After more than five decades, the historically iconic Mitchell and Milledge House, two freehold properties situated on one of Melbourne CBD’s most prominent corners, have undergone a transaction, marking the largest deal in the Melbourne CBD for 2023 at $56 million representing a 4.17% yield.

Positioned within Melbourne CBD’s ‘Golden retail core’ between Melbourne Central Shopping Centre and the Emporium, these properties constitute one of the largest privately held retail corners. The sale of these adjoining properties is noteworthy, considering the relative scarcity of large trophy listings in the CBD throughout 2023.

Mitchell House is a five-and-six-level, Art Deco office building built in 1936 in the Streamlined Moderne style designed by architect Harry Norris. It has seven ground-floor shops over two frontages, plus a two-storey building with a ground-floor shop. Next door is Milledge House at 287-289 Elizabeth Street. The two-storey building has a net lettable area of 518m2 comprising 146m2 of office space and 372m2 of retail space.

The transaction was facilitated by Oliver Hay, Daniel Wolman, and Leon Ma from Cushman & Wakefield, complemented by transaction advisers Tom Byrnes and Scott Keck of Charter Keck Cramer. The assets were previously held by a longstanding private Melbourne family for more than 50 years, further adding to the historical significance of the deal.

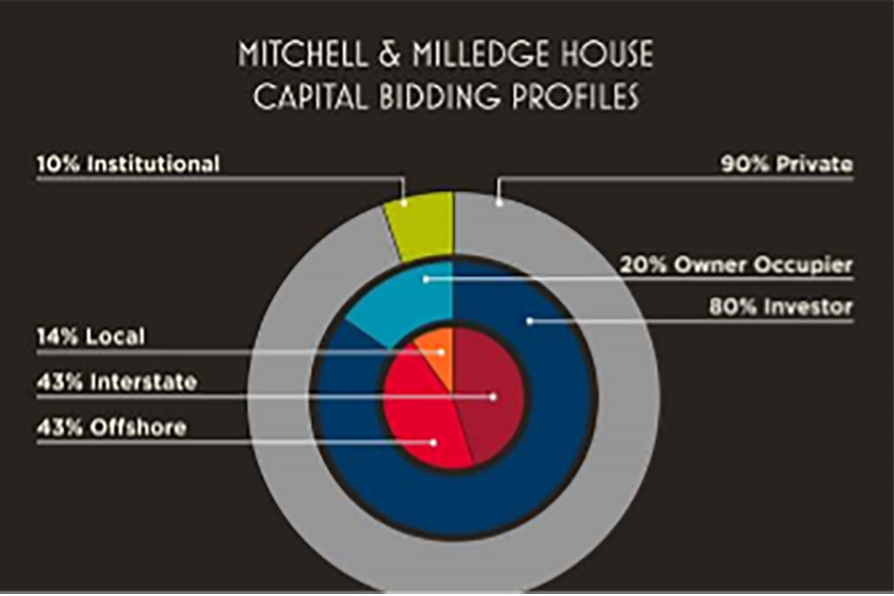

Cushman & Wakefield International Director, Oliver Hay, said: “In a period where the CBD market has been starved of sizeable transactions this is a strong indicator that prime CBD diverse assets are very resilient and appealing not only interstate investors but offshore private capital. Through a highly strategic and thought-out campaign the team generated over 10 offers for a mix of buyer profiles and over 39 inspections.”

Leon Ma, Director of Asia Capital Services at Cushman & Wakefield said: “43% of the capital offered was offshore generated originating from Macau, China and Singapore and we except further interest from similar groups throughout 2024 as they look to snap up iconic assets around Melbourne.”

In 2023, subdued deal activity in Melbourne’s real estate market was influenced by various challenges. The cost of debt surged to 4.35% by November 2023, creating a mismatch with stagnant asset values and cap rates.

Despite a decline in transaction volume, Cushman & Wakefield Melbco Middle Markets express confidence in sustained interest from high net worth and private investors. They anticipate a rebound in 2024 as investors aim to capitalise on CBD assets, buoyed by the expected return of office workers and immigrants pursuing higher-level studies in Australia.