian households and retail businesses, and that’s why we’re looking for a strong response in next week’s Federal Budget,” Griffith said.