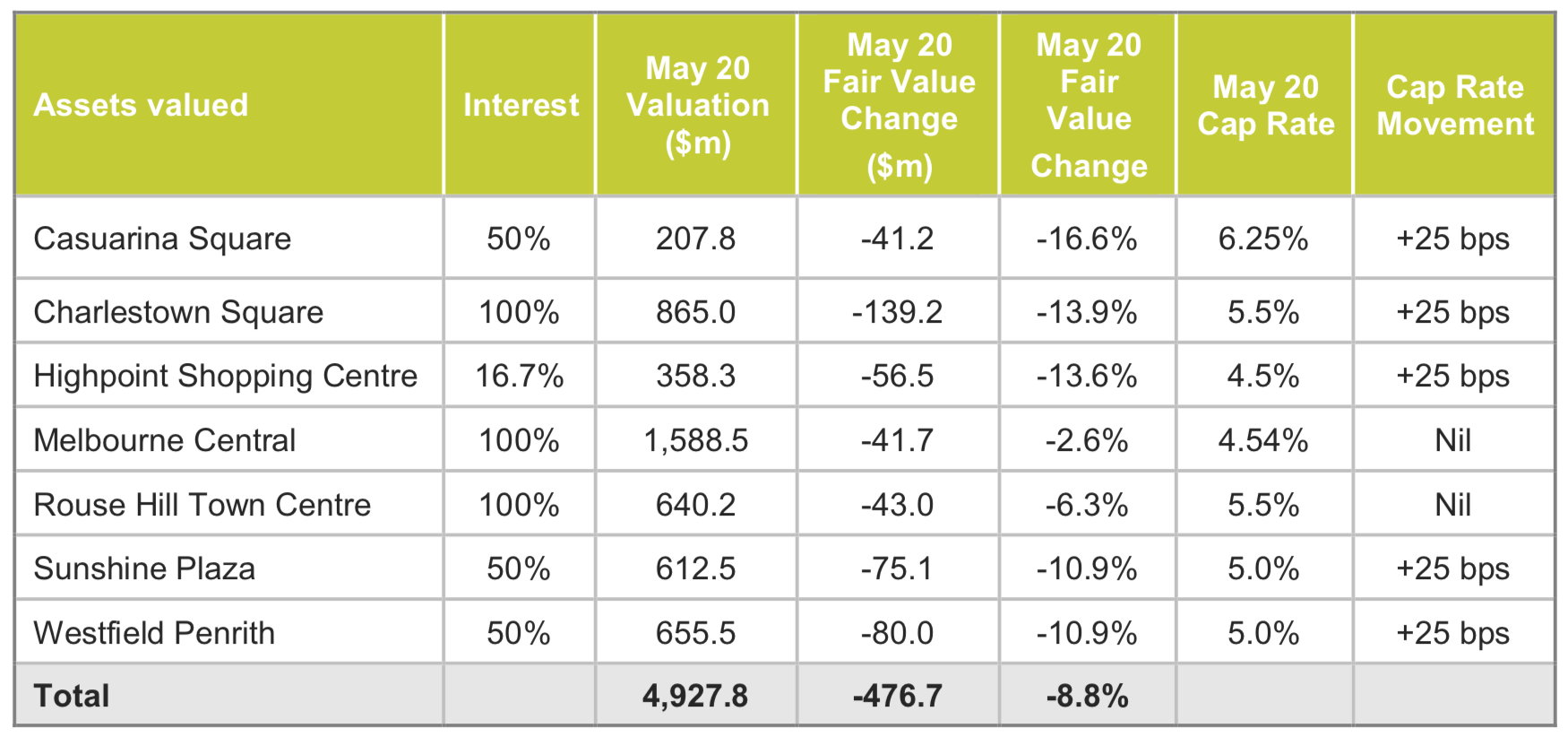

The coronavirus pandemic has had a large impact on retail trade figures and its flow on effect also means lower asset valuations across retail property as rental conditions and the ongoing consumer sentiment have created an uncertain environment across the entire industry. The GPT Group (GPT) has been one of those first casualties, today announcing that revaluations as at 31 May 2020 has resulted in a reduction in value of $476.7 million, or approximately 8.8% compared to the 31 December 2019 book value.

Commenting on the revaluations, GPT’s Chief Executive Officer Bob Johnston said: “The retail asset revaluations reflect the independent valuers’ assessment of the effects that COVID-19 and the subsequent social restrictions have had on our retail assets. This has generally been reflected in lower market rental growth rates, increased vacancy and abatement allowances and some softening in investment metrics.”

“In recent weeks it has been pleasing to see a significant increase in activity at our retail assets as restrictions have been eased. Across our regional shopping centres we now have approximately 90% of stores open and foot traffic has returned to approximately 85% of the level at the same time last year.” he said.

Separately, all assets owned by GWOF and GWSCF have been independently revalued as at 31 May 2020. GWOF recorded a negative revaluation of $34 million, representing a decline in book value of 0.4% against the 31 March 2020 book value. GWSCF recorded a negative revaluation of $137.6 million, representing a decline in book value of 3.5% against the 31 March 2020 book value. GPT’s ownership interest in GWOF is 22.3%, while its ownership interest in GWSCF is 28.5%.

The individual asset valuations are as follows:

2020 Interim Distribution and Policy Update:

GPT has previously declared its interim and final distributions prior to balance date. As a result of the uncertainty created by the effects of the COVID-19 pandemic and the application of the mandatory Code of Conduct, the Group is adjusting the timing of the declaration of its distributions to coincide with the release of the Group’s financial results in February and August each year.

In addition, the Group is amending its distribution payout policy to align with free cashflow. Under the amended payout policy, GPT will target to distribute 95 to 105% of Free Cashflow, defined as operating cashflow less maintenance and leasing capex and inventory movements. The Group’s previous policy was to distribute 95 to 105% of Adjusted Funds from Operations, defined as Funds From Operations less maintenance and leasing capex.

The above changes will take effect commencing with the Group’s 2020 interim distribution. The timing of the distribution payment to securityholders is not expected to materially change from prior periods.

Melbourne Central

As announced on 19 March, in light of the measures implemented by the Federal and State governments and business to slow the spread of the COVID-19 virus, and the current uncertainty in relation to the duration and impact of the pandemic on our operations, GPT has withdrawn its FY20 FFO and distribution guidance.

GPT will have all Group investment properties independently valued as at 30 June 2020 and will release its interim results on Monday 10 August.