Australia’s neighbourhood shopping centres have become increasingly sought after. Their attractive development controls and prime locations enhance their appeal, while a constrained supply pipeline further drives up demand. In this article, JLL’s David Mahood and Sebastian Fahey, delve into the factors fueling the growing competition for these high-demand properties and examine why they continue to captivate investors.

Neighbourhood shopping centres have remained a haven for private capital as the sub-sector benefits from a perfect storm of asset fundamentals and economic tailwinds. As cost-of-living pressures continue to grip the economy, the inelastic nature of non-discretionary retail spend underpins the neighbourhood sector’s strong tenant productivity and sales growth. In addition, neighbourhood centres are predominately situated on strategic landholdings in key locations, which are generally underpinned by attractive development controls. Combined with the sector’s defensive income stream, neighbourhood centres provide capital with a compelling investment proposition.

Key themes underpinning neighbourhood shopping centres

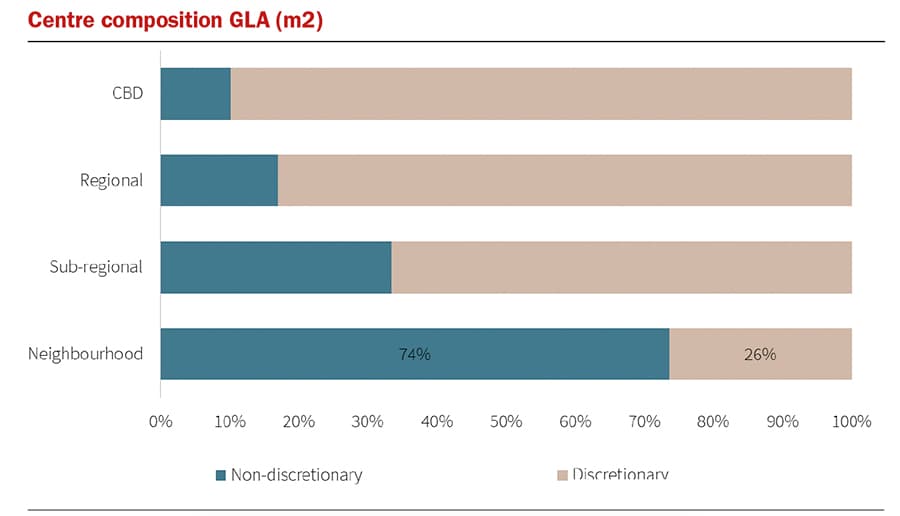

- Neighbourhood shopping centres in Australia on average comprise 74% non-discretionary tenants, which have demonstrated resilience and drive stability in the sector.

- Coles, Woolworths and ALDI are within the top 50 retailers globally (Deloitte, 2023), reflecting the strength of the neighbourhood shopping centre major tenant covenants.

- Neighbourhood shopping centres have proven their ability to serve as a hedge against inflation, with food spending growing at a 5.0% CAGR over the past two decades.

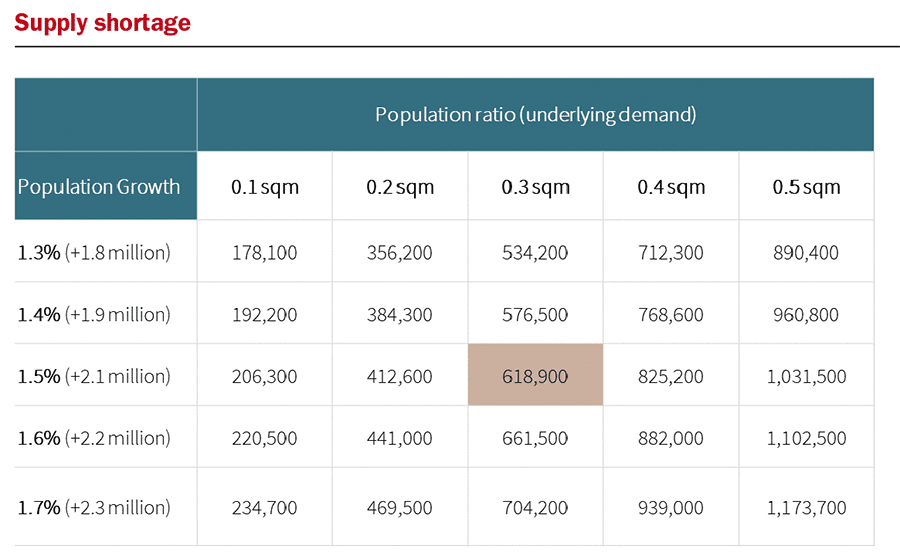

- The current neighbourhood shopping centre supply pipeline is well below the historical average, which implies an underlying demand for an additional 618,900m2 of neighbourhood floorspace over the next five years, equating to a 45.7% undersupply.

- Neighbourhood shopping centre land values are predominately underpinned by strategic landholdings with attractive development controls allowing for future development upside.

Income resilience continues to drive investor interest

Neighbourhood shopping centres in Australia are largely underpinned by supermarkets and a non-discretionary income profile predominately comprising of food and service-based tenants. The performance of these retailers is being driven by heightened inflation and the importance for consumers to maintain their spend on non-discretionary goods, with the food category accounting for the largest proportion of annual retail trade at $183.3 billion (40%) as at March 2024.

The strong growth in food spending is driving productivity of the retailers, providing investors confidence in the tenants’ longevity and ability to pay rents.

The investor confidence in the sub-sector’s income has seen neighbourhood yields remain relatively stable over the past two years, reflecting only a 104-bps expansion from peak 2022 levels compared to prime CBD office and prime industrial yields, which have softened by 147-bps and 183-bps respectively. In addition, more than half of neighbourhood centres have sold for a sub 6% yield this year. Combined, this provides further confidence for investors as the sector not only provides resilient and defensive income but has also delivered consistent capital preservation throughout volatile markets.

A restricted development pipeline to spur rental growth

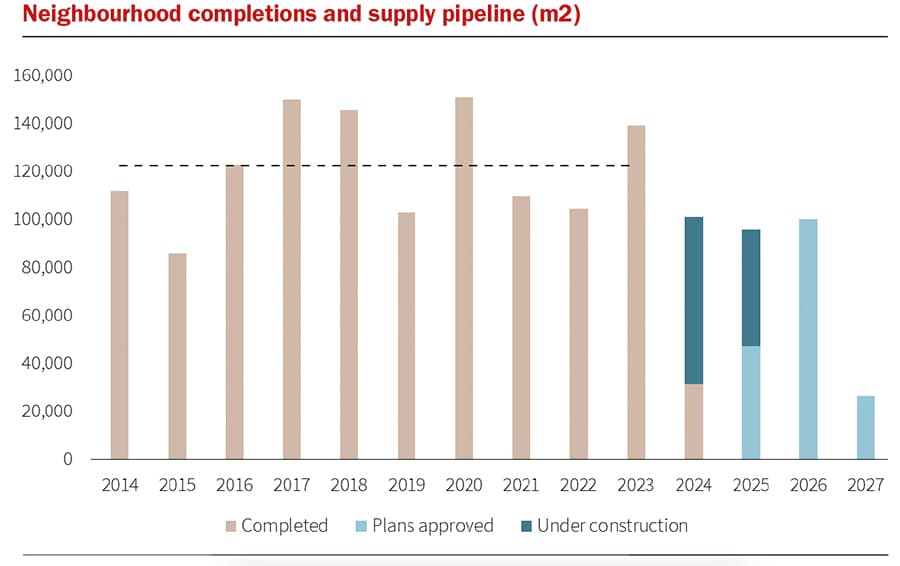

Rising construction costs and the inability to develop new assets has quickly become a consistent thematic impacting nearly all sectors of the property industry. Neighbourhood centres are no different and are arguably positioned to be the greatest benefactor out of the traditional asset classes of this thematic.

From our analysis, there was an additional 139,100m2 of neighbourhood floor space built in 2023, which is in line with the ten-year annual average. Since 2009, there has been an additional 0.3m2 of neighbourhood floorspace constructed per additional person in Australia based on the population growth profile (pre-COVID decade average to 2019). Based on the current population forecast, this base case requires an additional 618,900m2 to be constructed over the next five years to 2029.

Currently, only 149,300m2 of neighbourhood supply has either reached completion or is under construction over the next five years. As a result, the neighbourhood sector will only produce 0.07m2 per additional person. Including projects with plans approved, our best case scenario forecasts a supply shortage of 45.7%, nearly half of what is required to be built.

Based on the fundamentals of the retail sector, this supply shortage will further drive tenant productivity and support rental growth. National retail spending is expected to increase by an additional $78.6 billion (3.4% CAGR) over the next five years to 2029 (Oxford Economics, 2024). As per historical trends, food and grocery spending is expected to receive 40% of total retail spending, which equates to an additional $31.4 billion. As such, $47.2 billion is forecast to be spent on the remaining categories.

The current forecast supply shortage has been created by a combination of factors, mainly attributable to a steep rise in the cost of capital, construction costs, land values and softening exit yields. To get a better understanding of the current constraints, JLL conducted a development feasibility study on a hypothetical Sydney neighbourhood centre.

Based on this study, we estimate that on average, metropolitan neighbourhood rents need to increase by approximately 22% to trigger new supply, unless other factors alter significantly. In addition to the current constraints impacting the supply pipeline, neighbourhood centre development sites also need to compete with alternative ‘highest and best’ uses such as mixed-use residential apartments. Taking into consideration the current residential market, this could drive the required rental growth rate further.

Private investors continue to dominate transactions in the high interest rate environment

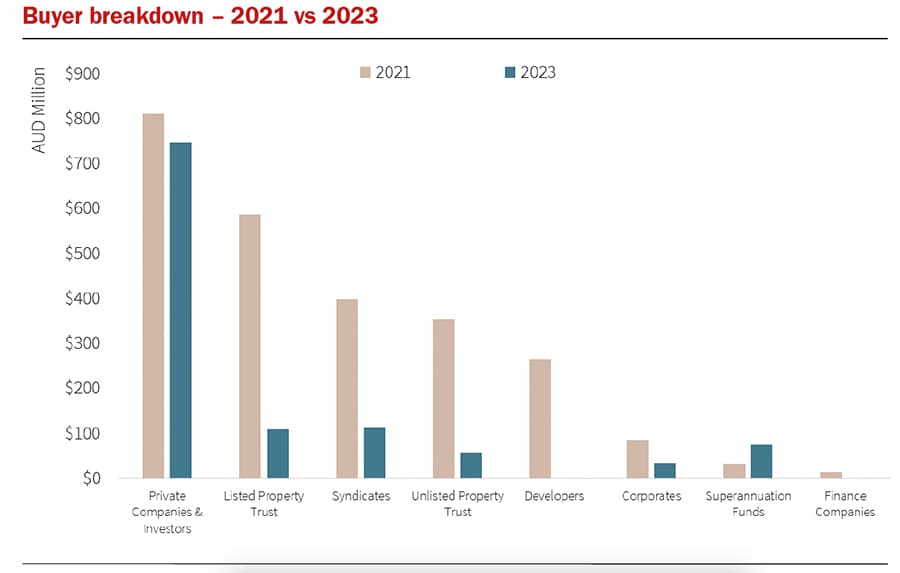

During the low interest rate environment in 2021, the market experienced a record-breaking $2.59 billion of neighbourhood transaction volumes over CY21 (69% above the prior ten-year average). This heightened activity was particularly driven by the involvement of institutional and syndicator capital, combined accounting for nearly 60% of total volumes, looking to build scale within a historically private investor dominated sector.

Since the first cash rate increase in May 2022, the market has experienced a period of consolidation with 2023 transaction volumes being the lowest level since 2013. The first half of 2024 has showed promising signs with first half transaction volumes totalling $559 million, in line with the first half of 2023. However, on-market supply of investment stock has, and continues to be, heavily constrained, with just over half of this year’s transactions occurring off-market.

On average, approximately $900 million worth of neighbourhood transactions have occurred on-market each year since 2019. Currently, there has only been $365 million worth of on-market transactions in 2024, just over a third of the annual five-year average. With limited forecast on-market supply for the remainder of this year, this trend is likely to continue into the first quarter of 2025 driving heightened investor demand for the few available opportunities. This limited on-market supply has resulted in capital needing to be more competitive on pricing to participate in the neighbourhood sector.

Combined with the current cost of capital, private investors have dominated the acquisition market. In particular, we are currently seeing a significant weight of maiden capital transition to the sector with a third of transactions in 2024 being acquired by new entrants.

Of the 57 neighbourhood transactions that have occurred since 2023, nearly 80% were acquired by private investors, with 35 of these being acquired on a passing yield of 6% or less.

We are currently dealing with a weight of private capital that continues to benefit from its ability to remain flexible in all economic cycles and can take a long-term speculative view, which over the long term has proven to generate both a secure and growing income stream, and capital growth.

Demand for neighbourhood centres are to remain elevated

Neighbourhood centres will continue to provide an attractive investment proposition due to the sector’s income stream being heavily weighted towards non-discretionary retailers. This has provided neighbourhood owners with a defensive income stream that has proven its resilience through both a COVID-19 and high inflationary environment.

The current dwindling supply pipeline for neighbourhood centres and Australia’s population growth forecast combine to create a strong case for rental growth across the sector. This creates an appealing investment case for investors.

Based on the current ownership profile and the sector’s positive tailwinds, opportunities to acquire an established neighbourhood centre will remain limited. This shortfall will see demand for the neighbourhood sector continue to outpace supply and drive competition for both on-market and off-market opportunities.

With the outlook suggesting potential for interest rate cuts within the next 12 months, more capital sources are becoming confident in supporting and underwriting neighbourhood yields below 6.00%. Given the adjustment in yields since the height of the market (in 2022) and where yields have stabilised, we are confident that the neighbourhood sector will continue to be at the forefront of investors’ minds as a desired asset class.

This article by JLL features in the latest issue of SCN magazine – Mini Guns 2024 edition.