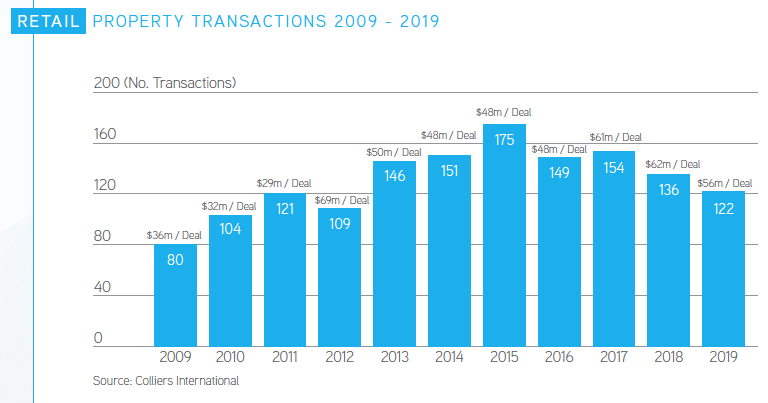

Private investors have led the way as quality Australian retail property assets remain well sought after, with $6.84 billion of transactions in 2019. The Colliers International Retail Investment Review, released today found that despite the growth of online retail, brick-and-mortar stores remain the major focal point of Australia’s retail landscape and have continued to evolve to meet consumer expectations.

Astute private investors accounted for 47% of all transaction volume by value after being presented with generational opportunities to invest in high quality defensive assets.

Lachlan MacGillivray, Colliers International Head of Retail Investment Services Australia said “Our key learnings from the last 12 months points to a return of stronger conviction in the retail investment market, primarily led by high net worth investors.”

“These investors are less constrained by global sentiment and able to look through cycles, while taking the opportunity to act quickly and acquire intergenerational assets. All of these factors in addition to an increase in interest from international investors such as SPH REIT, point to a view that the Australian Retail market has been oversold and represents good value”, he said.

NSW recorded the highest total transaction value in the country at $2.4 billion, accounting for 37% of the total retail investment market for 2019.

Despite only three assets trading, Super Regional/Regional centres accounted for the largest share of investment volumes in 2019 with $1.8 billion of transactions. This outcome is the result of 50% stakes in Westfield Marion ($670 million), Westfield Burwood ($575 million) and Garden City Booragoon ($570 million).

The Garden City sale represents the largest retail transaction ever to occur in Western Australia

“Similarly, domestic institutions have progressively reweighted their portfolios and disposed of selected underperforming centres. This environment has created opportunities for proactive investors willing to undertake refurbishment works to rejig the tenancy mix to enhance consumer experience in a bid to boost trading performance,” MacGillivray said.

The Retail Investment Review also found that the rising trend toward more sustainable consumption is having significant implications for the retail industry in Australia, with consumers increasingly expecting retailers and shopping centre owners to actively drive environmentally sustainable business.

“As the retail landscape continues to evolve, retail brands must compete on values, ethics and sustainability rather than just low prices, with sustainability initiatives becoming the norm and being integrated into the daily operations of centres,” said Michael Bate, Head of Retail at Colliers International.

“Some of these include environmentally-friendly transportation arrangements, electric vehicle charging stations, recycling stations, energy and water-efficient solutions and solar-power. All major shopping centres owners such as Scentre Group, Vicinity, AMP, Dexus and Lendlease, among others are at the forefront of this evolution.”

Westfield Burwood

Key insights from the report include:

- A return of stronger conviction in the retail investment market, primarily led by high net worth investors

- Astute private investors accounted for 47% of all transaction volume by value

- NSW recorded the highest total transaction value at $2.4 billion, accounting for 37% of the total retail investment market for 2019

- Super Regional / Regional centres accounted for the largest share of investment volumes in 2019 with $1.8 billion of transactions

- Sustainable consumption is having significant implications for the retail industry in Australia