The GPT Group (“GPT” or “Group”) today announced its operational update for the September 2018 quarter, and upgraded 2018 guidance for FFO per security growth and Distribution per security growth to 3.5% for the full year 2018.

Key Operational Highlights

• Total Office leases of 36,017 sqm signed during the quarter, and occupancy of 97.5% (96.6% at 30 June 2018)

• Acquired Eclipse Tower at 60 Station Street, Parramatta, for $277.6 million, reflecting an initial yield of 5.34%

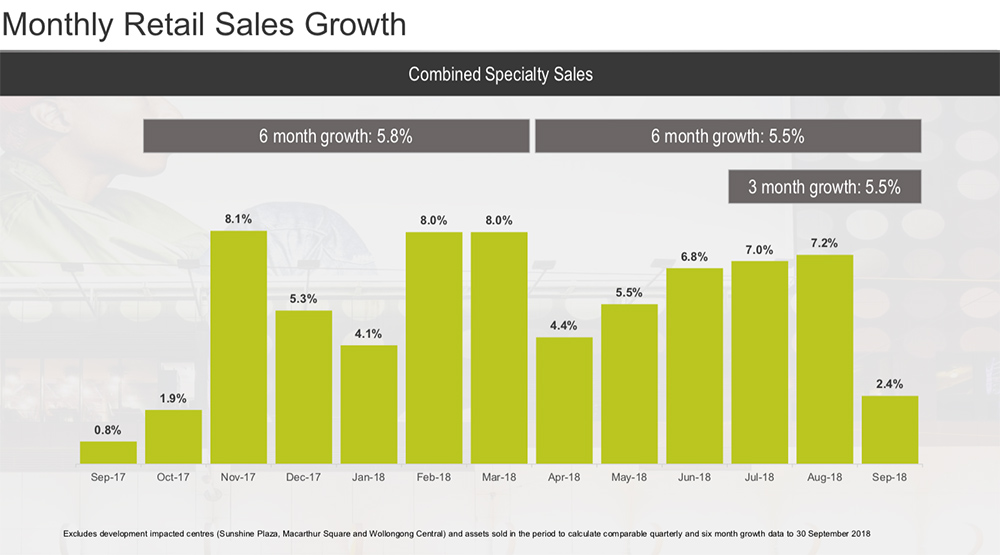

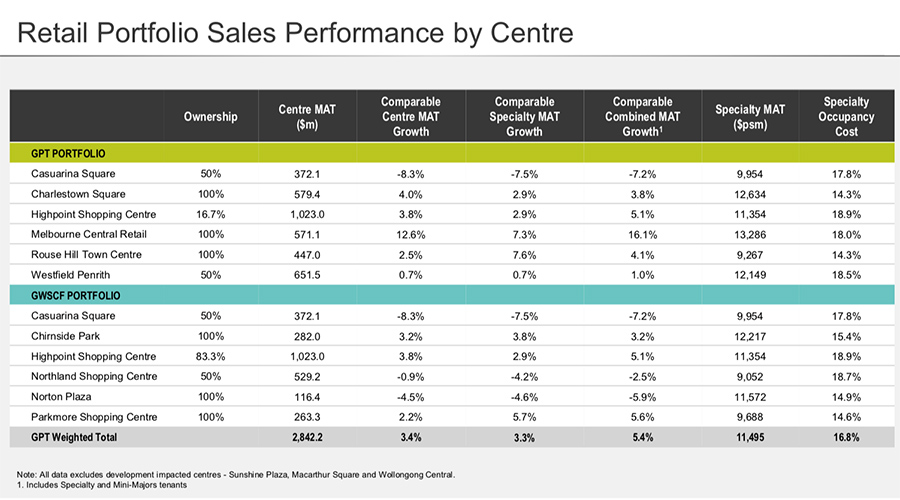

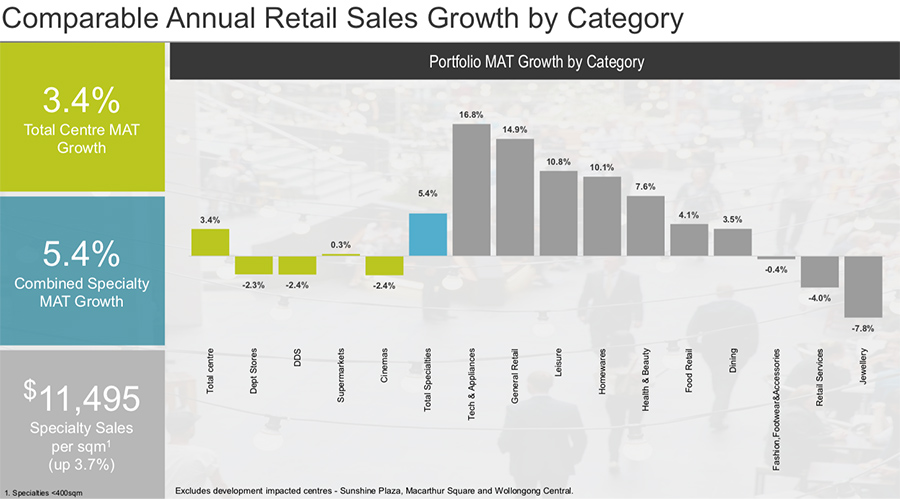

• Total Centre comparable MAT growth of 3.4% (2.3% at 30 June 2018)

• Combined Retail Specialty comparable MAT growth of 5.4% (4.4% at 30 June 2018)

• Retail specialty sales of $11,495 per square metre (psqm) at 30 September ($11,404 psqm at 30 June 2018)

• Total Logistics leases of 66,776 sqm signed during the quarter, and occupancy of 96.7% (96.6% at 30 June 2018)

• GPT issued a $200 million 6 year medium term note at a margin of 133 basis points over 3 month BBSW

• GPT Wholesale Office Fund (GWOF) priced a US$250 million (A$351 million) US Private Placement (USPP) debt issue for an average term of 14 years at a margin of 167 basis points over 3 month BBSW

Commenting on the successful debt capital markets issuance by the Group and GWOF during the period, GPT’s Chief Financial Officer, Anastasia Clarke, noted the success of both transactions is testament to the high credit quality of both GPT and GWOF, with the GWOF issue 10 times oversubscribed.

GPT’s Chief Executive Officer, Bob Johnston, said the Group was pleased to announce an upgrade to guidance for 2018, now forecasting to deliver FFO per security growth and Distribution per security growth of 3.5% for the full year.

“The upgrade to our guidance reflects the additional income arising from our recent purchase of the Eclipse office tower, and the stronger contribution from the Office and Logistics portfolio,” said Johnston. “The investment portfolio has continued to perform well, with occupancy remaining high. The Group has made good progress on our new Sydney Logistics developments, with Huntingwood 1B completed and fully leased, and terms agreed over half of the building at Eastern Creek.”

GWSCF achieved a total return of 5.5% for the 12 months to 30 September 2018 and has delivered a total return of 9.9% over the past two years following the acquisition of a further 25% interest in Highpoint in September 2017. The repositioning of Northland with five international mini-majors is progressing well with the opening of TK Maxx, JD Sport, and H&M in 2018. Sephora and another international mini-major are programmed to open in the first half of 2019. A sale campaign to divest Maribyrnong Homemaker Centre commenced in September 2018.