More Australian consumers than ever are shopping online and reporting high levels of ‘intent to continue to use’ – so, what does this mean for retail stores of the future? McKinsey Australia publishes the third piece in its online series, The Story of the Australian Consumer. The latest article, “As physical doors close, new digital doors may swing open” explores how the COVID-19 lockdown has created a new set of Australian digital users and what this means for Australian businesses.

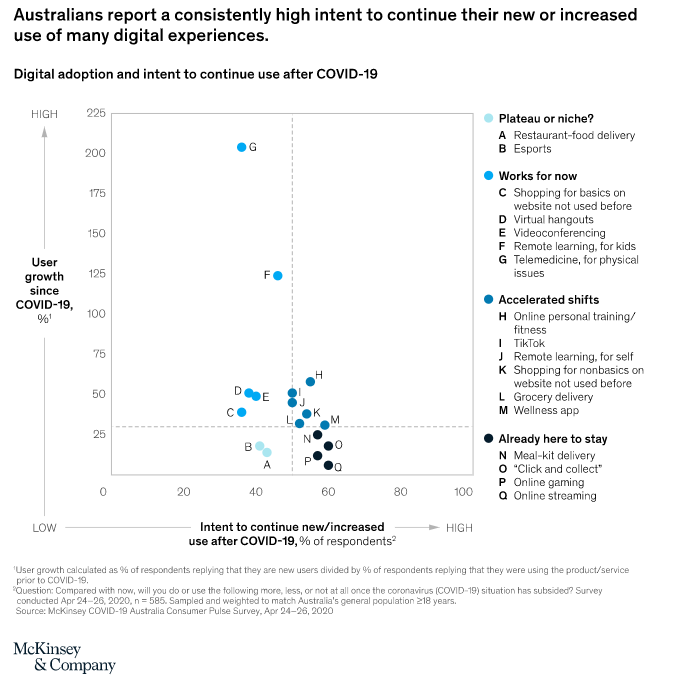

The report shows that of the consumers who are doing fitness activities online, 40% are satisfied with the experience, and 55% state their intent to continue their usage, while e-groceries – a sector that has experienced significant logistical challenges, extended delivery windows and sporadic availability of product – has left more than 60% of consumers reporting they are ‘very satisfied’ with the experience.

There is a similar outcome with the uptick in telemedicine, which has been tried by 10% of consumers – many for the first time – with 60% of users being ‘very satisfied’.

“High satisfaction levels for activities that have historically received a fair amount of scepticism about efficacy online, is a good sign of ‘stickiness’ post-lockdown,” says Jenny Child, series co-author and leader of McKinsey’s Consumer Packaged Goods and Retail practices in Australia and New Zealand.

“Our research shows that Australians are consuming more digital media, doing more online shopping and using more online services than ever before. Satisfaction levels with digital usage and ‘intent to continue to use’ are also quite high -34% of Gen X and 28% of baby boomers are reporting that they have increased their usage of digital tools since lockdown started”, she said.

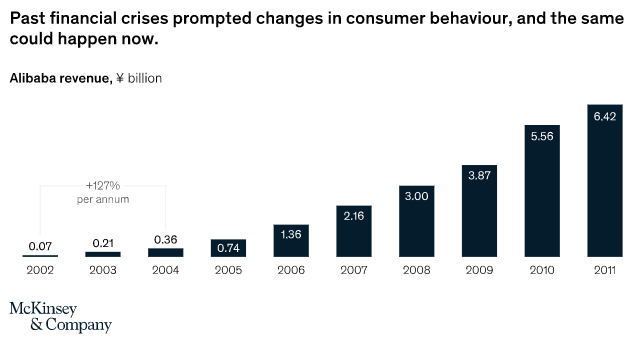

To better understand the growth potential of digital services in Australia, the authors look back at China and South-East Asian markets, in the wake of the Severe Acute Respiratory Syndrome (SARS) outbreak in 2003, which culminated in the expansion of their eCommerce sector.

For example, Alibaba was initially a B2B eCommerce company, with a business model focused on matching US procurement teams with Chinese suppliers. During SARS, when other countries issued travel warnings on China, Alibaba saw the opportunity to connect Chinese SMEs to the world; and wholesale buyers embraced this online gateway to source Chinese goods. In turn, Chinese suppliers invested more in online marketing on Alibaba’s platform, rapidly creating critical mass and self-perpetuation.

“A critical lesson though was that the China growth was not achieved without substantial infrastructure being in place. The potential for widespread demand that can fuel a new digitally-enabled economy in Australia is real. And, a more digital-enabled economy is an aspiration worth embracing – not just economically, but civically”, she said.

McKinsey’s research has proven that Australian consumers are showing a willingness to experiment and adapt to new activities in digital formats.

Australian business leaders who are questioning the need to go on an accelerated digital journey should consider that when stores reopen, not only will COVID-19-related regulations and restrictions disrupt in-store experiences, Australia’s consumers will have changed as well.

Child concluded, “The offline and online battle won’t have a binary outcome. The players who can use the best of both channels to deliver a new, inspired and meaningful experience will be the ones who win the hearts (and pocketbooks) of the post-COVID-19 consumer.”