JLL’s 19th Retail Centre Managers’ Survey was undertaken in August across 88 JLL-managed retail shopping centres nationally. The majority of centres were neighbourhood and sub-regional centres. The annual report gives a snapshot of the leasing environment, retail outlook and sentiment of centre managers.

A key theme running through the report is Centre Managers are optimistic about factors within their control (refurbishments and tenant remix) while more negative about external factors like fuel prices.

Shopping Centre Managers in the survey report refurbishments as the key to retail success in a competitive market.

The survey shows food operators continue to drive tenant enquiry. Food and beverage retailing in shopping centres continues to be the stand out performer, while there’s evidence that the impact of refurbishment works is being converted into positive trading results including driving customer traffic.

“The survey showed that 42% of JLL Centre Managers made a positive comment about the recent performance of their centres in relation to an improvement in sales trends, tenant sentiment, foot traffic and/or leasing enquiry.” said JLL’s Head of Property & Asset Management – Australia, Richard Fennell.

“Centre Managers were also slightly more optimistic about the outlook for sales, mainly due to factors within their control, such as refurbishments and tenant remix, but had a more negative view on the impact of external factors like ecommerce, the performance of the economy and fuel prices.

“This highlights the importance of active management in the retail sector and is evidence of the value of strategies such as changing the tenancy mix and refurbishment programs to attract foot traffic and customers and improve market share within trade areas.” he said.

“The majority of Centre Managers (56%) expected some growth in moving annual turnover (MAT) over the next 12 months.

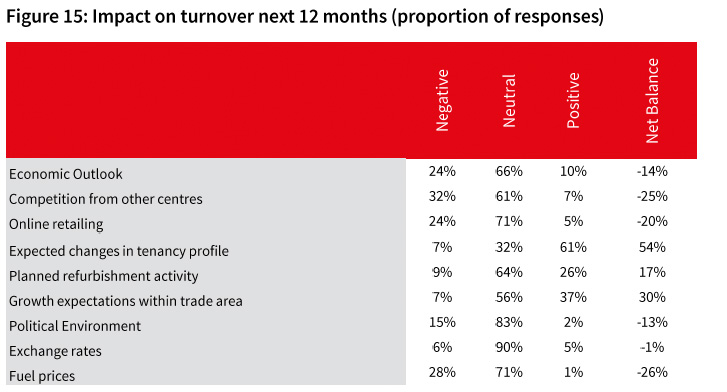

“JLL Centre Managers continued to view ‘expected changes to tenancy profile’ as having the most positive impact on the MAT outlook or their centres. More than half of survey respondents (61%) stated that it would drive sales growth over the next 12 months, up from 55% in the previous survey in February this year,” said Fennell.

When asked what factors were impacting turnover performance, the strongest positive factors were ‘expected changes in tenancy profile’ with a net balance of 54%, ‘growth expectations within trade area’ at 30% and ‘planned refurbishment activity’ at 17%.

The top three negative factors impacting on turnover have remained consistent with previous surveys. Fuel prices (with a net balance of -26%), competition from other centres (-25%) and online retailing (-20%) remain the top concerns.

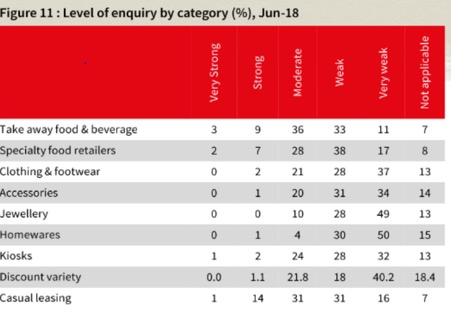

JLL’s Director of Retail Research, Andrew Quillfeldt said, “Food and Beverage retailers continue to drive leasing enquiry, with 52% of Centre Managers stating that enquiry levels remain the same or stronger than the previous survey. It is worth noting that the proportion has softened from previous surveys though, down from 66% in December 2017 and June 2017.” he said.

“Enquiry remains subdued in the Jewellery and Homewares categories, with over half of all Centre Managers reporting enquiry as very weak. Clothing and footwear retailer enquiry improved slightly from the previous survey in February, but remains in line with levels reported over the past few years where 74% of respondents reported enquiry was weak or very weak.

Centre Managers also noted higher incentives were required to secure a new tenant for specialty stores given that tenants are being more selective about where they choose to open new stores.

Supermarkets are driving total centre MAT growth in neighbourhood and sub-regional centres, with specialty store MAT remaining subdued across the portfolio. The recent improvement in supermarket sales growth was noted by Centre Managers, with 15% commenting on the strong performance of a supermarket within their centre,” said Quillfeldt.

To access the full report click here