The future of food and beverage in Entertainment and Leisure Precincts (ELPs) has never been brighter, as consumers continue to prioritise experiences where they can socialise through modern, design-driven places and spaces with a multitude of entertainment options, while choosing from a diverse and curated food and hospitality offer. Future Food’s David Mallon explains…

ELPs have been around, in one form or another, for more than three decades across Australian shopping centres – humble beginnings featuring the cinema as the primary entertainment component and a simple F&B offer creating a one-size-fits-all experience.

ELPs helped anchor shopping centres, providing a strong point of difference to standalone cinemas; and extended the trading of the shopping centre into the evening. Those early ELPs experienced great success in a homogenous Australian landscape and were copied and repeated across the country, eventually moving into mixed-use precincts.

The novelty of the concept and lack of alternative led to a relatively flat innovation curve, until recently. There was tinkering around the edges with different layouts, adding video arcade rooms adjacent and externalisation of the F&B into alfresco spaces – with mixed success.

The past ten years have seen a confluence of factors that led to a more competitive environment and a sharp upturn of the evolution of the ELP concept.

Factors such as the shift in demographics, relatively positive economic climate (followed now by a cost of living crisis), rise of on-demand streaming platforms eating into cinema attendance, disruption of consumer spending behaviour by COVID, increase in companies developing compelling entertainment concepts, continued work-social disruption, increased demand for creating design-driven spaces (with place-making); and growing diversification of food and hospitality concepts and positioning levels have allowed the consumer to create their own customised experience to suit their needs and wants.

In good economic times, shopping centres and mixed-use precincts could count on their existing customers and steady increase of footfall to support new developments as a solid base. With consumer spending now slowing overall – or, perhaps more accurately – shifting in specific segments of the ELP target market, those already positioned with a benchmark combination of modern design aesthetic and a balanced offer across entertainment and food will reap the highest return.

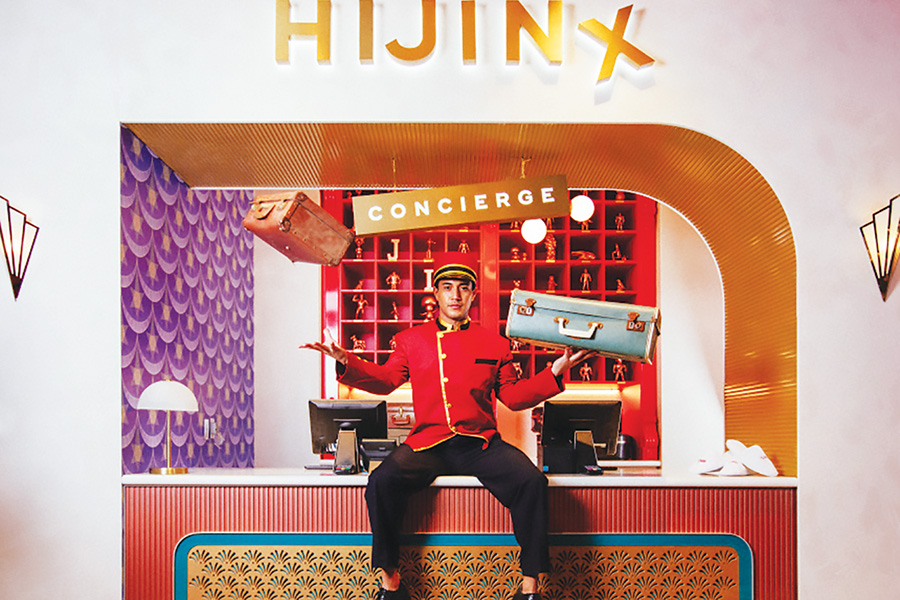

Great examples of ELPs that are at the top of their game are Westfield Chermside in Brisbane with cinemas, Holey Moley, Hijinx Hotel, iFly indoor skydiving; and Kingpin, a benchmark food precinct and aesthetic design, with a carefully allocated GLA to maximise the spend from the segments of the target markets. In Perth, Karrinyup Shopping Centre has taken advantage of its traditional sunny weather and created an externalised food and entertainment precinct over multiple levels, with a cinema, Archie Brothers, Hijinx Hotel, Strike Bowling and curated dining precinct with a diverse range of cuisines and positioning to suit their target market.

Overarching the target market segments, even given the cost-of-living pressures, customers are still seeking to maximise social experiences through F&B and entertainment while balancing their spending. The need to socialise for individual customer segments has not disappeared and perhaps even increased, given that work from home/office hybrid fragmentation continues to interrupt impromptu opportunities to socialise.

From a demographic point of view – Baby Boomers, Gen X, Gen Y and Gen Z – we see declining spending patterns in discretionary spending through the generations. CommBank iQ’s Cost of Living Insights Report released in May 2024 comparing the first quarter of 2024 to 2023 highlights this declining spending pattern. Drilling down into the demographics, we can see who is driving the overall spending increase across all categories: Baby Boomers up 4.9%; Gen X up 1.8%; Gen Y dropped -0.3%; and Gen Z dropped -1.89%.

Breaking into individual discretionary spending categories (regardless of demographics) ‘eating out and food delivery’ is up 2% and ‘entertainment’ is up 3% comparatively (some good news!) unsurprisingly, driven by Baby Boomers at 7% for eating out and food delivery.

Within the ‘eating out and food delivery’ category we do see a further divergence, with spend per capita increasing in fast food (5%) and premium dining (3%), while the middle ground declined -2%, which would include the typical dining precinct mix in ELPs. The challenge for shopping centres remains the same – stay close to the segments to ensure the ELP continues to provide great experiences with a strong value proposition.

As with any modern multi-faceted ELP precinct, the customer must be at the heart of the strategy. Given the capital expenditure required for an existing shopping centre or mixed-use precinct, a revamp or extension of existing facilities must ensure the needs of segments of the target demographic are considered (qualitative research), which naturally led to quantifying the feasibility and building a strong business case.

Matching those needs discovered in the qualitative research must flow through to not only the aesthetic design but also the overall size of the development, allocation of GLA to the selection of entertainment and F&B concepts.

Zero Latency VR, The District Docklands

The evolution of entertainment experiences across the world that resonate in ELPs have leapt ahead, exemplified in Australia by Funlabs with its ever-growing house of brands (Holey Moley, Hijinx Hotel, Archie Brothers, La Di Darts, B.Lucky & Sons), providing a wide range of entertainment – mini golf, virtual reality experiences, karaoke, bowling, laser tag, arcade video games, interactive darts, challenges and escape rooms. Within the individual entertainment brands, a considered approach to different levels of positioning appeals to a diversity of segments with the target market. Naturally, along with the fun activities, they offer a commensurate range of food and beverages to provide a holistic social experience.

Competition continues to drive concept development, with Funderdome by HOYTS at Highpoint in Melbourne adjacent to its cinema, featuring mini golf, arcade games, karaoke and an adult bar area with snacks and games for groups. Highpoint also welcomed the new-to-market SuperPark indoor playground in late 2023 with a range of zones for kids to play and challenge themselves.

New entertainment experiences are not limited to ELPs, of course, with the arrival late last year of a new-to-market concept at Sealife Sydney Aquarium: Immersive Gamebox – with 27 locations across the UK, US, Europe and UAE. The interactive group gaming experience combines motion tracking, projection mapping, touch screens and surround sound to deliver a 360-degree experience. The experiences are themed with in-house concepts as well as leveraging a range of partnerships to create experiences with well-loved brands like Angry Birds, PAW Patrol, Shaun the Sheep, Ghost Busters, Squid Game and LEGO.

Seven’s (Saudi Entertainment Ventures) Al Hamra precinct

Looking overseas, our recent visit to Riyadh in Saudia Arabia (KSA) highlighted a stand-alone entertainment complex coming out of the ground, with a planned nine distinct entertainment/experience options plus a multi-purpose venue for live shows. Seven’s (Saudi Entertainment Ventures) Al Hamra precinct will include a Transformers: The Experience facility, Indoor Hubless Observation Wheel, Warner Bros. Discovery Adventures, Indoor Surf experience, Clip N Climb, Indoor Skydiving, Bowling, Formula E-Karting and an AMC Cinema. A mix of F&B will be included with supporting cafe and restaurant level of positioning. Seven plans to open across 14 cities with KSA over 21 different destinations with 21 different experiences.

Lastly, in the US, we watch with interest as streaming platform Netflix launches the concept Netflix House at Galleria Dallas and King of Prussia (Philadelphia) shopping centres, promising ‘immersive experiences, exclusive merchandise and F&B’ inspired by Netflix IP, shows and films – think Stranger Things and Squid Game. These concepts are not going to be strategically located in ELPs, as they are taking advantage of large format spaces left vacant after retailers have departed. The possibility of adding an interactive high profile brand experience into an ELP is tantalising, if a few years away.

Netflix House at Galleria, Dallas

The continued evolution of ELPs in tandem with food and beverage continues to drive footfall, diversified revenue, innovation and the experience-driven economy in Australia and across the world, delivering spaces that will become even more customer-focused over the next few years. SCN

This article by David Mallon, Future Food, is featured in the latest issue of SCN magazine.