Drysdale Village Shopping Centre on the Bellarine Peninsula has been listed for sale as regional retail assets continue to find favor with investors. The single level, 3,130 m2, neighbourhood centre is anchored by a strongly trading Woolworths supermarket complemented by seven specialty retailers.

The centre, located on a substantial 8,349m2 site, will be sold fully leased with a net annual income of circa $990,442. The tenancy profile includes the 20 year Woolworths lease (expiring 2035) and those of Hommy’s Quality Meats, JR’s Café, Bakers Delight, National Australia Bank, United Pty Ltd, YanQun Wang, and a Tattslotto agency as well as a Bank of Melbourne ATM and Hoyts kiosk.

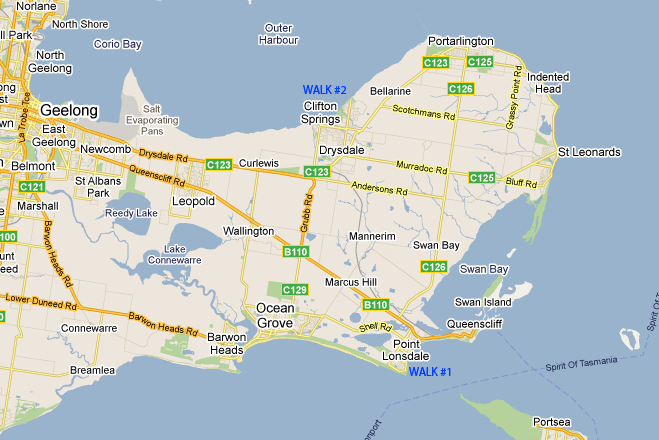

According to CBRE State Director Retail Investments, Justin Dowers, who is marketing the property with National Director Investments, Mark Wizel, the centre’s strong lease profile, its location within 20 minutes of Geelong, and rapid population growth, provide potential purchasers with a compelling investment opportunity.

“Geelong is one of Victoria’s fastest growing regions with a forecast 32% increase in population by 2036 while the Bellarine Peninsula is expected to experience an even stronger rate of growth delivering the sort of catchment which underpins the most successful neighbourhood centres.

We are also seeing shopping centre investments in the Geelong region trade at similar returns and pricing levels to metropolitan Melbourne and that is very attractive to investors,’’ Dowers said.

Bellarine Peninsula

Retail property sales earlier this year totalling nearly $200 million indicated Drysdale was likely to attract a lot of interest from local and off shore buyers.

“We have already seen two nearby shopping centres – Leopold and Bellarine – generate an enormous level of enquiry and expressions of interest which saw both sell on tight yields, as did Torquay Village in February.

There is no doubt that Geelong and surrounds is now firmly on the radar of serious investors as it is for Melbourne residents seeking affordable housing options,’’ said Wizel

The commercial zoning of the site, which allows for more intensive mixed-use development, would provide the successful purchaser with the flexibility to meet the changing demand for services and potentially add significantly to the value of the asset.