With a portfolio spanning 2.6 million square metres of site area, preliminary valuations for all 57 properties in the HomeCo Daily Needs REIT (HDN) portfolio have been completed. The June 2022 preliminary unaudited net valuation recorded a gain of $209 million, representing a 4.6% increase on December 2021.

Since the merger with Aventus Group (AVN), HDN has undertaken a detailed review of the portfolio to identify priority projects which can commence over the medium-term and increase HDN’s annual capital expenditure programme. The development pipeline is now in excess of $500 million across 30 projects in various stages of planning.

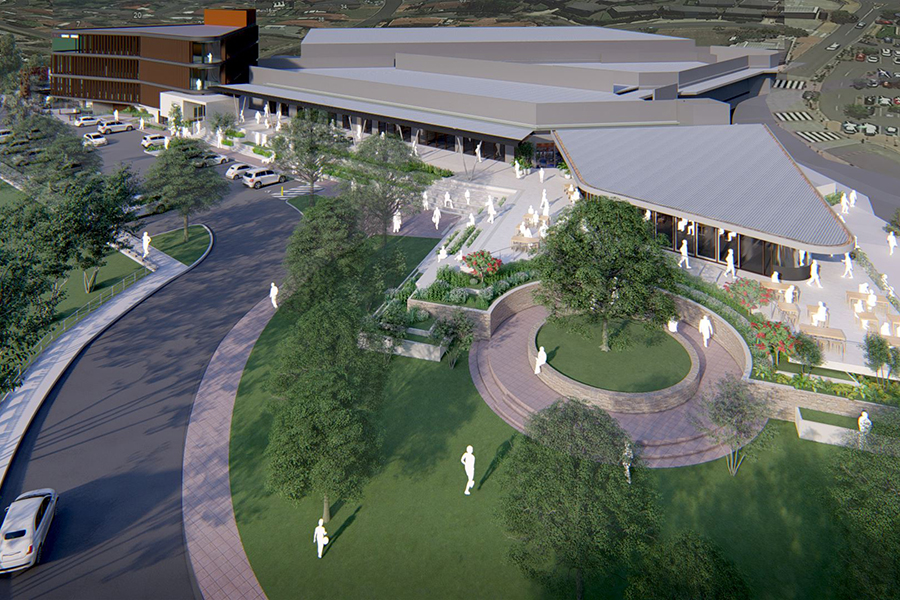

- Mackay Development – render

- Mackay Development – render

More than $100 million of near-term projects now have requisite approvals from planning authorities and is expected to activate approximately $75 million of projects in FY23.

HomeCo Daily Needs REIT CEO, Sid Sharma, said: “HDN’s high quality and strategic asset base remains well-positioned for the higher inflation and interest rate environment we are now facing. The portfolio is in strong shape with 99% rent collection and 99% occupancy, providing a strong platform to drive rental growth and new income streams via development. With more than 77 million total annual customer visits, foot traffic remains robust and increased by 1.4% in the March quarter versus the prior corresponding period.”

“The portfolio recorded strong valuation gains highlighting the growing demand for daily needs assets from both private and increasingly, institutional investors. Investors remain attracted to high-quality daily needs assets offering defensive income streams underpinned by attractive long-term megatrends. We believe the shift to omnichannel retailing is a long-term structural tailwind which is driving the evolution of our asset base into critical last-mile infrastructure.”

Construction on Glenmore Park is expected to commence in Q1 FY23

“We are making significant progress unlocking and accelerating our value accretive $500m+ development pipeline with over 30 projects in various stages of planning,” said Sharma.

Three key projects which are expected to commence in FY23 include:

- HomeCo Glenmore Park development will add approx. 2,400m2 of GLA to the existing daily needs town centre and will be anchored by government services, health and wellness tenants. Leasing commitments for more than 75% of GLA and requisite planning approval have been received. Construction on Glenmore Park is expected to commence in Q1 FY23.

- HomeCo Mackay leisure and lifestyle precinct has received planning approval for more than 17,000m2 of GLA. The precinct complements the existing 14,000m2 large format retail centre and has received more than 64% leasing commitments from national brands in the leisure and lifestyle categories. Construction on Mackay is expected to commence in Q1 FY23.

- HomeCo Nowra development has received planning approval for more than 11,000m2. Tenant demand is strong with more than 75% leasing commitments from national brands in the wellness, leisure and lifestyle categories. Construction on Nowra is expected to commence in Q1 FY23, noting that Nowra is an ex-Masters building undergoing conversion.

HomeCo Mackay leisure and lifestyle precinct has received planning approval for more than 17,000m2 of GLA