Inflation, bond yields, wage rises, labour shortages, cash rates… the list goes on – and they all affect shopping centre valuations. There’s so much negativity around at the moment regarding our economic future that for many, doom and gloom seem to prevail. But our industry, weighing everything up, seems to be still doing OK!

The noise in the past few months about inflation, interest rates and the cost of capital rising borders on humour if weren’t so serious. One financial head from a major international bank actually sounded surprised when they stated in the AFR recently something like “…bonds really do set the cost of capital” – but it is no surprise at all to some, as we can now see. Ah, the loss of generational memory.

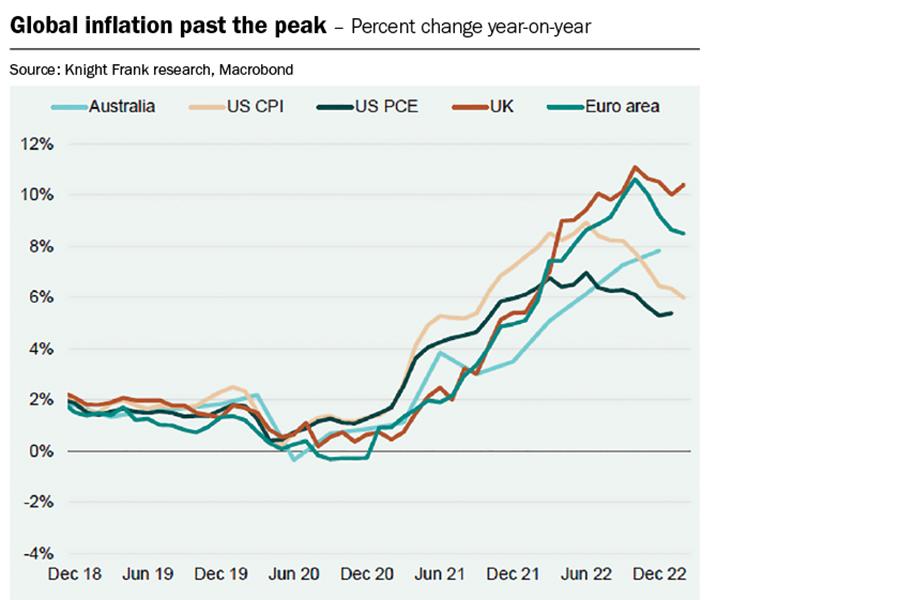

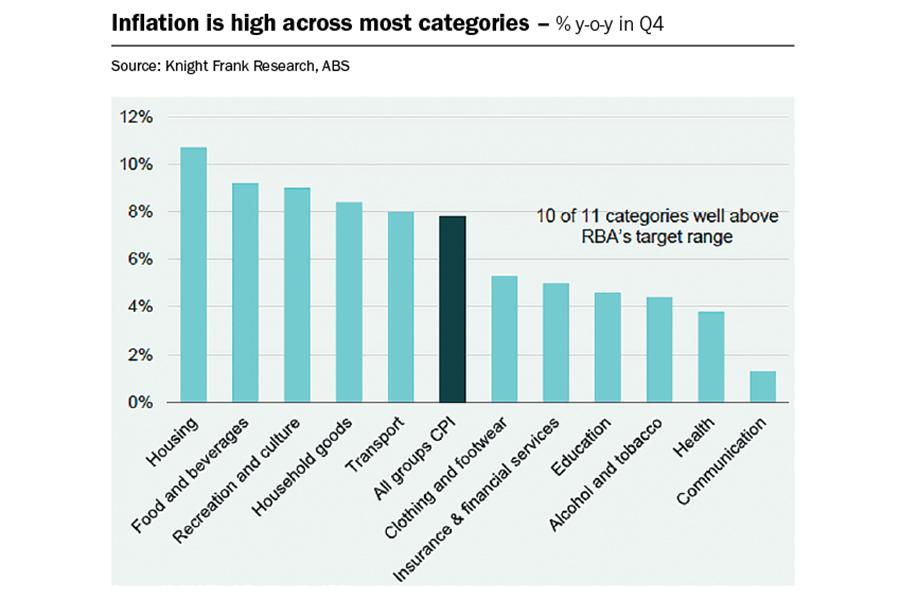

Inflation that has driven up cash rates, bonds and property cap rates – savagely in some cases – is now peaking globally – we hope. So what does this mean for bonds, and therefore interest rates, retail spending and property yields that drive capital values (along with income – let’s not forget about that)?

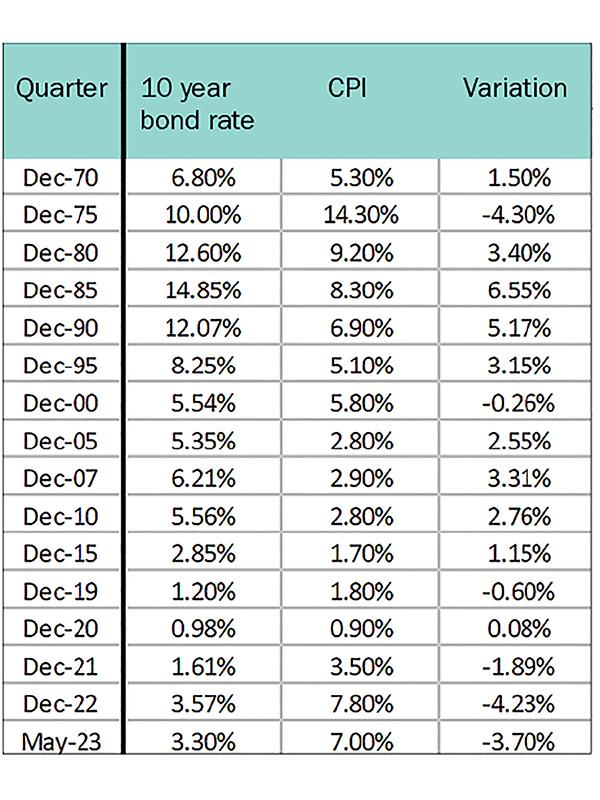

What no one seems to want to talk about is that ALL interest rates – central bank cash rates, lending rates, home loan rates, and the gilt cost of capital – 10 year bonds – remain well below inflation. This is the inverse of the normal economic condition because a yield below inflation is negative in real terms over time.

This seems to be a huge bet by capital markets that inflation will return to below the bond rates – which, in our case, is hovering around 3.5%, having come down from about 4% as inflation globally eased.

The theorem seems to be that central banks will raise interest rates in the short term and then lower them again when inflation has returned to levels they want. In life, wants and needs are different.

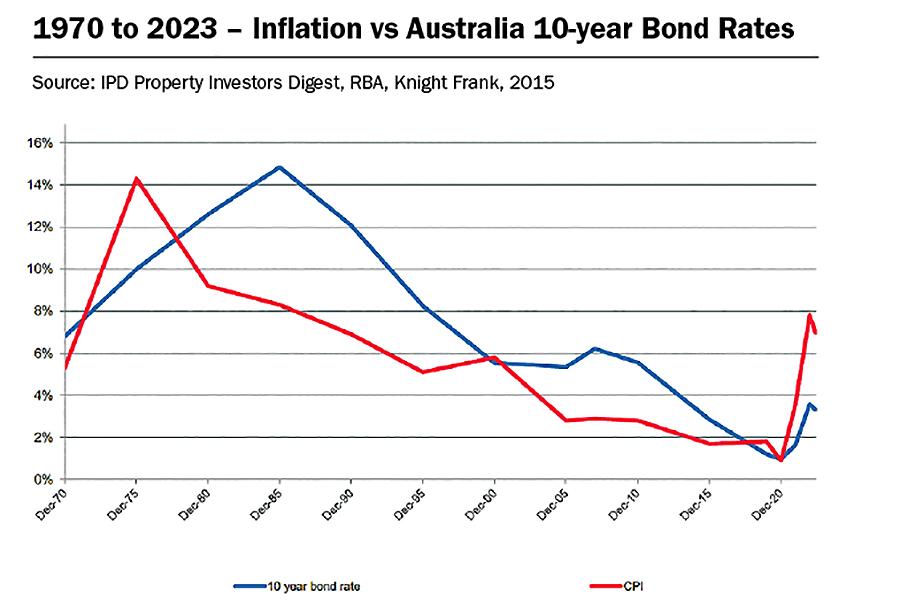

Theory is nice, but what have markets really done over time? Let’s go down memory lane – are bond rates that set the cost of all other capital always above inflation? Most of the time – but not always.

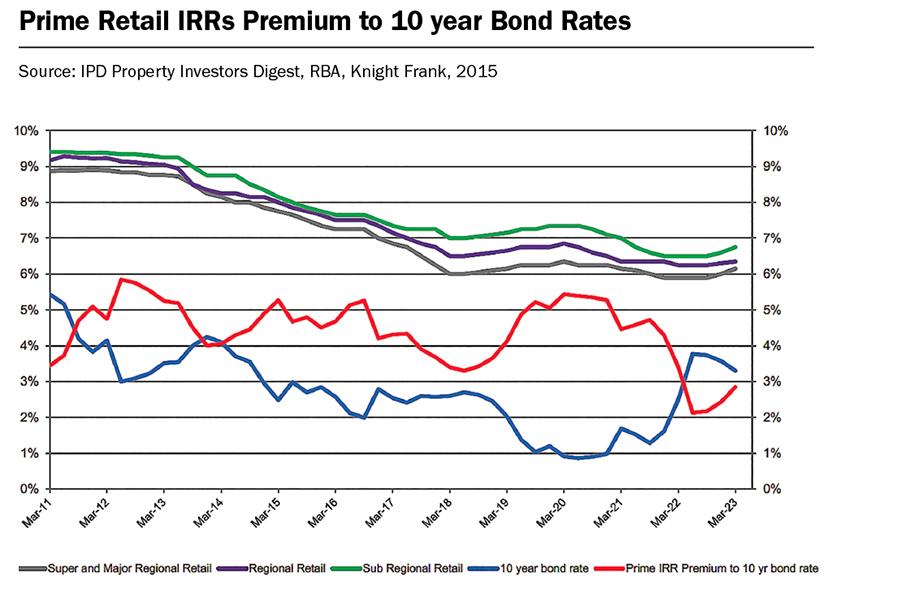

The graph is a good visual for trends, but the numbers do also help. It’s also important to remember the Australian financial market and banking system was deregulated by Keating circa 1985.

Most of the time, the obvious theory applies – bond yields (and then all other total returns – yes, total returns) are above inflation – and by quite a bit. However, in periods of a change in the CPI outlook financial markets look ahead as they always do. What is unusual now is how long the markets have held the view that inflation will significantly fall. The late 2022 property yield correction should be no surprise to anyone.

This historic comparison can’t be definitive as financial markets are now far more complex and interlinked than at any time in the past. Huge sectors of the bond market hold to maturity and have mandates and capital allocation obligations that support liquidity at these negative real-term yields – for the present. Add in that we can assume central bank intervention will continue one way or another.

I think we’d all be very surprised if inflation did settle around 2% – 3% despite this being the stated aim of most western central banks. There are so many headwinds, not the least of which is deglobalisation – it was the globalisation of manufacturing and employment, as well as technology, that was deflationary since the GFC, combined with money printing. AI and technology will continue to be fundamentally deflationary as it will impact the labour market – but it is also true the inflation impact on the cost of living is starting to push wages in a very tight labour market. Climate change is fundamentally inflationary because it adds new costs, and eats into productivity (such as natural disasters).

Let us say inflation isn’t going to be 2% or even 3% anytime soon. Then assume the RBA (and other central banks) will continue to raise rates but avoid rates that are materially recessionary.

What it says is that the recent rise in interest rates and bonds as the benchmark for the cost of capital is unlikely to have finished in a medium-term context. The disconnect between current inflation and the cost of capital rates is so great that any total return strategy for capital investment now must consider this likelihood.

This therefore means leveraging up is not wise and that income growth is back to being a central function for all investments – property or otherwise – which is already playing out in all commercial property markets since the correction began in late 2022.

It also means the awful initial yield-driven investment behaviour that prevailed in many asset classes is over – this is why the change in secondary yields is so savage in other sectors.

This savage repricing of secondary assets in other sectors isn’t being applied to retail because retail returned to (largely) proper reversionary risk pricing some time ago.

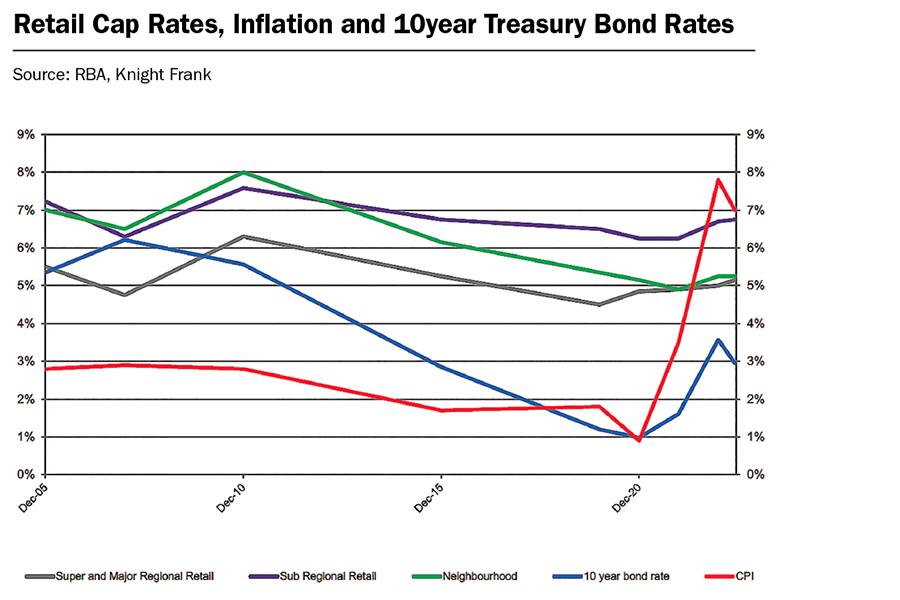

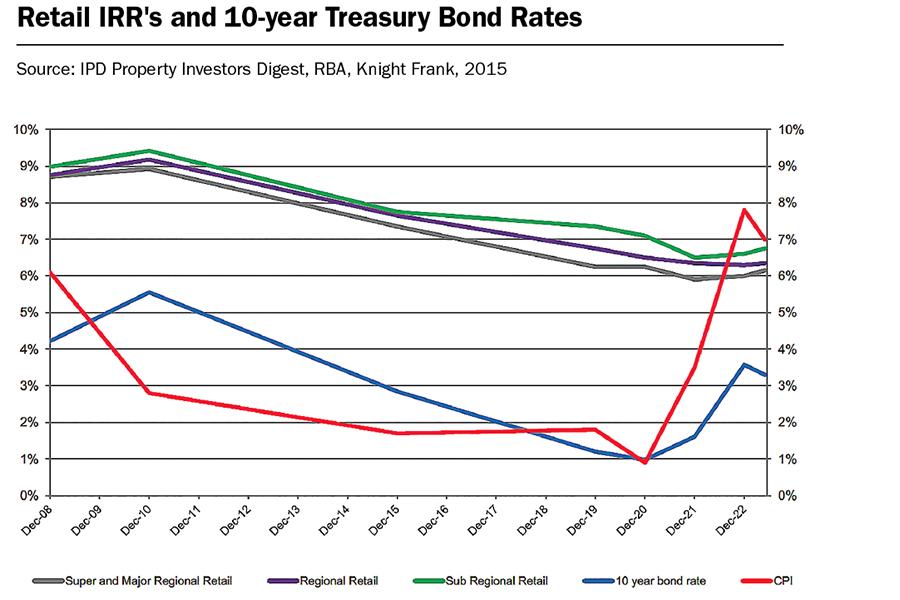

These things you already know. So what have retail cap rates done over this time? Our data only goes back to 2005, which is pre-GFC – and an important change to the market over time is the rise of high equity rather than high leverage – a lesson learnt in the GFC.

What is true is that retail property yields never truly followed the more liquid financial markets down this track and didn’t contract in the way other property sectors did – possibly apart from convenience retail and for very good reasons. Firstly retail had its own structural problems over the past ten years. Combined with the high equity market, this kept a lid on yield contraction. At present, retail cap rates and IRR’s are rising but not remarkably.

Cap rates mathematically aren’t the comparable measure to bonds because of the rental growth function. The IRR directly prices in the rental growth that is intuitive in the cap rate. (IRR less net growth = cap rate). Right now, prime IRRs sit at just under 3% premium to bonds – however secondary IRRs and cap rates have corrected far more significantly in the past few years and can be 7% to 7.5% – a healthy 3.5% to 4% points above bonds – which is where historically it was up to the GFC (bonds at 5% to 6% – property IRRs 9% to 10%) and this gap moved out to 4% to 5% during the artificial post-GFC money printing era – because property never believed it would stay this low.

This seems to say that provided income is stable and better still has some growth, there is scope for further softening in cap rates and IRRs, but it won’t be dramatic if the income side is okay – and provided inflation does keep falling – that is very important.

There are not any prime transactions in this market now, but its probable the next prime transaction will show further softening in cap rates and IRRs than is shown herein – but not to the same level that is playing out in other non-retail sectors that had IRRs well below 6% prior to the correction.

More interesting still is where the activity is – in sub-regionals. To me, this seems to be that for this secondary market this could be approaching an early bottoming – because the income reset that is normally at the commencement of a correction in commercial property markets has been underway for probably five to ten years and is now at the end – and the yield pricing seems to reflect the times – again provided inflation keeps falling.

This brings us to rental growth. I’ve banged on about this before but it’s worth restating. Almost every retail lease in the country expired and/or has come to market in the past five to seven years, pricing in online competition, clicks and bricks, changing consumer sentiment toward services and experience – and rationalising of over-represented speciality and DDS premises. OK, the department store is still being sorted out but exists on very low gross rents.

Also, retail rents, by and large, are effective on renewal, and retail tenants are very, very sticky – and this sets it apart from office, which is at the beginning of its journey – and that may become important when capital allocations to property are made.

To think about this, think about capital fluency and capital allocations. The rise in bond yields from 1% or even zero to say 3% or 3.5% globally now returns bonds to the historic allocation mix of equities, bonds and property. During the cycle, when equities fall, bond values rise, evening out the losses. In theory, property can remain the hedge awaiting an equity return (and property tips over as equities return). For the allocation to property, now that bonds are back, this then places the spotlight on which sector a property allocation is sent to. If there is a perception the retail sector is at the end of its income reset and other sectors are at the beginning, this will bring capital back. It will be interesting to see if redemptions in this sector start to slow in 2023.

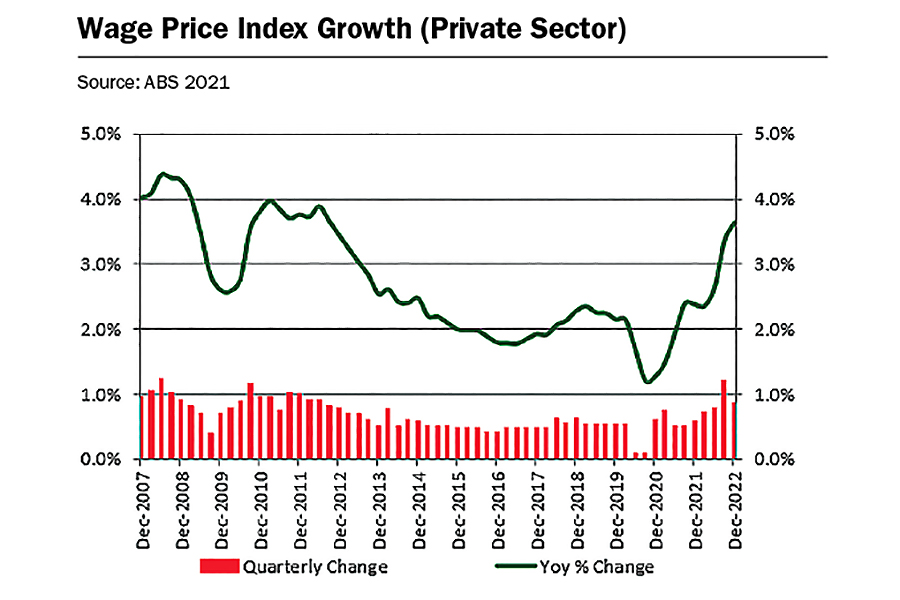

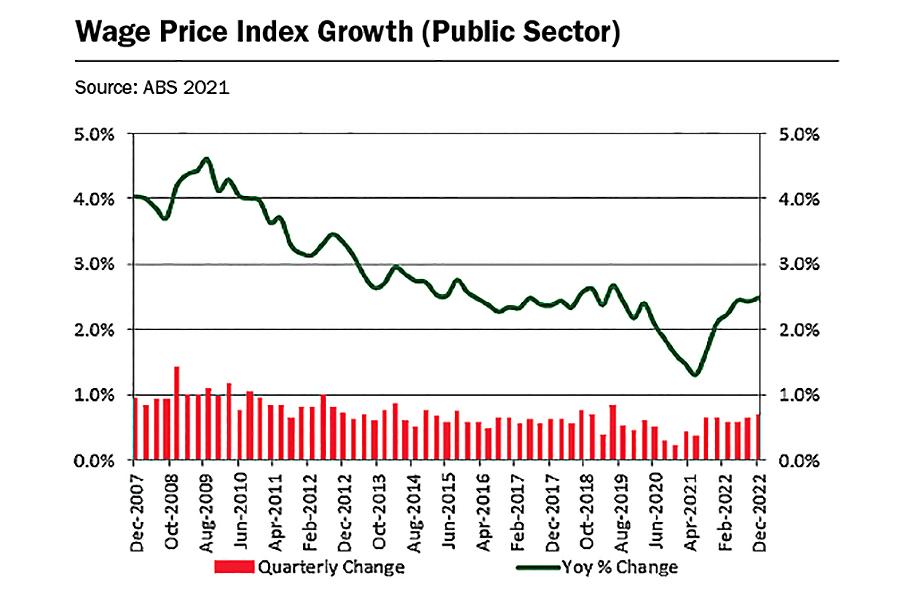

But what about the cost of living? In my last article, I spoke about the exposure to rising interest rates – only 30% of the population have a loan, and a whole lot of them bought in at higher rates and lower going in values – high equity. The cost of living isn’t just interest rates but wages growth is on its way. This is why, against all expectations – and note near full employment – the housing market is back in areas that the census would say are not impacted. Building approvals have plummeted (and possibly some of this is fear of home builders), which tells you the mortgage belt catchments – some but not all – are where it’s being felt. So it’s very much centre by centre, catchment by catchment – nothing new there, but this is why some cap rates are 6.25%, and some are 7.5%.

On the whole though, it seems that structurally much of the retail’s income market has bottomed and now looks forward to the combined benefits of population growth and a lack of new supply – as one would think, building costs, low major anchor gross rents, and cap rates aren’t likely to assist retail supply. Compared to other sectors, many retail centres may well be the back marker coming home on a run on track.

So what do I really think?

Investors are not blind and there is plenty of activity in the sub-regional market at yield pricing that can absorb some increase in the blue-chip cost of capital.

The gap between bonds and inflation says borrowing costs, and the property yield softening trend in the property market is not over, but it will be felt most in property sectors where incomes are uncertain. For retail centres the period of structural negative reversion has ended, and the market incomes for many centres are in the bottom of the cycle. For other sectors, it is the opposite.

Looking forward, retail does have some very positive drivers (not the least of which is effective rents on renewal!) in population growth, which is loosely forecast to be 300,000 to 350,000 people in the next year or two – although this should be regarded as a government aspiration rather than a probability. Firstly, where do we house them and, secondly, the government is coming clean that this seems to be including tourists and students in this number – no surprise there really.

What is true is that medium-term population migration is going to be supported as government policy. Although retail spending growth is now shared with online deliveries, population growth remains a very strong fundamental driver for shopping centre rental growth and tenant demand.

Under the old rules, retail rental growth was the sum of population growth, CPI, and wage growth, less capex and incentives. Inflation and wage growth have been benign for so long that we forgot about them. They are now back. It could be good times in a lot of centres in the next few years, particularly when inflation has stabilised – wherever that may be.

This article by Michael Schuh features in the latest edition of Shopping Centre News. Premium members can view the digital magazine here.