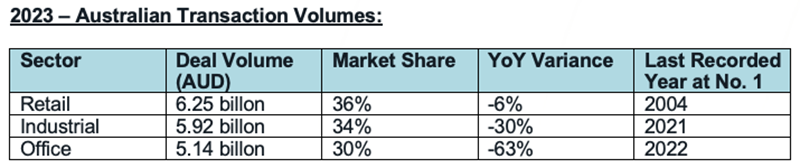

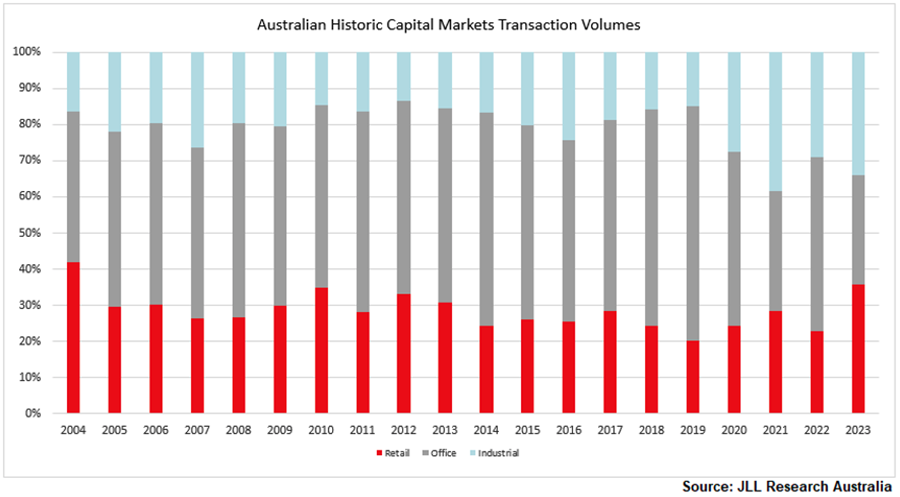

For the first time since 2004, Retail Investment transaction volumes were higher than Office and Industrial with $6.25 billion of sales representing 36% of the traditional property sectors. According to JLL Research, during 2023, Office transactions decreased to 30% market share ($5.14 billion) and industrial representing 34% ($5.92 billion).

Although volumes were down, indications are that the Q4 increase in sales trend may push through into 2024.

Nick Willis, Senior Director of JLL Retail Investments Australia & New Zealand said: “In a year of subdued transaction volumes in global capital markets, retail property in Australia has for the first time in 20 years been the most liquid sector with over $6 billion transacting, demonstrating the returning capital demand.

“While formal on-market offerings for retail assets was significantly constrained in 2023, the weight of capital drove a year dominated by off-market transactions led by buyer mandates. Globally, the performance of the retail sector is driving renewed interest, and while the majority of this capital is focused on higher return opportunities, core capital is re-engaging given the attraction of the robust underlying fundamentals of the asset class,” said Willis.

JLL Research has indicated that the Q4 2023 retail sales figures represented almost 60% of the total $5.52 billion of sales for the calendar year with $1.95 billion of Regional and Sub-Regional transactions dominating the final three months.

The buyer profile in 2023 was also dominated by local fund managers and syndicator capital across all retail sub-sectors accounting for more than 40% of total sales.

Willis said: “Managers have identified value in the Regional and Sub-Regional sub-sectors during 2023, notably Haben acquiring their first Regional classified shopping centre in Stockland Townsville for $238.5 million. However, further to syndicate capital activity, the higher cost of debt has increased participation from ultra-high net worth investors who have a lower cost of capital, including the recent sale of Rosebud Plaza to a Sydney private for $134.5 million.”

Rosebud Plaza sold to a private Investor from Sydney for $134.5 million

Sam Hatcher, Head of JLL Retail Investments Australia & New Zealand said: “The retail thematic is validated by the continued strength in tenant performance, limited floor space supply across all sub-sectors and heightened deal flow aiding underwriting. Further, funding for retail remains positive given the diversification of income providing stable interest cover ratios in comparison to other traditional assets classes which are often linked to a one or two major tenant expires.”

Andrew Quillfeldt, Head of JLL Capital Markets Research Australia said: “Retail transaction volumes were only down by 8% YoY compared with -41% across all sectors, reflecting the slew of deals occurring in late-2023. While the outlook for rates has been volatile, global capital markets are now reflecting lower official cash rates for many of the major established markets, which is helping to improve conviction in underwriting future funding costs for real estate investors, and that the current round of monetary policy tightening from central banks may have concluded.”