According to data analysed and published by MSCI Real Capital Analytics (RCA), JLL advised on the most retail transactions in 2022 and has been ranked as the leading retail investments advisory firm in Australia in the respected investment tracking study, brokering nearly $4 billion of transactions in 2022 across 84 properties.

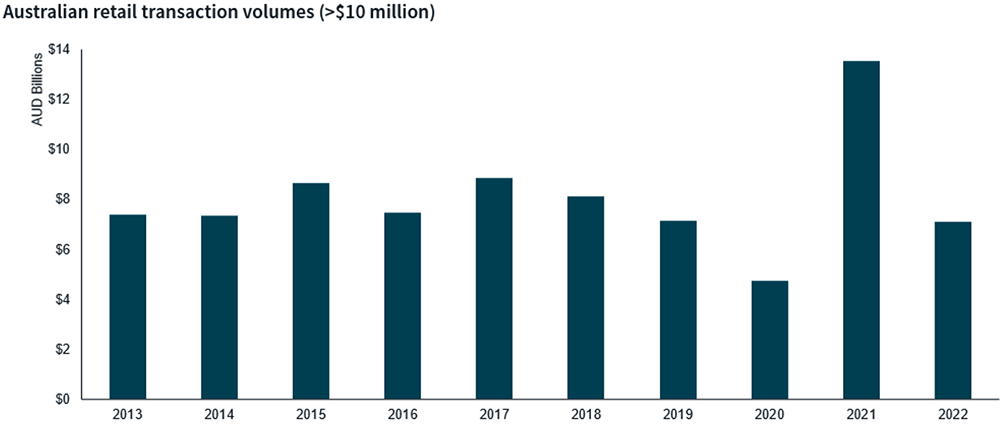

In 2022, retail transaction volumes totalled $7.1 billion, in line with the 10-year average. However, investments were down in comparison to the year prior, noting the record-breaking sales volumes that totalled $13.5 billion in 2021.

JLL’s Head of Retail Investments – Australia, Sam Hatcher said, “We are honoured to be recognised by RCA as the top retail investments firm in Australia. The Australian retail industry faced unprecedented challenges in 2020, however, retail assets remained firmly on the radar of investors. Between 2020 and 2023, our team transacted more than 173 retail assets nationally.

“Globally we are seeing a shift in sentiment back towards the retail sector, driven by relative instability in the other asset classes. Global capital is recognising the fundamental robust performance of Australian retail, particularly over the past two years, and we are now seeing the re-emergence of major institutional capital and super funds looking at Australian assets given their land-rich nature and future mixed-use development potential,” said Hatcher.

- Centuria Portfolio

- Caneland Central (sold by JLL for $280 million)

- Crossroads

- Casuarina Square, NT

- Casuarina Square, NT

JLL’s Senior Director of Retail Investments – Australia, Nick Willis said, “The capital dynamics in Australia’s retail sector continues to evolve at a rapid pace, with significant maiden capital entering the market. Nearly $1 billion of transactions in 2022 was attributed to maiden retail buyers, including Pelligra Group acquiring Dandenong Plaza for $145 million and Aware Real Estate acquiring the 50% interest in Sunshine Marketplace.

“2022 started strong with a flow over of activity from 2021, however the shift in debt markets resulted in a slowdown of transactions in Q2 and Q3. We experienced a significant resurgence of activity in Q4 and completed over $600 million of transactions in December alone.

“This Q4 confidence has carried on in 2023, however available investment supply remains an issue for investors, with only two assets currently on the market in Australia over $100 million,” said Willis.

Since 2012, an average of five transactions of $250 million or above, have occurred annually. In 2022, there were four transactions of this significance, and two of these were Large Format Retail assets, highlighting a resurgence in the sub-sector.

JLL brokered some of Australia’s most significant retail transactions in 2022. These include:

• Casuarina Square – $418 million, representing Australia’s largest retail transaction in 2022

• Fort Street Recapitalisation – $350 million, representing Australia’s largest recapitalisation in 2022

• Caneland Central – $280 million, representing the only Regional Shopping Centre to trade in Australia in 2022

• Crossroads Homemaker Centre – $282 million, representing the largest Large Format Retail transaction in Australia in 2022

• Centuria Convenience Retail Portfolio – $180 million, representing the largest Neighbourhood Shopping Centre portfolio to transact in Australia in 2022