Data released by the Australian Bureau of Statistics (ABS) today has revealed November’s retail trade rose by 1.4%, with the Black Friday and Cyber Monday sales period spurring a spending frenzy on discretionary items.

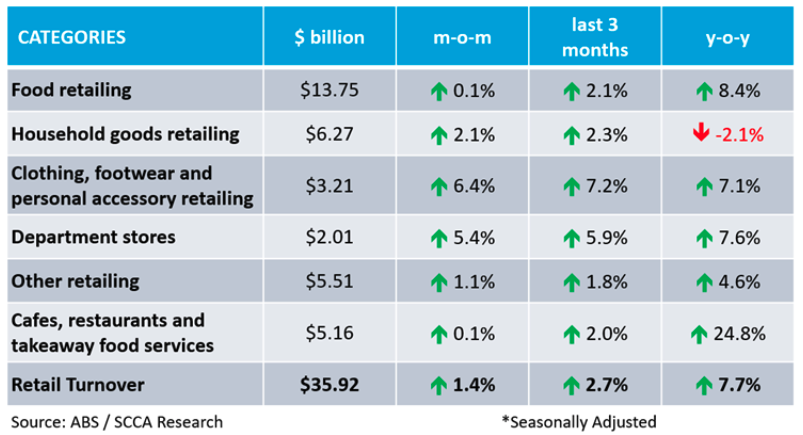

Retail Turnover increased by 7.7% year-on-year (y-o-y), down from (a revised) 13.0% in the prior corresponding period.

The National Retail Association interim CEO Lindsay Carroll said the monthly result is reflective of consumers satisfying their spending cravings through the sales event.

“Consumers have been constrained by increasing costs to everything from their groceries to power bills, and this year’s Black Friday and Cyber Monday presented the perfect opportunity to take advantage of great deals and discounts.

“It also shows the interest of consumers to bring their Christmas shopping forward to November,” she said.

Black Friday drove South Australia to a record $2.3 billion turnover in November 2022

The increase in turnover has been driven by ongoing price increases impacting day-to-day spending, and the sales events boosted non-discretionary spending in clothing, furniture and electronics.

“Contrary to previous months, clothing, footwear and accessories saw the greatest rise of 6.4%, followed by department stores at 5.4% and household goods rising by 2.1%.

“Food retailing and food services, which had held one of the strongest spend increases across the retail industries, saw the smallest growth of just 0.1%.”

Carroll said the results demonstrate how beneficial retail sales events are for the Australian economy.

“Sales events like Black Friday and Cyber Monday are becoming more common across Aussie retailers, and the sales periods themselves are becoming longer.

“Last year, household budgets felt the pinch of inflation, interest rates and energy costs, and many consumers were hesitant to spend, but the sales events offered them the opportunity to splurge on gifts and experiences.

“However, with the RBA having increased interest rates by 300 basis points in 2022, household budgets will become more constrained to start this year, putting further downward pressure on spending.”

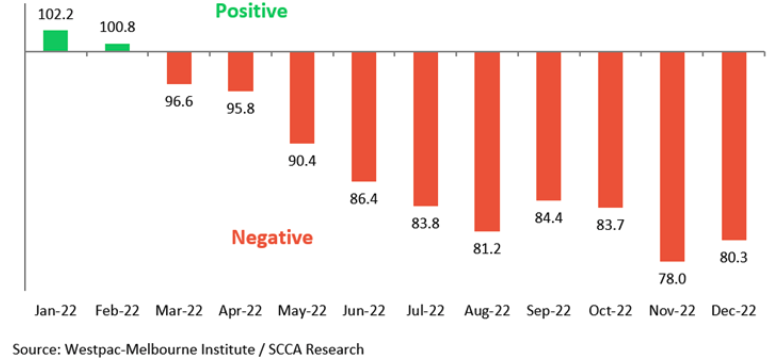

According to the latest figures from the Westpac-Melbourne Institute Index of Consumer Confidence report, consumer sentiment was recorded at 80.3 in December 2022, the 10th consecutive month of negative sentiment.

Westpac commented that “Despite this welcome lift, the level of the Index remains comparable with the lows seen during the COVID pandemic and the Global Financial Crisis.”

The increase in December followed a decrease of 6.9 percentage points in November. It is worth noting that despite the fall in consumer sentiment, retail spending throughout 2022 has remained at record levels.