JLL Retail Investments Australia & New Zealand has released its latest insights on the Large Format Retail (LFR) sub-sector, highlighting supply scarcity and strengthening fundamentals as the catalyst for increasing demand from capital.

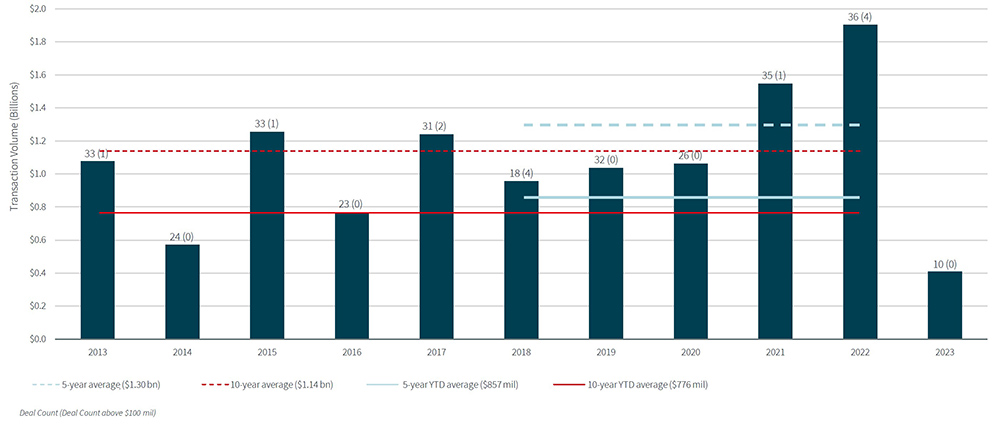

LFR has experienced limited trading activity throughout 2023, resulting in a 79% year-on-year decrease in transaction volumes and a 65% decline compared to the 10-year average (Figure 1 – below). This scarcity of opportunities has led to an increased demand from investors seeking to capitalise on the few available options.

Nick Willis, Senior Director of JLL Retail Investments Australia & New Zealand said: “the LFR sector is entering an interesting phase of its cycle with supply and vacancy at historic lows for the major metropolitan markets like Sydney, this coupled with the rapid population growth and strong retailer performance is driving income growth in the sector.”

Figure 1

Since the onset of COVID, Large Format Retail has experienced a decline in institutional capital investment, leading to an increase in both private and syndicator interest. Syndicators are now targeting ‘non-metro’ locations in search of higher yielding assets.

Sam Hatcher, Head of JLL Retail Investments Australia & New Zealand said: “LFR property has always had strong underlying investment fundamentals. However, more recently, the sector has experienced an increase in tenant activity with new entrant retailers requiring access to larger format stores – in some cases to implement a last mile strategy – which has begun to translate to rental growth.

“This is driving growth in cash flows and leading to institutional capital’s re-engagement on the LFR sector, however more recently the challenge for capital is accessing prime LFR assets, which rarely trade across Australia,” said Hatcher.

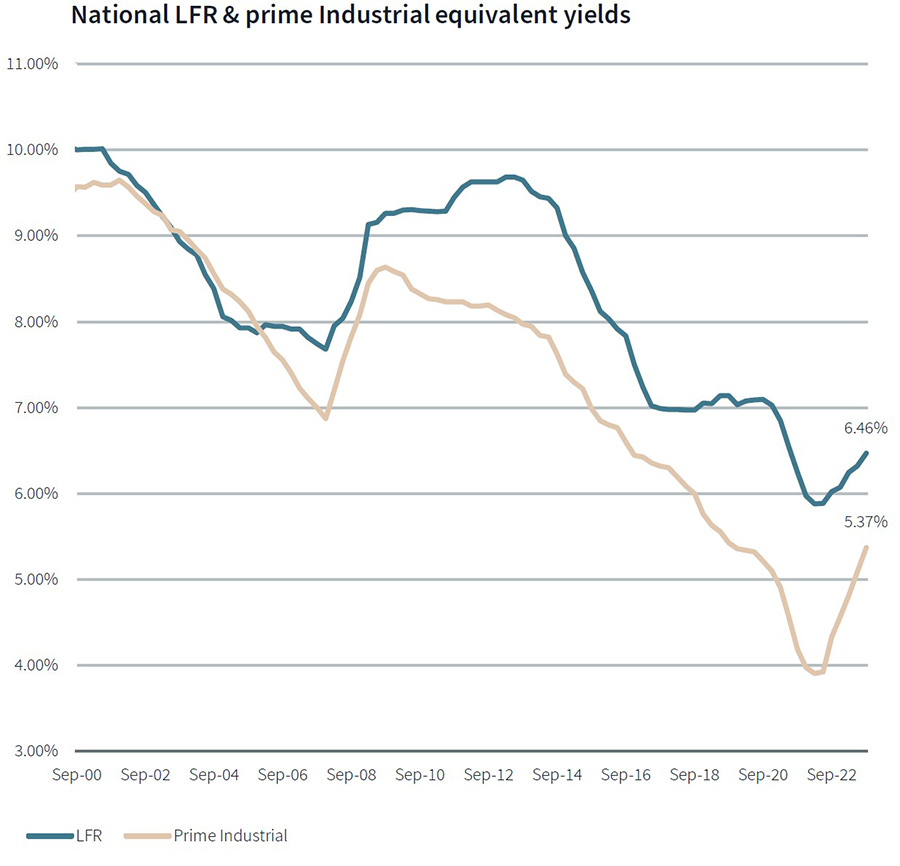

Among the various retail sub-sectors, Large Format Retail stands out as one of the most resistant to repricing pressures. Despite cash rate rises since June 2022 retail yields have softened (significantly less in comparison to prime office) and LFR remains one of the most resilient.

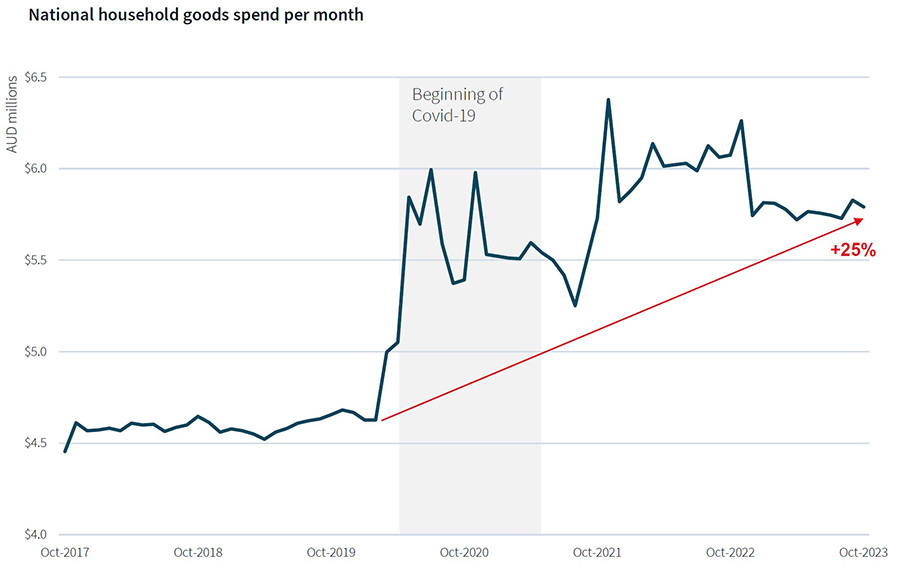

In regard to performance, consumer spending grew by 25% compared to pre-COVID levels. Household goods sales have stabilised (fluctuations not exceeding 1.2%) but remain above pre-pandemic levels, indicating a sustainable demand in a post-pandemic era (Figure 2 – below).

Figure 2

LFR assets are commonly situated on large land holdings with low site coverage, allowing for flexible optionality on alternate uses. These assets are well-suited for logistics purposes due to their prime locations in transport corridors and strong population access. Furthermore, the sub-sector has experienced a significant decrease in new developments, solidifying their investment potential and delivering positive outcomes for retailer performance on existing assets.

Phoebe Cooney, Analyst in the JLL Retail Investments Australia & New Zealand team commented, “rising construction costs and the low rental profile on LFR assets are increasingly placing pressure on feasibility for new LFR development. This coupled with a rapid rise in demand from industrial in core metro locations is leading to the building case for conversion of LFR assets into last-mile logistics. Our latest research is showing average net LFR rents are now only $33/m2 more than prime industrial net rents, which is placing pressure on existing LFR assets to meet increasing consumer demand.”

Historically, LFR yields have trended above industrial. Due to LFR yields not compressing as far or as fast as industrial, the LFR sector has experienced a lesser correction in pricing. This is being complemented by the underlying retailer performance holding up in the higher inflationary environment (trending above pre-COVID) (Figure 3 – below).

Figure 3

JLL has facilitated the transaction of over $2.05 billion in Large Format Retail since 2020, with Charter Hall emerging as the largest buyer, acquiring $460 million worth of LFR Bunnings Warehouse assets via JLL.

A list of the most recent JLL Large Format transactions is highlighted below:

| Centre Name | Date | Price | Yield (Passing) | Buyer |

|---|---|---|---|---|

| HomeCo Box Hill | Nov-23 | $67,500,000 | 5.51% | Private Investor |

| Bunnings Young | Sep-23 | $10,500,000 | 5.50% | MPG Funds |

| HomeCo Midland | Aug-23 | $74,750,000 | 6.61% | Primewest Property Developments (PWD) |

| Rothwell Central | Jul-23 | $41,000,000 | 6.98% | OzProp Holdings |

| HomeCo Epping | Feb-23 | $70,250,000 | 5.51% | Forza Capital |

| Homemaker Prospect | Nov-22 | $78,900,000 | 5.57% | AsheMorgan |

| Crossroads Homemaker Centre* | Oct-22 | $282,000,000 | 4.62% | LaSalle Investment Management |

| HomeCo Sunshine Coast | Aug-22 | $140,000,000 | 6.17% | Private Investor |

| Homeworld Tuggeranong | Aug-22 | $46,000,000 | 7.67% | Private Investor |

| Bathurst Supa Centre | Jun-22 | $17,350,000 | 6.29% | Centuria (Primewest) |

| Cairns Home Improvement Centre | Jun-22 | $30,100,000 | 6.16% | Private Investor |

| Burleigh Home + Life* | Jun-22 | $72,500,000 | 4.68% | Private Investor |

| Woolcock Supa Stores | May-22 | $19,200,000 | 6.84% | Private Investor |

| Sunshine Mitre 10 | Mar-22 | $16,125,000 | 4.50% | Private Investor |

| Bunnings Nowra | Jan-22 | $65,343,750 | 4.00% | Charter Hall |

| Joondalup Commercial Centre | Nov-21 | $16,500,000 | 5.75% | APIL Group |

| Lot 101 Domain Central | Nov-21 | $10,000,000 | 5.57% | QIC |

| Bunnings Delacombe | Oct-21 | $45,400,000 | 4.15% | Charter Hall |

| Craigieburn Junction* | Sep-21 | $135,000,000 | 5.44% | QIC |

| Albury Convenience Centre | Aug-21 | $29,500,000 | 6.21% | Collective Capital |

| Homebase Campbelltown | Jul-21 | $48,500,000 | 5.00% | Confidential |

| Homemaker Lake Haven | Jun-21 | $46,250,000 | 6.50% | Private Investor |

| Bunnings Modbury | Apr-21 | $22,800,000 | 6.46% | Inheritance Capital Asset Management |

| Home + Life Robina* | Apr-21 | $66,000,000 | 4.93% | Primewest |

| Bunnings Preston* | Jan-21 | $84,209,000 | 4.40% | Newmark Capital |

| Bunnings Robina | Dec-20 | $28,050,000 | 5.49% | Private Investor |

| HomeBase Wagga Wagga | Nov-20 | $46,000,000 | 7.20% | Private Investor |

| Tamworth Lifestyle Centre | Nov-20 | $15,100,000 | 8.48% | Primewest |

| Bayview Centre* | Nov-20 | $35,250,000 | 6.67% | Griffith Capital |

| Bunnings Portfolio | Oct-20 | $353,150,000 | 4.63% | Charter Hall |

| City West Plaza | May-20 | $39,000,000 | 5.26% | Cadence Property Group / Assembly Funds Management |

*Sold with conjunctional agent

Crossroads Homemaker (NSW). Sold by JLL* for $282 million